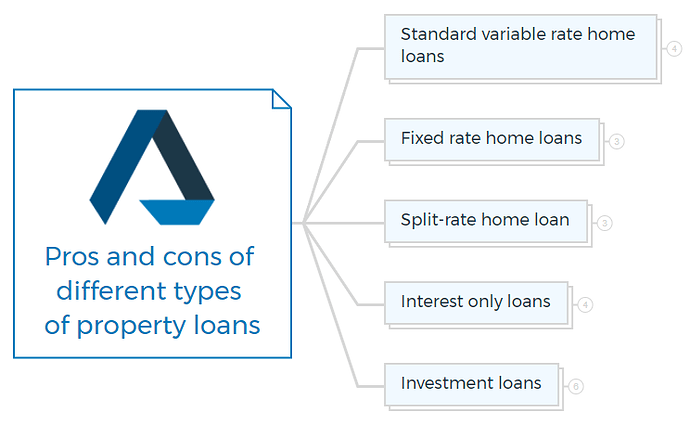

One of the most significant financial investments that the majority of Australians will ever make is purchasing a property. The choice of a home loan can have a substantial impact on the long-term financial outcome, just like any significant investment.

There are several types of home loans accessible in Australia. To assist you in making a sound decision, we will examine the pros and cons of several Australian home financing options in this post.

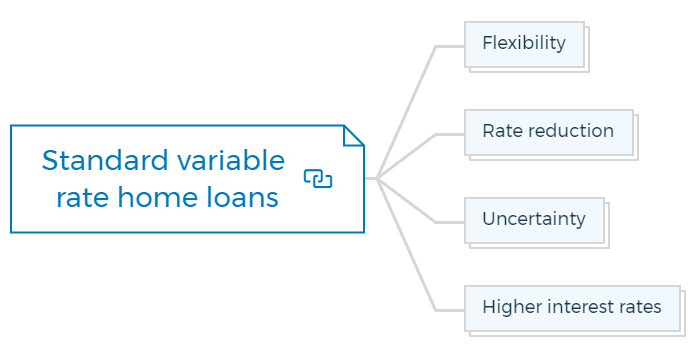

Standard variable rate home loans

One of the most common forms of home loans in Australia is the Standard Variable Rate (SVR) mortgage. The interest rate on this kind of loan may change over time based on the state of the market.

Pros:

Flexibility

The loan structure for variable interest rate home loans is relatively flexible, allowing you to make extra payments or pay off the loan early without paying penalties.

Rate reduction

If interest rates go down, so will your interest rate and payback schedule, resulting in less interest paid overall for the loan.

Learn More

Cons:

Uncertainty

Planning your budget and finances might be difficult when you have an SVR home loan since you are unsure of your future repayment amounts.

Higher interest rates

SVR home loans sometimes offer higher interest rates than other types of mortgages.

You are missing out if you haven’t yet subscribed to our YouTube channel.

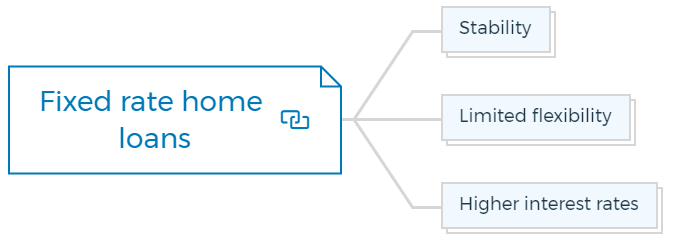

Fixed rate home loans

Fixed rate loans are a type of home loan where the interest rate is fixed for a set period, typically between 1-5 years. During this time, borrowers make both the interest and principal repayments, which means their monthly repayments remain constant for the duration of the fixed-rate period.

Pros:

Stability

A fixed-rate home loan gives you greater financial security since you know what your payments will be for the duration of the fixed-rate period.

Budgeting

Fixed-rate mortgages offer a fixed monthly payment, making it simpler to plan for loan repayments.

Learn More

Cons:

Limited flexibility

Fixed-rate home loans have limited flexibility, so you can’t make extra payments without paying a lot of money in fees.

Higher interest rates

Fixed-rate house loans sometimes have higher interest rate than those of other home loan alternatives, which deters some borrowers.

Learn More

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

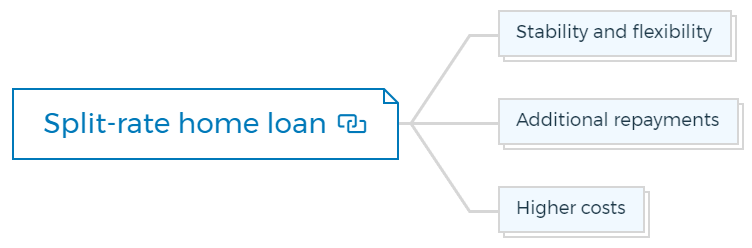

Split-rate home loan

Split-rate mortgages allow borrowers to divide their loans into a fixed and a variable portion, giving them the advantages of both loan types.

Pros:

Stability and flexibility

Split-rate home loans give borrowers stability and flexibility, enabling them to benefit from declining interest rates while still having some degree of predictability regarding their repayment obligations.

Additional repayments

Split-rate home loans provide borrowers with the option to make extra payments on the loan’s variable balance.

Cons:

Higher costs

Split-rate mortgages sometimes have higher startup and account-keeping costs than other types of mortgages.

Split-rate mortgages might be more complicated than other mortgage alternatives, so it’s essential to fully comprehend their structure and expenses.

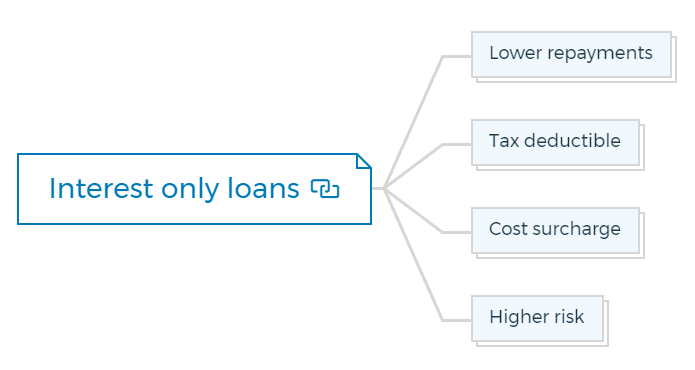

Interest only loans

Borrowers with interest-only mortgages are required to pay just the interest portion of the loan for a certain amount of time, often between 1 and 5 years.

Pros:

Lower repayments

Interest-only mortgages feature lower monthly payments than other mortgage choices, which appeals to property investors and borrowers with erratic income.

Tax deductible

For real estate investors, the interest portion of the loan is tax deductible, bringing down the total cost of borrowing.

Learn More

Cons:

Cost surcharge

Despite the lower monthly payments, the longer loan period and interest-only portion result in a higher overall loan cost.

Higher risk

Because borrowers aren’t making principal reductions on their mortgages, interest-only home loans may be riskier overall.

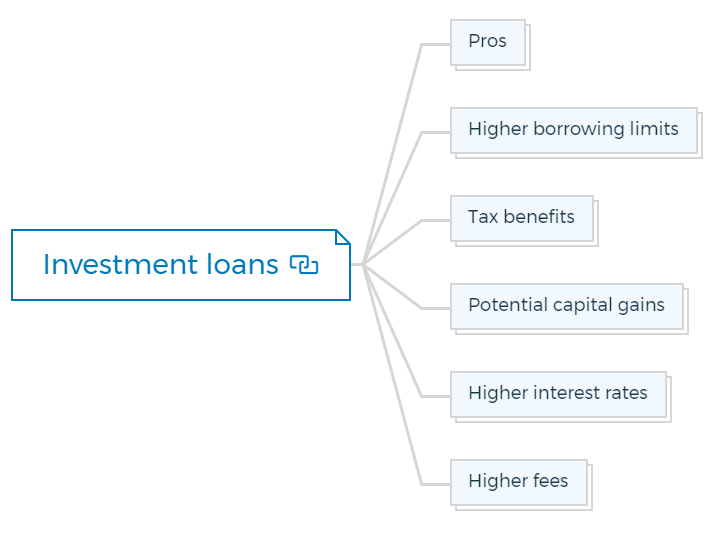

Investment loans

Investment loans are designed for investors who want to purchase an investment property. These types of home loans typically have higher interest rates than owner-occupier home loans.

Investors seeking to reduce their tax liability may find investment loans to be an appealing option, as the interest payments on such loans are eligible for tax deductions.

Pros

Higher borrowing limits

Investment loans typically have higher borrowing limits than standard home loans, allowing investors to purchase a more expensive property.

Tax benefits

Interest payments on investment loans are tax-deductible, making them an attractive option for investors looking to minimise their tax liability.

Potential capital gains

Investment properties have the potential to increase in value, allowing investors to realise capital gains when selling the property.

Cons

Higher interest rates

Investment loans typically come with higher interest rate than standard home loans, making them more expensive over the loan’s life.

Limited flexibility

These types of home loans have limited flexibility, making it harder for investors to make extra repayments or access funds if needed.

Higher fees

These loans can come with higher fees and charges compared to standard home loans, which can increase the overall cost of the loan.

When selecting a home loan, it’s crucial to consider essential elements like interest rates, fees, loan features, and repayment flexibility.

Gain an extensive understanding of the loan term and structure, including potential penalties for early repayment or additional repayments, to properly compare home loans and ensure a successful borrowing experience.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber