Continued from…

How to be real estate investor? [Part 1-2]

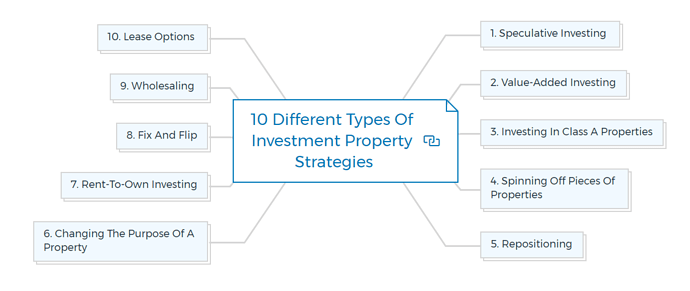

10 Property investment strategies

Below are the 10 best property investment strategies followed by successful investors.

1. Speculative investing

Over the last decade, many real estate speculators have made a lot of money. Many bad agreements were bailed out by inflation during periods of high inflation and increasing competition for real estate.

Despite their bad judgement, many property investors became wealthy due to this.

Speculators in the real estate market today and in the near future will need to have:

- A lower expectation of making a quick and huge profit.

- A forecast of what will happen in a specific market

- Participation to make the investment worthwhile.

Real estate speculation can take the following forms:

- Buying vacant land in the hopes that its value will rise quickly.

- Buying an older home that can be demolished and replaced with a larger, more expensive home.

You are missing out if you haven’t yet subscribed to our YouTube channel.

2. Value-added investing

Professional investors and real estate developers commonly use this strategy. It involves purchasing an underperforming or distressed property, adding value through renovations or other means, then selling it at a profit.

A “bottom fisher” is a term for this type of investor.

3. Investing in class a properties

Class A core properties are high-quality, well-located assets that generate stable and predictable revenue.

They are typically newer buildings in good condition with strong tenant profiles. Core properties tend to be lower risk and offer moderate returns, making them attractive for conservative investors.

They believe that the best properties will always attract the greatest rental rates and consequently the highest valuations. These buyers are frequently long-term owners.

4. Spinning off pieces of properties

Many investors buy properties to sell pieces to other investors or users. Some properties have additional unoccupied land or buildings.

You might use the revenues from the sale of unused parts to pay down the mortgage or put it in the investor’s pocket.

5. Repositioning

This strategy is used when an investor buys a property that is not being utilised to its fullest potential and then changes to increase its value.

The goal is to improve the property’s returns and sell it at a higher price.

A common example of this is converting an office building into a residential property.

6. Changing the purpose of a property

If the property lends itself to a different use, the investor may be able to unlock new value by converting it to higher and better use.

- Apartments to condos.

- Retail properties to offices.

- Condominiums that don’t sell to apartments

- Industrial loft space to apartments

7. Rent-to-own investing

The investor agrees to rent the property to a tenant for a set period, usually one to three years.

At the end of the lease, the tenant has the option to purchase the rental property. The investor typically requires a non-refundable deposit and sets the sales price at market value or above.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

8. Fix and flip

The fix and flip strategy is one of the most popular real estate investing strategies. The goal of the fix and flip strategy is to buy a property, make necessary repairs or renovations, and then sell it for a profit.

The key to success with this strategy is to purchase the property at a significant discount below market value and complete the renovations as quickly and cheaply as possible.

This can be a high-risk strategy, as there is no guarantee that the property will sell for a profit after the repairs are made. However, if done correctly, investors can make a significant profit in a short period.

9. Wholesaling

The goal of wholesaling is to buy a property at a discount and then sell it to another investor for a higher price.

The key to success with this strategy is to find properties sold by motivated sellers who are willing to sell at a discount. Wholesaling can be a great way to get started in real estate investing without putting up a lot of money.

10. Lease options

A lease option is an agreement between the investor and the seller of a property in which the investor agrees to lease the property for a set period, usually one to three years. At the end of the lease, the investor has the option to purchase the property.

Find motivated sellers willing to give the investor an option to purchase the property below-market price.

There are many other real estate investing strategies that you can use to generate profits; which one is right for you will depend on your goals, risk tolerance, and financial situation.

If you’re looking for a low-risk investment with a potential for high returns, buy and hold investing may be the right strategy for you. If you’re looking for a more hands-on approach with the potential for higher profits, fix and flip or wholesaling may be the right strategies for you.

How to diversify your real estate investment portfolio?

Dealing in the real estate market can be a great way to make money.

However, it’s important to diversify your existing portfolio to mitigate risk.

Here are some ways to diversify property investment portfolio:

- Direct ownership of property

- Indirect ownership through a REIT

- Debt investments secured by mortgages or deeds of trust on income-producing properties

- Equity participation in large development projects

- Precious metals such as gold or silver

- Commodities such as oil, gas, or timber

- Foreign property investments

- Tax liens and tax deed sales

Diversify your real estate portfolio by geography and property type. To avoid competition, look for houses in underserved markets. For example, duplexes in college towns or small retail areas with credit tenants.

Where should real estate investors invest?

If you’re a first-time investor, you might wonder where you should invest in real estate. It would be best to look for opportunities as near home as possible. This will allow you to better understand the real estate market and view the home more frequently.

You may decide to diversify your investments to other sectors where profitable opportunities exist as you become more sophisticated and capable of completing daily management chores. You can take help from a property manager.

Learn More

Bottom line - The secret to success as an investor

Long-term real estate success requires homework. That includes knowing the basics of real estate, the history of previous market cycles, and the local players.

Many real estate investors fail due to rash investment decisions and a lack of overall market study. Poor decisions can lead to overpaying for a property, over-leveraging it, generating inaccurate cash flow estimates, and less capital growth to stay with the venture during the bad times.

Finally, research the deal thoroughly and base your conclusions on sound business standards. Understand that there is no quick way to wealth through real estate. After weighing the benefits and downsides of each contract, make your decisions with caution and patience.

Long-term real estate success requires homework. That includes knowing the basics of real estate, the history of previous market cycles, and the local players.

FAQs

How do you start real estate investments from scratch?

You need to take a few basic steps to start real estate investing from scratch.

- First, you need to establish your financial goals and objectives. It will help you determine how much money you need to invest and what return on investment you’re looking for.

- Once you know your financial goals, it’s time to start researching different investment options.

- You’ll want to consider traditional and nontraditional real estate investments. It includes single-family homes, multifamily properties, commercial real estate, and even vacation rental properties.

- Once you’ve decided on the type of property you’d like to invest in, it’s time to start looking for potential deals.

What skills do you need to be an investor?

There are a few key skills you’ll need to be an investor. First, you need to understand financial statements and how businesses operate. Next, you’ll need to be able to think critically and make informed investment decisions. Finally, you’ll need to have a strong network of contacts in the business world. If you can hone these skills, you’ll be well to become a successful investor.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber