What is equity release?

Your property’s substantial amount of equity can give you access to additional financial resources. Learn the secret to freeing up this money by equity release scheme and use it for home improvements, purchasing an additional residence, or other purposes.

What is equity release for investment properties?

Equity release for investment property is a financial tool designed to help homeowners access the equity in their homes without selling up or downsizing.

It enables homeowners aged 55 and over (no upper age limit) to borrow money using their property as security, allowing them to access cash for any purpose they choose.

Equity release mortgages, also known as reverse mortgages or top-up loans, are available to Australian homeowners who meet the criteria of their lenders.

You are missing out if you haven’t yet subscribed to our YouTube channel.

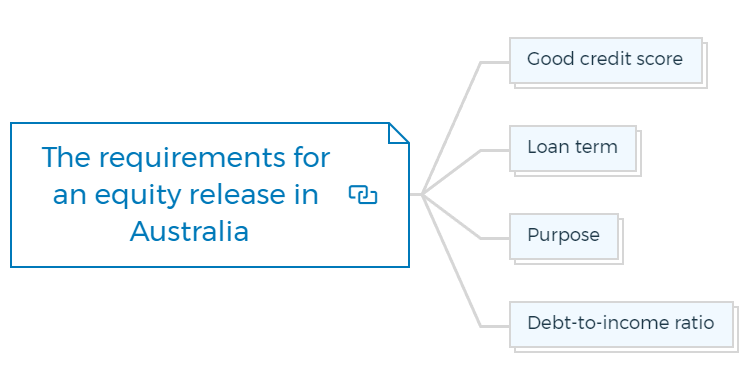

What are the requirements for an equity release in Australia?

Before approaching lenders for refinancing, check out if you qualify for equity release -

Bad credit prevents equity release, including defaults, judgements, and missed payments. Most lenders prefer a credit score of at least 650.

You have a home loan for the long term, and it must be 6 months old.

A reverse mortgage lender may grant a loan after considering the borrower’s purpose for doing so. The purpose could be buying an investment property, paying off debt, or investing in shares.

Divide your total debt by your gross income to calculate DTI. Most lenders require a six-or-less DTI ratio.

How does equity release work in Australia?

When you take out an equity release mortgage, your lender will use the value of your home as security. The money you borrow is then paid directly to you, and no regular repayments are required.

Instead, the loan amount plus interest is repaid when you either sell or refinance your property or pass away. This means that borrowers are not required to make any monthly payments, as the loan is repaid when the mortgage term ends.

Example of equity release calculation -

You have property values at $700,000 with home loan debts of $250,000; your equity is $450,000.

While calculating your equity release, you need to consider only 80% of your property’s value.

80% of your home value = $700,000 x 80% = $560,000

Minus current outstanding debt = $560,000 - $250,000 = $310,000.

This means you can get an equity release of $310,000.

Is equity release good?

Whether equity release is good for you depends on your situation. You should opt for it if -

- In retirement, you will need help to get by on your current savings and other income sources.

- You’re not willing to (or capable of) making a significant reduction in your current living situation.

- An independent financial advisor advises you on this option.

Like any financial product, equity release isn’t for everyone. But for some people, getting access to the money locked up in a property can make a big difference, whether they want to fix up their home, give money to family, or pay off debt.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How much equity can I release from my home?

The equity you can access and use from your home is known as usable equity. Most lenders let people borrow up to 80% of the market value of their property.

How much extra you can put on your mortgage depends on how much equity you have in your home, your Loan-To-Value Ratio (LVR), and your financial situation.

Controlled equity release Vs uncontrolled equity release

Controlled equity release allows you to borrow a certain amount of money and set the loan term, while uncontrolled equity release gives you access to more money than you can repay within the loan’s term.

This type of equity release product is only available to those who are aged over 55 and have significant equity in their home.

Pros and Cons of equity release in Australia

Equity release can be a great way to access cash and provide financial security in retirement. However, it is essential to consider the risks associated with equity release before committing to one of these products.

One of the most significant drawbacks of equity-release mortgages is that they typically attract high-interest rates and upfront fees, making them expensive over the long term.

Additionally, equity-release mortgages can reduce the value of your estate and leave you with less to pass on to family members or loved ones.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber