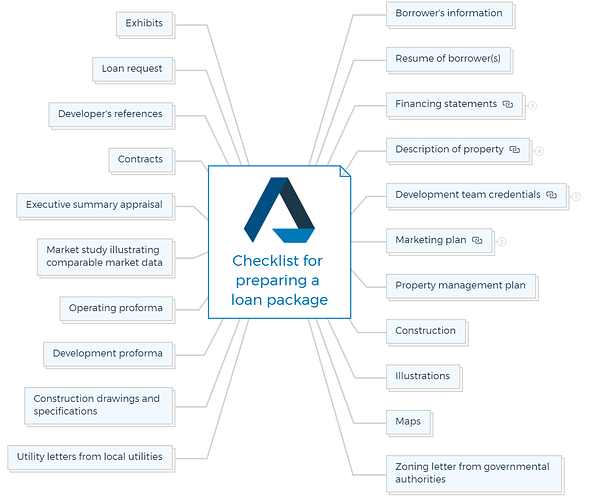

1. Borrower’s information

- Name, address, telephone number, social security number: Provide accurate personal information for identification and communication purposes.

2. Resume of borrower(s)

- Professional background: Submit detailed resumes for all borrowers involved in the loan request. Highlight education, work history, skills, and relevant experience to demonstrate your qualifications.

You are missing out if you haven’t yet subscribed to our YouTube channel.

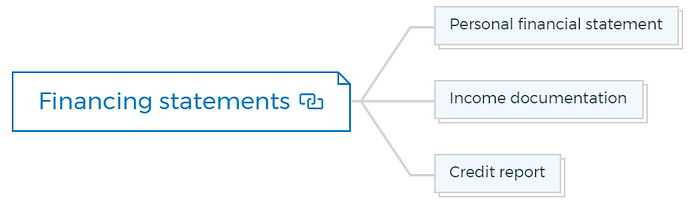

3. Financing statements:

3.1. Personal financial statement

Detail your personal assets, liabilities, and net worth. This helps lenders understand your financial stability and capacity to handle the loan.

3.2. Income documentation

Include pay stubs, tax returns, and other income evidence. This verifies your income and repayment ability.

3.3. Credit report

Obtain and include your credit report to showcase your creditworthiness.

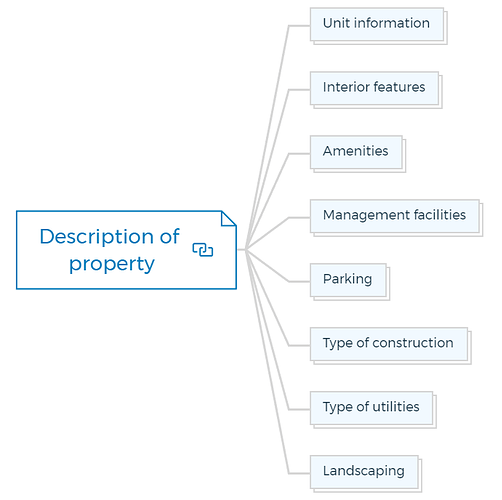

4. Description of property

4.1. Unit information

If applicable, provide details about individual units in the property (e.g., number of bedrooms, bathrooms, square footage).

4.2. Interior features

Describe interior features of the property, such as flooring, appliances, and finishes.

4.3. Amenities

List any amenities available to residents, such as swimming pools, fitness centers, or community spaces.

4.4. Management facilities

Detail facilities for property management, such as leasing offices or maintenance areas.

4.5. Parking

Describe parking arrangements, including availability of spaces and type (covered, open, etc.).

4.6. Type of construction

Specify the construction type (wood, concrete, steel, etc.).

Learn More

4.7. Type of utilities

Outline utilities available (electricity, water, gas, etc.).

4.8. Landscaping

Provide information about landscaping and outdoor areas.

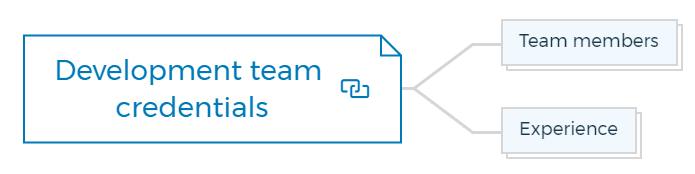

5. Development team credentials:

5.1. Team members

List key development team members, including architects, contractors, and designers.

5.2. Experience

Highlight team members’ relevant experience and past successful projects.

6. Marketing plan

6.1. Target audience

Define the target market for the property (e.g., renters, buyers).

6.2. Marketing strategies

Explain how you plan to market the property to attract tenants or buyers.

7. Property management plan

Describe how the property will be managed, including leasing, maintenance, and tenant relations.

8. Construction

Provide an estimated timeline for construction phases.

9. Illustrations

Include visual renderings of the property’s exterior and key interior spaces.

10. Maps

Provide a map showing the property’s location in relation to nearby landmarks.

11. Zoning letter from governmental authorities

Obtain a letter confirming that the property complies with local zoning regulations.

12. Utility letters from local utilities

Obtain letters confirming the availability of necessary utilities.

13. Construction drawings and specifications

Include architectural and engineering drawings detailing the property’s design.

14. Development proforma

Present a detailed financial forecast for the development project.

15. Operating proforma

Provide projections for property income and expenses after completion.

16. Market study illustrating comparable market data

Include data on comparable properties in the area to support your market projections.

17. Executive summary appraisal

Summarize an appraisal report estimating the property’s value.

18. Contracts

Include contracts with contractors, architects, and other relevant parties.

19. Developer’s references

Provide references from previous lenders, partners, or clients.

20. Loan request

Clearly state the amount of loan you are seeking.

21. Exhibits

Include any additional documents that support the information in your loan package.