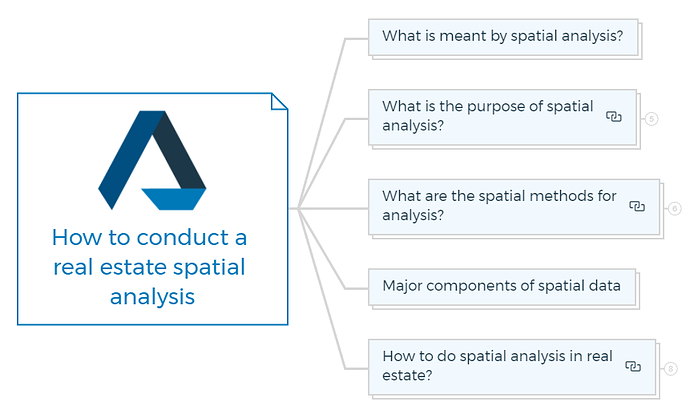

Spatial Analysis

Spatial analysis has emerged as a powerful tool in the real estate industry, enabling professionals to gain valuable insights into market dynamics, property values, and location factors.

By leveraging spatial data and analytical techniques, real estate practitioners can make informed decisions, optimise strategies, and stay ahead in a highly competitive market.

I planned all the data I collected on Google Maps to see where the property sits concerning other properties around. You can check the detailed video to understand how to analyse spatial data.

What is meant by spatial analysis?

Spatial analysis in real estate refers to studying spatial data and using analytical techniques to gain insights and make informed decisions about the real estate industry.

It involves examining and interpreting the spatial relationships, patterns, and trends within real estate data to understand the market dynamics, property values, location factors, and other spatial aspects.

You are missing out if you haven’t yet subscribed to our YouTube channel.

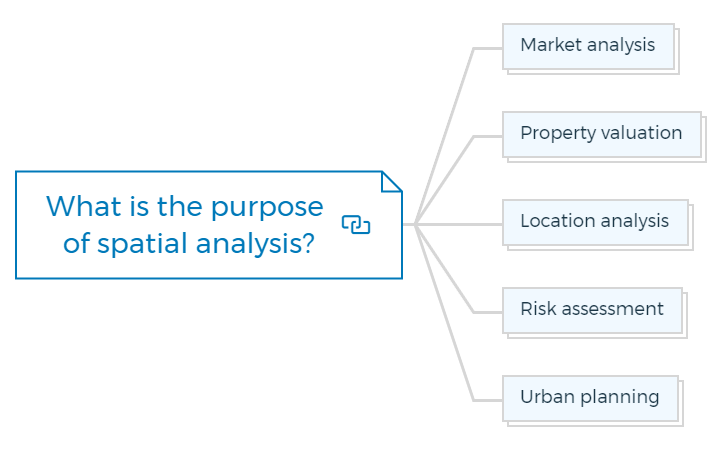

What is the purpose of spatial analysis?

Real estate spatial analysis helps comprehend market, property, and location factors. This enhances real estate knowledge.

It means using property location data and other analysis methodologies to understand how properties are related, what patterns may be seen, and what real estate market trends are occurring.

The goal is to provide information that can help in making decisions and improving strategies related to real estate.

Here are the specific purposes of spatial analysis in real estate -

Market analysis

Spatial analysis can help real estate professionals identify market trends, hot spots, and how sales data, rental costs, and property features vary by geography.

When you consider how markets are evolving in different places, you can make sensible decisions about where to invest and how to price your property.

Learn More

Property valuation

Spatial analysis helps determine property value by considering numerous spatial aspects. Property value is determined by its proximity to amenities, transit networks, employment centres, and community characteristics.

Understanding spatial context helps real estate agents value properties.

Location analysis

Spatial analysis helps locate real estate, retail, and office buildings. Accessibility, demographics, competitiveness, and market demand can help professionals find the best locations.

It also helps in choosing a place and maximising ROI.

Risk assessment

Spatial analysis helps assess real estate investment risks. Spatial data analysis helps professionals assess natural risks, environmental issues, crime rates, and other threats.

By doing so, real estate professionals may identify risky locations and make informed property, insurance, and risk mitigation decisions.

