Continued from…

The Ultimate Guide To Property Investment Finance [Part 1-4]

The Ultimate Guide To Property Investment Finance [Part 2-4]

What is a principal and interest loan?

A principal and interest loan is a loan in which you repay both the principal (the amount you initially borrowed) and the interest on that amount each month. Your monthly repayments will be higher than if you choose an interest-only loan, but you will own the property at the end of the loan term.

- You will need to repay less than 1% of the loan principal each month, so these loans have higher repayments than interest-only loans.

- There are no tax benefits if the borrower has a home loan and the loan is not for investment purposes, so many borrowers prefer to pay down their home loan first before paying down debt for an investment property.

- The majority of repayment is an interest with some principal. They charge interest not only on the loan amount but also on the interest charged on the loan amount 'every day until the repayment.

Disadvantages of principal and interest loans

- The monthly repayments are higher than if you choose an interest-only loan. It may take longer to save up for a deposit on another property, or you may have less money available each month to put money into other assets.

- Your loan balance will not go down during the interest-only period, so you may owe more money at the end of the loan term than when you started.

What is bridging finance?

Bridging finance or a bridging loan is a short-term loan used to ‘bridge’ the gap between buying a new property and selling your old one. Property investors can use a bridging loan for a variety of purposes, including:

- To buy a new property before your old one has sold.

- To buy a property at auction.

- To release equity from your property to use as a deposit on another property.

- To pay for renovation costs on a new property.

- To cover the cost of stamp duty and other purchase expenses.

Bridging finance is usually a short-term loan (between 6 and 12 months) at a higher interest rate than a traditional home loan.

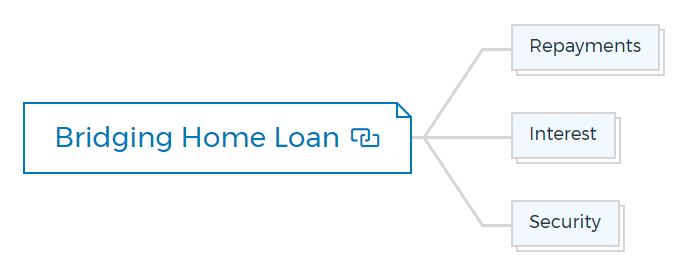

How does a bridging home loan work?

A bridging home loan works similarly to a standard home loan; however, the interest rate is usually higher, and the loan term is shorter.

You will make regular repayments on the loan, and at the end of the term, you will need to either sell your property or refinance to a longer-term loan.

Repayments

Repayments on a bridging loan are usually interest-only, which means that you will not reduce the amount you owe during the loan term.

It can be beneficial if you are trying to save for a deposit on another property, as you will not have to make repayments on the principal (the amount you borrowed).

Interest

Interest rates on bridging finance are usually higher than standard home loan interest rates. The loan is for a shorter period, and the lender takes on more risk.

Security

Bridging finance is usually secured against your property, which means that the lender can sell your property to repay the loan if you default on the repayments.

This makes it essential to make sure that you will sell your property or refinance the loan at the end of the term.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Costs involved in buying a property

When buying a property, you need to budget for various costs.

These costs can include:

Stamp duty

Stamp duty is a tax paid when purchasing property or land in Australia.

The stamp duty depends on the property’s value, state or territory, and whether you’re a first home buyer.

You can use a Stamp Duty Calculator to estimate how much stamp duty you need to pay.

Legal and conveyancing fees

These are the fees your solicitor or conveyancer charges for their services about your property purchase.

Bank fees

You might face charges of bank fees, such as a loan application fee, an establishment fee, and ongoing fees.

Other costs

You need to consider maintenance costs, building and pest inspection fees, removalist costs, and furniture and appliance costs if you’re buying an unfurnished property.

Acceptable income types

You can use a few types of income to qualify for property investment finance. The most common income and how the lender treats these are:

- Overtime - Some lenders will use a percentage of your overtime income, while others will not consider it.

- Casual Income - 50%

- Rental Income - 75%

- Shift work - 25-50%

- Deductible Interest - Some lenders will consider that the interest on your loan is tax-deductible. It can increase your borrowing power by up to 30%.

- Salary Packaging - Use 50% of pre-tax

- Second Job - Use 50% of income

- Pension - 100%

If you have other types of income, such as income from a trust or property investment, you will need to speak to your lender to find out how they are treated.

Tenure

-

Full-time and Part-Time and Contract

Six months of full-time or permanent part-time work in the same role with the same company is generally considered appropriate.

One day at a new job is fine. A lender will even accept an employment contract and its income before the person starts the new work. Probation is appropriate up to 80% LVR but should end at 80%. -

Contract employment

Lenders accept unemployed people on a contract basis.

Depending on the lender, they will use either the contract value or a percentage of the contract value. The minimum contract length is usually 3 months. -

Living expenses

Lenders will consider your living expenses when assessing your application for property investment finance. It includes things like your rent, food and utility bills. You will need to provide proof of your living expenses to the lender.

Learn More

What is the comparison rate?

A comparison rate is a tool that lenders use to compare the cost of different loans. It includes the interest rate and other fees the lender may charge you.

The comparison rate can help you compare different loans and find the best deal for you.

Valuations

A property valuation is an opinion of the value of a property. The valuer will consider the property’s location, the condition of the property, and recent sale prices of similar properties.

A property valuation is different from a market appraisal, which estimates the value of a property based on the current market conditions. Before approving your loan, your property investment finance lender may require a property valuation.

The property valuation assesses the property’s value and ensures that the property is worth the amount of money you are borrowing. A property valuation can be useful for other reasons as well.

For example, if you want to sell your property, a property valuation can help you set a price for your property. A valuation can be free as well as comes with a fee. Some property investment finance companies offer free property valuations for their customers.

If the valuation is low, the buyer has six options:

- Renegotiate the price with the seller

- Cancel the contract and get their deposit back

- Ask the seller to pay for the property to be revalued

- Ask the bank to finance the difference to continue with the purchase

- Walk away from the deal

- Buy the property at a lower valuation.

Home loan requirements and applying for a home loan

A home loan is a loan taken out to finance the purchase of a property.

Home loans are available from banks, building societies, and credit unions.

Home loan application requirements

To qualify for a home loan, you will usually need to -

- Two to three forms of ID

- Two or three types of income evidence

- Self-employed full documentation loan, 1-2 full financial years tax returns, and assessment notices for company/trust.

- 6 months of repayments statements of any mortgage debt (if refinancing)

- 3 months personal loan and car loan statements

- Credit card statements of 3 months.

- Notice of Council Rates for Refinances, sometimes required to prove other properties.

- To complete a purchase, you will need the purchase contract, land transfer, deposit receipt, and proof of funds.

- Rental statement/lease agreement or rent appraisal if buying vacant property.

- Full ‘stamped’ trust deed, if one exists.

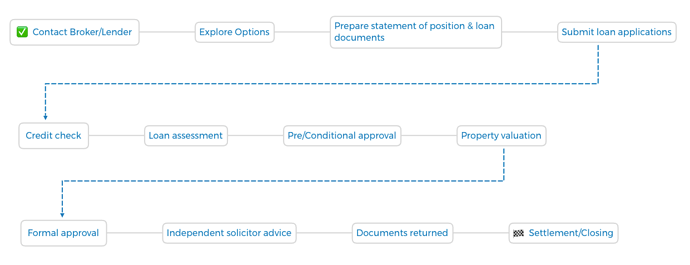

Process of applying for a home loan

When you’re ready to buy a house, apply for a home loan to help manage your property expenses.

- Firstly, collect all required paperwork. Tax returns, pay stubs, and bank statements are some examples. You’ll also need to know your credit score. The better your credit score, the better your loan interest rate.

- You can now start applying for home loans. There are numerous lenders, so comparing rates and terms is critical. Ask about origination fees and prepayment penalties.

- After selecting a lender, you must submit a loan application. It usually involves completing a loan application and providing basic personal information like name, address, and Social Security number.

- The lender will then assess your loan eligibility. So the lender will likely send an appraiser to value your home. After the appraisal, the lender will make a loan offer.

- You can now accept or reject the loan offer. If you accept, you’ll need to sign paperwork and pay a deposit. If you reject the offer, you can look for another loan.

Applying for a home loan does not have to be difficult or stressful. With a little planning and knowledge, you can get the best loan for property investment.

What is negative gearing?

Negative gearing is when your rental income doesn’t cover the cost of your mortgage repayments, and you have to make up the difference from your own money.

The property is known to be negatively geared property if the outgoings, such as mortgage repayment, rates, insurance, agents, commission to manage the property, and any body-corporate expense and maintenance, are larger than the income.

Negative gearing example

If you earn $30,000 a year and your rental property costs you $27,000 a year in expenses, your property is negatively geared by $3000 a year.

The ATO will allow you to deduct this amount from your taxable income, which means you’ll only be taxed on $27,000 instead of $30,000.

It can reduce your tax and may even bring you into a lower tax bracket.

What are the benefits of negative gearing?

The main negative gearing benefit is that it allows you to offset some of your rental losses against other income, such as your salary or wages.

It can reduce the amount of tax you pay.

It can also help you build up equity in your property more quickly, as your rental income may not cover your mortgage repayments, but the rent you’re charged will usually be more than the interest on your loan.

What are the risks of negative gearing?

- The main risk of negative gearing is that you may lose money if your rental property doesn’t increase in value or if rents go down.

- You could also end up with a property that is hard to sell, as you may need to sell it for less than you paid for it.

It’s important to remember that negative gearing is a long-term strategy, and you should only put your money in the property if you’re comfortable with the risks.

If you’re unsure whether a negative gearing investment property is right for you, speaking to a financial advisor is good.

What is positive gearing?

Positive gearing is where your rental income covers your mortgage repayments and other costs, such as maintenance and insurance. You also receive a tax deduction for the interest payments on your loan.

It can result in a cash flow positive situation, where you’re receiving more money than you’re paying out each month.

What are the benefits of positive gearing?

There are several benefits of positive gearing, including:

- The ability to generate a passive income stream

- A tax deduction for the interest payments on your loan

- The potential for capital growth on your property as the value of your property increases

What are the risks of positive gearing?

There are also several risks associated with positive gearing, including:

- An increase in your tax liability if you make a profit on the sale of your property

- The potential for negative cash flow if rental prices fall or interest rates rise

- The possibility that you may have to sell your property if you can’t afford the repayments

What is capital gains tax on real estate?

Capital gains tax (CGT) is a tax on your profit when you sell an asset for more than you paid for it. You’re only liable for CGT if you make a profit, and you don’t have to pay CGT on any losses.

The main assets subject to CGT are shares, managed fund investments, and real estate.

When do I have to pay CGT?

You only have to pay CGT when you sell an asset, and you usually have to pay it within 30 days of the sale. However, there are some exceptions, such as selling your home or being a foreign resident.

How is capital gains tax calculated?

CGT is calculated on your profit from selling an asset, not on the total sale price.

For calculating capital gains tax liability, you need to know the following:

- Cost base of the asset (what you paid for it plus any costs associated with buying or selling it)

- Capital gain (the difference between the cost base and the sale price)

- Capital gains tax rate (currently 18% for most assets)

You then apply the CGT rate to your capital gain to calculate your CGT liability.

For example, if you sell an asset in Australia for $100,000 and your cost base is $80,000, your capital gain is $20,000.

If you’re a resident for tax purposes, you will pay 18% on your capital gain, which means your CGT liability would be $3600.

What are the main exemptions and concessions?

The main exemption from the CGT tax rate is your home, as long as it is your main residence.

You can also claim several concessions, such as the following:

- CGT discount (if you’ve owned an asset for 12 months or more, you may be eligible for a 50% discount on your capital gain)

- Main residence exemption (if you sell your home, you may be able to exempt all or part of the capital gain from tax)

- Private use assets exemption (if you sell an asset that you’ve used for personal use, such as a boat or a painting, you may be able to exempt some or all of the capital gain from tax)

The 6-year rule in Australia

You won’t be eligible for the CGT discount if you sell an asset you’ve owned for less than 12 months.

However, if you’ve owned the asset for more than 12 months, you may be eligible for the discount if you meet certain conditions.

One of these conditions is the “six-year rule”, which states that you must have owned the asset for at least six years before claiming the discount.

The six-year rule encourages long-term investment in assets, as it provides a greater incentive for people to hold onto their assets for longer periods.

Do I have to pay CGT if I’m not a resident for tax purposes?

If you’re not a resident for tax purposes, you may still have to pay CGT on any assets you own in Australia. However, several exemptions and concessions may apply, such as the following:

- Foreign resident CGT exemption (if you’re not a resident for tax purposes, you may be exempt from CGT if you sell your main residence in Australia)

- Temporary residents concession (if you’re a temporary resident, you may be eligible for a concession on any capital gains you make when you sell your assets before you leave Australia)

If you’re not sure whether you’re liable for CGT, it’s good to speak to a tax advisor.

What is equity release for investment properties?

Equity release is a way to access the money tied up in your home without moving out.

You can take out a loan against the value of your home or sell part of your property in exchange for a cash lump sum or regular payments. Equity release is available to homeowners over the age of 55, and you don’t have to be retired to qualify.

There are two types of equity release -

Un-controlled equity release/ cash out

With Uncontrolled Equity Release/Cash Out, you can take out as much money as you want, whenever you want, but the amount of money you can borrow decreases as you get older.

The interest rate is usually fixed, so you’ll know exactly how much your repayments will be each month.

Controlled equity release/cash out

With Controlled Equity Release, the amount of money you can borrow doesn’t decrease over time, but there are limits to how much you can take out.

Equity release can be a great way to boost your retirement income, but it’s important to understand how it works before making any decisions.

What are self-employed loans?

Self-employed loans are a type of loan specifically designed for self-employed people. People can use them for various purposes, including starting or expanding a business, making home improvements, and consolidating debt.

Self-employed loans typically have higher interest rates than traditional loans. Still, they can be a good option for people who have difficulty getting approved for a loan through a traditional lender.

There are a variety of lenders that offer self-employed loans, including banks, credit unions, and online lenders. Be sure to compare interest rates and terms before you choose a lender.

Low doc self-employed loan for property finance

- A low doc loan for self-employed is a home loan that does not require you to provide evidence of your income.

- This can be beneficial if you are self-employed or have a complex income situation.

- To apply for a low doc loan, you will need to provide proof of your identity and assets and evidence of your ability to repay the loan.

- It may include tax returns, bank statements, and asset valuations.

- The interest rate on a low doc loan is usually higher than a standard home loan, as the lender has more risk.

This loan type is also known as alt-doc, lo doc, low doc, and low documentation.

Full doc self-employed loan for property finance

- A full doc self-employed loan is a home loan that requires you to provide evidence of your income.

- To apply for a full doc loan, you will need to provide pay-slips, tax returns, and other documentation to prove your income.

- The interest rate on a full doc loan is usually lower than a low doc loan, as the lender has less risk.

- This loan type is also known as a standard home loan or a conventional home loan.

What is a deposit bond when buying a house?

Deposit bonds can be a practical option if you do not have the cash for a deposit or if you want to keep your savings in an interest-bearing account.

- A deposit bond is a type of insurance that can be used in place of a cash deposit when buying a property.

- An insurance company and guarantees issue the deposit bond to the seller.

- If the buyer does not pay the deposit, the insurer will pay the seller.

- Real estate investors can use deposit bonds for both residential and commercial properties.

- They are usually valid for up to 12 months, but this can vary depending on the insurer.

How to get private funding for real estate investing?

Private funding is an alternative to traditional lending in which a group of private investors pool their funds and lend them to a borrower for a limited period.

Most borrowers seek private funding since they don’t qualify for traditional loans. It includes a lack of security, a desire for speed, or it’s just too complicated or complex.

- They’re 6-24 month terms with interest-only payments required at 1% above market rates, up to 6% monthly.

- The minimum amount you can borrow is usually $50,000 with no maximum.

- Try contacting your local real estate investors’ association or searching online directories to find private lenders.

- Private funding LVRs are typically 60-75 per cent, equivalent to commercial finance.

Learn More

What is the off-the-plan purchase?

Buying Off-the-plan properties can be a great way to get into the property market, as you can often buy properties at a discounted price.

- An off-the-plan purchase is when you buy a property that has not yet been built.

- You usually deposit and then make payments during the construction period.

- Once the construction is complete, you will need to pay the purchase price balance and take possession of the property.

However, more risk is involved, as the property’s value may not be as high as you expect it to be when completed.

Benefits of buying off-plan property

- You can often buy the property at a discounted price.

- There is no need to pay stamp duty on the purchase price.

- You may be able to get a better loan deal from the lender.

- They are mostly in the city or high-density developments in good suburbs within 20 km of a CBD.

Risks of buying off-plan property

- The property’s value may not increase as much as you expect.

- There may be a delay in the construction of the property.

- You may not be able to get your deposit back if you change your mind about the purchase.

- There would be no transparency between the building’s investor versus owner-occupier split, so proceed cautiously.

The off-the-plan market is booming in many Australian cities, so do your research before taking the plunge.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber

Continued at…

The Ultimate Guide To Property Investment Finance [Part 4-4]