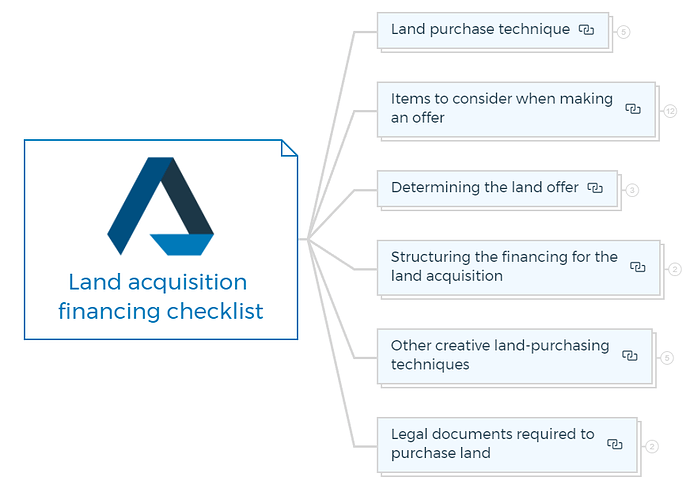

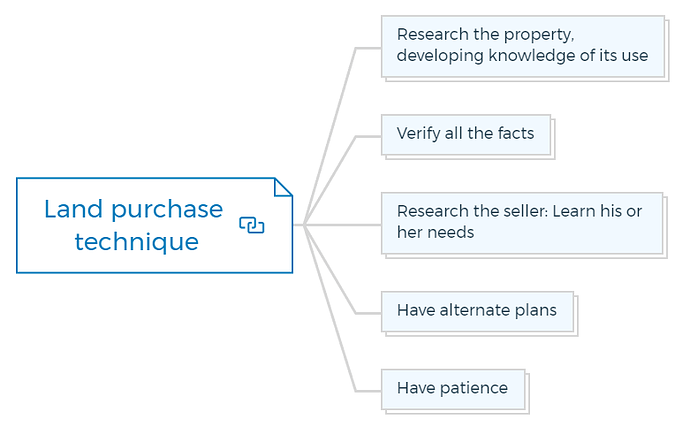

1. Land purchase technique

Step 1: Research the property, developing knowledge of its use

- Determine the property’s zoning regulations and allowable land uses.

- Understand any potential restrictions, easements, or encumbrances on the property.

- Research the property’s history, including past ownership, use, and legal disputes.

Step 2: Verify all the facts

- Confirm property boundaries through surveys and legal documents.

- Verify property title and ownership history through a title search.

- Ensure compliance with local regulations, environmental laws, and permits.

Step 3: Research the seller: Learn his or her needs

- Understand the seller’s motivation for selling (financial, personal, etc.).

- Identify any urgent needs or timelines that might influence negotiations.

Learn More

Step 4: Have alternate plans

- Develop contingency plans if the initial purchase falls through.

- Explore different negotiation strategies based on possible scenarios.

Step 5: Have patience

- Be prepared for negotiation rounds and avoid rushing into an agreement.

- Patience can lead to better terms and a more favourable deal.

You are missing out if you haven’t yet subscribed to our YouTube channel.

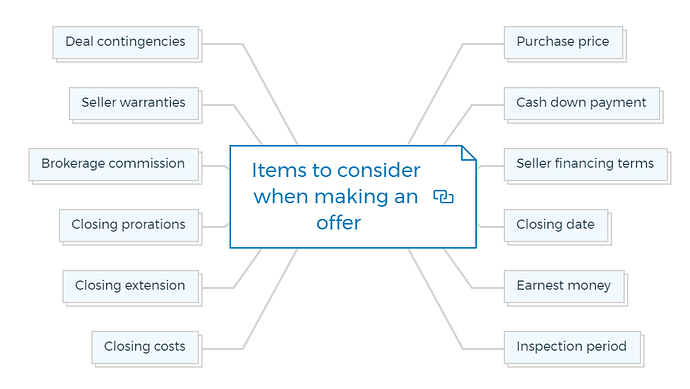

2. Items to consider when making an offer

2.1 Purchase price

The total amount offered for the land.

2.2. Cash down payment

The initial payment made in cash.

2.3. Seller financing terms

If the seller is offering financing, outline terms.

2.4. Closing date

The date by which the transaction will be completed.

2.5. Earnest money

A deposit showing commitment to the purchase.

2.6. Inspection period

A time frame for property due diligence.

2.7. Closing costs

Additional costs associated with the purchase.

2.8. Closing extension

If more time is needed to close the deal.

2.9. Closing prorations

Calculations for shared costs like taxes and utilities.

2.10. Brokerage commission

Payment to real estate agents involved.

2.11. Seller warranties

Any guarantees provided by the seller.

2.12. Deal contingencies

Conditions must be met for the deal to proceed.

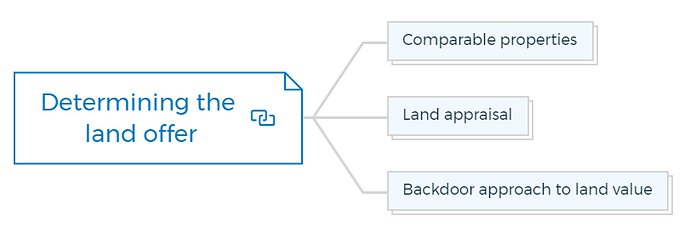

3. Determining the land offer

3.1. Comparable properties

Evaluate recent sales of similar properties.

3.2. Land appraisal

Professional valuation of the land’s worth.

Learn More

3.3. Backdoor approach to land value

Analyze potential income or development value.

4. Structuring the financing for the land acquisition

4.1. All cash

Paying the entire purchase price upfront.

4.2. Seller financing

The seller provides financing for part or all of the purchase.

5. Other creative land-purchasing techniques

5.1. Joint venture

Instead of involving more equity partners, consider forming a joint venture with the seller to purchase the land. This can happen in two ways:

- The landowner holds a secondary mortgage (after the construction and permanent loans) that earns interest. They also get a portion of the cash generated and future profits when the property is sold.

- The landowner contributes their land to the development as the necessary equity at an agreed price. They then participate in the cash flow and future profits from the property sale. The developer could offer the seller a prioritized return on cash flows until their equity investment is paid off.

5.2. Options

Secure the right to purchase within a specified period.

An option is a future purchase right set for a specific date. You can use an option if you don’t need all the land right away or want to avoid high costs. This lets you buy what’s needed now and later decide to purchase the rest at agreed-upon prices for future dates.

The landowner gets earnest money for the option, either upfront or at a set future date.

5.3. Ground lease

A ground lease is advantageous when owners won’t sell due to emotions or taxes. Owners get lease payments and keep ownership. Payments can adjust for inflation.

It doesn’t affect developer taxes, lowering costs. As an operating expense, it reduces upfront expenses.

Review lease terms during financial planning. Lenders usually require a lease longer than the loan period. After the lease, the property returns to the owner, so negotiate a 99-year lease for control. Get an extension for a shorter lease. The lease should grant full ownership rights to the developer.

Learn More

5.4. Ground lease with option to purchase:

In this method, the developer can choose a ground lease when the owner wants to wait before selling the property.

This lease allows the developer to buy the property later. A new property appraisal or a set value can decide the future purchase price.

5.5. Land contract

As per the contract, the developer will have control of the property while the seller keeps the title. Once a predetermined loan amount is paid off, the seller will transfer the title to the buyer.

6. Legal documents required to purchase land

6.1. Letter of intent

To start negotiations, send the seller a detailed letter of intent. This letter should cover all the transaction terms.

The seller can agree by signing it and needs to respond within a specified time.

Expect negotiations after the first offer. Using this form and the attached exhibits can save time and money.

Once both parties sign the letter of intent, send a copy to the attorney to create the purchase agreement.

6.2. Land purchase and sales agreement

A legally binding contract detailing the purchase terms and conditions.