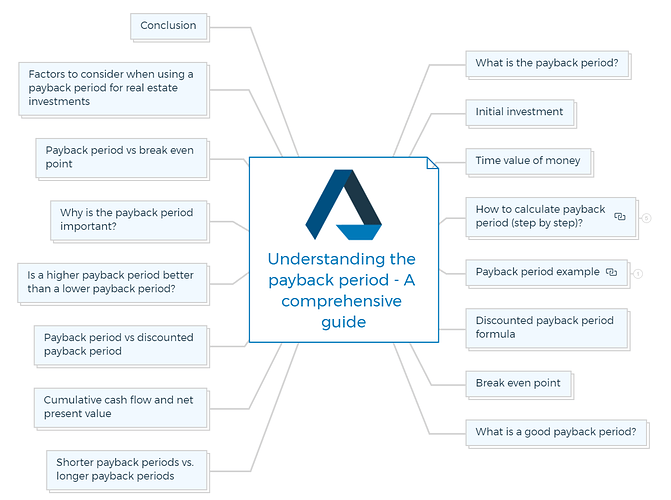

Mastering the payback period formula: An investor’s guide

Understanding the payback period helps investors and business owners make smart financial decisions. The payback period is a financial metric that measures the time it takes an investment to generate enough cash flow to cover its initial cost.

What is the payback period?

The payback period measures how long a project pays for itself. It is the time required for the total cash inflows to equal the project’s initial cost.

The payback period formula calculates the breakeven point and helps real estate investors estimate how long it takes to recoup their property investment. The measurement of payback period is done in years or months.

Initial investment

Capital investment, or initial investment, is the full project cost needed to start the project. It includes research, development costs, equipment, closing, and remodeling and maintenance costs.

The project break even point depends on the initial investment.

Time value of money

Payback periods assume constant cash inflow and reinvestment. But inflation and other factors change the value of money. Thus, the payback period must consider the time value of money.

Learn More

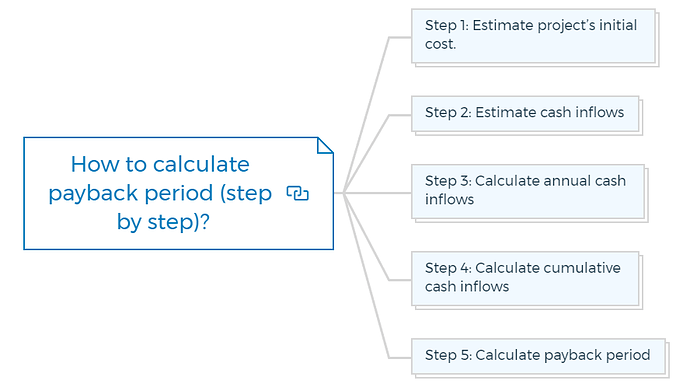

How to calculate payback period (step by step)?

Payback period calculation:

Step 1: Estimate project’s initial cost.

The initial investment is the amount that is required to begin the development project. This may include labor, construction, and equipment.

Step 2: Estimate cash inflows

Cash inflows are the amount of money the project is expected to generate over its lifetime. Revenue from sales or cost savings may be included.

Step 3: Calculate annual cash inflows

Calculate annual cash inflows by dividing total cash inflows by the project’s estimated revenue years.

If the property generates $1,000,000 over five years, it would generate $200,000 annual cash inflow.

Step 4: Calculate cumulative cash inflows

The project’s total cash inflows are cumulative. Add the annual cash inflows each year until they meet the project’s initial cost.

Step 5: Calculate payback period

The payback period is when cash inflows match project costs. Add the years it takes cumulative cash inflows to meet or exceed the initial cost.

Payback period example

You invest $1,000,000 in a real estate property and expect annual cash streams of $200,000.

Annual cash inflows:

Year 1: $200,000

Year 2: $400,000

Year 3: $600,000

Year 4: $800,000

Year 5: $1,000,000

Cash inflows reach the project’s initial cost after 5 years. The payback period is 5 years.

This payback period calculation ignores time value of money, which may alter the project’s long-term profitability.

You are missing out if you haven’t yet subscribed to our YouTube channel.

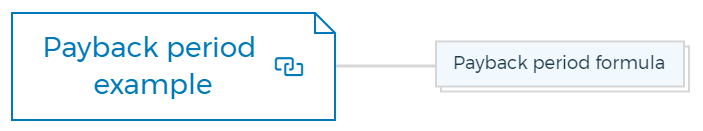

Payback period formula

The project’s initial cost and average annual cash flow determine the payback period. Payback period formula:

Payback period = Initial cost / Average annual cash flow

Net cash flow (cash inflows minus cash outflows) divided by project lifespan gives the average annual cash flow.

