12 Superannuation Tax Saving Tips to Help You Keep More of Your Money

What is superannuation?

Superannuation refers to funds saved aside throughout your working career to support your retirement.

It’s many Australians’ second-largest asset, after the family house. But the lack of attention given to it is absurd. One of your most valuable possessions needs to be taken care of, so make the time.

Super Funds can be invested in real estate, shares, term deposits, and managed funds. They also receive substantial tax breaks, complying with super funds and obtaining preferential tax treatment over businesses and people making more than $18,200.

A conforming superannuation fund must pay taxes 15% of its net income and contributions. If contributions are made by those whose income is more than $250,000, they are subject to a 30% tax. When an asset is kept for at least a year, capital gains tax is decreased to 10%.

This article will discuss various strategies for boosting your super and the most tax-efficient ways to access it.

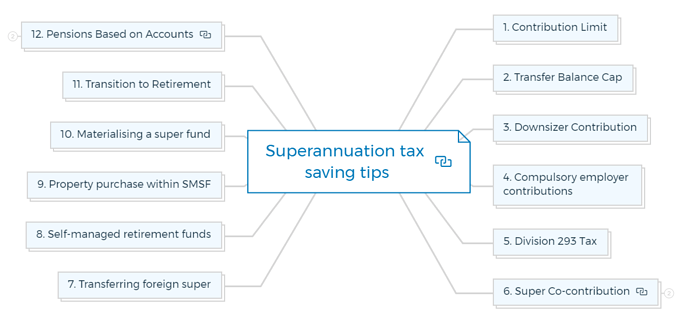

Superannuation tax saving tips

1. Contribution Limit

Making consistent, sizable donations to the fund over time—and then reaping the rewards of seeing money grow—is the easiest way to increase your super fund balance.

Quick Tip

Superannuation tax tips -

If your annual income is under $250,000, you can contribute up to $27,500 to super and pay only 15% tax. Even if you don’t have access to it right now, the money is yours, and by investing it now, you can increase your net worth faster than by paying up to 47% in taxes.

There are two different ways to contribute to a super fund:

- Concessional contributions (before tax)

- Non-concessional contributions (after tax).

Concessional contributions are before-tax contributions because the giver, typically an employer, can claim a tax deduction. Concessional contributions are taxed at 15% (or 30% if the individual earns more than $250,000).

Concessional contributions are limited to $27,500 annually. They consist of every mandatory super guarantee contribution, every salary sacrifice contribution, and any personal tax deductible contributions that you want to claim.

Risk -

If you have multiple funds, the cap is applied to the total of all concessional contributions made to each fund.

The ATO does not tax non-concessional contributions, which include after-tax personal contributions you make.

Quick Tip

You may be qualified for the super co-contribution if you earn less than $56,112 and don’t claim a tax deduction for any personal contributions you make to super.

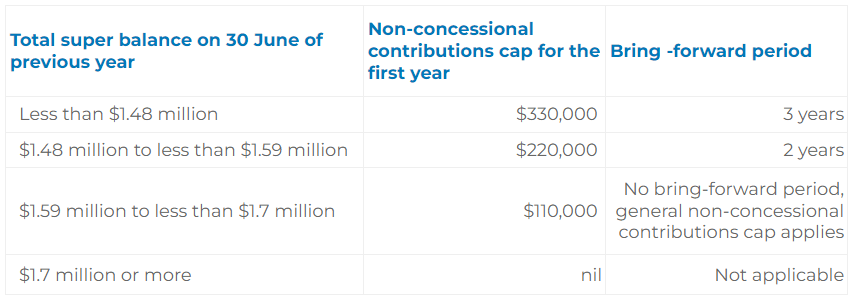

The amount of non-concessional contributions you can make each year without incurring additional tax is capped by the ATO at four times the number of concessional contributions, or $110,000.

Additionally, only those having superannuation balances of less than $1.7 million at the end of the prior fiscal year are eligible for the non-concessional cap. The untaxed plan cap of benefits within a super fund that has not been subject to contributions tax is $1,615,000.

When superannuation balances exceed $1.48 million, the table below shows that the maximum non-concessional cap you can bring forward decreases. When you exceed the non-concessional contribution cap for the first time, the period starts that year.

Risk -

Any sum above the cap on concessional contributions is subject to an additional 32% tax, while any sum above the cap on non-concessional contributions is subject to a 47% tax. You are responsible for this tax, but you can access your superfund funds to make the payment with a release authorisation from the ATO.

Regardless of income or the reason for the violation, excess concessional payments are included in a person’s taxable income and taxed at their marginal tax rate (plus interest). The person can pay the tax bill out of their own funds or use their extra concessional superannuation contribution after taxes.

The additional income tax resulting from excess concessional contributions included in your income tax return is taxed at an excess contribution charge, which is presently 3.02 per cent.

2. Transfer Balance Cap

Superannuation is one of the most acceptable places to lawfully reduce your tax burden, especially since you don’t have to pay taxes on your savings while in retirement.

The transfer balance cap is a cap on how much superannuation can be transferred from your accumulation super account to a tax-free “retirement phase” account; it is currently set at $1. 7 million. It will be rounded down to the nearest $100,000 and linked to CPI.

When calculating this sum, all your account balances are considered. No matter how many accounts you have these funds in, it makes no difference.

Risk -

Retirement account tax-free status is constrained by a $1.7 million transfer balance cap on funds entering the tax-free pension phase.

Balances may rise above this ceiling dependent on the growth of tax-free income (after minimum withdrawals). Amounts over $1.7 million as of July 1 2021, must either be rolled into an accumulation fund with future earnings subject to a 15% tax rate or taken as a lump sum (eligible to individuals over preservation age).

Go over your transfer balance cap. You might have to pay tax on the notional earnings associated with that excess and convert a portion of your retirement phase income stream into a lump sum accumulation account.

The tax rate is only 15% on the excess income, and the first $1.7 million in earnings are tax-free, so it’s still a desirable concession.

You won’t go over your cap if the amount in your retirement phase account eventually increases (via investment gains) to more than $1.7 million. As long as you stay under the cap, you can keep making several transfers into the retirement phase.

If you have already used up your whole $1.7 million cap space, you cannot top up your retirement phase account if the balance decreases over time.

Only those with a total superannuation balance of less than $1.7 million at the end of the prior fiscal year are eligible for the super co-contribution.

Quick Tip

Superannuation tax tip -

Some assets that surpass the $1.7 million transfer balance cap must be transferred back into accumulation mode.

If an SMSF uses the segregation of assets method, moving assets back into accumulation mode could allow the SMSF to keep assets. These assets might incur a capital gains tax liability in pension mode while transferring assets that are unlikely to incur a capital gains tax liability or will produce lower income (cash and fixed interest investments) into accumulation mode.

With a $1.7 million transfer balance cap on superannuation, it is possible to divide contributions between spouses so that each one maximizes their individual $1.7 million thresholds (a total of $3.4 million) before retiring.

3. Downsizer Contribution

Over the past ten years, the government has restricted the number of methods people can invest in super, from lowering the concessional and non-concessional quotas to enacting the transfer balance limitation.

The 2017-18 federal budget reversed this trend by allowing senior Australians to contribute some or all of the proceeds from the sale of their own home towards superannuation without influencing pre-existing concessional or non-concessional restrictions.

Although this is called a ‘downsizer’ contribution, neither ‘downsizing’ nor buying a new property is required.

Your downsizer contribution will not count toward your contribution caps because it is not a non-concessional contribution. You can still make the downsizer contribution even if your overall super balance is higher than $1.7 million.

Even if you and your spouse were the only owners of the home sold, provided they met all of the other criteria given above, your spouse may also make a downsizer contribution of up to $300,000.

The downsizer contribution will count toward your transfer balance cap, but your overall super balance won’t be updated until June 30 at the end of the fiscal year; it’s crucial to remember.

Even though a downsizer contribution must be given within 90 days of receiving the sale profits, the ATO will let you apply for a longer term if necessary due to unavoidable circumstances.

Due to illness, a death in the family, or a move, the request should be submitted within the first 90 days of eligibility. It is possible to make several downsizer contributions, but they must all originate from a single sale’s earnings, and the sum of all your donations cannot be greater than $300,000.

Alternatively, the sale’s total proceeds are less than any of your spouse contributions.

Your superannuation fund must have received a downsizer contribution into super form by making your contribution. If the ATO later decides your downsizer donation was ineligible, it may impose false and misleading penalties.

Your superannuation fund will need to determine whether your payment might have been made as a personal contribution after receiving notification from the ATO in this case.

It will count toward the applicable contributions cap if it might be considered a personal contribution. Your super fund will need to return your contribution if they cannot accept it.

4. Compulsory employer contributions

When employed, your employer must pay SG (superannuation guarantee) contributions into a conforming super fund. Since 1992, when SG became mandatory, Australians’ superannuation savings have soared.

Your company contributes 10% of your ordinary earnings to the maximum contribution base every quarter. Payments count toward your concessional maximum.

You can choose the conforming super fund this super is paid into.

If you are 18 years or older and make $450 or more before monthly taxes, you are only eligible to have SG contributions made on your behalf by your employer.

It makes no difference if you are simply a temporary resident of Australia or have a full-time or casual job arrangement.

For super payments to be made on your behalf, if you are under 18, you must work more than 30 hours per week.

Contractors who are paid exclusively or primarily for their labour are regarded as workers for SG purposes and are subject to the requirement to have 10% SG payments paid on their behalf as employees.

Any SG contributions due from employees are calculated using their regular hourly wages. They typically consist of allowances, bonuses, commissions, and any over-award payments and represent what you make during your regular working hours.

Quick Tip

Superannuation Tax Tip

The first step is to double-check with your employer if you are concerned that they are not contributing the appropriate amount of super to your fund. If your question isn’t answered, you can contact the ATO, who will look into your employer’s business practices in more detail.

Your non-concessional contributions cap for a financial year does not apply to superannuation contributions made with personal injury settlement money.

Learn More

5. Division 293 Tax

Over the years, there has been a strong incentive for taxpayers paying the highest marginal tax rate of 47 per cent to contribute as much money as they can to their superannuation accounts in order to pay taxes at the more lenient concessional tax rate of 15 per cent, effectively locking in a 32 per cent tax break on any contributions.

The recent addition of Division 293 to the Tax Act reduced this advantage but not complete elimination.

The Division 293 tax is an additional tax on super contributions that lowers the tax break for people whose total combined contributions and adjusted taxable income are above the $250 000 Division 293 level.

An additional 15% (essentially 30% overall) of a person’s taxable contributions made during the fiscal year in which they exceeded the $250,000 cap is subject to Division 293 tax. If you did not make any taxable contributions throughout the year, there is no Division 293 tax to pay.

Risk -

Even though your income may not typically exceed $250,000, some circumstances, such as qualifying termination payments and capital gains, can push it beyond this threshold for a given year. In these circumstances, you will be responsible for paying an additional 15% Division 293 tax on your super contributions for that year.

Quick Tip

Superannuation tax tip -

Only your annual concessional contributions are subject to Division 293 tax. Non-concessional donations are not taxable, but any earnings are subject to the usual 15% concessional tax rate.

Once they have compared your tax return with the information your super fund has provided them regarding contributions made, if you are over the income threshold, the ATO will typically issue a Division 293 notice several months after the end of the financial year.

Instead of spending your own money to pay the balance due, you can choose to have money withdrawn from your super fund.

6. Super Co-contribution

The phrase “super co-contribution” should be renamed “free money” instead! However, it is incredible how few individuals use this fantastic opportunity.

A super co-contribution government programme has been in place since 2005 to aid low- and middle-income employees in increasing their superannuation accounts.

You can benefit from the super co-contribution payment if your annual income is less than $56,112 by contributing a maximum of $1000 in personal super to your super fund. Then, up to an additional $500, the government will match by 50%.

Only those having a total superannuation balance less than the transfer balance ceiling of $1,700,000 at the end of the prior fiscal year are eligible for the super co-contribution. Additionally, it is not available if your annual non-concessional contribution cap has already been met.

You only need to make real personal super contributions to your super fund and file your income tax return if you are eligible for the co-contribution.

There isn’t a separate application or paperwork to fill out. The individual’s superannuation contribution must be made to a super compliant fund and may not have been deducted from income for tax purposes.

You must meet the two income requirements listed by the ATO to qualify for the super co-contribution:

The income threshold test.

According to the ATO, the government will match your $1000 post-tax contribution to your super fund with an additional $500 if your total income is less than $41,112 per year.

The super co-contribution gradually phases out to zero at the higher income threshold of $56,112.

IMPORTANT

Example -

Luke is an employee whose superannuation contributions, reported fringe benefits, and assessable income total $43,000. He makes a $3000 personal super contributions to his super fund in the fiscal year 2022–2023.

The government will provide Luke with a co-contribution of $437, calculated as follows:

$500 - (($43000 - $41112) X $0.03333]

The 10% eligible income test.

According to the ATO, at least 10% of your total income must be derived from employment-related activities or business operations to qualify for the co-contribution.

You are not eligible for a super co-contribution for any personal payments that you have chosen to make and that have been accepted as a tax deduction.

7. Transferring foreign super

Many Australians have taken advantage of international super funds to accumulate retirement benefits while working abroad. You might be permitted to transfer money from a foreign super fund to either an Australian super fund that complies with the criteria or to yourself, depending on the restrictions of your foreign super fund.

The following prerequisites must be satisfied before your Australian super fund will accept any transfers of international super funds:

- Age.

If you are under 67, contributions can still be accepted (apart from SG contributions, which have no age restriction). The “work test” must be passed by individuals between the ages of 67 and 74.

- TFN

Your super fund has your TFN on file.

- Maximum contribution.

The transfer stays within your fund’s contribution cap. Depending on your superannuation amount, you might be able to move forward three years of the cap if you are under 65.

IMPORTANT

Example -

John, 71, sends his $248,000 super interest from France to Australia. He passed the work test and has contributed $320,000 in non-concessionary contributions to Australian funds throughout his lifetime.

He must return the extra $138,000 to his French super fund because he is over 65 and cannot contribute more than the initial $110,000 (which would bring him to the annual non-concessional contribution limit). If he continues to pass the work test, he may contribute more in the years to come.

A foreign fund transfer’s “applicable fund earnings” portion is subject to income tax. These profits have accumulated on your super international balance solely since you moved to Australia. If you move your foreign super to Australia within six months of becoming an Australian resident, none of it will be considered eligible fund profits.

Quick Tip

Superannuation Tip -

Your fund will pay the tax on the amount at a rate of 15%, which may be less than the marginal rate of tax that you must pay if you choose to include some of your applicable fund profits in your super fund’s assessable income rather than your own.

8. Self-managed retirement funds

As the name implies, a self-managed super fund (SMSF) is a sort of super fund that the members manage for their benefit. As member balances grow and individuals get more experience managing their retirement funds, SMSFs are becoming more and more popular.

The $259 annual SMSF charge is paid to the ATO in advance.

Setting up an SMSF may be an option for you to consider for your retirement if you have the time and expertise to commit to managing your investments, including advisers you can call on.

Quick Tip

Superannuation tip -

Consider your risk profile when determining the minimum balance to start your SMSF. Administration expenses might offset the advantages of running it yourself and vary depending on the investment strategy.

An SMSF has several advantages, including:

- Choosing where and how to invest your superannuation funds at will

- Tax advantages

- Economics of scale: When a family’s (up to four) superannuation accounts are combined, the result may be more than the sum of its parts.

- Possibility of investing in direct share portfolios, which might result in dividend imputation credits that assist lower the overall tax that the fund must pay.

- The capacity to invest in commercial real estate

- Rates for deductible life insurance

While SMSFs might be beneficial, not everyone should use them. You should give some of the following considerations significant thought before you establish one:

-

Administrative responsibilities. These could be burdensome, including

– arranging for your investment to be audited each year

– maintaining accurate records

– reporting on the fund’s operations to the ATO. -

A yearly fee For an average-sized fund, fees for administration, accounting, tax preparation, and audit can cost between $2,000 and $6,000.

-

Adherence Being an SMSF trustee entails knowing the criteria because you make sure the fund complies with its trust deed and applicable superannuation regulations.

-

Administration You must manage the fund’s investments in the best interests of fund members, which includes ensuring they are only used to provide retirement benefits and keeping them apart from fund members’ personal and professional affairs.

An SMSF may pay a financial penalty by being taxed at the regular rate of 45% rather than the concessional rate if it loses its compliant status due to breaking the laws and regulations.

Continued at…

12 Superannuation Tax Saving Tips to Keep More of Your Money [Part 2-2]