How the rule of 72 can help in real estate investing

Real estate investment can develop wealth over time. However, investing concepts like the Rule of 72s must be understood.

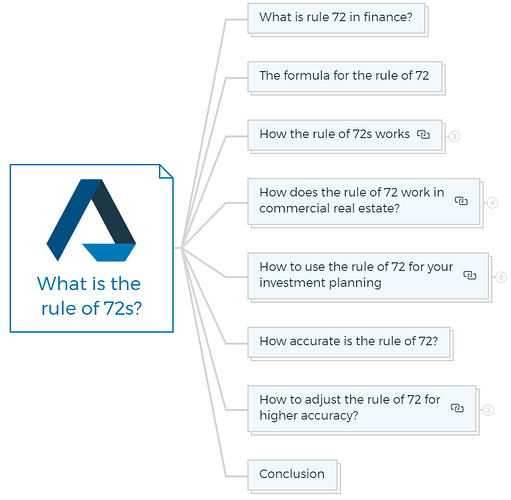

What is rule 72 in finance?

The Rule of 72 is a very helpful tool that can quickly estimate how long it will take to double your money. It calculates how long an investment will double in value at a specific interest rate.

The formula for the rule of 72

Number of years to double your money = 72 / interest rate

72 divided by the annual return gives you the approximate number of years it will take to double

For example, doubling your money with a 6% investment would take 12 years (72 / 6 = 12). If you invest 8% annually, it will take 9 years to double your money (72 / 8 = 9).

Learn More

How the rule of 72s works

The Rule of 72s can be a valuable tool for real estate investors. They need to understand the potential for appreciation and the effects of compounding.

Examples of rule of 72s calculation

1. Rental property investment

An investor invests $200,000 in rental property, which increases by 5% per year. Using the Rule of 72s, the investment property would double in value to $400,000 in 14.4 years.

72 / 5 = 14.4.

2. Investing in REIT

Similarly, assume you invested in a Real estate investment trust (REIT) that provides an annual return of 8%.

The Rule of 72s estimates that it would take 9 years (72 / 8 = 9) for a real estate investment trust (REIT) to double in value.

You are missing out if you haven’t yet subscribed to our YouTube channel.

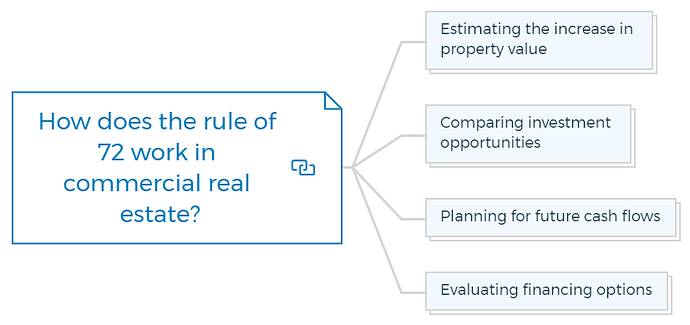

How does the rule of 72 work in commercial real estate?

Commercial real estate applications of the Rule of 72 include:

Estimating the increase in property value

Commercial real estate uses the Rule of 72 to estimate the growth in property value.

Comparing investment opportunities

Applying the Rule of 72 to investing possibilities helps you predict which opportunities may provide better returns in the long term.

Planning for future cash flows

The Rule of 72 can anticipate commercial real estate investment cash flows.

If a property is expected to provide a 10% yearly return, it would take 7.2 years (72/10=7.2) to double in value, and the investor can plan for future cash flows accordingly.

Evaluating financing options

Real estate investors can analyse their financing options using this rule. For example, if a loan had a 4% interest rate, the amount owed would double in 18 years (72/4=18).

The investor can use this information to analyse different financing options and their impact on investment returns.

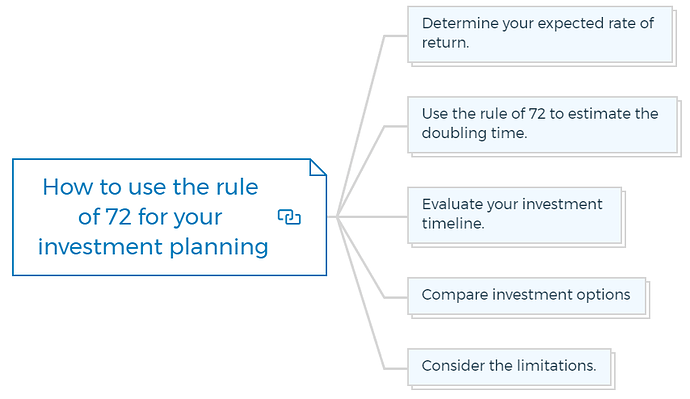

How to use the rule of 72 for your investment planning

Investment planning is easy using the Rule of 72. Here are the steps to use in your property investment planning -

Determine your expected rate of return.

This could be based on an investment’s past success or your prediction. For example, the Rule of 72 helps forecast how long your investment will double if you expect a 6% return.

Use the rule of 72 to estimate the doubling time.

Using the Rule of 72 formula, you can calculate your projected rate of return.

Divide 72 by your expected rate of return. Continuing to the above example

72/6 = 12.

The doubling time would be 12 years.

Evaluate your investment timeline.

Understand your investment’s doubling time to assess its timeline. For example, use the Rule of 72 to forecast how long your retirement investments will take to double and plan retirement goals accordingly.

Compare investment options

Compare investing possibilities using this investing concept. For instance, you can use the Rule of 72 to estimate the doubling time of two investment options with differing rates of return and choose the one that fits your investment timeline and goals.

Consider the limitations.

Remember that the Rule of 72 is simplified and has restrictions. It presupposes a set rate of return, which may not be realistic. It also ignores inflation and taxes.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How accurate is the rule of 72?

Based on a given rate of return, the Rule of 72 gives a rough estimate of how long an investment will double in value. It is useful for rapid estimates and comparisons but not necessarily accurate.

The Rule of 72 presupposes a fixed rate of return. In reality, property investment returns vary year-to-year. The Rule of 72 also ignores taxes, inflation, and fees.

Despite its limitations, the Rule of 72 is useful for rapid calculations and comparisons. However, the Rule of 72 may not accurately predict an investment’s growth, so it’s best to do more research before investing.

Based on a set rate of return, the Rule of 72 estimates how long an investment will double. Here are some ways to use this Rule -

- Estimate investment growth over time.

- Compare different investment options

- Determine the impact of fees and expenses

- Plan for long-term financial goals

How to adjust the rule of 72 for higher accuracy?

The Rule of 72 can forecast how long an investment will take to double in value, but it is not always correct. To improve its accuracy, you can make the below adjustments:

Use the rule of 70

For higher-return investments, the Rule of 70 is more accurate than the Rule of 72. Instead of 72, divide 70 by the annual return to utilise the Rule of 70. This can better estimate how long an investment will double in value.

Adjust for compounding interest rate

The Rule of 72 assumes simple interest, or interest generated simply on the initial invested money. Many investments earn compound interest on both the initial investment and the interest earned over time.

Use a modified Rule of 72 that accounts for compounding frequency. For monthly compounding, divide 72 by the annual interest rate divided by 12 (72/12=6).

Learn More

Other considerations

Fees, taxes, and inflation do not affect investment growth under the Rule of 72. Consider these considerations while estimating real estate investment growth. Advanced financial planning tools or financial advisors can do this.

Conclusion

In conclusion, the Rule of 72 is a useful tool for real estate investors to estimate how long it will take for their investment to double in value. It calculates the exact doubling time for an investment by dividing 72 by the fixed annual interest rate.

Although it has some limitations and does not consider inflation and taxes, the Rule of 72 can still be a helpful way to compare investment options and estimate investment growth over time.

However, to achieve higher accuracy, investors can use the Rule of 70 for higher-return investments or a modified Rule of 72 that accounts for compounding interest rates.