What is Mezzanine financing or mezzanine debt?

What is Mezzanine Financing?

Mezzanine financing is a type of financing that combines elements of debt and equity, used primarily in the real estate, private equity, and venture capital sectors.

It provides capital to companies and is positioned between equity and senior debt in a company’s capital structure, often secured by a second lien on property or projects.

How Does Mezzanine Financing Work in Real Estate?

In real estate, mezzanine financing provides capital to developers or investors in exchange for a share in the ownership of the property or a project.

Mezzanine finance in real estate works by providing capital to a real estate developer or investor in exchange for a share in the ownership of the property or project.

The mezzanine lender will typically provide financing to a developer or investor through a loan secured by a second lien on the property. This means that in the event of a default, the mezzanine lender would be repaid after the senior lender but before the equity holders.

Mezzanine financing is typically structured as a loan or a combination of a loan and equity, such as preferred stock or warrants.

Mezzanine financing is sometimes also known as gap financing. The gap loan or mezzanine finance is a secondary form of financing used to fill the gap between the floor amount of the loan and the maximum, or the construction loan amount and the permanent loan.

The source of these loans is often a mortgage banker or private party. At times, commercial banks will take up the call here but these loans are often very expensive for builders and should be used only when absolutely necessary.

The only redeeming factor on a gap loan is that it is usually for a short term. This means that even though the interest rate is high, it will not last for long.

Learn More

The key characteristic of mezzanine financing is that it is subordinated to senior debt in terms of priority for repayment in the event of a default.

Mezzanine financing can be used for a variety of purposes in real estate, such as to fund the acquisition of a property, to refinance existing debt, or to fund the construction or redevelopment of a property.

The terms of a mezzanine loan will vary depending on the specific deal, but it can include an interest rate that is higher than a traditional mortgage loan and a repayment period that is shorter.

Mezzanine financing can also include an equity component, such as an option for the mezzanine lender to convert the loan into an equity stake in the property or project.

Mezzanine financing is typically used in real estate as a way to add leverage to a project while keeping the equity stake of the developer or investor relatively low. It allows the developer to raise more capital for the project, but also brings in an additional investor with a higher interest rate.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What is Mezzanine financing?

In real estate and project finance, mezzanine funding and mezzanine debt refer to the same type of financing. It is a hybrid of debt and equity used to finance the development and construction of a specific project.

This type of financing is typically used when a project’s cash flows need to be increased to cover the debt service on traditional bank loans or when the project’s sponsors wish to retain a higher percentage of equity.

Mezzanine debt in project finance is typically structured as a subordinate loan to senior debt, meaning that it is repaid after the senior debt has been paid off.

The word subordinate means that mezzanine debt is a second-ranking debt and that the mezzanine lender understands the rights and entitlements of the first-ranking (senior debt) lender to receive repayment of their debt in priority to the second-ranking mezzanine lender.

IMPORTANT: Not all senior lenders would agree to allow a subordinated debt position behind their securities in the capital stack.

The term Capital Stack is used to describe the various levels or tranches of capital equired to fund the cost of a project.

Mezzanine debt carries a higher interest rate than senior debt, as the lender is taking on more risk.

The lender may also have the option to convert the debt into equity in the project if certain conditions are not met.

Here’s how mezzanine finance works:

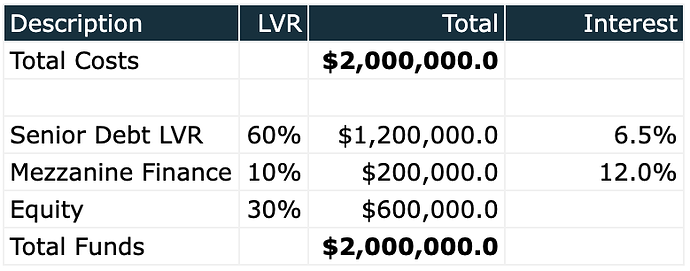

Let’s say you have a project where total costs or total uses of funds = $2m

You started this project thinking that you will be able to borrow 70% of the total costs and hence would only need 30% as equity.

However, when it was time get the construction loan, you realised that the market had changed now banks are only lending 60% of the Total Development Costs.

This is where mezzanine funding can help, because now instead of abandoning the project, you can bring another lender to fund the shortfall of 10%.

As it is clear from the example above, your main bank that will lend you 60%, is going to be your senior lender and when any money comes in, they will get paid out first.

Your mezzanine lender will be the junior debt or subordinate debt, as it gets paid afte the senior debt is paid out. And finally when both senior and junior debts are paid out, that’s when you get back your developers equity, as well as your profit.

Capital structure

- Senior debt is funding 60% of TDC i.e. $1,200,000 @ 6.5% / annum.

- Mezzanine debt is funding 10% of short fall i.e. $200,000

- Developers equity contribution - $600,000

Advanced Property Development Books Bundle

Looking for an edge in the property development game?

This Advanced Property Development Books Bundle is for you. 572+ pages chock-full of insights on residential + commercial property development and investment, this bundle spans 18 ebooks. Whether you’re a beginner or a seasoned pro, these books will take your development game to the next level.

Get The Advanced Property Development Books Bundle

Includes 18 x advanced detailed eBooks

✓ 7 Real Estate Negotiation Tactics That Win More Deals - 25 pages

✓ 7 Easy Steps To Market Your New Development Project - 30 pages

✓ Improve Your Development Game With Development Economics - 40 pages

✓ How To Get Development Approval FAST? - 49 pages

✓ Advanced Real Estate Market Analysis In 13 Easy Steps - 34 pages

✓ Invest In Commercial Property To Achieve Your Investment Goals - 22 pages

✓ 10 Finance Options For Your Next Property Development Project - 29 pages

✓ 13 Golden Rules Of Investing In Commercial Real Estate - 28 pages

✓ 6 Ways To Invest In Commercial Real Estate – The Complete Guide

✓ Commercial Development 101: Become an Expert - 34 pages

✓ Definitive Guide To Commercial Property Investment - 24 pages

✓ A Beginner’s Guide To Apartment Development (Tips & Principles) - 33 pages

✓ How To Build Townhouses And Develop Villas Successfully? - 41 pages

✓ How To Sell A Commercial Property In Record Time? - 25 pages

✓ Raw Land Development - What you need to know - 34 pages

✓ Single Family Homes: Learn Property Development Without Financial Risk - 33 pages

✓ What Exactly Is Equity Finance And How Does It Work? - 42 pages

✓ Real Estate Market – 6 Tips for Timing The Market - 19 pages

Who provides Mezzanine Financing?

Mezzanine funding in project finance often comes from institutional investors such as pension funds, insurance companies, or private equity firms.

They provide the funds for the property development project but take on a higher level of risk than traditional senior debt.

In return, they typically receive a higher return on their investment and may also have the option to convert their investment into equity in the project.

Why use Mezzanine financing?

There are several reasons to use mezzanine financing. It includes -

- Requirement for larger amounts

- It can be added to a standard loan, which helps to get more money.

- A less expensive and tax-friendly option to equity.

Are mezzanine loans secured?

A mezzanine loan is backed by a pledge of the company’s equity (like an LLC) that owns the mortgaged property.

If the mezzanine borrower doesn’t repay the loan, the mezzanine lender takes the property back and becomes the new owner.

The borrower’s real estate interests indirectly secure real estate mezzanine loans.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Mezzanine Financing - Frequently Asked Questions

What are the Typical Structures of Mezzanine Financing?

Mezzanine financing can be structured as a loan or a mix of loan and equity components, such as preferred stock or warrants. This flexibility allows it to serve as gap financing to cover the difference between primary loans and the total financial requirement of a project.

Why is Mezzanine Financing Used?

It is used for various purposes such as funding property acquisitions, refinancing existing debt, or supporting construction or redevelopment projects. Its primary advantage is enabling developers to raise more capital while maintaining a lower equity stake, adding leverage to the project.

What are the Risks and Costs Associated with Mezzanine Financing?

Mezzanine financing carries higher interest rates than traditional mortgage loans due to its subordinated status and the higher risk assumed by lenders. Additionally, the terms can include shorter repayment periods and the possibility of the loan being converted into an equity stake by the lender.

How is Mezzanine Debt Repaid?

Mezzanine debt is typically repaid after senior debt but before equity holders receive returns. It is subordinate to senior debt, meaning it carries more risk and, as a result, demands higher interest rates.

What is the Capital Stack?

The Capital Stack refers to the hierarchical structure of financing sources used in a project, including senior debt, mezzanine financing, and equity. It outlines the order in which these sources are repaid and their respective risk levels.

Can Mezzanine Financing Convert to Equity?

Yes, mezzanine financing can include an equity component, allowing the lender the option to convert the debt into an equity stake in the property or project under certain conditions. This feature adds a potential upside for lenders while increasing the complexity of the financing arrangement.

Why Might a Developer Choose Mezzanine Financing?

Developers opt for mezzanine financing to cover funding shortfalls without significantly diluting their equity stake. It is particularly useful when market conditions change, limiting the amount of traditional bank financing available.

What Are the Implications of Mezzanine Financing for Senior Lenders?

Not all senior lenders may approve the inclusion of mezzanine financing due to its subordinated position. However, it can be an essential tool for ensuring the completion of a project by providing necessary additional capital.