Principal and interest vs Interest only loans?

Are you looking for the best options for paying off your mortgage faster?

Selecting the best option between interest only Vs principal and interest loans is easier than you think. Here’s a breakdown of the two repayment options and what you should know about them before making your decision.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What are principal and interest [P&I] loans?

Principal and interest loan is the most common home loan in the real estate industry. Predominantly these loans are used for owner occupied properties i.e. for PPOR (Principal Place of Residence). You will also find that these loans carry the best interest rate as compared to interest only loans.

With a P&I loan, each monthly payment includes a portion to cover the principal repayment (the amount borrowed) and the interest charged.

The repayment as well as the loan balance decreases with every payment until it is fully repaid at the end of the loan term. Overtime P&I loans help you increase equity in your property and reduce the amount of interest you end up paying over the loan term.

The process of paying principal and interest repayments is known as loan amortisation.

It can be represented in a loan amortisation schedule, a table showing all loan repayments over a predetermined period, most frequently 15, 20, 25 or 30 years in Australia.

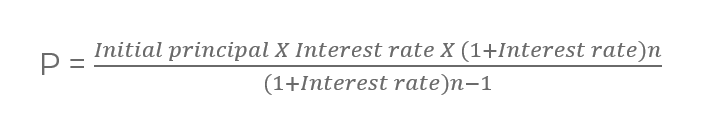

The formula for working out a loan amortisation schedule -

Here, n is the number of repayments.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Principal and Interest only loans can suit both:

- Owner occupiers - because loans carry the lowest possible interest rates.

- Property Investors - Those who wish to reduce their mortgage and build equity over time.

What are interest-only loans?

With an interest-only loan, the borrower only pays the interest portion of their home loan each month. The repayment balance does not reduce over time – it will stay at the same level throughout the loan.

At the end of the loan term, the borrower can choose one of three options -

-

Roll the loan over for another term.

-

Begin a Principal and Interest (P&I) Loan by repaying the principal over a new predetermined term.

-

The borrower can pay off the lump-sum amount to cover any outstanding principal.

Interest-only loans typically have a shorter loan term and are often used as an investment strategy.

They can also provide borrowers with lower monthly payments, which can help to free up some cash flow for other expenses in the short term.

Who is an interest-only mortgage good for?

Property Investors: Those looking to maximise cash flow and want a buffer to invest elsewhere.

First-time home buyers: Buyers who might need an affordable and cheaper mortgage.

Interest-only loans Vs principal and interest loans?

Here is the exact difference between interest-only and principal and interest loans.

Principal and interest repayments

The repayment includes the principal amount as well as interest.

Pros

- The borrower will pay less interest over the life of the loan.

- They can own the property sooner by paying off the loan faster.

- The interest rates are cheaper because of less risk. (Since interest rates can change, check the current rates on loan products before applying for a loan or taking one.)

- The loan term is typically at most 30 years.

Cons

- Compared to interest-only loans, repayments are higher.

- If you are looking for a good investment loan, a loan where you pay back both the principal and the interest may not be the most tax-friendly choice.

Interest-only repayments

The borrower only pays the interest portion of the loan for a predetermined period.

Pros

- Interest-only home loans are usually available for 5 years. After this, the loan reverts to principal and interest.

- The borrower can claim tax deductions against the interest paid.

- Lower minimum payments, as you won’t be paying the principal balance.

Cons

- Higher repayments after the completion of the interest-only period.

- More interest is to be paid over the life of the loan.

- Interest rates are higher.

Which type of loan is better for your investment strategy?

Both repayment options differ significantly; hence you can select one according to your needs.

Interest-only mortgage

Most savvy investors prefer to opt for Interest Only (IO) Loans. It is because monthly repayments are lower than Principal and Interest (P&I) loans, making them more affordable and easier on cash flow.

Also, to buy an investment property, only the interest part of the interest-only loan is used, which is tax-deductible.

Contrary to this, the principal repayments are not tax-deductible.

Learn More

Principal and Interest mortgage

Those who want to pay off the loan quickly with less interest charged consider principal and interest loans. With an interest-only loan, repaying the entire loan takes a longer time.

No matter which type of repayment you choose, it’s always a good idea to shop around for a better interest rate and look into any extra fees that your lender might charge, like set-up fees and yearly or monthly fees.

One Minute Feaso: You can run numbers on potential real estate projects in under a minute.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber