Internal rate of return (IRR) is a basic financial analysis method for assessing investment profitability. It is a crucial tool for real estate investors to evaluate different projects or capital budgeting decisions.

In simpler terms, it is the rate of return that makes the initial investment worthwhile. This article will cover the IRR formula, how to calculate it, and why it is essential in financial analysis.

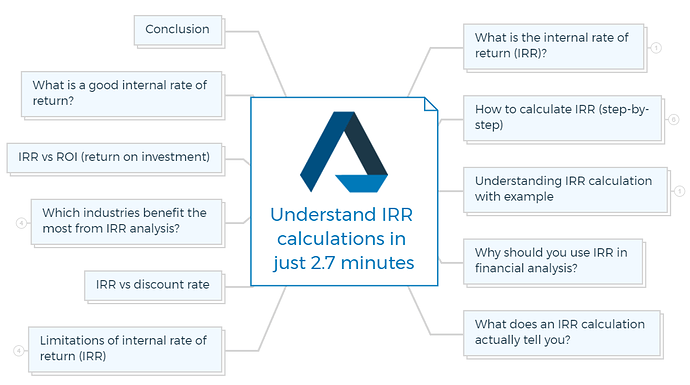

What is the internal rate of return (IRR)?

To define what IRR means: It is the compound rate of return on investment. IRR is the discount rate that makes a project’s net present value (NPV) zero.

Investments with higher internal rates of return are usually better. IRR is consistent across investments and may be used to rank several potential investments or projects. When you compare similar investment options, the one with the highest IRR is usually the best.

IRR calculation formula

The formula for calculating IRR is as follows:

NPV = ∑[CFt / (1+IRR)^t] = 0

where:

- NPV is the net present value of the cash flows

- CFt is the cash flow in period t

- IRR is the internal rate of return

- t is the time period

You can calculate IRR with trial-and-error or financial calculators with IRR functions. Find the discount rate that makes cash flow NPV zero.

You are missing out if you haven’t yet subscribed to our YouTube channel.

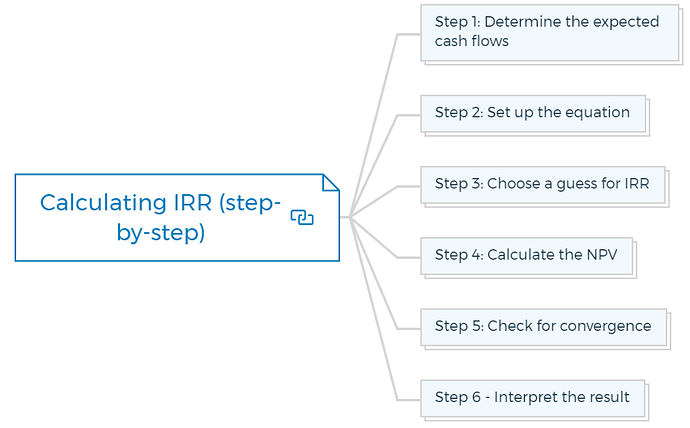

How to calculate IRR (step-by-step)

Step 1: Determine the expected cash flows

First, calculate investment or project cash flows. These cash flows can be positive cash flows or negative and may occur at various times.

Step 2: Set up the equation

Calculate cash flow NPV using the equation. The equation:

NPV = CF0 / (1+IRR)^0 + CF1 / (1+IRR)^1 + … + CFn / (1+IRR)^n

Where:

- CF0 is the initial investment (negative cash flow)

- CF1 to CFn are the cash flows for periods 1 to n

- IRR is the unknown internal rate of return

- n is the number of periods

Step 3: Choose a guess for IRR

Choose a guess for the IRR. This can be any reasonable value, such as 10% or 15%.

Step 4: Calculate the NPV

Calculate cash flow NPV using the selected IRR. If the NPV is negative, use a lower IRR. Repeat until the NPV approaches zero.

Step 5: Check for convergence

Convergence occurs when the NPV approaches zero. Calculate the NPV using many IRRs and see whether they all get the same result. If so, you discovered the IRR.

Step 6 - Interpret the result

Interpret the IRR once discovered. The discount rate at which cash flows have zero net present value is the IRR. Profitable investments have an IRR larger than the needed return. Unprofitable investments have IRRs below the needed rate of return.

Learn More

Understanding IRR calculation with example

You can easily calculate the IRR with the help of online calculator and spreadsheet applications. The IRR is the discount rate at which the NPV of a project equals zero. Set the NPV to zero and solve for the interest rate.

IRR calculation example

The initial investment and future cash flows are needed to compute the IRR. To calculate the NPV, discount each future cash flow at the appropriate interest rate and add them. Find the interest rate that makes the NPV 0.

Suppose investor A invest $10,000 in an investment project that provides the below cash flow -

Year 1 - $3,000

Year 2 - $4,000

Year 3 - $5,000

The discount rate is 10%. To determine the NPV, discount each cash flow at the proper rate.

The formula for calculating the present value of cash flow -

PV = CF / (1 + r)^n

Where:

- PV: Present value

- CF: Cash flow

- r: Discount rate

- n: Number of years

Using the formula, we can calculate the present value of each cash flow as follows:

- Year 1:

PV = 3,000 / (1 + 0.1)^1 = $2,727.27

- Year 2:

PV = 4,000 / (1 + 0.1)^2 = $3,305.79

- Year 3:

PV = 5,000 / (1 + 0.1)^3 = $3,801.72

Now, we can sum the present values to calculate the NPV:

NPV = -10,000 + 2,727.27 + 3,305.79 + 3,801.72 = $834.78

The negative sign in front of the initial investment amount indicates a cash outflow (investment). The positive NPV of $834.78 indicates that the investment is worthwhile, as the sum of the present values of the future cash flows is greater than the initial investment.

Now that we have the NPV, we can use a financial calculator or spreadsheet software to find the IRR. Using the IRR function in Microsoft Excel, we can calculate the IRR to be 16.09%. This means that the investment is expected to generate a return of 16.09% per year, which makes it a good investment opportunity.

Why should you use IRR in financial analysis?

IRR is an essential tool for financial analysis because it measures the investment return relative to the cost of the investment. It helps investors choose the best investment opportunity.

In capital planning, the IRR is used as a hurdle rate or minimum acceptable rate of return for a project to be a worthwhile investment.

IRR also considers the time value of money. Due to the possibility of various interest rates or other returns, a dollar now is worth more than a dollar tomorrow. The IRR accurately measures investment profitability by discounting future cash flows at a specified rate.

Learn More

What does an IRR calculation actually tell you?

IRR calculations estimate an investment’s lifetime return. The interest rate makes the net present value (NPV) of all future cash flows from the investment zero.

The IRR is a financial metric commonly used to evaluate investment opportunities. It provides investors with a way to compare the expected returns of different investments, taking into account the time value of money.

Calculating the IRR for an investment is like asking, “What rate of return do I need to make this investment worthwhile?”

Profitable investments have an IRR larger than the investor’s hurdle rate or minimum acceptable rate of return. The investment is unprofitable if the IRR is below the hurdle rate.

Let’s imagine an investor is evaluating two investments. The first opportunity costs $10,000 and generates $2,000 each year for five years.

The second possibility costs $15,000 and generates $3,000 each year for five years. The investor can compare IRRs to decide which investment is best.

The initial investment is lucrative if the IRR is 12% and the investor’s hurdle rate is 10%. The second investment is not lucrative since its IRR is 8%, below the minimum allowable rate of return.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

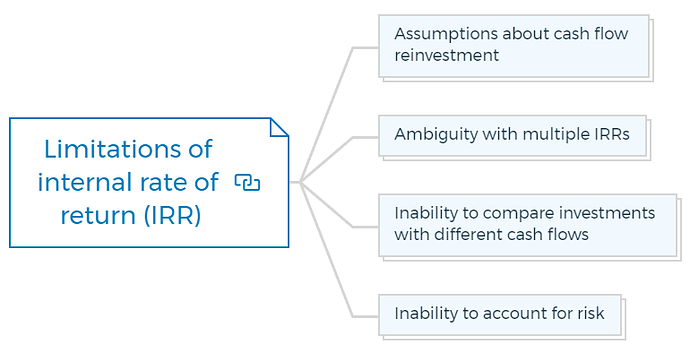

Limitations of internal rate of return (IRR)

Investors should be aware of the limits of the internal rate of return (IRR), a valuable financial indicator for assessing investment possibilities.

Assumptions about cash flow reinvestment

The IRR calculation assumes that all future cash inflows will be reinvested at the same rate as the IRR. It may be difficult to identify investments with IRRs. This assumption might create exaggerated ROI expectations.

Ambiguity with multiple IRRs

Some investments have numerous IRRs. If the investment cash flows change sign many times, the IRR equation has multiple solutions. This uncertainty might make calculating the investment’s return challenging.

Inability to compare investments with different cash flows

IRR calculations depend on cash flow timing and amount. Thus, comparing cash flow investments is challenging. Even though it yields less cash flow than a lower IRR investment, a higher IRR investment may have a shorter payback period, making it more appealing to some investors.

Inability to account for risk

Two investments with the same IRR may have quite different risk profiles, affecting their predicted returns. Thus, investors should evaluate investments using risk-adjusted return on investment (RAROC) indicators.

IRR vs discount rate

IRR and discount rates are similar yet different. The discount rate discounts future cash flows to compute the current value. The interest rate that zeros out all future cash flows is the IRR. In other words, the discount rate is used to calculate the NPV, while the IRR calculated is the result of the NPV calculation.

The discount rate is typically used to represent the opportunity cost of capital or the rate of return on an alternative investment with equivalent risk. The IRR, on the other hand, is a measure of the investment’s return relative to its cost.

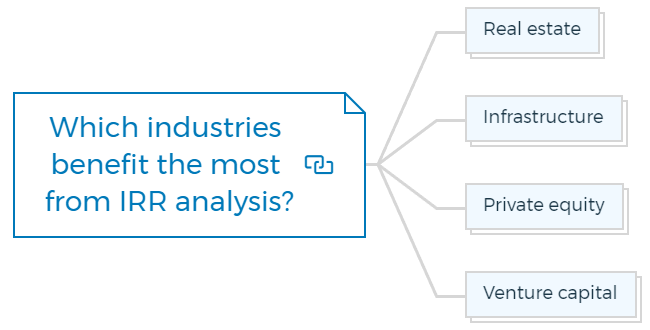

Which industries benefit the most from IRR analysis?

Internal rate of return (IRR) analysis is a financial statistic used in many businesses. IRR analysis may assist some industries make more money, depending on the sector and investments.

Real estate

IRR analysis can assist investors in assessing a property’s return on investment throughout its estimated lifespan. A property developer may use IRR analysis to assess the profitability of a new residential or commercial development project.

Infrastructure

Transportation, energy, and utilities require huge, long-term investments in infrastructure. IRR analysis may assist investors in assessing these investments’ predicted cash inflows during the project’s lifetime and the impact of alternative payment and financing methods.

Private equity

IRR analysis may assist investors in assessing these assets’ return on investment, including predicted cash inflows during the investment’s lifespan and the effect of possible exit plans.

Venture capital

IRR analysis helps to evaluate these firms’ return on investment, including predicted cash outflows and inflows during the investment’s lifetime and the effect of possible exit plans.

IRR vs ROI (return on investment)

Both the internal rate of return (IRR) and return on investment (ROI) are financial indicators used by investors to assess an investment or company’s cost and prospective profitability. However, they have distinct applications and interpretations.

ROI compares investment profit to investment cost. The percentage formula is:

ROI = (Gain from Investment - Investment Cost) / Investment Cost x 100

For example, if an investor purchased a stock for $1,000 and sold it for $1,200, the ROI would be:

ROI = ($1,200 - $1,000) / $1,000 x 100 = 20%

IRR, on the other hand, considers cash flows over the investment’s lifespan. It’s the interest rate when an investment’s cash flows have zero net present value (NPV). IRR is calculated by finding the discount rate at which the total of future cash inflows equals the initial investment cost.

For example, if an investor is considering a real estate investment that requires an initial investment of $500,000 and has a net present value of $600,000, the IRR would be the interest rate at which the present value of the future cash flows equals $500,000.

What is a good internal rate of return?

A “good” internal rate of return (IRR) relies on the investor’s risk tolerance, the investment, and the market. A decent IRR is usually higher than the investor’s minimum acceptable rate of return (MARR).

A wise investor may have an 8% MARR, whereas an aggressive investor may have 15%. The IRR needed to invest viable increases with MARR.

In addition to the MARR, other factors can influence what constitutes a good IRR. The IRR needed for a fair return depends on the investment and market circumstances. In a competitive real estate market, the IRR may be greater.

Finally, the IRR should not be the exclusive indicator for investment evaluation. When investing, investors should consider risk, liquidity, and capital appreciation.

Learn More

Conclusion

The Internal Rate of Return (IRR) is a fundamental tool for assessing the profitability of investments, especially in real estate. It is the discount rate that makes a project’s net present value (NPV) equal to zero. The formula for calculating IRR involves finding the discount rate that makes cash flow NPV zero.

You can calculate IRR with trial-and-error or use financial calculators with IRR functions. Investments with higher IRRs are generally more profitable.

IRR is consistent across investments and can be used to rank multiple potential investments or projects. By using the IRR calculator, investors can compare the returns of different investment options and select the one that provides the highest return on investment.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber