To start a large-scale property development project or sometimes even to get started in the property development journey, a real estate developer needs to explore property development financing options.

Property finance can be complex, but the below ways can help property developers get finance easily.

What is property development finance?

Property development finance is a short-term loan that helps developers to get funding for their residential or commercial real estate projects. This can include several things, such as - construction projects, land purchases, property renovation, property subdivision, etc.

Property developers typically obtain financing for their projects through equity and debt financing.

How do property developers get finance?

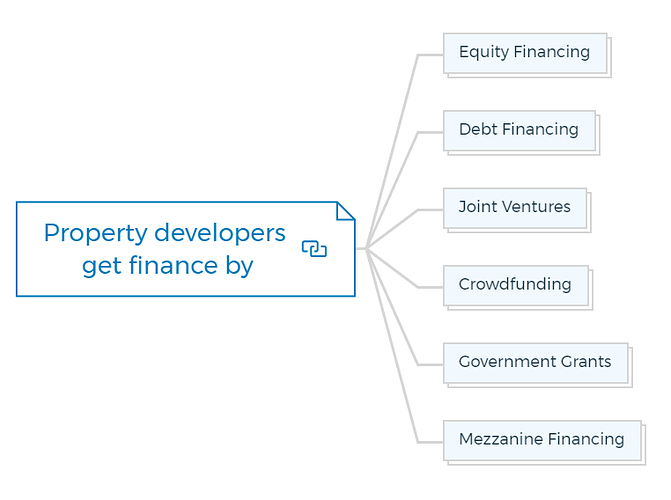

Some ways property developers can get finance include:

Equity Financing

Equity financing is a quick and easy way for real estate developers to raise money for their projects. Equity financing in real estate gives the lender a stake in the borrower company. Common stock, preferred stock, or convertible securities are equity stakes.

Developers can raise funds by selling project shares to investors, including individuals, institutions, and other developers. This type of financing allows developers to raise large amounts of capital without incurring debt.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Debt Financing

Developers can borrow money from banks, mortgage companies, and other financial institutions to fund their projects.

This can include construction loans, typically short-term loans used to fund the construction of a new property, and permanent loans used to refinance the construction loan once the property is complete.

If you ask which is better, equity or debt financing for property development funding, I suggest debt financing. Debt is usually better than equity. Giving away equity means losing control of your company.

Joint Ventures

Developers can form joint ventures with other developers or investment firms, providing them with equity and debt financing. In this case, the developer provides the land, and the JV partner provides the funds.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Crowdfunding

Developers can raise funds by leveraging online platforms that allow investors to fund projects in exchange for a return on investment.

Government Grants

Developers can also apply for government grants to help fund their projects.

Mezzanine Financing

Developers can obtain mezzanine financing, a type of debt financing typically used in conjunction with traditional bank financing.

This type of financing is typically more expensive than traditional bank financing, but it provides developers with more flexibility regarding loan structure.

It’s important to note that, depending on the project and the developer’s creditworthiness, the lender may require personal guarantees, mortgages over the developer’s assets, and other forms of security as collateral for the loan.

When to use development finance?

You can use development finance when you need funding for a real estate project. A residential or commercial property development loan helps with buying and construction costs.

Larger projects benefit from these loans. Generally, funding from different sources supports up to 65% of building costs, and the borrower pays the rest.

A real estate developer can get customized development loan options.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber