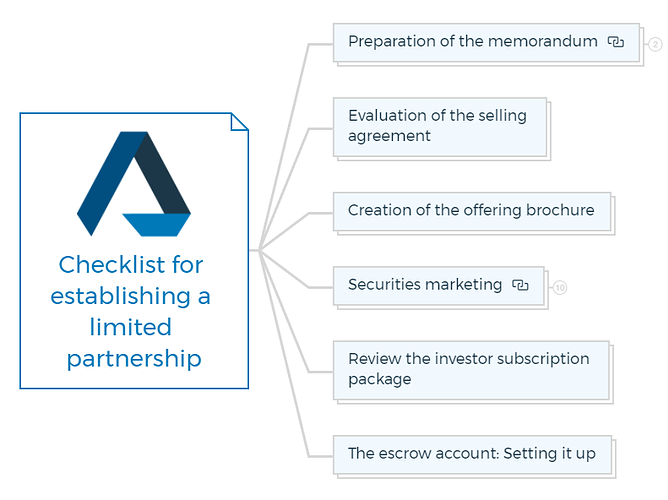

1. Preparation of the memorandum

When creating the memorandum, the manager (or, in our case, the developer) should hire a lawyer who’s experienced in real estate and security laws.

This is because when raising money for the project, the manager isn’t just selling real estate but is also selling something called a security.

1.1. Limited partnership memorandum

- First page with:

- Partnership name

- Amount of money being raised

- Number of units available

- Other important info

- Who can invest

- Who is allowed to invest in the partnership

- About the investment

- What the investment is all about and a short summary

- Risks involved

- Any possible problems or risks that could happen

- Money matters

- How much money is needed and how it will be used

- Plan for selling

- How the partnership plans to sell its offering

- Sharing the money

- How the profits will be shared among partners

- Details about the property

- Information about the property the partnership is dealing with

- Getting the property

- How the partnership plans to get the property

- Payment for the manager

- How the manager will be paid for their work

- Manager’s experience

- Background and financial status of the manager

- Past projects

- Other deals the manager has worked on before

- Manager’s duties

- What the manager is responsible for

- Manager’s conflicts

- Situations where the manager might have a conflict of interest

- Property purchase agreement

- The agreement for buying the property

- Development agreement

- The agreement for developing the property

- Property management agreement

- The agreement for managing the property

- Taxes to consider

- How taxes will affect the investment

- State and local taxes

- Taxes from the state and local government

- Limits on selling shares

- Rules for selling or transferring partnership shares

- Summary of partnership agreement

- Brief explanation of the partnership’s legal agreement

- Ongoing legal cases

- Any ongoing legal problems involving the manager

- Definitions

- Meanings of important terms

- Partnership’s financial situation

- A snapshot of the partnership’s finances

- Predicting the future

- Estimates of how things will go financially

- Extra documents

- Additional papers that are important

1.2. Outline of a subscription booklet

This is what should be in a Subscription Booklet:

- How to subscribe

- Steps to follow for subscribing

- Questions for investors

- Questions about the investor’s background

- Questions for representatives

- Questions for the person handling the investment

- Partnership’s legal agreement

- A copy of the partnership’s official legal agreement

- Agreement to invest

- Document saying the investor wants to invest

- Promise to pay

- Document outlining how the investor will pay

- Financial information

- Documents about the investor’s finances

- Banking references

- Information about the investor’s banks

- Promise to cover losses

- Document saying the investor will cover losses

2. Evaluation of the selling agreement

- Consult legal experts to draft the selling agreement.

- Define the roles, responsibilities, and obligations of all partners.

- Outline procedures for admitting new partners or transferring partnership interests.

- Include dispute resolution mechanisms and partnership termination clauses.

- Ensure compliance with applicable laws and regulations.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Creation of the offering brochure

To make the marketing process smoother, the manager should make a short brochure of one to four pages that shares the important details about the investment. This brochure should include:

- A picture or drawing of the property.

- How much the property costs and the deal’s conditions.

- Information about the financing used.

- What the money from investors will be used for.

- Details describing the property.

- A map showing where the property is located.

- Plans for renting out the property and the types of units available.

- Financial plans:

- Predictions about how much money the investment will make.

- Estimates of the money that will be taxed (or not) and what will be spent.

- Forecasts about how valuable the investment might be if sold in the future.

-

Special reasons why this investment is a good idea.

-

Contact details for any questions about the investment.

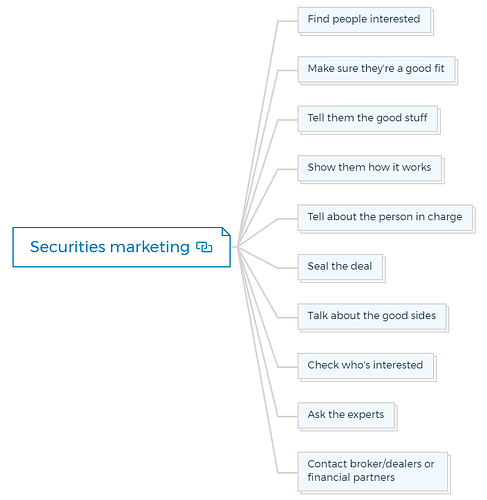

4. Securities marketing

When you’re trying to sell a limited partnership, it’s a bit like selling a special kind of investment that’s watched over by the government. This means there are important rules you have to follow exactly.

If you don’t follow these rules, it can lead to problems later, like arguments with the people who invested or even getting into legal trouble, like having to pay money or go to jail. You have to be really sure you’re telling the truth and not leaving out any important information when you talk about this.

Here’s what you should do to tell people about this investment and get them interested:

4.1. Find people interested

Figure out who might want to invest in this.

4.2. Make sure they’re a good fit

Check that the people who want to invest are a good match for this kind of deal.

4.3. Tell them the good stuff

Let them know all the great things about this investment.

4.4. Show them how it works

Explain how this investment works, sort of like showing them how a new gadget works.

4.5. Tell about the person in charge

Tell them about the person who’s going to take care of their investment.

4.6. Seal the deal

If they’re still interested, you can finish up the deal.

You can find people who might want to invest using a few different ways:

4.7. Talk about the good sides

Teach them about why owning real estate is a good idea through small gatherings where you chat about it.

4.8. Check who’s interested

Look at records to see who has invested in similar things before.

4.9. Ask the experts

Talk to people like lawyers, accountants, bankers, or insurance agents who have clients wanting to invest in real estate.

4.10. Contact broker/dealers or financial partners

Get in touch with people who help others with investments, like brokers or financial planners.

5. Review the investor subscription package

- Compile all necessary legal documents, including the subscription agreement.

- Specify the terms of investment, including the minimum contribution required.

- Outline the procedures for subscribing to the partnership and transferring funds.

- Clearly communicate the rights and responsibilities of limited partners.

- Include a provision for anti-money laundering (AML) and know-your-customer (KYC) checks.

6. The escrow account: Setting it up

- Choose a reputable financial institution to set up the escrow account.

- Ensure the account is properly designated for holding investor funds.

- Clearly define the conditions for releasing funds from the escrow account.

- Coordinate with legal and financial professionals to ensure compliance with regulatory requirements.

- Provide investors with transparent information about the escrow process.