Continued from…

How To Get Started With REITs? [Part 1-2]

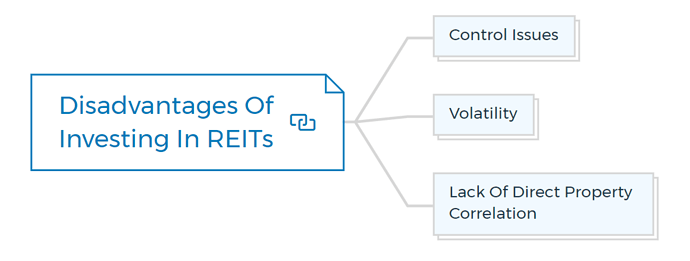

Disadvantages of investing in REITs

Property trusts, on the other hand, have some drawbacks.

Control issues

You will have little say in the trust’s management as a small investor. The majority of investors want no control at all. However, the trust managers may choose to buy a property you dislike or sell a property you think they should keep.

Or they might do something else that you find offensive. You won’t be able to do much about it. The management of public corporations does not always function in the best interests of shareholders.

Volatility

Listed property trusts are less volatile than most stocks, although more volatile than direct property investment. It can benefit the astute investor, who may be able to purchase a trust just as the share price begins to rise.

However, it may be possible to buy just before the price enters a protracted period of dormancy. It is dangerous for small investors, who frequently purchase shares garnering media attention and have already achieved their peaks.

Property trusts are more hazardous than direct property investments because of volatility. Nonetheless, property trusts’ high liquidity allows them to exit the transaction swiftly if something goes wrong, which is not always the case with direct property.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Lack of direct property correlation

Investors buy property trusts to obtain exposure to commercial real estate, but the trusts’ share prices do not always move in lockstep with property prices.

Property trusts are similar to stock market investments, and market conditions heavily influence their performance.

When the government decides to pump liquidity into the economy by decreasing interest rates, it can instantaneously and positively influence the market, including the trusts, while taking a long time to trickle down to actual property values.

Investors looking for a haven when other stock market assets appear risky may purchase the trusts. The link between property values and the gross income is frequently shaky for all of these reasons.

How to get into a REIT?

You can contact someone to assist you with the procedure once you’ve decided on the REIT you want to invest in.

There are a few steps to follow:

- If you’re interested in joining a REIT, speak with an investment broker.

- Examine all of the REIT’s terms and conditions. These include any fees incurred and how the trust may evolve.

- Talk to your broker about how the REIT is doing and what kind of return you might expect. The broker should go through everything with you and show you how it can benefit your investing strategy.

- Determine how much money you want to put into the REIT in total. After transferring your cash into the trust, REIT will officially include you.

It is a simple procedure that requires little effort on your part. If you don’t have the funds to invest in real estate more traditionally, joining a REIT might be gratifying and worthwhile.

You’ll need to verify your identification and deposit funds into the trust. You may also need to meet with an advisor who can provide detailed information about the trust’s risks and other aspects.

Potential investors should ask the following questions before investing in REITs:

- What is the condition of the underlying real estate assets?

- What is the trust manager’s track record and ability to add value?

- How stable is the cash stream (the lease terms and rent review details, for example)?

- What can I expect from my LPT investment in terms of returns?

- What are the risks associated with a specific LPT investment?

- Is the current market mood in favor of this LPT’s price?

- Is the market in an uptrend, consolidating, or declining right now?

Purchasing shares in a publicly-traded property trust is simple. All you need is a brokerage account and the ability to make an order. Of course, you’ll have to pay a stockbroking fee.

As a result, placing an order for less than $1000 would not usually be considered cost-effective. For example, if you bought $500 worth of stock, you’d need a 6% return to recoup a $30 brokerage charge.

You will receive REIT dividends typically twice or four times a year. Increasingly, firms are issuing a yearly statement to help you with tax preparation.

Some trusts provide a distribution reinvestment plan, allowing you to reinvest your pay-out in new units at a slight discount to the current market price without paying any brokerage fees.

The trust manager gets paid a proportion of the total assets. It usually amounts to about 0.5 per cent of the assets. If the trust’s shares meet a specified benchmark, some trusts may have a provision that pays the managers a performance fee.

Some trusts are part of a stapled securities structure, in which investors possess both trust units and shares in a different asset. The latter security is usually a funds management firm administering the trust and its assets and other development operations.

It is not possible to trade the units and shares separately. Investing in trusts with a stapled security attached has a higher risk, but it can also yield more significant rewards.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

Monitoring of your real estate investment trusts

The Australian Stock Exchange divides all listed businesses into sectors using the Global Industry Classification Standard (GICS) developed by Standard & Poor’s and Morgan Stanley Capital International, the two largest providers of stock index services in the world.

GICS aimed to make investment research and management easier for financial professionals worldwide. And also to make sector analysis and investing easier on a global scale.

The financial sector in other nations includes property trusts. On the other hand, property trusts classify as a separate asset class from the equity in Australia, with lower gearing levels than elsewhere in the world.

UBS-Warburg Australia, a stockbroking firm, publishes a lot of research on the industry and creates six sub sector indices, including trust leaders, diversified trusts, retail trusts, commercial (office space) trusts, and industrial properties and hotel trusts.

Other brokerage firms create their property trust indices.

REITs futures

A new type of real estate investment trust has emerged in recent years - the real estate investment trust futures. These futures contracts allow investors to bet on the future performance of a REIT index, such as the S&P 500 Nareit Index.

To trade REIT futures, you first need to open an account with a broker that offers these contracts. Then it would help if you decided which contract to buy. There are three types:

- The front-month contract is for the current month’s settlement price.

- The next-month contract is for the following month’s settlement price.

- The far-month contract is for the expiration date several months in the future.

Once you have decided on a contract, you need to decide how much money you invest. The minimum investment is usually $500, but it can be higher depending on the broker.

Then you place your order with the broker and wait for the contract to expire. If the REITs index ends up higher than the settlement price, you make money. If it ends up lower, you lose money.

Conclusion

REITs offer a unique way to invest in the real estate market. They can provide high returns and come with a certain amount of risk. Before investing in a real estate trust, be sure to consult with a financial advisor and do your research to find the right one for you.

If you’re interested in trading REIT futures, remember that they are a high-risk investment and perform them only with the help of experienced investors.

REITs can be a great addition to your investment portfolio if you are looking for exposure to the real estate market without having to purchase property directly. However, it is essential to understand the different REIT types and the risks involved before investing.

With a bit of research, you can make an informed decision about whether or not a real estate trust is suitable for your investment portfolio.

Happy investing!

FAQs

What are REITs?

A real estate investment trust (REIT) is a company that owns, and in most cases operates, income-producing real estate. It allows those who do not have a lot of money or access to a loan to invest in real estate. The best way to describe a REIT is it acts as an exchange-traded fund.

What are the benefits of investing in a REIT?

There are many benefits of investing in a REIT. Some of the key benefits include:

Diversification: A REIT offers investors broad exposure to a basket of properties and mortgages, which reduces risk relative to owning individual property assets.

Liquidity: REITs offer daily liquidity, not typically available for real estate investments. This liquidity allows investors to respond quickly to changing market conditions.

Transparency: REITs are required to disclose their financial information quarterly, which provides investors with timely and accurate information about the trust’s performance.

What are the different types of REITs?

There are three main types of REITs -

Equity REITs own and manage physical properties, such as office buildings, malls, warehouses, and hotels. These companies are the most similar to traditional landlords.

Mortgage REITs invest in mortgages and mortgage-backed securities. They earn income from the interest payments on those mortgages.

Hybrid REITs combine the features of both equity and mortgage REITs. For example, they may invest in both physical properties and mortgage-backed securities.

What are the risks of investing in a REIT?

A REIT is a real estate investment trust. It’s a company that owns or finances income-producing real estate. There are a few risks to consider when investing in a REIT:

Interest rate risk: The prices of REITs tend to fall when interest rates rise because higher interest rates make it less attractive for people to invest in bonds (which are competing with REITs for investor money).

Credit risk: REITs can be affected by the creditworthiness of their tenants. For example, if a large tenant goes bankrupt, the REIT may write off some losses.

Liquidity risk: It is the risk that you may not be able to sell your shares of a REIT easily or quickly if you need to. It can be precarious during market turmoil, when investors may not want to buy REITs.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber