Continued from…

What is Cap Rate? [Part 1-2]

How is the cap rate used to value real property?

Suppose you are considering the purchase of an apartment building. You have determined that the current net operating income (NOI) is $100,000 per year. You also know that similar buildings in the area have recently sold for an average price of $500,000.

What is the capitalisation rate for this property?

To calculate the capitalisation rate, we will use the following cap rate formula:

Cap Rate = Net Operating Income / Purchase Price (or Market Value)

In this case, the capitalisation rate would be:

IMPORTANT

$100,000 / $500,000 = 0.20, or 20 percent.

Now let’s say that you are looking at another property with an NOI of $50,000. However, this property is selling for $200,000.

What is the capitalisation rate for this second property?

IMPORTANT

$50,000 / $200,000 = 0.25, or 25 percent.

As you can see from these two examples, the capitalisation rate can vary quite a bit from one property to another.

In general, properties with higher cap rates are considered better deals because they offer more potential return on investment.

What impacts a cap rate?

A cap rate is impacted by a variety of factors, including:

- The current state of the real estate market

The capitalisation rate is also impacted by the state of the real estate market. Cap rates will be lower when the market is good, and there is high demand for properties. It is because investors are willing to pay more for a property when they know they will be able to sell it at a higher price in the future.

Conversely, cap rates will be higher when the market is slow, and there is less property demand. Investors are not as confident about their ability to sell a property for a profit in the future, so they are willing to pay less for it upfront.

- The type of property

Different types of properties also have different average cap rates. For example, properties that are considered a higher risk, such as undeveloped land or properties in need of major renovations, will generally have higher cap rates than properties considered lower risk, such as brand new buildings or well-maintained properties in desirable locations.

- The property’s income and expenses

Of course, the capitalisation rate is also directly impacted by the property’s income and expenses. A property with high income and low expenses will have a lower cap rate than a property with low income and high expenses.

Investors should always carefully consider all of these factors before deciding whether or not to invest in a particular property. By taking the time to do your research and understand the cap rate, you will be in a better position to make informed and profitable investment choices.

- Interest rates

When interest rates are low, the capitalisation rate will be lower. It is because investors can get a loan for the property at a lower interest rate, which means they will have to pay less interest over the life of the loan.

Conversely, the capitalisation rate will be higher when interest rates are high. It is because investors will have to pay a higher interest rate on their loan, which means they will have less money available to put towards the property’s purchase price.

- The overall economy

The state of the overall economy also has an impact on capitalisation rates. When the economy is doing well, property values tend to go up, which means that investors are willing to pay more for a property and lower the cap rate.

Conversely, when the economy is struggling, property values tend to go down, which means that investors are unwilling to pay as much for a property, and the cap rate will be higher.

- The property’s physical condition

The physical condition of the property is also a factor that can impact the capitalisation rate. If a property is in good condition, it will generally have a lower cap rate than a property in poor condition.

Real estate investors are willing to pay more for a property they know will not need as much money to spend on repairs and renovations.

- The location of the property

Another factor that can impact the capitalisation rate is the property’s location. Properties in desirable locations, such as near good schools or in a safe neighbourhood, will generally have lower cap rates than properties in less desirable locations.

Property investors are willing to pay more for a property that is in a good location because they know that it will be easier to sell in the future.

- The current owner of the property

Finally, the property’s current owner can also impact the capitalisation rate. If the current owner is motivated to sell, they may be willing to accept a lower price for the property, which will result in a higher capitalisation rate.

Conversely, if the current owner is not motivated to sell, they may be less willing to negotiate on price, which will result in a lower capitalisation rate.

Each of these factors can significantly impact the capitalisation rate of an investment property. As a result, it is important to be aware of them before deciding whether or not to purchase a particular property.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What type of commercial property has the highest cap rate in 2022?

The type of commercial property that has the highest cap rate is industrial property. There is a high demand for industrial property and a limited supply, which drives up prices and lowers cap rates.

Other types of commercial real estate, such as office space and retail space, also have high demand but not as high as industrial property. As a result, these types of commercial real estate have lower cap rates than industrial property.

To get the best return on your investment, you should purchase an industrial property in a desirable location. It will ensure that you get a high rental income and can sell the property for a profit in the future.

What is a good cap rate on rental property?

There is no one answer to this question as it will vary depending on several factors, such as the property’s location, condition, and income.

However, as a general rule of thumb, a good cap rate for rental property is usually around five to six per cent.

Key comparisons of cap rates

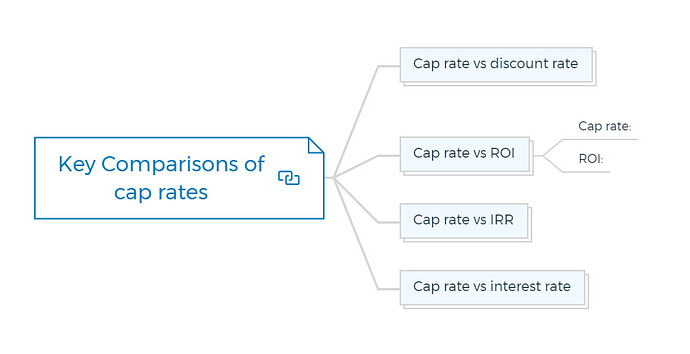

Cap rate vs discount rate

A capitalisation rate and a discount rate are two different ways of looking at the same thing – the rate of return that an investor expects to receive on an investment.

- The capitalisation rate is used when considering investments in real estate, while the discount rate is used when considering investments in stocks or bonds.

- The capitalisation rate is calculated by dividing the expected annual rent by the investment’s purchase price. The discount rate is calculated by dividing the expected annual cash flow by the investment’s purchase price.

- The capitalisation rate is a more conservative measure of return than the discount rate because it doesn’t consider the possibility of price appreciation. On the other hand, the discount rate takes into account both the income from rent and the potential for price appreciation.

- Investors typically use a higher discount rate when considering stocks or bonds because these investments are more volatile than real estate. For example, an investor might use a discount rate of 10% when considering a stock investment but only a 5% capitalisation rate when considering an investment in a piece of property.

Cap rate vs ROI

Cap rate is the percentage of return on investment, while ROI is the actual cash return on investment. Both are important to consider when making any real estate investment, but they often mean different things to different people.

Cap rate:

- The percentage of return on investment.

- You can calculate this number by dividing the net operating income by the purchase price.

- For example, if a property costs $1 million and generates $100,000 in net operating income, the cap rate would be 10%.

ROI:

- The actual cash return on investment.

- This number is calculated by subtracting the initial investment from the sale proceeds and then dividing that number by the initial investment.

- For example, if a property is sold for $1.2 million after being purchased for $1 million, the ROI would be 20%.

As you can see, cap rate and ROI are two different ways of looking at return on investment. Cap rate is a more general measure of profitability, while ROI considers the specific details of a particular transaction. Both are important to consider when making any real estate investment.

Cap rate vs IRR

- IRR, or internal rate of return, is a measure of the profitability of an investment. It considers both the initial investment and the subsequent cash flows from the property. It makes it a good metric for comparing different investments.

- On the other hand, the cap rate measures the return on investment. It only considers the cash flows from the property and does not consider the initial investment. It makes it a good metric for assessing how well an investment performs.

Cap rate vs interest rate

The cap rate is the return on investment (ROI) that an investor can expect to receive from a property, while the interest rate is the amount of money that must be paid to borrow money.

The two are not directly related, but they are connected.

- The interest rate will affect how much an investor can afford to pay for a property.

- The cap rate will affect how much rent an investor can charge.

- The higher the interest rate, the lower the amount that an investor can afford to pay for a property.

- The lower the cap rate, the lower the amount of rent that an investor can charge.

Final Words

In short, the cap rate is an important factor to consider when valuing a property. You can use it to measure an investment’s attractiveness and show how much return on investment property is expected to generate.

While several factors will impact a cap rate, it is generally accepted that properties with lower risk and steadier income streams will have a lower cap rate. Those with more risk and less predictable income streams will have a higher cap rate.

If you’re looking for expert advice on commercial real estate valuation or want help determining the right property development strategy, enroll for one of our structured property development courses and make your development project a success.

CAUTION

Test Your Understanding - Cap Rates Calculation in Real Estate.

You’re thinking about purchasing a specific property. The seller provides you with the following information:

- For the previous 12 months, gross operating income was $153,000.

- Gross operating income forecasted for the following 12 months: $160,000

- Expenses for the previous 12 months: $50,000

You look at the source documents (lease agreements, expense records, etc.) and determine that the owner’s claims are correct and reasonable.

In your area, the average cap rate for properties of this sort is 12.5 per cent. Answer the following questions using income capitalisation as your way of calculating value:

- The seller’s asking price is determined by the following factors: next year’s gross operating income (GOI), last year’s operating expenses, and a cap rate of 12%. He adds an additional 10% for the negotiation room. How much is the asking price for it?

- What cap rate would the property yield at the full asking price if you looked at it using this year’s GOI and operating expenses?

- What do you think a reasonable price for this property is?

- Why do you think the seller chose to utilise the GOI from the following year and a cap rate that is 0.5 per cent lower than the market rate?

Check the solution

- First, you need to calculate the NOI

IMPORTANT

Net operating income = Gross operating income - operating expenses

- Gross operating income = $160,000

- Operating expenses = $50,000

- Net operating income = $110,000

Using one of the transposed variations of the cap rate formula, the seller assigns a value to the property. Remember that he chose to utilise a 12 per cent rate:

Present value = net operating income /capitalisation rate

Present value = $110,000/0.12

Present value = 916,666

He adds a 10% negotiation margin to this figure:

916,666 x 1.10 = $1,008,332

So the asking price set by the seller is = $1,008,332

- Now you want to examine the property utilising the GOI and operating expenses from this year:

IMPORTANT

Net operating income = Gross operating income - operating expenses.

Gross Operating Income = 153,000

Operating Expenses = $50,000

Net Operating Income = $103,000

You must compute the cap rate using this NOI and the seller’s asking price to answer the question; you will need the capitalisation formula:

IMPORTANT

Capitalisation rate = Net Operating Income / Present Value

Capitalisation rate = 103000/108332

Capitalisation rate = 9.50%

- To use income capitalisation to estimate what you believe will be a fair price for the property, you must first decide on the cap rate and the NOI to employ.

It’s simple to choose a cap rate. You’ve already determined that other properties of this type in this vicinity are selling at 12.5 per cent. There’s no reason to use the 12.0% suggested by the merchant. Choose 12.5 per cent.

In this case, you’ve been given the GOI for the previous 12 months and the next 12 months. Which method do you use to determine the NOI?

If you’re a buyer, you’re probably thinking that the property’s future performance isn’t guaranteed and that you shouldn’t be paying for it as if it were.

Furthermore, that unclear future indicates a level of risk that you are shifting from the seller’s shoulders to your own. You have no intention of paying for the privilege of removing the risk from the seller’s hands.

As a result, you’ll be charged for what has happened, not what might happen.

To put it another way, you’ll use the GOI from the previous 12 months.

Gross Operating income = $153,000

Operating Expenses = $50,000

Net Operating income = $103,000

Now find the present value

IMPORTANT

Present value = Net Operating Income/Capitalisation Rate

Present value = 103000/0.125

Present value = $825,000

Because the GOI for the following year is higher, the vendor chose to use it. Because you’re capitalising the revenue to estimate the value, the bigger the income, the higher the value.

His logic is that you’re buying an income stream that starts when you buy the property, so the price should reflect that.

Notice how, while he remembered to say that revenue will increase next year, he forgot to say anything about operational expenses, assuming that they would stay the same.

The decision to use a lower cap rate also raises the value estimate. Given a fixed NOI, the lower the cap rate, the higher the value.

When you compare the seller’s suggested 110,000 NOI at his 12 percent to the market’s 12.5 percent, you’ll see the following:

Present value at 12% cap rate = 110000/0.12 = $916,666

Present value at 12.5% cap rate = 110000/0.125 = $880,000

Although a half-percentage-point difference in the cap rate may not appear to be significant, the seller is attempting to play the old salami game here.

One slice at a time, and he’ll have the whole salami in no time. The seller was able to come up with an estimate of worth, before negotiation room, of $916,666, $91,000 higher than yours, by considering next year’s GOI (only $7,000 more), previous year’s running expenses, and a cap rate 0.5 per cent below market—all seemingly minor items.

There is, without a doubt, no alternative for conducting your own mathematics.

FAQs

How do you calculate the property capitalisation rate?

There are a few different ways to calculate the property capitalisation rate, but the most common method is to divide the property’s current value by its expected rental income.

So, for example, if a property is valued at $1 million and its annual rental income is expected to be $100,000, its capitalisation rate would be 10%.

Of course, there are a lot of factors that can affect the capitalisation rate of a property, such as its location, condition, and market conditions. However, this is generally considered the most straightforward way to calculate it.

What cap rate I should look for?

The answer to this question depends on several factors, including your investment goals and risk tolerance. However, you should look for a cap rate of at least 10%. It will ensure that you’re getting a good return on your investment while minimizing your risk.

Of course, if you’re willing to take on more risk, you may get a higher return by investing in property with a lower cap rate. Ultimately, it’s up to you to decide what level of risk you’re comfortable with.