Understanding vacancy rates in real estate

Vacancy rate is one of the essential tools for analysing property investment. To avoid significant future losses, you must lay enough stress on this point.

What is the vacancy rate?

The vacancy rate is referred to as empty or vacant positions (without a tenant) available on the market. The number of vacant properties determines the vacancy rate concerning the number of rental properties in the suburb.

For example, if there are 200 rental properties in a suburb and four of them are vacant, then the rental vacancy rate is 2%. We will understand the calculation in the below example.

In real estate, vacancy rates reveal market circumstances, investment property performance, and investment opportunities. Understanding vacancy rates is essential for property owners and investors to maximise returns.

Vacancy rate definition

A market’s or portfolio’s vacancy rate is the percentage of unoccupied properties. As a percentage, they indicate real estate market supply and demand dynamics.

How is the vacancy rate helpful?

The vacancy rate helps draw a lot of valuable conclusions through comparisons.

For instance, the generally acceptable vacancy rate is 3%. If the vacancy rate is more than 4%, you need to think twice before opting into that location, whether it is a safe investment.

The lower the rate, the higher the demand for rental property or a lower supply, sometimes even both.

Moreover, it also predicts the graph of possible inflation in the market. i.e., if the percentile value is less than or equal to 1%, there is a greater chance for an increase in rental prices in that area in the near future.

Property developers and investors use vacancy rates for the following -

Market analysis

Real estate professionals and investors utilise vacancy rates to assess market conditions and find investment possibilities.

Low vacancy rates may imply a robust rental market and rental income growth.

Learn More

Property management

Owners and managers optimize property performance using vacancy rates. Property managers can reduce income loss by monitoring and managing excessive vacancy rates.

Risk management

Investors and lenders use vacancy rates to gauge property or portfolio risk. Consistent rental income makes lower vacancy rates safer investments.

You are missing out if you haven’t yet subscribed to our YouTube channel.

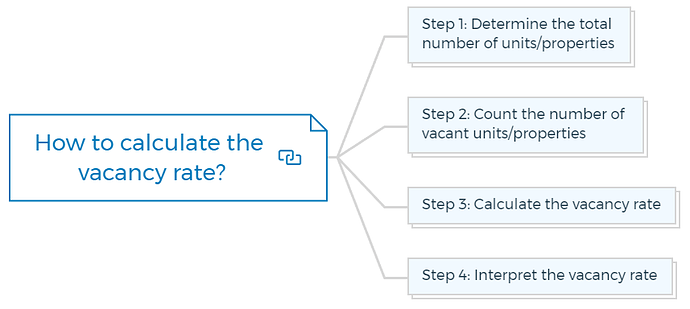

How to calculate the vacancy rate?

The vacancy rate is calculated by dividing the number of vacant units or properties by the total number of properties in an area or portfolio.

Step-by-step instructions for calculating the vacancy rate:

Step 1: Determine the total number of units/properties

Start by counting the units or properties in the area or portfolio you want to calculate the vacancy rate for. This could be a property, building, complex, market, or region.

Step 2: Count the number of vacant units/properties

Next, count the vacant properties in the same location. Vacant units are those that are unoccupied or available for rent. Exclude renovation or maintenance-vacant units.

Step 3: Calculate the vacancy rate

Divide the number of vacant units or properties (Step 2) by the total number of units or properties (Step 1) to calculate the vacancy rate. For a percentage, multiply by 100.

The formula for vacancy rate:

Vacancy Rate = (Number of Vacant Units / Total Number of Units) x 100

If 20 of 100 units are unoccupied, the vacancy rate calculation is:

Vacancy rate = (20/100) X 100 = 20%

The vacancy rate in this scenario would be 20%.

Step 4: Interpret the vacancy rate

Calculate the vacancy rate and interpret it in context. Vacancy rates below 5-7% suggest a tight rental market with high demand and low supply. Vacancy rates above 10% may indicate oversupply or reduced demand.

Learn More

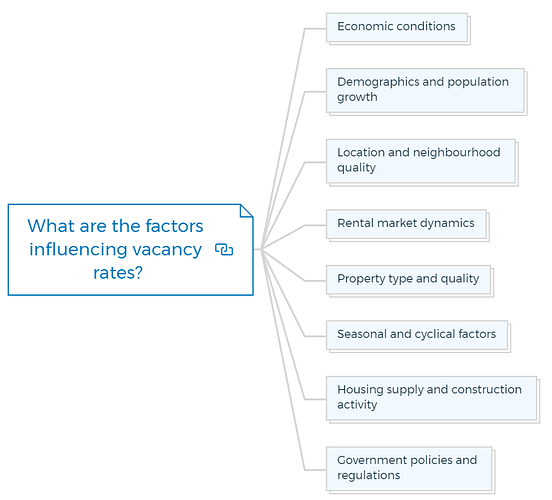

What are the factors influencing vacancy rates?

Several factors affect real estate vacancy rates. These aspects are essential for market analysis, trend prediction, and decision-making. Key vacancy rate factors include:

Economic conditions

Housing demand rises during economic expansion and low unemployment, lowering vacancy rates. Economic downturns can increase unemployment, affordability, and rental property vacancy rates.

Demographics and population growth

In places with limited housing availability, growing populations increase demand and lower vacancy rates.

Declining populations or demographic trends like ageing or migration might increase vacancy rates.

Location and neighbourhood quality

Desirable neighbourhoods with outstanding schools, amenities, transit, and low crime have lower vacancy rates.

However, vacancy rates may be greater in less desirable neighbourhoods with high crime, few facilities, or inadequate infrastructure.

Rental market dynamics

Competitive rental markets with appropriate rents and desired amenities have lower vacancy rates. Rent control, vacancy taxes, and laws can also affect vacancy rates.

Learn More

Property type and quality

Urban residential flats may have lower vacancy rates than specialist business assets in the suburbs.

Well-maintained properties with modern amenities and attractive features have lower vacancy rates because they appeal to tenants.

Seasonal and cyclical factors

Summer vacancy rates may climb in student-centric locations as students leave rental units. Similarly, in vacation destinations, vacancy rates can fluctuate based on peak and off-peak tourist seasons.

Housing supply and construction activity

Vacancy rates can be affected by the supply of available housing units and the level of construction activity.

Oversupply of properties relative to demand can lead to higher vacancy rates, while a shortage of housing supply can result in lower vacancy rates.

Government policies and regulations

Zoning, rent control, and affordable housing standards can affect vacancy rates. These policies can influence the development, availability, and affordability of housing units, ultimately affecting vacancy rates in specific areas.

Difference between vacancy rates and occupancy rates

Vacancy rate and occupancy rate are two distinct measures used in the real estate industry to assess the utilization and performance of properties. Here’s a breakdown of the key differences between these two metrics:

What is the vacancy rate?

Vacancy rate refers to the percentage of unoccupied units or properties within a specific market, property portfolio, or building during a given period.

It is calculated by dividing the number of vacant units by the total number of units and multiplying the result by 100 to express it as a percentage.

Vacancy rate provides insights into the supply and demand dynamics of the real estate market and indicates the availability of rental or sale properties.

A higher vacancy rate suggests a larger proportion of unoccupied units, which can impact rental income, property values, and market perceptions.

What is occupancy rate?

Occupancy rate measures the percentage of units or properties that are currently occupied within a given market, property portfolio, or building during a specific period.

It is calculated by dividing the number of occupied units by the total number of units and multiplying the result by 100 to express it as a percentage.

Occupancy rate indicates the level of utilization and demand for properties and is an essential metric for property owners, investors, and lenders.

A higher occupancy rate implies a larger proportion of units being rented or utilized, leading to stable rental income, increased property value, and a positive market perception.

Key differences

Focus

Vacancy rate focuses on unoccupied units, while occupancy rate focuses on occupied units.

Calculation

Vacancy rate is calculated by dividing the number of vacant units by the total number of units, while occupancy rate is calculated by dividing the number of occupied units by the total number of units.

Interpretation

Vacancy rate reflects the availability of rental or sale properties and indicates market conditions. Occupancy rate reflects the utilization and demand for properties and indicates their performance.

Impact

High vacancy rates are generally considered unfavorable as they can lead to decreased rental income, property values, and market perception. High occupancy rates are generally desirable as they signify strong demand, stable rental income, and positive property performance.

Both vacancy rate and occupancy rate are important metrics in real estate analysis. By considering both measures together, stakeholders can gain a comprehensive understanding of the market dynamics, property performance, and investment potential.

Test Your Knowledge

Real Estate Vacancy Rate: Practical Exercise

Objective:

This exercise aims to deepen your understanding of the concepts related to vacancy rates in real estate, how they are calculated, and their significance in evaluating real estate investments. By completing this assignment, you will learn to analyze market conditions, interpret vacancy rates, and assess investment opportunities in the real estate sector.

Instructions:

Complete the following tasks and answer the questions. This assignment can be done individually or in groups. Use the information provided in the article as a reference.

Tasks:

To Do: Calculate Vacancy Rates

Scenario Analysis: Assume you are analyzing three different suburbs for a potential investment. Suburb A has 150 rental properties with 5 vacant, Suburb B has 200 rental properties with 15 vacant, and Suburb C has 300 rental properties with 18 vacant.

- Calculate the vacancy rate for each suburb.

- Interpret these rates in terms of investment safety based on the benchmark vacancy rate mentioned in the article.

To Do: Market Analysis

Choose a real suburb or region (you can use online real estate databases or local government resources to find data). Collect data on the total number of rental properties and the number of vacant rental properties.

- Calculate the vacancy rate for your chosen area.

- Compare this rate to the national average or another region’s rate (if available) and discuss the implications for investors.

Research Question: Factors Influencing Vacancy Rates

Identify and describe at least three factors that could influence the vacancy rates in the area you chose for Task 2. Consider economic conditions, demographics, location quality, rental market dynamics, and government policies.

- Provide specific examples of how these factors currently affect or could affect the vacancy rates.

To Do: Occupancy Rate Calculation

Using the data from Task 2, calculate the occupancy rate for the same area.

- Compare and contrast the vacancy rate and occupancy rate you found. Discuss what these rates indicate about market conditions and property performance in your chosen area.

To Do: Analyze Impact of High Vacancy Rate

Imagine a scenario where a new large housing development is completed in the area you selected in Task 2, significantly increasing the number of rental properties available. Predict the potential impact on the vacancy rate.

- Discuss strategies property owners and investors might employ to manage the potential increase in the vacancy rate.

Research Question: Government Policies

Investigate and summarize the impact of at least two government policies or regulations that could affect vacancy rates in real estate markets.

- Consider zoning laws, rent control measures, affordable housing initiatives, and any other relevant policies.

Discussion Question: Vacancy Rate vs. Occupancy Rate

Reflect on the differences between vacancy and occupancy rates.

- Discuss why it is important for investors to consider both rates when assessing real estate investments.

Deliverables:

- Calculations for each scenario and task.

- A written report (2-3 pages) summarizing your findings, analyses, and conclusions for Tasks 2, 3, 5, and 6.

- A short presentation (10-15 slides) focusing on the implications of your findings from the above tasks for real estate investors. Include charts or tables to illustrate vacancy and occupancy rates.

Submission Guidelines

- Submit your written report and presentation slides in PDF format.

- Ensure your calculations are clearly shown, and your analyses are well-supported with data and examples.

- Reference any external sources of information or data you use in your report.

- Submit your report via mail or comments.