Discounted payback period formula

The discounted payback period calculation takes into account the time value of money.

The discounted payback period formula uses a discount rate to present future cash flows instead of assuming a constant rate of return.

This better estimates how long an investment takes to return its initial cost in today’s dollars.

Learn More

Break even point

The breakeven point is when the total cash inflows equal its total cash outflows, including the initial cost and continuing expenses like property taxes, insurance, and upkeep.

Breakeven indicates the investment’s first positive cash flow.

What is a good payback period?

A real estate investment’s payback period depends on the investor’s goals, the local market, and the property’s condition and location.

In general, a shorter payback period is better. A shorter payback period means the investment will recover its initial cost and generate cash flow faster.

Shorter payback periods vs. longer payback periods

Between these two, a shorter payback period is preferable.

A shorter payback period means the project is generating positive cash flow faster, reducing risks of future uncertainty.

Projects with better long-term rewards or strategic value may have a longer payback period.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Cumulative cash flow and net present value

Cumulative cash flow is the total cash generated by a real estate investment over a given period.

Net present value is the present value of all future cash inflows less the initial cost. These measures can assess long-term real estate investment profitability.

Payback period vs discounted payback period

There are two different approaches to analyse investment: The payback period and discounted payback period method. The discounted payback period takes into consideration the time value of money by discounting future cash flows, unlike the payback method, which solely examines the investment’s initial cash outlay.

The payback period method is a simple way to calculate an investment’s payback time.

Payback period formula:

Payback period = Initial cash outlay/Average annual cash flows

This method helps investors calculate their return. It ignores the time value of money, which might lead to inaccurate conclusions.

The discounted payback period method discounts future cash flows to account for time value of money.

Discounted payback period formula:

Discounted payback period = Initial cash outlay/Discounted average annual cash flows

Due to the time value of money, the discounted payback period method is more accurate for assessing investment profitability. However, it requires additional computations and assumptions about the cash flow discount rate.

Is a higher payback period better than a lower payback period?

No, a lower payback period is beneficial because it means the investment will return its initial cost faster and start generating positive cash flow.

You should consider the payback period alongside net present value and internal rate of return.

Why is the payback period important?

Real estate investors use the payback period to assess property profitability. The investor might assess a property’s suitability by comparing the payback period to their goals and finances.

Payback period vs break even point

The payback period and break even point are connected yet measure different things.

The payback period is the time it takes to recoup the initial investment, while the breakeven point is when the investment starts to make money.

When assessing real estate investments, both are crucial and should be considered together.

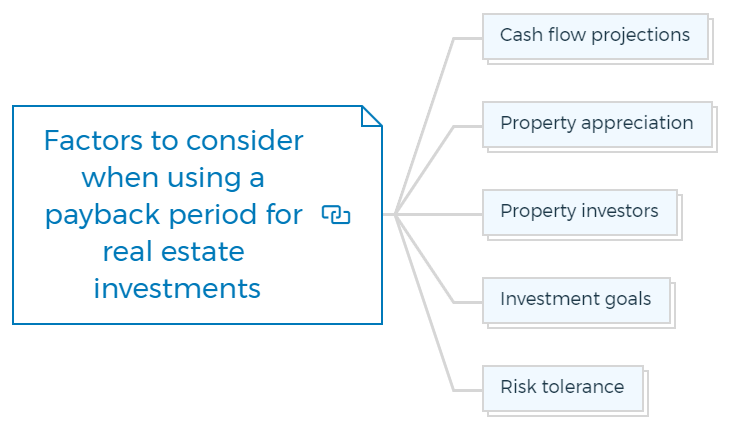

Factors to consider when using a payback period for real estate investments

Cash flow projections

Consider cash flow estimates when evaluating real estate investments utilising the payback period.

Cash flow predictions assist investors in estimating property revenue and expenses. Payback period calculations require accurate cash flow estimates.

Property appreciation

Property appreciation means an increase in the value of property over time.

Property investors

Property investors should consider property appreciation when assessing real estate investments because it might affect the payback period.

Investment goals

Payback periods should be based on real estate investors’ goals. Different goals may have different payback periods.

Risk tolerance

Real estate investors must consider risk tolerance when using the payback period. The payback period ignores real estate investment risks.

Thus, investors must examine their risk tolerance and determine if a longer payback period is worth the risk.

Conclusion

It’s important to comprehend the payback period if you want to make wise financial choices while evaluating an investment opportunity. Investors often use a metric to estimate the time it takes to recover their investment and start making a profit. This metric is quite important.

It’s important to keep in mind that the payback period shouldn’t be the only thing you consider when making a decision. It’s important for investors to keep in mind things like the time value of money, break even point, cumulative cash flow, and net present value.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber