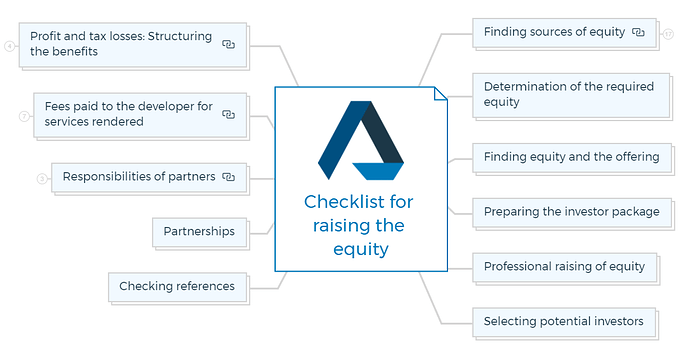

Checklist for raising the equity

Raising equity for property development is a strategic process that involves finding investors, structuring deals, and forming partnerships. This checklist outlines the key steps to effectively raise equity for property development:

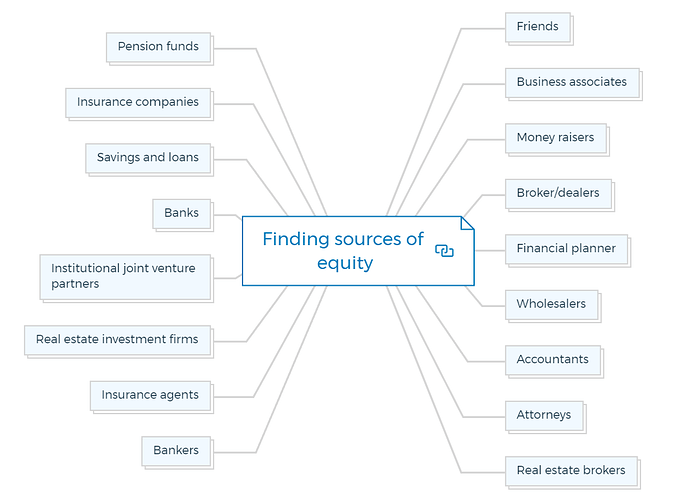

1. Finding sources of equity

When raising equity for property development, exploring diverse sources of funding is essential. Here are various avenues to consider:

1.1. Friends

Personal connections can be potential investors who share your enthusiasm for the project.

1.2. Business associates

Colleagues and business partners may have an interest in investing in property development.

1.3. Money raisers

Individuals or firms specializing in raising capital can connect you with potential investors.

1.4. Broker/dealers

Professionals specializing in real estate investment can introduce you to a network of interested investors.

1.5. Financial planner

Seek out financial advisors with expertise in real estate who may have clients interested in investment opportunities.

1.6. Wholesalers

Those with connections to investors looking for opportunities might facilitate introductions.

1.7. Accountants

Accountants with clients seeking real estate investments can be valuable sources of equity.

1.8. Attorneys

Legal professionals may have clients interested in diversifying their portfolios through property development.

1.9. Real estate brokers

Brokers familiar with your project’s market can introduce you to potential investors.

1.10. Bankers

Bankers with high-net-worth clients might have individuals interested in real estate investment.

1.11. Insurance agents

Agents serving affluent clients might have individuals open to real estate opportunities.

1.12. Real estate investment firms

Dedicated firms can connect you with institutional investors looking for projects.

1.13. Institutional joint venture partners

Partnering with institutions can provide substantial equity and expertise.

1.14. Banks

Financial institutions might offer investment options to their clients, making them potential sources.

1.15. Savings and loans

These institutions could offer investment opportunities through their networks.

1.16. Insurance companies

Insurance firms often seek stable investment opportunities, making them potential partners.

1.17. Pension funds

Pension funds may consider real estate investments for diversification and income.

You are missing out if you haven’t yet subscribed to our YouTube channel.

2. Determination of the required equity

- Calculate the total development costs, including land acquisition, construction, permits, and other expenses.

- Determine the amount of equity funding needed to cover a portion of these costs while considering other financing options.

3. Finding equity and the offering

- Develop an investment offering that outlines the property development project, its potential returns, risks, and investment structure.

- Create a compelling pitch highlighting the project’s unique selling points and the value proposition for potential investors.

4. Preparing the investor package

- Compile a comprehensive investor package containing project details, financial projections, market analysis, legal documents, and risk assessments.

- Craft an engaging presentation or pitch deck that effectively communicates the project’s potential and investment opportunity.

5. Professional raising of equity

- Consider hiring professionals such as financial advisors, real estate brokers, and legal experts with experience raising equity for property development.

- Leverage their expertise to streamline fundraising, conduct due diligence, and negotiate terms.

6. Selecting potential investors

- Identify potential investors who align with the project’s goals, risk tolerance, and investment horizon.

- Evaluate their track record, investment preferences, and expertise in the real estate sector.

- Consider investor interest in the property type and location.

- Narrow down potential investors based on:

- Passive or active investor preference

- Typical holding period

- Investing motivation (capital appreciation, cash flow, tax benefits)

- Required projected rates of return:

- Cash flow

- Tax losses

- Internal rate of return

- Discuss desired profit and tax benefit splits, including cash flow, tax losses, refinancing, and resale proceeds.

- Allocate preferred proceeds among investors based on agreements.

- Define payment of fees, such as development fees, property management fees, partnership management fees, leasing fees, refinancing fees, and resale brokerage fees.

- Determine the involvement and magnitude of money-raiser fees.

7. Checking references

- Request references from potential investors and conduct thorough background checks to ensure credibility and legitimacy.

- Seek testimonials from other projects they have invested in to gauge their level of satisfaction.

8. Partnerships

- Consider forming partnerships with co-developers or joint venture partners who can provide additional equity or expertise.

- Clearly outline roles, responsibilities, profit-sharing arrangements, and exit strategies in a partnership agreement.

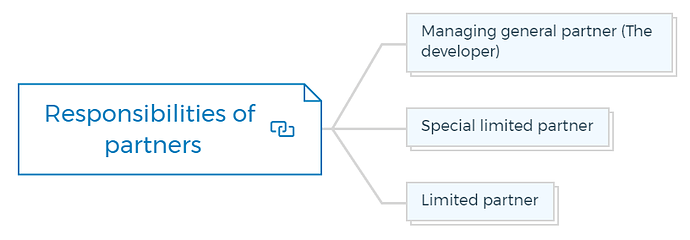

9. Responsibilities of partners

When forming partnerships for property development, each partner’s roles and responsibilities must be clearly defined to ensure a harmonious collaboration. Here’s an overview of the key responsibilities for different partner roles:

9.1. Managing general partner (The developer):

- Oversee the overall property development process.

- Lead project planning, design, construction, and management.

- Coordinate with contractors, architects, and other stakeholders.

- Secure necessary permits and approvals.

- Manage project finances, including budgeting and cost control.

- Develop and implement the project’s marketing and sales strategy.

- Communicate regularly with all partners and stakeholders.

9.2. Special limited partner

- Bring specialized expertise or resources to the partnership.

- Contribute in areas such as design, construction, legal matters, or financing.

- Advise and consult on decisions related to the partner’s specific area of expertise.

- Collaborate with the Managing General Partner on project execution.

- Ensure compliance with legal and regulatory requirements.

9.3. Limited partner

- Contribute equity financing to the project.

- Participate in decision-making processes based on the terms of the partnership agreement.

- Receive regular updates on project progress, financials, and milestones.

- Provide input and feedback on project strategy and direction.

- May have the option to exit the partnership according to the agreed-upon terms.

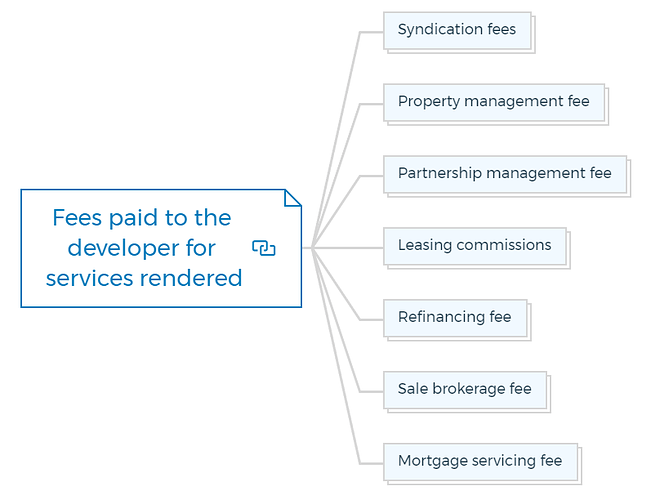

10. Fees paid to the developer for services rendered

In property development partnerships, various fees may be paid to the developer for the services they provide.

10.1. Syndication fees

- Compensation for the developer’s effort in sourcing and securing equity investors for the project.

- Covers expenses related to marketing, investor relations, and administrative tasks associated with syndicating the project.

10.2. Property management fee

- Payment for managing day-to-day operations and maintenance of the property.

- Includes tasks such as tenant management, maintenance coordination, and overseeing property staff.

10.3. Partnership management fee

- Compensation for managing the partnership and ensuring smooth communication among partners.

- Covers tasks such as organizing meetings, distributing financial statements, and addressing partner inquiries.

10.4. Leasing commissions

- Fee earned by the developer for leasing out units or spaces within the property.

- Typically, a percentage of the lease value covers the effort to find and secure tenants.

10.5. Refinancing fee

- Compensation for managing the process of refinancing the property, which might involve negotiating new loan terms or seeking better interest rates.

- Covers the developer’s effort and expertise in optimizing the property’s financial structure.

10.6. Sale brokerage fee

- Payment earned by the developer for acting as a broker during the property’s sale process.

- Applies if the developer plays a role in identifying buyers and negotiating the terms of the sale.

10.7. Mortgage servicing fee

- Compensation for managing the property’s mortgage, including collection of mortgage payments and liaising with lenders.

- Reflects the developer’s involvement in ensuring timely and accurate mortgage-related tasks.

11. Profit and tax losses: Structuring the benefits

In property development partnerships, structuring profit and tax benefits is crucial to ensure fair distribution among partners. Here’s how you can structure these benefits:

11.1. Cash flow

- Determine how the positive cash flow generated by the property will be distributed among partners.

- Consider proportional distribution based on ownership percentages or another agreed-upon formula.

- Define a schedule for cash distribution, which can be regular intervals (monthly, quarterly, annually) or triggered by specific events.

11.2. Tax benefits

- Decide how tax benefits, such as depreciation and deductions, will be allocated among partners.

- Partners may have varying tax profiles, so consider a fair allocation method that aligns with their individual circumstances.

11.3. Refinancing proceeds

- Outline how proceeds from refinancing the property will be distributed.

- Consider whether the distribution will be proportional to ownership percentages or a different arrangement.

11.4. Sale proceeds

- Define how profits from the sale of the property will be distributed among partners.

- Consider factors such as ownership percentages and the order of distribution (e.g., return of initial investment first, then profit split).