Real estate forecasting methods

There is no real estate without forecasting. Even if you are buying a property to live in, you are still making a forecast about the future – how long you will live there, what the market will be like when it comes time to sell, etc.

There are three popular forecasting methods that you can use to make more accurate predictions for your real estate investment purposes. These include time series analysis, subjective forecasts, and analysis of associated variables.

Because predicting is challenging, employing more than one method for each property investment analysis is desirable. You can use real estate forecasting techniques from all three approaches.

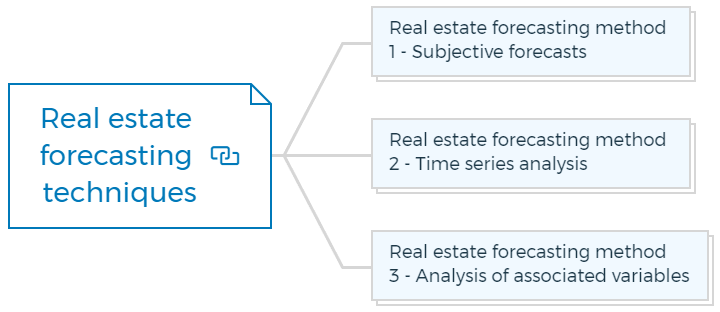

Real estate forecasting techniques

Real estate forecasting method 1 - Subjective forecasts

Subjective projections are appropriate when relevant data is lacking or historical trends are unlikely to persist. These utilize the applicable experience and market knowledge to evaluate changes subjectively.

This method is often used by real estate professionals such as brokers, appraisers, and consultants. It involves making a forecast based on your knowledge and experience of the market.

Forecasts using judgement may acknowledge current patterns but only formally incorporate historical data.

For instance, if an oversupply is impending, but office rents in one area have increased at an annual compound rate of 8%, an expert might forecast rent growth will be only 2% per year for the following three years.

The percentage chosen can seem random, but it may unintentionally depend on prior trends and patterns that the expert is aware of. Forecasts based on judgement can move forward using a historical analogy.

For instance, one might have investigated the effects of prior crashes on housing prices shortly following a stock market collapse. Markets for real estate have frequently responded favourably as investors flee declining stock markets.

This became especially noticeable during the 1987 stock market meltdown. Without a good knowledge of the relationships, this oversimplified use of the past can be untrustworthy.

Several variables influence the relationship between share prices and home prices. Depending on which variables are most important at any moment, share price decreases have preceded both real estate booms and busts. A group of professionals can reach a consensus forecast to avoid any potential bias from one opinion.

The Australian Property Institute conducts and publishes six-monthly surveys of valuers’, fund managers’, analysts’, and financiers’ perceptions of the Australian real estate markets.

Evidence suggests that analysts’ typical expectations in Australia have been off, nevertheless. Experts in the USA conducted similar forecasts research, which revealed inaccuracy and a propensity to tie estimates to the success of the previous two years.

The main benefit of depending solely on judgement is negated if the process of integrating opinions becomes strict, as in the case of the so-called Delphi method or needs responses to questionnaires.

It can be a helpful real estate forecasting method if you understand the factors that affect property values in your area. However, it is essential to remember that subjective forecasts are just one person’s opinion and may not always be accurate.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Real estate forecasting method 2 - Time series analysis

The second strategy involves studying a time series of the variable that needs to be forecasted without attempting to relate one variable to others across time.

Time series analysis is a statistical technique that you can use to predict future events based on past data. This method uses historical trends and patterns to identify relationships between different variables.

Time series analysis can be used to predict things like future property prices, rental rates, and construction costs.

This real estate forecasting method does not directly attempt to explain why the pattern should exist; instead, it searches for a pattern over time that is presumed to be reproduced or continuing in the future.

The most straightforward technique to forecast a time series is to graph the variable, such as average rents or prices, vacancy levels, or absorption rates, and extend the line or curve to the forecast date by eye-picking a straight line across the data.

As an alternative, you can use linear regression to find the straight line of best fit. Examining long-term trends in time series is frequently done using linear regression with time as the independent variable.

Suppose the data does not closely resemble a straight line. In that case, it is possible to eliminate unpredictable changes by plotting a moving average or converting the data into a straight line by taking the logarithm of exponent.

Other statistical methods might be more appropriate if the data series cannot reasonably be made to follow a straight line roughly. Short-term forecasts are made using exponential smoothing, which uses a weighted average of historical data.

Although you may choose the average weighting of recent and historical values to suit historical trends, the weighting is frequently arbitrary. You can also use the autoregressive moving averages or the more complex Box-Jenkins method to make short-term projections.

Most cash flow projections demand to model long-term trends and cyclical effects.

For instance, regressions seldom show R-squared values of more than 0.8 (which suggests that the straight line explains 80% of the fluctuations over time), demonstrating that the rent changes are never entirely explained as constant linear growth.

Construction and economic cycles significantly impact these time series of property data. Some property data, like monthly retail turnover or quarterly dwelling commencements, might also be impacted by seasonal fluctuations.

Time series decomposition can be helpful to distinguish the long-term trend from the seasonal and cyclical changes when there is historical data covering three or more cycles of constant length or when the seasonal influences are significant.

Univariate time series analysis extrapolates observed trends over time into the future rather than attempting to explain the changes. Time series approaches are not particularly well adapted to identifying the “turning points” in historical data, which is how profitable investments are frequently made.

They are also particularly susceptible to variations in cycle length and intensity since they disregarded market cues that previous patterns were no longer valid.

Real estate forecasting method 3 - Analysis of associated variables

Forecasting cash flow variables from other related variables is the third strategy. It is far more potent than univariate time series analysis. Still, it necessitates solid correlations between the variables and one or more explanatory or “independent” variables that are straightforward to anticipate or regularly lead to a “dependent” cash flow variable.

This real estate forecasting method looks at the relationships between different variables to make predictions. For example, you would look at factors like population growth, employment rates, interest rates, and inflation to predict property market performance.

By analysing these associated variables, you can get a better understanding of how they might affect property prices in the future.

The procedure entails modeling the relationships between the variables, testing those relationships mathematically in the past, and using a mathematical model to forecast the values of the cash flow variable based on the independent variable (s).

In recent years, this procedure has undergone extensive testing by academics and practitioners who have used various econometric models and frequent software programmes.

Vacancy rates and rental growth have a strong relationship in most submarkets, with rental growth being higher when vacancies are lower.

The relationship between vacancy and rental growth can then be defined and tested using historical data, indicating the mathematical relationship between the variables that best fit the data and the coefficients for the variables in regression or other models.

Finally, if the explanatory variable(s) can be reliably projected, you can use the mathematical relationship to predict the future.

Use regression methods such as primary and multiple to assess linear relationships between two or more variables.

A linear relationship is one that, perhaps after altering one or both of the series, exhibits consistent changes over the entire data range.

For instance, a linear change would occur if rental growth rose by the same proportion for every 1% drop in vacancies. The underlying relationship between two property variables is rarely linear, and many of the earlier regression applications resulted in “cruder (and frequently deceptive)” models and predictions.

Regression and more advanced econometric models can be practical forecasting tools if there are trustworthy leading indicators for any cash flow component.

Commercial rents for the following year can be anticipated given known earnings; for instance, if an increase in retail rents over the following year depends heavily on retail profits this year.

There are numerous leading economic indicators of the performance of commercial properties. Still, the time it takes for the indicator to reflect a change in the property’s performance can differ significantly.

Analysts should avoid using “spurious regressions” between time series of variables. Many time series data are rising in trend and may exhibit positive autocorrelation, such as rental indexes.

Simply put, if two similar time series are regressed, they can appear connected since both are rising. The percentage changes throughout each period are typically preferred as the associated variables, although these can be autocorrelated.

The time series should be tested for “stationarity” before being associated with other time series. The time series should be changed to become stationary by taking its first or subsequent differences, “deflating” to real values, or switching to logs.

Multiple regression analysis has been a well-liked technique for explaining and predicting property variables since, in reality, no one indicator is adequate to describe historical patterns in property performance.

Numerous regression analyses allow multiple factors to be used simultaneously to predict a dependent variable, but the findings must be carefully considered throughout time.

Sometimes the historical data used to calibrate the model does not go deep enough into the past to get accurate coefficients. The market conditions were frequently so different in the early eras, even when there were extended time series, that the early data did not help forecast the future.

“Multi-collinearity” refers to a condition where the independent variables are related. In contrast, “heteroscedasticity” refers to a condition where the independent variables have unequal variance in different areas of the sample of data records.

When a time series is divided into two or more previous eras, the variables frequently have different effects in each of those periods.

A variable group is simultaneously associated with their lagged values in VAR (vector autoregressive) models. These models require a lot of data because the vector for a given time is made up of the values of each variable across that period.

The data can be evaluated for cointegration if it is thought that two or more time series are connected over the long term but may behave independently in the short term.

Examples include long-term links between the returns from real estate and several financial assets, links between markets in different countries, and long-term links between the returns from real estate and several financial assets.

However, tests of cointegration between property returns and inflation have found little to no short-term protection against inflation.

Since real estate securities trade often, cointegration tests have been utilised in many of these research to examine traits like speculative bubbles. The results of cointegration tests are still not frequently utilised to forecast real estate markets because they require a lot of data.

More complex econometric models make an effort to analyse the factors affecting submarkets, frequently using several concurrent equations. These models appear more trustworthy when tested with historical data than time series analysis. Still, they are time-consuming and frequently inaccurate when used to predict cash flows.

When business conditions are uncertain or it is challenging to gather data indicative of the asset being evaluated, econometric models are unlikely to be any more trustworthy than basic procedures.

Problems with data, identifying the submarket’s boundaries, and the results of overlapping submarkets will continue to be a concern because most cash flow predictions require some projection at the local or suburban level.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How to evaluate the accuracy of real estate forecasts

Property analysts should give logical estimates for cash flow analyses. Forecasts need to depend on historical data, patterns, and trends and be described in detail.

Instead of just extrapolating previous data into the future, the estimates should reflect how real estate markets function.

The techniques used to create cash flow estimates can pass three tests.

- First, is the method or model that underlies the forecast reliable?

It is challenging to defend relying on projections at odds with our knowledge of how real estate markets function, how previous cycles have developed, or how the variables are related.

Learn More

- Second, how precise, consistent, and steady are the historical data points used to anticipate the cash flows?

In Australia, the accuracy of historical property records has frequently been a big challenge. The standard deviation of the sample, confidence intervals for the predictions, and t-tests for the significance of variables can all be used to quantify uniformity, which facilitates prediction.

The predictability of a market is also impacted by its stability and capacity to tolerate external shocks.

- Third, will the method or model likely be used in the future?

There will always be questions about whether the economic factors will continue to have the same impact in the future with any forecasting model. When applied to historical data, some models have been demonstrated to offer an “excellent fit,” but when used to predict property variables “outside the sample,” they utterly fall short.

The only method to determine which forecasting models are the most accurate is to test them and track how closely the results match the predictions.

The following are three explanations of how effectively the forecasting technique, model, and equations function. You can use them to test how well a model would have predicted future events and previous data to determine how well it would have fit the data in the past.

These reliability metrics do not address the uniqueness of many real estate investments, concerns regarding erroneous data, and potential future market changes.

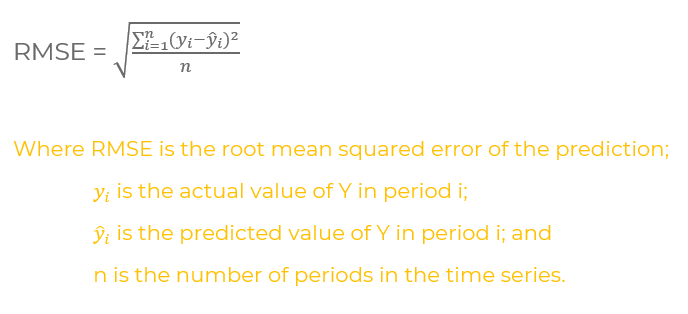

Reliability measures evaluate the accuracy of the forecasts and any bias in the forecasts. The root mean squared error is the initial indicator of the discrepancy between actual and anticipated data.

