Will banks lend to property developers?

Yes, banks do lend to property developers, although the terms and conditions of the loan may vary depending on the specifics of the project and the strength of developer’s financial situation.

When property developers seek financing from banks, the banks will typically evaluate the developer’s track record, creditworthiness, and the feasibility of the project.

Banks will look at factors such as the developer’s experience, the location and type of the property, the projected return on investment, and the developer’s ability to repay the loan.

You are missing out if you haven’t yet subscribed to our YouTube channel.

In general, property development loans are considered to be higher-risk loans than other types of loans, such as mortgages for owner-occupied homes. As a result, banks may require a higher Loan to Value Rato (LVR) payment or charge a higher interest rate for property development loans.

It’s worth noting that the lending landscape can vary by country and region. Different jurisdictions may have different regulations and requirements for property development loans, and the availability of financing may also depend on the local real estate market and economic conditions.

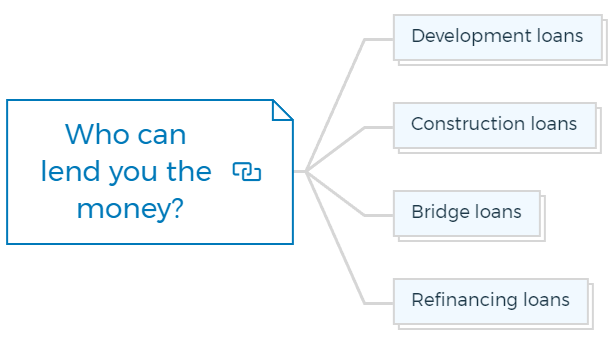

Who can lend you the money?

Establishing who can lend you the money and how much you can borrow before commencing any real estate development project is a must.

Banks and many other financial institutions also lend funds to real estate developers.

There are various loan products designed for specific real estate development needs that the bank provides. It includes -

Development loans

These loans are specifically designed for property developers and are used to finance land acquisition and construction of new development.

Banks will typically require a deposit of around 20-30% of the total project costs, but it can also range from as low as 10% to as high as 50%.

There are 3 main stages in a property development process - acquisition, development, and construction.

Depending on credit score, financial condition, and permits, a bank can lend money to a property developer for either a single stage or a complete project.

Learn More

Construction loans

These loans are used to finance the construction of a new development.

Banks will typically require a deposit of around 20-30% of the total project costs, but it can also range from as low as 10% to as high as 50%.

You will not get a lump-sum amount; your bank will provide you funds in installments as your property is being built. The payments in installment in a construction loan is known as progress payment or progressive drawdowns.

Bridge loans

Bridging loans are used to bridge the gap between purchasing a property and completing a development.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Refinancing loans

Developers can also refinance their existing loans to take advantage of lower interest rates or access the project’s additional funds.

However, it’s important to note that obtaining a loan from a bank for property development can be complex, and banks will have specific criteria and lending policies.

Learn More

Developers will typically be required to provide a deposit, usually a percentage of the purchase price, and demonstrate their creditworthiness and the project’s viability.

Additionally, developers will be subject to ongoing monitoring of their loan performance and compliance with loan covenants and the terms and conditions of the loan.