How to sell a commercial property in record time? (Find out what the experts are doing)

When you are looking to sell a commercial property quickly, there are a few things you can do to help speed up the process. Here are some tips to help get the job done. The quicker you can find a buyer and close the deal, the better. Follow the article and sell commercial property in no time.

What is the need to sell the commercial property?

The consensus is that commercial property is a long-term investment with regular income and capital growth. On the other hand, people’s needs fluctuate throughout time. What was once an intriguing investment may become less tempting several years down the road for various reasons. As a result, you may determine that selling is necessary.

For example, you may require the part (or all) of the funds you’ve invested right now. Or maybe you get a deal that is too wonderful to pass up. You may believe that property values are about to fall and that you should sell now.

When to sell a commercial property?

When it comes to selling a commercial property, however, there are several obvious factors to consider, and the smart real estate investor should be aware of them:

- You can ‘up value’ (increase the proportionate value) of plant and equipment when you buy a property, even if it isn’t brand new, as long as the contract doesn’t specify a particular written-down value for these components. It might provide you with significant depreciation benefits during the first few years of property ownership.

Plant and equipment (carpets, cabling, light fixtures, elevators, heating and air conditioning) deteriorate faster than other assets. Depreciation is higher in the first few years of ownership. You can claim most of that type of depreciation after five or six years.

Ensure that the purchase contract does not include a value for the plant and equipment when purchasing the property. It will protect you from overvaluing those highly depreciable components. When it comes time to sell, though, it’s just as crucial to reflect their written-down worth in the contract.

If the new owner decides to up value the plant and equipment again, you could face a balancing charge from the Tax Office. As a result, this could be the tipping point for you to sell, especially if you’ve recently renewed a five-year lease on better terms, increasing the property’s value.

-

You may discover that an older property (that you own) requires significant structural or capital improvements. The roof, for example, may need to be replaced. If you don’t have the cash on hand, selling the property and passing these charges on to the new owner may be preferable.

-

You may own a home in an area with considered zoning or road network modifications. If the lease has fewer than two years left, it may be conceivable to sell the property to an owner-occupier who is anxious to take advantage of the improvements’ ‘blue-sky’ potential.

In reality, you may not implement the proposed adjustments. However, for as long as they appear to be a possibility, they could make your house incredibly enticing to a specific qualified buyer, potentially resulting in a significant cash gain upon its sale.

How to sell a commercial property?

Know your market

Who is your target audience, and what are they looking for in a property?

It’s essential to have a clear idea of your target audience when selling commercial real estate. Once you know this, you can tailor your marketing and sales strategy accordingly.

You should also be aware of what features and amenities are most important to your target market - for example if you’re targeting businesses, then access to major highways or public transportation may be key selling points.

Finally, always remember that time is of the essence when selling commercial property. The sooner you get your property on the market, the better returns you will get. So be prepared to act quickly when a potential buyer expresses interest.

Price your property correctly

Don’t overprice or Under-price, and make sure to factor in all associated costs

Accurately pricing your property is one of the most critical aspects of selling commercial real estate fast. If you overprice your commercial property, purchasers will move on to another option. On the other hand, if you price your property too low, you may not get the total value of your investment.

When pricing your property, it’s crucial to find the right balance and factor in all associated costs. It includes marketing costs, repair/renovation costs, and commissions.

The best way to price your property correctly is to consult with a professional real estate agent who has experience selling commercial real estate in your area. They will understand the market and give you an accurate valuation of your property.

Have realistic expectations

Be prepared for offers that may not meet your asking price

When selling properties, it’s essential to have realistic expectations. In most cases, you won’t get the total asking price for your property. However, this doesn’t mean that you shouldn’t accept any offers; consider every offer, no matter how low or high it is.

By being flexible and open to negotiation, you may be able to get closer to your asking price than you thought possible.

Many commercial real estate transactions are less glamorous than high-rise office complexes. Farms, light industrial structures, small retail stores, and vacant land zoned are the reasons for most of your commercial real estate sales. Expect to visit farms and talk about livestock more than large office properties.

Compare similar properties

See what’s selling and for how much to get an idea of your competition

During the sale of commercial real estate, it’s important to compare your property to similar ones in the area. It will give you an idea of your competition and the average price of similar properties in the current market.

It’s also an excellent way to see what features and amenities are most important to a potential buyer. By understanding your competition, you can tailor your selling strategy accordingly.

If you’re not sure where to start, check out listings on popular real estate websites or ask a local real estate agent for help. Once you’ve gathered comparable properties data, you can price your property accordingly and start marketing it to potential buyers.

Take great care of your commercial property

Keep it clean and well-maintained to attract buyers

When you are trying to sell a commercial property, it is important to keep it clean and well-maintained. This will make it more appealing to potential buyers and help you get a better price for your property. Here are some tips on how to keep your commercial property in top condition:

- Hire a professional cleaning company to regularly clean the premises.

- Make sure the common areas are always tidy and free of debris.

- Repair any broken or damaged fixtures and fittings immediately.

- Keep the landscaping around the property well-maintained.

- If there is any graffiti or vandalism, have it removed immediately.

Make use of online resources

Create a website or listing with high-quality photos and detailed information about the property

In today’s digital age, it’s more important than ever to use online resources when selling commercial real estate property online. It includes creating a website or listing that features high-quality photos and detailed information about the property.

Potential buyers will be much more likely to take an interest if they can easily find all the information they need in one place. Using these resources, you can reach a larger audience and speed up the selling process.

You are missing out if you haven’t yet subscribed to our YouTube channel.

You are missing out if you haven’t yet subscribed to our YouTube Channel

Use real estate agents

They have the experience to sell commercial property fast at the best price possible

Real estate agents have the experience and expertise to help you sell your property quickly and at the best price possible. Plus, they can handle all the paperwork and negotiations for you. While there may be a fee involved, it’s worth it to get your property sold fast and for top dollar.

Your realtor should be able to discuss the present situation of the market in detail and provide estimates for the property’s potential price. However, these experts may provide a lot more to a home seller. A skilled agent should also be able to:

- Collect and compile all required information to ensure that potential investors are entirely educated and capable of making an informed buying decision.

- Communicate with you and your lawyers to ensure that the paperwork is complete and accurate.

- Send out brochures and letters (or, more likely, personal emails) to those possible qualified buyers who are known to be on the market right now.

- Attempt to get editorial coverage in the many media outlets you can utilise.

- Qualify all of the leads that come in as a result of the marketing campaign

- Arrange for various inspections to be conducted.

- Get potential bidders ready for the actual auction

- Keep you up to date on the progress at least once a week

- Ensure to do all the preparations for a smooth auction day.

- Organise the auction and oversee the signing of contracts with the winning bidders

- Check in with your real estate attorneys to ensure the completion of documents to their satisfaction.

How to market your commercial property successfully?

If you’ve ever sold a house, you’ll know that in the competitive market of real estate, each of the numerous commercial brokers you speak with will claim to have the effective recent sales technique. In reality, they don’t have a straightforward approach.

The following is a marketing strategy that most developers, investors, and experienced brokers have used for great success. It is a strategy for achieving the best possible result by creatively targeting investors, developers, and potential owner-occupiers and implementing a broad yet cost-effective marketing campaign that will attract the most qualified purchasers for your property.

Selecting a method of sale

The key to successfully marketing any property is to make potential purchasers feel they could be missing out. However, in the case of a straight, private transaction, this is extremely difficult to execute.

In reality, a private sale may take longer to produce a result because this method of selling fails to elicit any sense of urgency in the buyer’s mind.

Another problem is that choosing an ‘asking price’ puts you at a disadvantage. Traditionally, you’d need to inflate this number to account for the expected level of negotiation, but this can be a double-edged sword.

Because the figure is so much above their initial expectations, you may be able to discourage potential customers effectively. It might also go the other way: you could end up selling for less than what purchasers would have been willing to pay if they were under the strain of competitive bidding.

As a result, a well-publicised public auction is frequently the best sale form. That way, all potential purchasers are working toward the same deadline, and you won’t have to announce a selling price publicly. You may keep control of this method.

An advertising approach

As you may be aware, media advertising can be rather pricey, and there is a limit to how much information you can convey about a property in a single campaign. Experts’ strategy is to link media ads to dedicated internet pages for each property they sell or lease, which is highly effective.

Most agents choose to list their properties on the internet in a generic manner, for as on portal sites. Following this course may result in the difficulty of going through a lengthy search process on one or more websites for every buyer looking for such homes.

What’s worse for you as a seller is that while you’re doing so, purchasers may find several other properties that they prefer instead!

Experts found that creating numerous dedicated web pages for your property on our website and promoting that unique web address in media ads, brochures, and posters works best. It means that qualified buyers can zoom in on your home and see and download a lot more information about it.

You can give a complete description of the property (across several pages), give facts about the location, and lay out the property’s inherent merits by using dedicated websites. You can also upload photos of the outside and inside of the building.

In most cases, you’ll need to spend 1.0 to 1.5 percent of the anticipated selling price on marketing your home. However, as shown, sellers can obtain an even better result while saving money by using this innovative, web-based technique.

Why properties sell for less (or more) than market value

Market value sales in real estate specifies the below criteria -

- Both buyers and sellers usually want to make a deal. Neither acts under duress.

- Both buyers and sellers have a good understanding of the property and market.

- The marketing time frame and sales promotion efforts are enough to let potential buyers know that the property is for sale (i.e., no forced or rushed sales).

- There are no unusual terms of purchase, such as a low down payment, all cash, or an interest rate that is lower than the market rate.

- Neither the seller nor the buyer makes any unusual concessions, like letting the seller stay in the house rent-free for three to six months while their new house is being built or making their offer contingent on the sale of their current home.

If the owner needs to sell quickly, they may have to settle for less than the market value. Also, a “for sale by owner” (FSBO) seller who doesn’t know how to market and promote a property probably won’t get top dollar.

Or, let’s say the sellers live somewhere else. They don’t know that recent sales prices have gone up, or maybe they don’t know that their property (or the area around it) is a great place to make some money-making improvements.

Below are some situation/reasons when people sell property at different price than the market value -

Owners in distress

People go through hard times every day, and news stories show this in a very clear way. They lose their jobs, get divorced, get hurt or sick, have setbacks in their businesses, fall behind on their car loans, credit card payments, and mortgage payments, and a whole host of other problems hit them like a freight train.

Any of these disasters can make it hard to pay the bills. For many of these people, the only way out of their problems is to sell their property quickly at a low price to get cash.

Some investors don’t like to take advantage of the poor. But owners who are having trouble paying their bills want to get rid of their restless nights. If that means they have to sell their home for “less than it’s worth,” they are willing to do that.

People don’t just sell a house to these people; they buy relief. If the sellers feel they have benefited more from the transaction than they have lost, then it is a win-win situation for both of them.

If you want to help people deal with hard times instead of taking advantage of them, look for owners in distress and will sell you their property at a low price or on good terms.

Stage-of-life sellers

If you want to buy something for less than the market price, look for deals from sellers in different stages of life. Some of these sellers are people whose lifestyles no longer fit with their homes. They might not like having a big house or yard, getting rent, or dealing with complaints from tenants anymore.

No matter why they want to sell, stage-of-life sellers want to move on with their lives. Also, sellers in this stage of life have usually built up a lot of equity in their homes, which makes them good candidates for a good deal on price or terms.

And because they are older, they might have saved or invested a lot of money. Sellers in a certain stage of life are open to offers. They don’t have to get every last penny from their sale or keep all of the money from the deal. Because sellers in this stage of life often don’t need cash right away, they are great candidates for OWC (owner will carry) financing.

Not only will OWC terms help them sell their property faster, but an installment sale also reduces or delays the capital gain taxes that might be triggered by a cash sale.

Another benefit of OWC financing is that it often gives sellers a higher cash income return than a savings account, certificate of deposit, bonds, money market fund, or stocks. This is true even when the interest rates are below market rates.

Seller ignorance

Some people underprice their homes because they don’t know what similar homes have been selling for in the past few months. Or they don’t know of a unique benefit that makes their property stand out in a good way.

Sometimes sellers do it by accident, and sometimes they do it on purpose. Keep your eyes open for this chance. Jump on a good deal when you see one. Properties that are priced too low often sell quickly.

Even though good deals go quickly, not all properties that are cheap are good deals. A good deal is only good if you can sell the property for a lot more than what you put into it. Watch out for long-term markets that are going down, where a price that seems low today will be even lower tomorrow.

Also, make sure you have a good idea of how much it will cost to fix any hidden problems or environmental issues, such as lead paint, underground oil storage tanks, asbestos, or contaminated well water. Split up your money. Keep your improvements in line with what your potential renters can and are willing to pay.

Do a thorough physical, financial, market, legal, and feasibility analysis of a bargained-priced property before you decide to buy it. Take your time with seller financing that requires little or no money down. Don’t give in to the urge to jump without looking.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

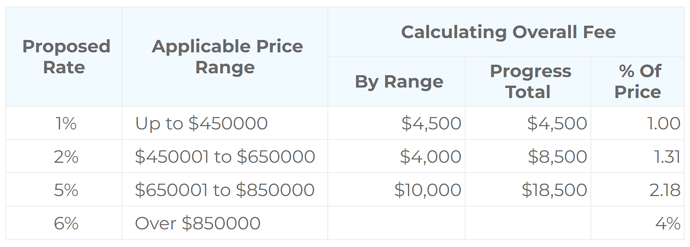

Fees of agents for selling a commercial property

When you sell a property successfully, agents usually charge 2.0 to 3.0% (plus GST) of the actual amount that appears on the contract, depending on the valuation.

On the other hand, a flat-fee deal isn’t always in your best interests. Some agents frequently offer incentive-based fees, in which the percentage charged climbs in proportion to the property’s sale price. As a result, the agent has a stronger motivation to achieve the feasible price.

A typical incentive-based fee scale for a new property expected to sell for $840,000 to $860,000 could look like this.

Hopefully, this has given you some insight into promoting your business property effectively when the time comes.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

Continued at…

How to sell a commercial property in record time? [Part 2]