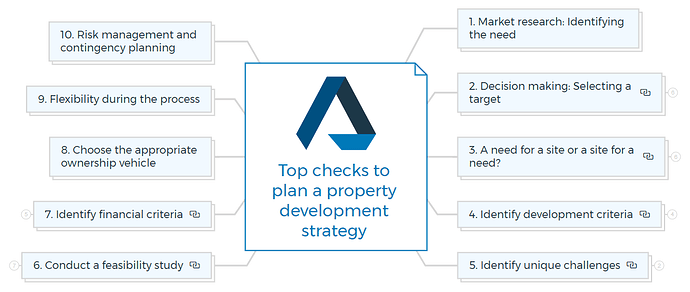

1. Market research: Identifying the need

- Study current market trends and demands in the target area.

- Analyse demographic data, economic indicators, and population growth projections.

- Identify gaps and opportunities within the market that your development can address.

You are missing out if you haven’t yet subscribed to our YouTube channel.

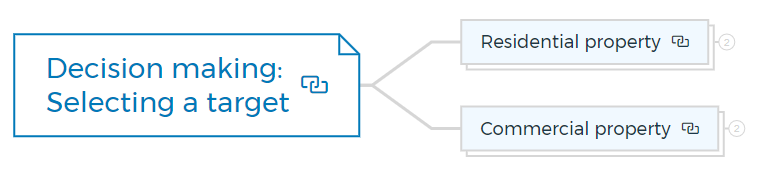

2. Decision making: Selecting a target

Your target audience may be families, young professionals, retirees, or specific sectors. Customising your development for a certain demographic can boost its attractiveness and profitability.

Follow the below list to select your target -

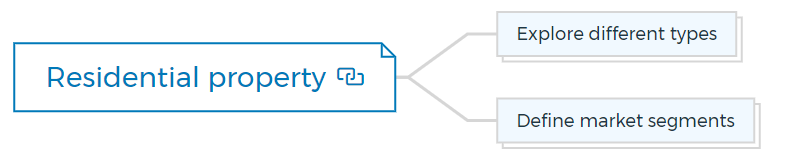

2.1. Residential property:

-

Explore different types

- Rental Property Housing Types (apartments, townhouses, condos)

- For Sale Housing Types (single-family homes, luxury villas, duplexes)

-

Define market segments

- Identify rental preferences of students, families, young professionals, and senior citizens.

- Understand buyer preferences for different housing types based on income, family size, and lifestyle.

2.2. Commercial property:

-

Explore different types:

- Retail Developments (malls, shopping centres, stand-alone stores)

- Office Spaces (corporate offices, coworking spaces)

- Industrial Facilities (warehouses, manufacturing plants)

- Lodging (hotels, resorts)

- Mixed-Use Developments (combination of retail, residential, and office spaces)

-

Analyse market demand:

- Determine the demand for specific commercial spaces based on location and local business needs.

- Consider the potential for mixed-use developments in areas with diverse requirements.

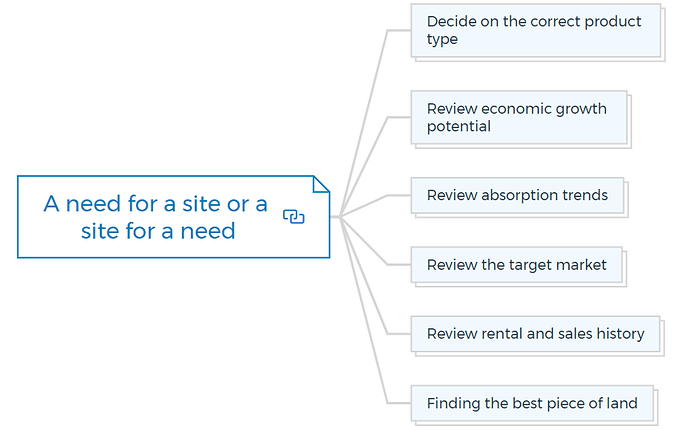

3. A need for a site or a site for a need?

3.1 Decide on the correct product type:

- Match the product type to the current and future market demand.

- Evaluate whether rental or sale properties are more suitable for the chosen location.

3.2 Review economic growth potential:

- Assess the economic indicators and growth prospects of the area.

- Identify areas with potential for long-term appreciation and demand.

3.3 Review absorption trends:

- Study absorption rates for similar developments in the area.

- Understand how quickly properties are being sold or rented to gauge demand.

3.4 Review the target market:

- Analyse the demographics, preferences, and needs of the target market.

- Ensure your development aligns with their requirements.

3.5 Review rental and sales history:

- Investigate historical data on rental and sales prices.

- Determine pricing strategies based on past trends and future projections.

3.6 Finding the best piece of land:

- Research potential land parcels that meet your development criteria.

- Consider factors like location, accessibility, and zoning regulations.

Learn More

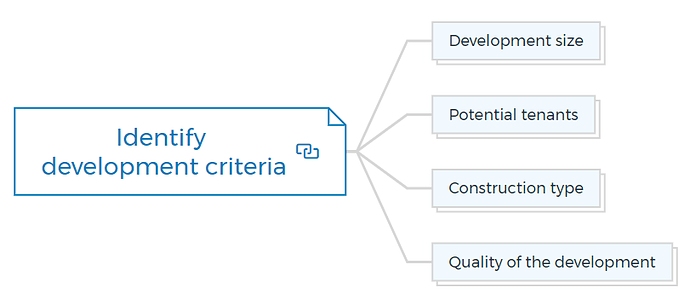

4. Identify development criteria

4.1 Development size:

- Determine the appropriate size of the development based on market demand.

- Ensure scalability without compromising quality.

4.2 Potential tenants:

- Identify potential tenants or buyers for commercial or residential properties.

- Tailor your development to cater to their needs.

4.3 Construction type:

- Choose construction methods that align with the property type and budget.

- Evaluate the feasibility of sustainable and eco-friendly construction practices.

4.4 Quality of the development:

- Establish quality standards for construction, materials, and finishes.

- Aim for a balance between quality and cost-effectiveness.

5. Identify unique challenges

5.1 Social objectives:

- Align your development with social objectives, such as community enhancement and sustainability.

- Consider incorporating green spaces, community facilities, or public amenities.

5.2 Financial objectives:

- Define clear financial goals for the project, including return on investment and profitability.

- Develop strategies to optimise revenue generation and cost management.

6. Conduct a feasibility study

6.1 Strategy review:

- Evaluate the overall strategy, objectives, and alignment with market trends.

- Identify any potential gaps or inconsistencies in the initial plan.

6.2 Market study:

- Conduct a comprehensive analysis of the market demand, competition, and pricing trends.

- Assess the feasibility of capturing a substantial market share.

6.3 Consumer marketing study:

- Understand the preferences and behaviours of potential buyers or tenants.

- Tailor your marketing and sales strategies accordingly.

6.4 Legal study:

- Review zoning laws, land use regulations, and legal restrictions.

- Ensure compliance with local regulations throughout the development process.

6.5 Design study:

- Develop detailed architectural and design plans based on market preferences.

- Ensure the design aligns with the target audience’s lifestyle and needs.

6.6 Environmental impact study:

- Evaluate the potential environmental impact of the development.

- Identify measures to minimise adverse effects and enhance sustainability.

6.7 Financial study:

- Create comprehensive financial projections, including costs, revenues, and potential profits.

- Assess the financial viability and risk factors associated with the project.

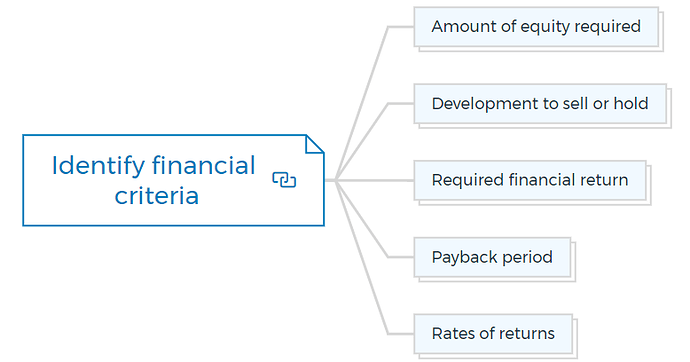

7. Identify financial criteria

7.1. Amount of equity required:

- Determine the initial equity investment needed to fund the project.

- Plan for additional capital requirements throughout the development.

7.2. Development to sell or hold:

- Decide whether to sell the completed development or retain it for rental income.

- Consider the long-term financial benefits and tax implications of each option.

Learn more - 5 Reasons buy-and-hold investors fail at property development

7.3. Required financial return:

- Define the desired return on investment (ROI) for the project.

- Align the ROI with the risk profile and market expectations.

7.4. Payback period:

- Calculate the expected time it takes to recoup the initial investment.

- Ensure the payback period aligns with your financial objectives.

7.5. Rates of returns:

- Analyse potential rates of return, such as internal rate of return (IRR) and cash-on-cash return.

- Compare these rates to industry benchmarks to assess project performance.

8. Choose the appropriate ownership vehicle

- Sole Ownership

- Tenants in Common

- Joint Tenancy with Right of Survivorship

- Corporation

- Subchapter S Corporation

- Limited Partnership

- General Partnership

- Master Limited Partnership

- Joint Ventures

- Real Estate Investment Trust (REIT)

Learn More

9. Flexibility during the process

- Acknowledge that market conditions and unforeseen challenges may require adjustments to the original plan.

- Build flexibility into your strategy to accommodate changes without jeopardising project success.

- Regularly reassess your approach and be open to adapting as needed.

10. Risk management and contingency planning

- Identify potential risks such as market fluctuations, regulatory changes, or construction delays.

- Develop detailed contingency plans for each identified risk to mitigate its impact.

- Regularly review and update your risk management strategy throughout the development process.

By following this detailed checklist, you can confidently navigate each crucial step, ensuring your project’s alignment with market needs, financial goals, and vision for a thriving development venture.