Learn More

Urban planning

Urban planning relies on geographical analysis. Spatial data on land use patterns, transportation networks, population distribution, and environmental factors can help planners make smart decisions regarding zoning, infrastructure, and sustainable growth.

Developing cities and communities carefully and effectively is crucial.

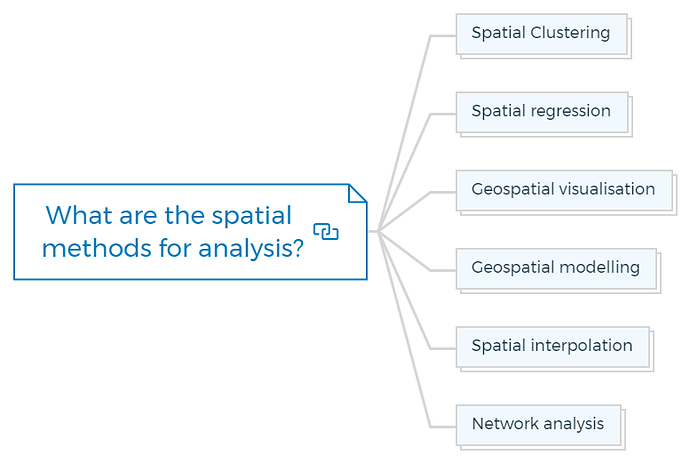

What are the spatial methods for analysis?

Property developers and investors use different spatial analysis methods to get insights into market dynamics, property valuations, and location factors.

Real estate uses numerous spatial approaches.

Spatial Clustering

It helps identify real estate data patterns and groupings. Cluster analysis can find properties with similar traits or market behaviour. This lets you find areas with high demand, emerging markets, or specific property categories.

Spatial regression

Spatial regression models analyse spatial relationships. Spatial autocorrelation or dependence helps understand how spatial factors affect property values.

Spatial regression helps assess how location-based factors like transit and amenities affect property values.

Geospatial visualisation

Visualise real estate data on maps via geospatial visualisation. This method intuitively visualises spatial patterns, trends, and linkages. Heatmaps, choropleth maps, and interactive mapping tools let you analyse property prices, market trends, and spatial variances.

Geospatial modelling

This method predicts outcomes using spatial data. Geographically weighted regression (GWR) and spatial econometric models examine geographical heterogeneity and location-specific connections. These models forecast property values, market patterns, and other geographical phenomena.

Spatial interpolation

Spatial interpolation calculates or predicts values for locations without data. Real estate professionals can predict property values and rental prices in untested areas by examining data from nearby places.

Network analysis

Real estate network analysis examines how locations are connected and accessible.

Transportation, amenities, and infrastructure affect property values and market dynamics. Network analysis determines residential and commercial location suitability.

Major components of spatial data

Real estate spatial data provides valuable information on properties, locations, and surroundings.

Real estate spatial data includes several key elements:

- Property boundaries

- Location coordinates

- Land use and zoning

- Property attributes

- Sales and rental data

- Spatial infrastructure

- Environmental factors

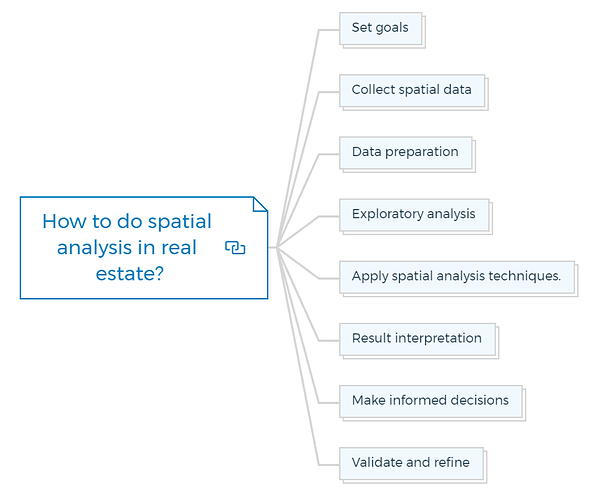

How to do spatial analysis in real estate?

Real estate spatial analysis requires numerous crucial processes. Here are the steps to conduct spatial analysis in real estate -

Set goals

Define your spatial analysis aims. Determine the topics or challenges you want to explore, such as market trends, appropriate development locations, property valuations, or market spatial relationships.

Collect spatial data

This contains property data, location data (boundaries, coordinates, and infrastructure), and pertinent market data (sales and rental prices). Validate and prepare the data for analysis.

Data preparation

Remove duplicates, handle missing values, standardise formats, and ensure dataset consistency. Property addresses may require geocoding.

Exploratory analysis

Visualise spatial data first. Map and visualise patterns, clusters, and geographical relationships. Analyse and visualise data using geospatial applications.

Apply spatial analysis techniques.

Use geographical analysis to achieve your goals. This may employ spatial clustering to detect hotspots and market trends, spatial regression to analyse location influences on property values, interpolation to estimate values in unsampled areas, or network analysis to assess accessibility and connection.

Result interpretation

Interpret spatial analysis results. Find noteworthy data patterns, correlations, and trends. Consider the spatial context and how the results match your goals.

Make informed decisions

Make informed decisions and suggestions based on your spatial analysis. This could involve finding attractive investment possibilities, choosing ideal development sites, creating pricing strategies, or mitigating risk.

Validate and refine

Maintain your spatial analysis strategy. Seek feedback, review your analysis, and make any necessary changes to improve accuracy and relevance.

I have also attached sample data and the map I explained in the video. You can play around with it and understand the concept of spatial analysis in more detail.

Test Your Knowledge

Assignment: Real Estate Spatial Analysis Project

Objective:

To conduct a comprehensive spatial analysis on a selected real estate market, leveraging spatial data to understand market dynamics, property values, location factors, and potential investment opportunities.

Instructions:

Introduction to Spatial Analysis

Write a brief essay explaining what spatial analysis in real estate is, its importance, and how it can influence decision-making in the real estate market.

Set Goals for Analysis

Define the objectives of your spatial analysis project. Choose a specific challenge or topic within the real estate market you wish to explore. This could be identifying market trends, determining the best development locations, analyzing property valuations, or examining the impact of location on property values.

Collect Spatial Data

- Identify and list the spatial data you will need for your analysis. This should include property data, location data (such as boundaries, coordinates, infrastructure), and relevant market data (sales and rental prices).

- Use the sample data provided with the article or collect your own data if necessary.

Data Preparation

- Clean your dataset by removing duplicates, handling missing values, standardizing formats, and ensuring consistency. Geocode property addresses if required.

- Submit a report detailing the steps taken to prepare your data for analysis.

Exploratory Spatial Data Analysis

- Visualize the spatial data using maps to identify patterns, clusters, and geographical relationships.

- Use geospatial visualization tools to create at least two types of maps (e.g., heatmaps, choropleth maps) that highlight key insights from your data.

- Describe your findings from the exploratory analysis in a written report.

Apply Spatial Analysis Techniques

- Choose and apply at least two spatial analysis techniques (such as spatial clustering, spatial regression, spatial interpolation, or network analysis) relevant to your project’s goals.

- Explain the methodology, process, and tools used for each technique in your report.

Result Interpretation and Decision Making

- Interpret the results of your spatial analysis, identifying significant patterns, correlations, and trends. Discuss how these findings relate to your initial objectives and the spatial context of your study area.

- Based on your analysis, provide recommendations for real estate investors, developers, or policymakers. Discuss potential investment opportunities, development sites, pricing strategies, or risk mitigation measures.

Validation and Refinement

- Reflect on your spatial analysis process and results. Discuss any limitations, challenges, or uncertainties encountered during your project.

- Propose steps for further research or analysis that could enhance the accuracy and relevance of your findings.

Presentation

- Prepare a presentation summarizing your project objectives, methodology, key findings, and recommendations. Include visual aids such as maps and charts to support your analysis.

- Present your findings to the class or submit a video presentation if required.

Research Questions (To be answered within your reports/presentation)

- How do property values vary spatially within your selected market?

- What are the key factors influencing the spatial distribution of real estate prices?

- Where are the emerging hotspots for real estate investment in your study area?

Submission Guidelines:

- Submit all written components as a single PDF document.

- Include any data files, maps, or visualisations separately or embedded within the PDF as appropriate.