Continued from…

Property Development Feasibility Study [The Key] [Part 1-2]

The Most important feasibility study concept in property development

The most important concept to remember when conducting a property development financial feasibility is to make sure that you don’t end up paying more for land.

Residual land value

Understanding the Residual Value Of Land is a crucial component when conducting financial feasibility. Usually, everything remains constant, including professional fees, construction value, permit fees, selling costs etc.

The only two variables in a feasibility study are land and end sale value. Just because you have paid more for land, does not mean that you can get more for your developed product.

Time to walk away

-

Let’s look at a hypothetical scenario. You are considering buying land to develop 4 x 3 Bedroom townhouses. You have determined that they sell for $530,000 in your suburb. However, the vendor is asking for $600,000 for his land. Which pushes the price of land to $150K for each townhouse.

-

Now if you do your numbers right, you will notice that in order to allow for all costs and for you to make profit on this deal, you really need to sell these townhouses at $575,000. However, the market does not allow that, as the current sale value sits at $530K for your townhouses.

-

In essence, you should be paying only $120K per townhouse for land to make your margins, which justify the end sale value of $530K.

-

It’s time to walk away as the asking price of land is too dear.

Feasibility concept - Land valuation

Residual land value

This a very important concept and it’s the one concept that underpins all property development feasibility studies. Make sure you watch this video below which explains this concept.

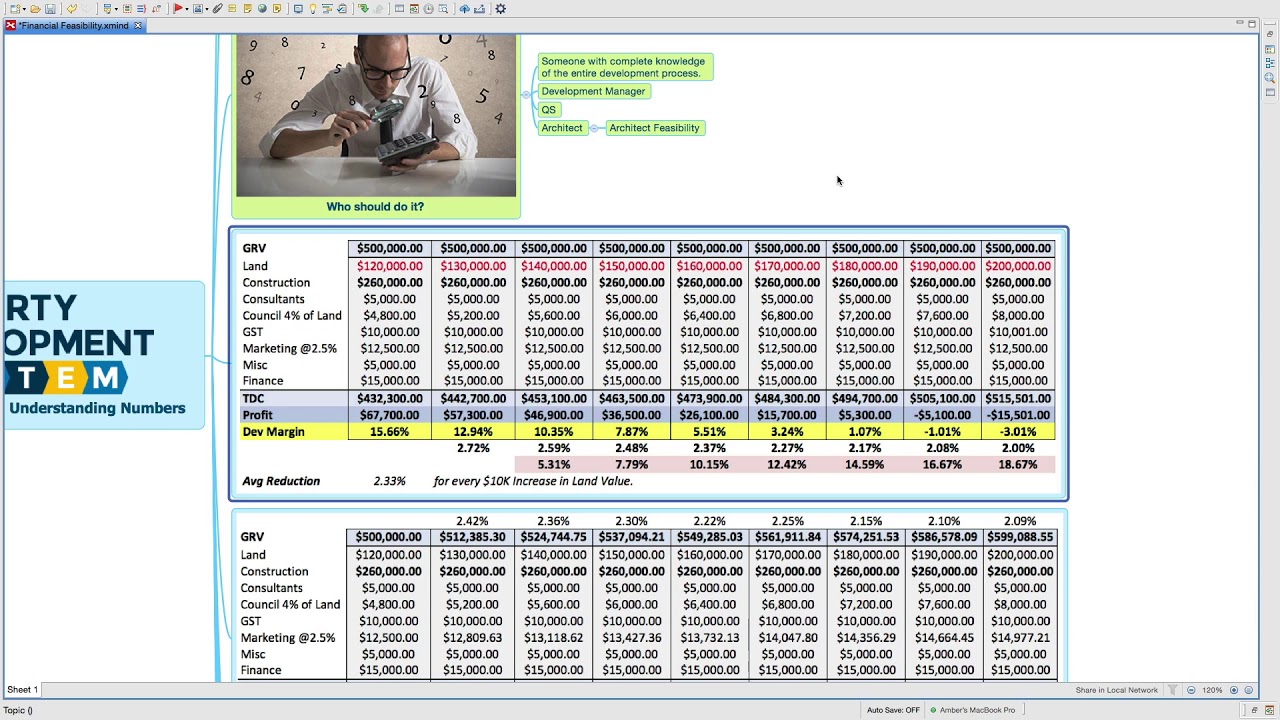

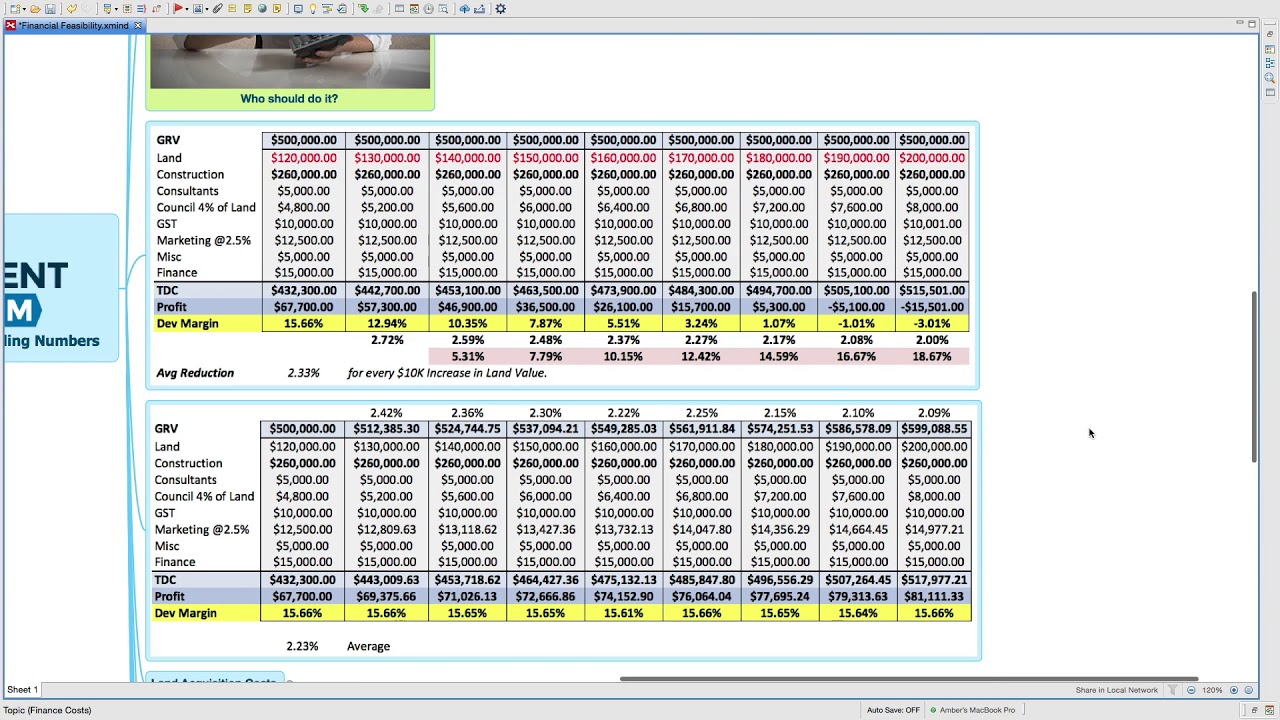

Let’s look at this table. What I’m trying to explain you in this table is the fact that if you look carefully, if you look at GRV, you’ll see that it’s 500,000 constant all throughout.

Don’t look at the land value, look at construction, it’s all constant all throughout, doesn’t matter where you’re building. Look at consultants, it’s all constant all throughout.

If you look at council contribution, in this scenario for example it’s a townhouse development and it’s a full townhouse development for example, and so I put in 4% on land value.

In Victoria usually as a thumb rule for council contribution, if you’re putting full townhouses on a block of land, council contribution are approximately 4% of the land value. That’s what I put in over there. See how that changes with respect to the land value.

If you look at marketing, that also stays constant, why? Because the GRV, which is the Gross Realization Value, what this means in layman’s terms is the sale price of the unit that you’re developing. Gross Realization Value is another term for the sale price.

If you go down you’ve noticed that everything else stays constant. It does not matter where you’re developing this, but the constant construction, and the total development cost will more or less come to be the same.

Everything in the middle from this section down here is actually going to remain constant. What’s going to change is your land value right here. You say, “Why wouldn’t the GRV or the sale price change?”

We’re talking about one suburb, and we’re talking about 3-bedroom townhouse, and if the market says that 3-bedroom townhouse in XYZ suburb can only sale for 500,000 dollars, the market doesn’t allow you to sell it for more than that.

However if you go and buy the block of land, and you pay more for the value of the land, see what happens at the bottom.

If you’ve got 500,000 and you paid 120,000 for the land, you paid 260,000 for construction, 5,000 for consultants, and then you pay 4,800 for council, you paid GST let’s say 10,000, you paid marketing, 2.5%, miscellaneous and so on.

Your total development cost was 432,300 and your total profit was 67,500. Your development margin was 15.66% which is not bad. However, everything being constant, the more you pay for the land, the less your development margin is going to be because there’s no way you can actually …

Just because you’ve paid 10,000 dollars more for land, that doesn’t mean you can sell your end product at 10,000 dollars above the market. The market doesn’t allow that, that’s going to be constant.

Every time that happens, you lose 2.72% of your profit. As you go on, if you pay 20,000 dollars above the market, you’ve actually lost 5.31% of your development margin and so on and so on.

As you see that if you pay too much for the land, say for example 180,000 you’ve started going into negative here. There’s no viability left in the project at all. Basically a 10,000 increase in land value will cause an average reduction of 2.33%.

If you look at the same example from a different angle, let’s look at this portion here, you’ve got GRV at 500,000, but if you pay more for the land, let’s say over here we pay 120,000 but over here I pay 130,000, I’ve got to sell my townhouse, or apartment, or unit at 512,385 to be able to still make the same amount of development margin. Every time I pay more for land, I’ve got to sell it at least at that price.

What this table is telling you is that everything else remains constant. If all is the same and remains constant, anytime you pay more for land, you got to be able to recover that in the end value.

If you can’t recover that, what’s going to happen is you’re going to start losing that much from your development margin. Basically your profit will start evaporating every time you start paying more for land.

This is a very important concept. Honestly, I actually paid 35,000 dollars just to understand this concept. Lot of people know it, all the different valuers live by it, but a lot of people charge a lot of money to understand this. Today this concept is free for you.

Thanks for watching the video. All links are actually in the description, if you would like to download a free resource, which is the free property blueprint, you can do so from my website by clicking on Free Blueprint, and you should be able to download everything.

Make sure you check out leaddeveloper.com and also the links in the description below. I’ll see you next time.

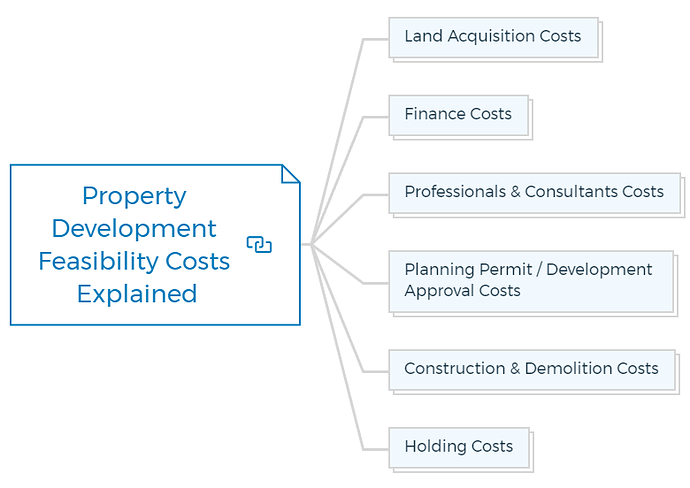

Property development feasibility costs explained

Before I forget, if you haven’t already, make sure you check out my FREE course in property development on YouTube & while you are there, don’t forget to subscribe.

We’ve got financial feasibility. Before I actually go ahead and explain to you what exactly is involved in financial feasibility or I show you an application that I use for financial feasibility… for conducting financial feasibility on property development projects, let me first explain to you a concept.

It’s a very important concept, and it’s the underlying basis of all property development feasibility studies. Make sure you watch this next video carefully, and don’t forget to leave your comments.

I’ll read all of them. If you’ve got any queries or anything, leave your queries in the comments and I’ll try and answer them. Let’s watch the video.

Land acquisition costs

Let’s say, if you were to do a detailed financial feasibility analysis, what are the different costs that would be included in your financial feasibility?

Let’s look at land acquisition cost. You have your purchase price, legal stamp duty, buyers, agents commission.

There are other acquisition costs like legal settlement, searches, transfer, discharge of mortgage, mortgage registration fee, pre-purchase inspections, due diligence, bars agents commissions, sorry that’s a repeat, structure setup and responding fee.

If somebody else formed a deal for you, you’ll have to pay them responding fee. All these things will become part of your land acquisition costs.

Finance Costs

Under finance you’ll have brokerage fee. I’m telling you all of these things because even if you can do a quick two minute fizzle, and understand whether or not a deal stacks up and then move on quickly to another deal and then another deal, you still need to understand what a detailed financial feasibility includes.

Under finance you’ll brokerage establishment, evaluation interest fee, basically the interest rate, annual fee, and different kind of admin fees.

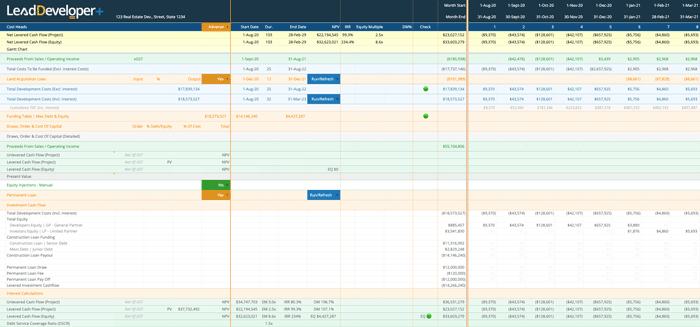

All bank fees and interest on capital utilized are capitalized with the cash flow of the development’s building programme. The capital employed is divided into two categories: debt and equity.

Debt capital is money borrowed from a financial institution that accrues interest at different project stages when capital is required.

Equity - The money provided by the developer as a deposit, which should be recorded as accruing interest, is referred to as equity capital.

Opportunity Cost of your money- The expense of putting your money in a particular investment rather than somewhere more lucrative; for example, if you put your money in a bank savings account, you may be forgoing the return you could get through property investment.

In most cases, equity capital is used up before borrowed capital is advanced.

Professionals & consultants costs

All the different drawings and the different professionals will make a feature survey, reestablishment surveys, architectural drawings.

Now there is going to be two different fees from the architect, one for the planning stage or the DA stage, and one for the working and drawing stage or the building approval stage.

You’ll have civil drawings, electrical drawings, hydraulic joinery landscape, mechanical and structural engineers of lands, where project management, development management, specifications and materials board, plan of subdivision documentation, town planning.

If you at this stage do not understand what these are, don’t worry about them, because I cover them in a lot more detail in my Property Development System.

Planning permit / Development approval costs

All different kinds of reports would be average reports, asbestos, building surveyors, CHMB, which is the Cultural Heritage Management Plan, very common in Victoria, especially if your block of land is actually close to a water body. I’ll explain that more in another video.

We’ve got energy report, environmental audit, soil report, allowance, condition surveyor report, cross plants and estimates, electrical pole relocation. You need to report that.

This is more for the builder, but because I’ve got a construction company as well, I’ve quoted in my feasibility so that I can account for it.

Construction & Demolition costs

Domestic demolition permit, BCC planning application, well this is the Council Planning Application, it shouldn’t be here. Then we’ve got material and finishes board again, fire levy. If you’re in Queensland, you’ll have a QUU order fees.

You’ll have building costs, external costs, civil costs, if you’re doing land subdivision.

Council contribution charges, would have your service connection fees for electricity, gas and water, telephone, path and contributions, council contribution, like number of buildings divided by land as a percentage.

Sewer and water contribution, and PIC number which stands for Plumbing Industry Commission Number in Victoria.

Holding costs

In different land holding costs, you’ll have land tax, council rates, water rates, property management fees, insurance and so on. Selling costs again you’ll have your agent’s commission fees, 3D artist impressions, advertising brochures, websites.

If you want to do a branding, Legals for contract of sales, owner’s corporation and photography. You might need to take photos of what you’re selling.

Under miscellaneous we’ve got building insurance, lawn mowing, account commercial evaluation, bank fees, house removals.

Now why do I have this here? I have this here because you can actually use these things as a checklist, especially when you’re doing your detailed financial feasibility.

However, this video is actually not for detailed financial feasibility, but I wanted to show you what’s actually involved in a detailed financial feasibility. Let’s look at a detailed financial feasibility applications that I have developed.

