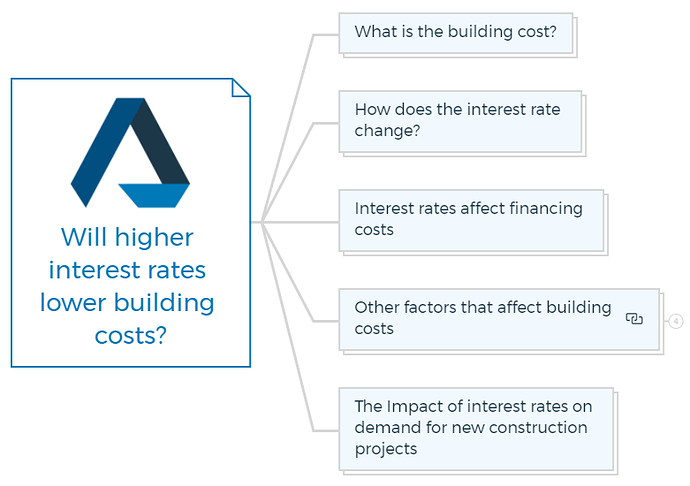

Will higher interest rates lower building costs?

When it comes to building a home or any type of construction project, there are many factors that can affect the cost, including labor, materials, and financing. Interest rates are one of the factors that can have a significant impact on financing costs.

In this blog post, we’ll explore the question: Will higher interest rates lower building costs?

What is the building cost?

Building costs refer to the expenses associated with constructing a new building, including labour, materials, and financing.

Higher interest rates do not necessarily lower building costs. Building costs depend on several factors, such as materials, labour, permits, and zoning rules.

Lenders charge borrowers interest on loans.

When the interest rate is high, it raises the cost of borrowing money, making it more expensive for property developers to fund their projects, thereby raising the entire cost of building a house.

You are missing out if you haven’t yet subscribed to our YouTube channel.

How does the interest rate change?

Interest rates change based on market circumstances and central bank policy. When interest rates are low, property developers may borrow money and fund their projects, lowering building costs.

Learn More

Interest rates can also affect housing demand, real estate prices, and development expenses. Low borrowing rates increase house demand, which raises development costs.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How do interest rates affect financing costs?

Interest rates affect financing expenses since they determine the cost of borrowing. Low-interest rates make funding easier and cheaper for developers and builders. This may boost construction and lower building expenses.

Conversely, when interest rates rise, borrowing money becomes more expensive. This may reduce construction and raise building expenses.

Higher borrowing rates can also reduce demand for new construction projects, which raises building costs.

Learn More

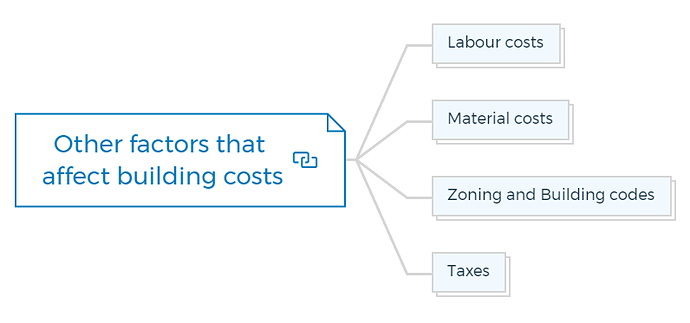

Other factors that affect building costs

Building expenses are affected by several factors, including loan rates. Other building cost variables include:

Labour Costs

The cost of labour can vary based on factors such as location, skill level, and demand.

Material costs

Supply and demand, tariffs, and global economic circumstances affect material costs.

Zoning and Building Codes

Local restrictions can affect building project costs, notably in terms of time and resources needed to obtain approval.

Taxes

Property, sales, and other taxes increase building costs.

Learn More

The Impact of interest rates on demand for new construction projects

Interest rates also affect new building demand. Low-interest rates make mortgages cheaper for homebuyers. This may enhance demand for new homes and buildings.

When interest rates rise, home loans cost more. This can reduce new house demand and development activity. As builders and developers compete for less work, building costs might rise.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber