5 ways to refinance investment property

If you’re a real estate investor, you know that refinancing can effectively help you improve your financial situation. Whether you’re looking to reduce your monthly mortgage payments, access cash for renovations, or take advantage of lower interest rates, various refinancing options are available to help you achieve your goals.

Refinancing your investment property is quite similar to any other home loan refinance. Here are 5 ways you can use to refinance your investment property.

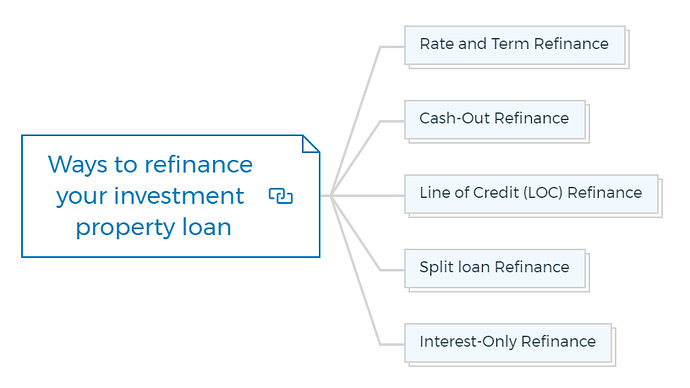

Ways to refinance your investment property loan

Rate and Term Refinance

This type of refinance involves a new mortgage loan with a lower interest rate or a longer loan term. This can lower the monthly mortgage payment and increase cash flow.

Cash-Out Refinance

This refinance allows the borrower to take out a new mortgage loan for a higher amount than the current loan and receive the difference in cash. You can use this to improve the property, pay off debts, or invest in other properties.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Line of Credit (LOC) Refinance

This refinance investment property strategy allows the borrower to access a line of credit secured by the investment property. You can use this to fund property renovations or other investments.

Split loan Refinance

Split loan refinance for investment property allows the borrower to have a portion of the loan on a fixed rate and the other on a variable rate.

Interest-Only Refinance

Interest-only refinance investment loan allows the borrower to pay only the interest on the loan for a certain period, usually up to 5 years. This can help increase cash flow during the property’s rental phase.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

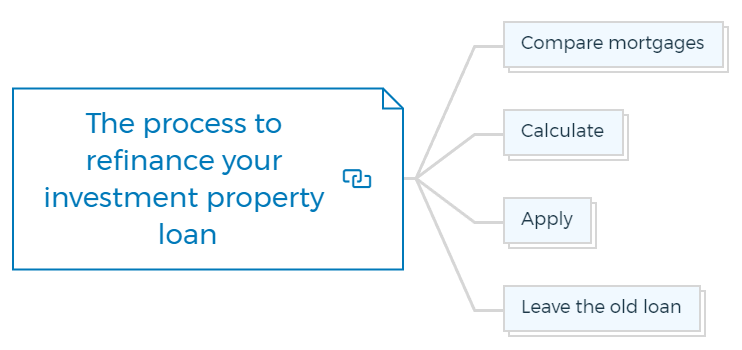

The process to refinance your investment property loan

Compare mortgages

Look for a low-interest investment loan. Check whether its features match with your needs.

Calculate

How much does switching loans cost? Check the new loan’s upfront fees and your old loan’s discharge fees.

Apply

Submit a new loan application. Provide your lender with income, spending, debt, and asset information.

Leave the old loan

Discharge the previous loan after the new one is approved.

Can I access equity to buy another investment property?

You can refinance and get a loan top-up or cash out to buy another investment property.

You can borrow up to 80% of your investment property. You’ll need a conveyancer’s letter stating you’re looking for a property or a copy of the Contract of Sale when you find one.