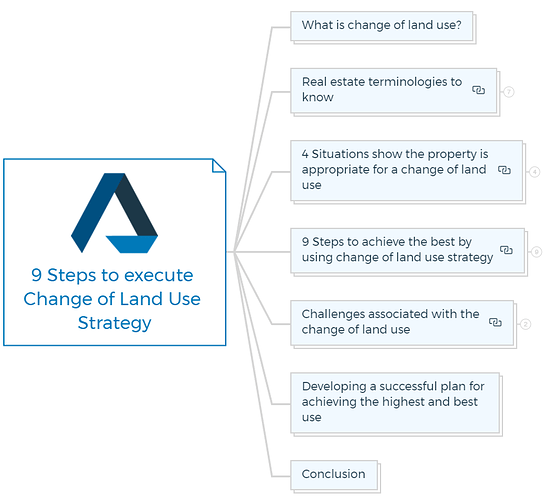

Change of land use strategy

9 Ways to achieve change of land use

The change of land use is a process by which the use or character of a particular parcel of land is changed. The change can be from agricultural land to residential, industrial, or commercial property.

It can also involve a change in the intensity of use, such as from low-density residential to high-density residential. There are many factors that go into determining the highest and best use for a property. Here are 9 of them.

What is change of land use?

Change of land use strategy is a process or plan to maximise the potential of land and natural resources in an area. It involves utilising existing land use practices, regulations, physical infrastructure, and other factors to determine how to best transform an area for development.

Change of land use strategies also involve assessing environmental impacts, identifying market trends and stakeholder preferences, and creating policies and plans to ensure the land is used most effectively.

Converting a motel into an office complex, turning a barren lot into a U-Pick-It Strawberry Patch, converting an apartment complex into a time-share resort, transforming a restaurant into a nightclub, and converting a five-unit apartment building into a seven-unit complex are just a few instances.

The land-use change can be subtle, such as when a general office facility is converted into an all-medical practice, but the result is constantly improved revenue potential.

This improved income potential may be transitory, serving as a stopgap measure, or it may be a long-term benefit to the property and its owners. Remember that no user can be deemed permanent because the building, site, and land tend to outlast any use.

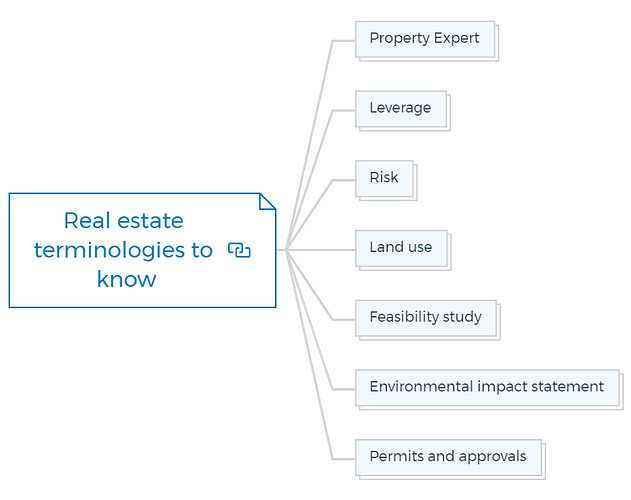

Real estate terminologies to know

Below are some terms you must know to learn and apply the concept of change of land use.

Property Expert

Property Expert also known as a Real Estate Developer, is an individual who has expertise in the buying, selling, and development of land or real estate.

Quick Tip

Property experts understand the intricacies involved in these transactions and have extensive knowledge of local zoning laws, market trends and values, construction costs, tenant/buyer preferences, financing options and more.

They are well-equipped to advise clients on the best strategy for change of land use in an area with respect to their personal needs or business objectives. These experts are also professionals who are familiar with the laws, regulations and procedures for changing land use in a particular area.

Becoming a property expert is simple. Enrol for property development mastermind course, get insider knowledge, apply the principles and concepts in your project. AND THAT’S IT…….

You will be on your way to become a property development expert.

Leverage

Leverage is when you borrow money at a lower cost than the yield generated by the property.

In rare cases, a real estate investor can borrow the entire amount needed to construct or purchase a property. If the property covers its expenses and pays the debt service, the investment is 100% leveraged in this situation.

In this case, even a break-even property will eventually amortise the debt’s value, which might be a significant return on investment.

Leverage, on the other hand, is a two-edged sword. When an investor uses too much debt, even a small drop in sales can turn a positive return into a negative cash outflow.

Learn More

Risk

Each person and transaction has its level of risk. You can reduce your risk by completing your initial due diligence. Most investors lose money not because they take risks they can’t handle but because they make mistakes in their investing strategies and lose sight of their initial objectives.

However, if the investor overestimates the income potential and underestimates the operational expenses, the agreement may face difficulties, and the transaction may be viewed as high-risk in retrospect.

The fundamental point of real estate investing is to minimise risk by learning everything there is to know about each investment. This concept will become more apparent as you complete the property development system.

It will help you gain confidence in your ability to invest in real estate and make you an expert in your field.

Some real estate terminologies to be aware of

Land Use Plan - A plan that outlines how an area will be used and developed, including designating areas for housing, commercial uses, etc.

Feasibility Study - An analysis of a proposed project or development to determine the likelihood of success.

Environmental Impact Statement (EIS) - A document that outlines the potential environmental effects of a proposed project or development.

Permits & Approvals - Permission from local, state and federal governments to undertake a proposed project or development.

You are missing out if you haven’t yet subscribed to our YouTube channel.

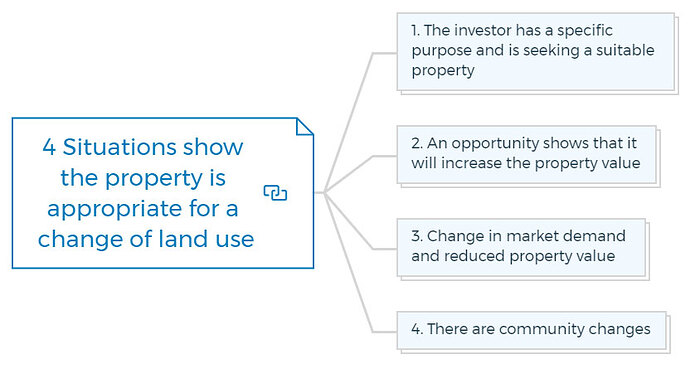

4 situations show the property is appropriate for a change of land use

You can make the highest and best land use in the following 4 situations by using a change in land use concept.

1. The investor has a specific purpose and is seeking a suitable property

Some investors hunt for defunct fast-food restaurants since this kind of conversion best suits their utterly different businesses.

Another developer converts existing residences into offices. Another investor has found apartment building conversions to seasonal furnished rentals profitable.

Land developers succeed because they know how to turn undeveloped agricultural land into residential and commercial projects. Each of these examples has intricacies that the individual property investor customises for his specific needs.

2. An opportunity shows that it will increase the property value

It frequently entails changing the zoning from one use to another to extend the market appeal, but the zoning may already permit the new use. Because many investors are visually oriented, this happens.

They notice a plot of property surrounded by single-family homes and assume the area is designated for single-family homes. However, the site may be zoned as industrial or other business.

Many investors specialise in taking a piece of vacant land and completing all of the necessary government paperwork to obtain approvals for a change of land use.

Then they sell the property to developers who would rather pay a profit to the first investor because they can now move forward into a ready-to-go property.

3. Change in market demand and reduced property value

In this instance, the owner should seek out a new use or change in the existing use, as well as a new type or category of the tenant, to boost the property’s value.

When an area deteriorates, rents drop, and property value plummets. Property owners may become trapped in this market and unable to sell their homes.

It’s challenging to watch land prices plummet, and most property owners believe there’s nothing they can do about it except lower the price.

Continuously falling pricing sets a tendency that might be difficult to reverse, and an already deteriorating area may deteriorate even more.

Worst of all, the few tenants you may have will be dissatisfied when they find that you are providing space in the building for half the costs they are paying now. It is the way to go if you want to eliminate your current tenants.

On the other hand, your tenants could contribute to your inability to rent the remaining space in the first place. The property owner should make a concerted attempt to identify a new use for the property that will help stabilise the decline.

When this is accomplished, the owner can reverse the downward trend, and property prices will begin to rise. In extreme cases, this may necessitate a collaborative approach with a group of property owners to determine what land-use change might allow for a turnaround.

Learn More

4. There are community changes

Many sorts of change might result in the demand for the highest and best use of land and, as a result, a higher economic return.

New roads, bridges, airports, schools, hospitals, and other infrastructure can significantly impact the surrounding neighbourhoods positively and negatively. Property values can rise and fall in response to the same improvement in community infrastructure.

A zoning change may be the best way to maintain or boost land values.

Because most infrastructure upgrades take time, an investor who is well educated about the community’s future intentions will be able to take advantage of possibilities long before they become apparent to the broader public.

So, these are some scenarios where you can take advantage of the change of land use concept and make huge profits.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

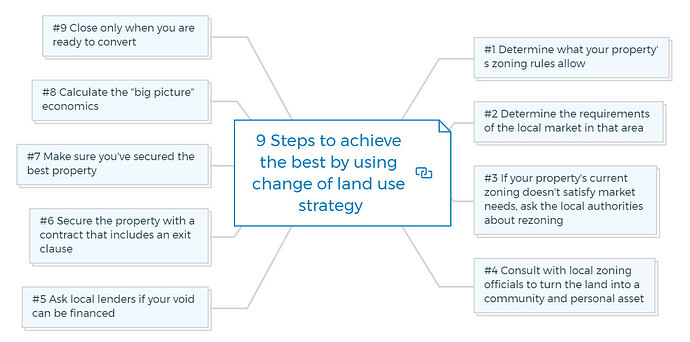

9 Steps to achieve the best by using change of land use strategy

The steps below will show you the highest and best use of change in land use strategy to your advantage in real estate investing.

#1 Determine what your property’s zoning rules allow

Often, buyers or property owners already have the zoning they need to do economic improvement. Still, they don’t realise it since they don’t see other properties in the neighbourhood going through the same process.

Few individuals know what can be built on their land or the property next door.

#2 Determine the requirements of the local market in that area

Is there a gap in the area for specific services? It’s simple to figure out, but it takes time and effort. The procedure is to drive around town and choose neighbourhoods that you perceive to be successful.

Note the many types of businesses that exist in and around these areas. Do you have similar businesses and services in your area? If not, think about why.

Is it because the demographics are so dissimilar—for example, high-end beauty salons may struggle to compete in your area due to the high price of their services?

Consider a similar business that would be more fit for the demographic in your area—for example, are there more cheap salons? If not, there is the possibility of a vacancy. The same thinking applies to successful businesses and services in your area.

Learn More

#3 If your property’s current zoning doesn’t satisfy market needs, ask the local authorities about rezoning

Some cities have obsolete zoning restrictions, which local leaders are well aware of. However, you can’t do anything to amend those restrictions until a property owner approaches them and asks whether they can rezone the property to less restricted zoning that will benefit the community.

Zoning laws are designed to change, and change of land use can thrive as a result.

#4 Consult with local zoning officials to turn the land into a community and personal asset

Any elected politician will not object to a well-presented strategy to improve the nature and economic strata of any neighbourhood. Once you’ve grasped that, it’s a good idea to pay a personal visit to the local government officials responsible for your area.

Inquire about what you can accomplish and how they may assist you in achieving your objective. If you’re not lucky, and you’re dealing with a region that is so resistant to change that little good can come of such visits, consider shifting (at least your investment interests) to another location.

#5 Ask local lenders if your void can be financed

Financing is often the most critical aspect of any land use change strategy. Unfortunately, many lenders are hesitant to make any loans due to the recent decline of sound thinking within the lending profession and industry.

It makes it more difficult for everyone. This is, in fact, the good news. The more complex things become for everyone, the easier it becomes for the dynamic investor—you—who understands that endurance will eventually pay off.

#6 Secure the property with a contract that includes an exit clause

By locking up a property with a contract, you may beat out other potential investors by having a hold on the deal while pursuing the economic conversion process and having the safety net of an out provision if the conversion is not successful.

#7 Make sure you’ve secured the best property

It could be the week’s most significant discovery. You’ve identified a need and a hole you can fill and secured a fantastic property—but is it the most significant property in the area for changing the land use?

If not, don’t be afraid to reserve another property or two so you may choose the best one. Don’t feel bad for the seller that you have to reject. Be grateful for the person to whom you say yes.

#8 Calculate the “big picture” economics

Will the new land use attract tenants who will occupy the building and provide you with the necessary return? You will be motivated to complete more homework as a result of this.

The simplest method to figure this out is to look at properties with the same type of use or business like the one you want to start. If they’re for sale, that’s fantastic.

Examine the figures demonstrating why that price is being demanded and how much the associated costs are. Please don’t hesitate to ask anything to the owner. Know the reason why they are selling the property.

Learning why something is the way it is can be a fantastic strategy to avoid risks and failure.

Learn More

#9 Close only when you are ready to convert

The closer you get to the required renovation or alterations, the better. The increased income from the conversion will not cover the extra costs involved in financing and retaining or maintaining the property if there is a considerable delay between closure and the conversion.

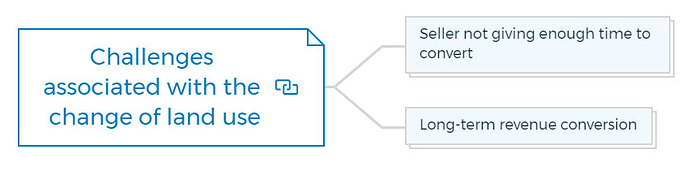

Challenges associated with the change of land use

A vendor who does not give you enough time to undertake the conversion and a conversion that takes a year or longer to earn revenue are two challenges that can arise with land conversion.

Seller not giving enough time to convert

What should you do if the seller insists on a contract that doesn’t give you sufficient time to pull out? It would help if you informed the seller about the flaws in your property investment strategy. Many property owners have no idea what challenges a real estate developer or investor’s faces.

Sometimes the seller’s counsel has an issue adopting an agreement with “escape” options for the buyer rather than the seller.

A knowledgeable and professional realtor can assist an investor who anticipates needing time to inspect the property or secure essential approvals before proceeding with the sale.

Long-term revenue conversion

Another issue is how to lock up a property for a year or more and still have a way out. The objective is to inform the vendor of the situation. The real estate investor should incorporate the seller as much as feasible when rezoning for economic improvements.

As a contract condition, the seller is motivated to aid the buyer. However, if the process is stretched out and takes longer than intended, there will be an issue.

In these instances, sellers tend to believe they are being exploited. Establishing a positive relationship with the seller will assist in resolving this issue.

It’s a good idea to do everything you can to avoid wasting time and money trying to get permissions only to be turned down. It may be essential to make a large deposit that is refunded to the investor if their time, hard work, and money are ineffective.

It is up to the parties to agree on who will hold the buyer’s deposit. The buyer may give the seller an option payment that remains with the seller regardless of the outcome, or it may be applied to the purchase price if the transaction closes.

Actual transaction deposits are held in escrow, most commonly by the buyer’s or seller’s lawyer and a third-party escrow company.

Developing a successful plan for achieving the highest and best use

Knowing what form of property is convertible and what to convert it to is crucial to making an economic conversion happen. Sometimes the best solution is to expand the current use to produce more revenue or improve the quality of what is supplied to raise revenue.

For example, suppose the property is performing well as a rental apartment complex and vacancy rates in the region are low. In that case, it is conceivable to raise a property value by adding a few more units.

However, the additional revenue must provide the investor with the anticipated return.

If the addition of rental units is done so that the yield increases, this is certainly a desirable option, but it isn’t the only one to consider.

Is there anything further that you can do? It is a question that every investor must ask themselves regularly to achieve the highest and best use of land. You can get the answer in several places.

Begin with the present zoning and work your way up.

- What are the permitted uses for that place under the present zoning?

- Is any restriction from any source that would make such use illegal?

- Which of the permitted uses will provide the greatest return on investment for the expense of implementation?

- Which usage can be implemented with the least effort and in the shortest amount of time?

- Would switching to a different zoning system be more effective?

Conclusion

So, change of land use is the process by which a property owner petitions their local government officials to allow them to change the permitted use of their property.

It can be lengthy and complex, but if done correctly, it can result in massive financial rewards for the property owner. Keep the above essential things in mind when pursuing a change, and you will achieve your land’s highest and best use.

FAQs

What is Zoning map?

Zoning maps are legal documents that define how land can be used in a municipality. In other words, they help local governments control development by telling developers what they can and can’t build on a piece of land.

Zoning regulations (the rules that accompany the zoning map) vary from place to place, but they typically divide a municipality into different types of zones, such as residential, commercial, or industrial. Each type of zone has its own set of regulations governing the size and type of development that can take place there.

The change of land use strategy is a way to increase the value of your property by changing its zoning designation to allow for more intensive development.

What is property zoning?

Property zoning is the process by which a local government designates specific areas of land for particular uses, such as residential, industrial, or commercial. Property zoning limits the types of structures that can be built and the activities that can take place on a property. Zoning also helps to ensure that neighbouring properties are used in a compatible way.

What factors to consider when calculating land value?

When calculating the land value, you’ll need to consider a few factors:

- Location - The closer a piece of land is to a major city or other desirable destination, the more expensive it will be.

- Size - The larger the plot of land, the more valuable it will be.

- Zoning - If the land is zoned for residential or commercial use, that will affect its value.

- Topography - Land that’s flat and easily developed is more valuable than land with hills or other obstructions.

- Accessibility - If the land is accessible by road, rail, or water, that will add to its value.