It emphasizes the severe deviations between actual and anticipated values, typically the ones that raise the most significant concern and conceals any bias due to the squaring of the discrepancies.

Root mean square error

The R-squared values and the standard error of estimate for regression analysis are two examples of the many statistical methods that have their metrics for gauging the robustness of their equations.

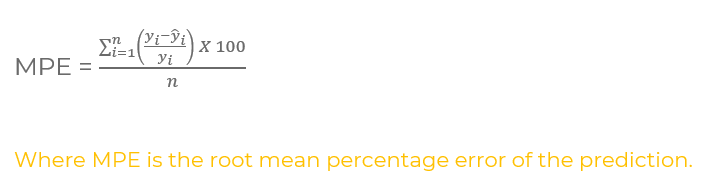

The second metric is the Mean Percentage Error, which measures any technique’s bias and shows if forecasts tend to overstate or understate actual values.

Mean percentage error

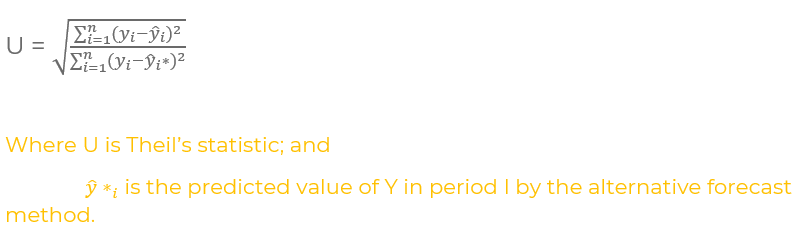

The third metric makes it possible to compare forecasts’ precision using different techniques. When the actual change is known, Theil’s U-statistic is calculated to determine which of the two strategies produced lower discrepancies between the actual and predicted changes.

Theil’s statistic

If Theil’s U is more significant than one, the alternative method has produced more accurate predictions than the original method.

An alternative approach would involve making a “naive forecast” and expecting no change.

Although some short term forecast models for Australian listed property trusts did outperform naive forecasts, it is fairly uncommon for studies of forecasting methods to find that such forecasts are more accurate than statistical approaches and consensus projections.

Bottom line

Regardless of your forecasting method, it is important to remember that real estate is a long-term investment. To be successful, you need to have a clear understanding of your goals and objectives.

With this knowledge, you can make more informed decisions about which properties to buy and when to sell them. By using forecasting methods, you can give yourself a better chance of making profitable real estate investments.

FAQs

Which forecasting method do real estate dealers use?

The most appropriate forecasting method for real estate dealers is the use of trend analysis. Trend analysis is a business strategy that uses historical data to predict future trends. This information can be used to make informed decisions about pricing, inventory, and other strategic decisions.

Why is multiple linear regression used in housing price index forecasting?

Multiple linear regression is often used in housing price index forecasting because it can help to identify trends in the market and forecast future prices.

The technique can be used to develop a variety of different models, which can be tailored to the specific needs of the business. >

For example, a multiple linear regression model could be used to predict how prices will change over time, what factors will influence demand, or what impact new developments will have on prices.By using multiple linear regression, businesses can get a better understanding of the market and make more informed decisions about their pricing strategy.

What is construction demand modeling?

Construction demand modeling is a business strategy that helps companies forecast future demand for construction projects. This forecasting method is based on past patterns of construction activity, economic indicators, and other factors.

By identifying future construction demand, companies can make informed decisions about real estate investment, staffing, and other operational issues.

There are several different approaches to construction demand modeling, but the most common methods are trend analysis and regression analysis. Trend analysis looks at past data to identify patterns of growth or decline in the construction industry.

Regression analysis uses mathematical formulas to predict future trends based on economic indicators.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber