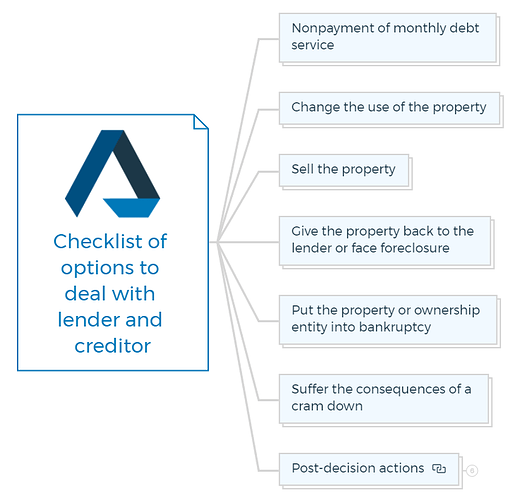

1. Nonpayment of monthly debt service

The developer can stop making monthly debt payments if negotiations with the lender go nowhere. While this will negatively impact the developer’s credit score, it will grab the lender’s attention.

Lenders often assume everything is fine as long as payments are on time. Stopping payments will prompt action from the lender.

- Assess the financial situation and determine the cause of nonpayment.

- Review the loan agreement and understand the terms and consequences of nonpayment.

- Communicate with the lender or creditor to inform them of the financial difficulties.

- Explore options for temporary relief, such as forbearance or loan modification.

- Create a budget and financial plan to improve cash flow and resume payments.

- Consider debt consolidation or refinancing to make payments more manageable.

- Seek legal advice if the lender is uncooperative or the debt is unmanageable.

2. Change the use of the property

- Evaluate the current and potential alternative uses of the property.

- Check local zoning and land use regulations to ensure compliance.

- Consult with an attorney or real estate professional to navigate any legal requirements.

- Assess the financial implications and feasibility of the new property use.

- Negotiate with the lender or creditor if the change of use impacts the loan agreement.

- Secure necessary permits and approvals for the new property use.

Learn More

3. Sell the property

- Determine the market value of the property through an appraisal or market analysis.

- List the property for sale with a qualified real estate agent or broker.

- Promote the property through various marketing channels.

- Consider staging and making necessary repairs to enhance the property’s appeal.

- Review offers from potential buyers and negotiate terms.

- Coordinate with the lender or creditor to release the lien upon sale.

- Ensure all legal and financial obligations related to the sale are met.

You are missing out if you haven’t yet subscribed to our YouTube channel.

4. Give the property back to the lender or face foreclosure

- Contact the lender or creditor to discuss voluntary surrender of the property.

- Understand the consequences of voluntary surrender, including potential deficiency judgments.

- Cooperate with the lender’s process for property return.

- Seek legal counsel to navigate the surrender process and protect your rights.

- Consider a deed in lieu of foreclosure as an alternative to foreclosure.

5. Put the property or ownership entity into bankruptcy

- Consult with a bankruptcy attorney to evaluate bankruptcy options.

- Determine whether to file for personal bankruptcy or business bankruptcy.

- Understand the automatic stay that halts creditor actions upon filing for bankruptcy.

- Prepare and file the necessary bankruptcy documents.

- Attend creditor meetings and follow the bankruptcy court’s instructions.

- Work with the bankruptcy trustee to create a repayment plan or liquidation strategy.

6. Suffer the consequences of a cram down

- Consult with an attorney to explore the possibility of a “cram down” in bankruptcy.

- Understand the cram down process, which may involve reducing the principal balance of a secured debt and reamortizing the loan.

- Evaluate whether you meet the eligibility criteria for a cram down, typically in Chapter 13 bankruptcy.

- Initiate negotiations with the secured creditor to reach a cram down agreement.

- Consult with your bankruptcy attorney to draft and file the necessary legal documents.

- Comply with the terms and conditions outlined in the cram down agreement.

- Monitor your progress and financial stability during the cram down period.

- Understand the potential long-term implications, including reduced debt but potentially longer repayment terms.

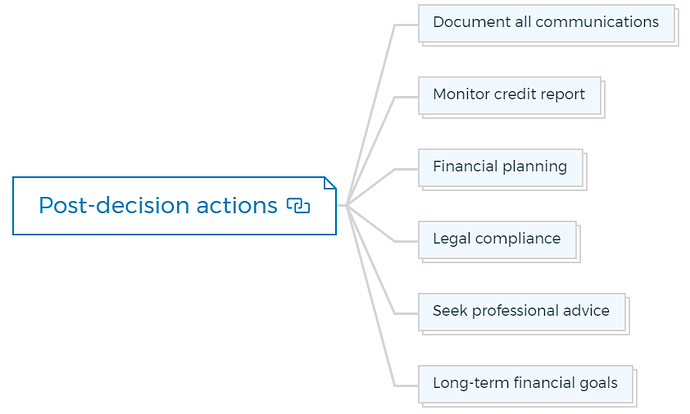

7. Post-decision actions

Regardless of the chosen option, there are important post-decision steps to take:

7.1. Document all communications

- Keep records of all communications with lenders, creditors, legal advisors, and real estate professionals.

7.2. Monitor credit report

- Regularly check your credit report for accuracy and any changes resulting from your decisions.

7.3. Financial planning

- Continuously manage your finances to ensure you can meet your obligations and make informed decisions.

7.4. Legal compliance

- Adhere to all legal obligations, such as those outlined in bankruptcy or property transfer agreements.

7.5. Seek professional advice

- Consult with legal and financial professionals as needed to address any unforeseen challenges or changes in your financial situation.

7.6. Long-term financial goals

- Establish and work towards long-term financial goals to prevent similar situations in the future.