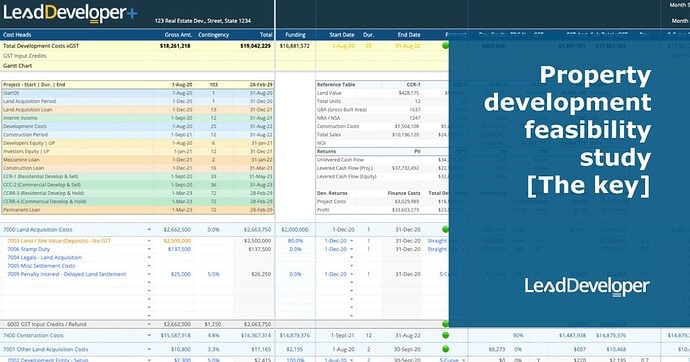

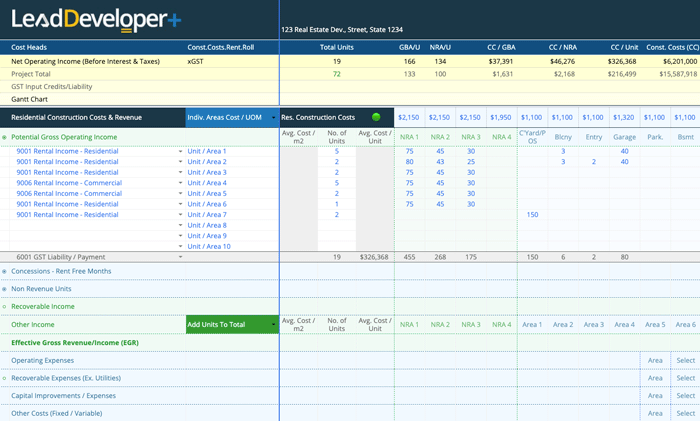

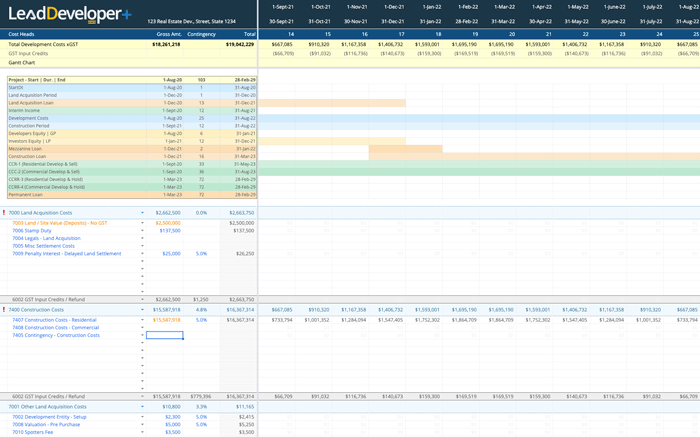

If you’re part of the Property Development System or you’ve invested in Property Development System, you actually get a two-year license of this software for free. For this video, it’s only to get an understanding of what it actually covers.

It’s got a project planning sheet where you plan your project, and basically you allocate what kind of time period, what kind of expenses will occur. Based on that planning, you actually come in and you start putting in the details.

You select their GSC. This side of the application is all about allocating cash flows based on the different periods where those costs will occur. Don’t let this thing scare you, because it is not scary at all.

I explain this application in over nine different videos step-by-step, so you can understand it really clearly especially if you invested in Property Development System.

This application actually comes pre-populated with the professional fees. The basic difference between a two-second application, or a two-minute feasibility and a detailed feasibility is that the detailed feasibility will be number one, there will be a lot more detail.

It will also include cash flows and all different kinds of financing needs. Then there’s going to be a full cash flow and-

Thanks for watching the video. All links are actually in the description. If you would like to download a free resource, which is a free Property Development blueprint, you can do so from my website by clicking on free blueprint, and you should be able to do everything.

I’ll see you next time.

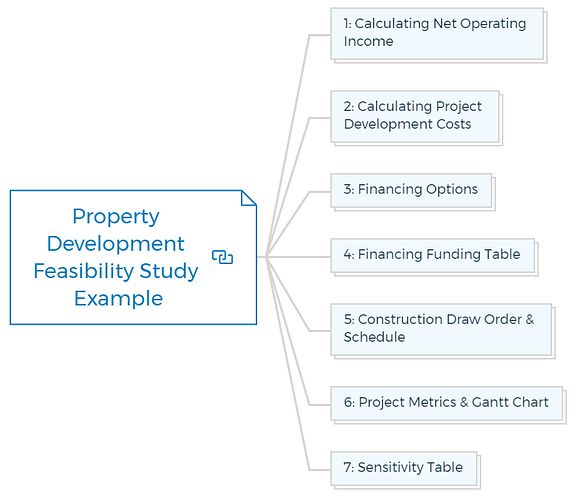

Property development feasibility study example

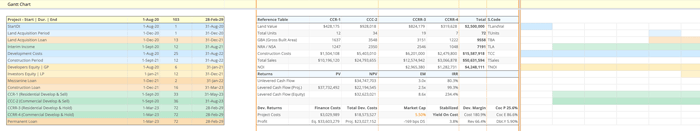

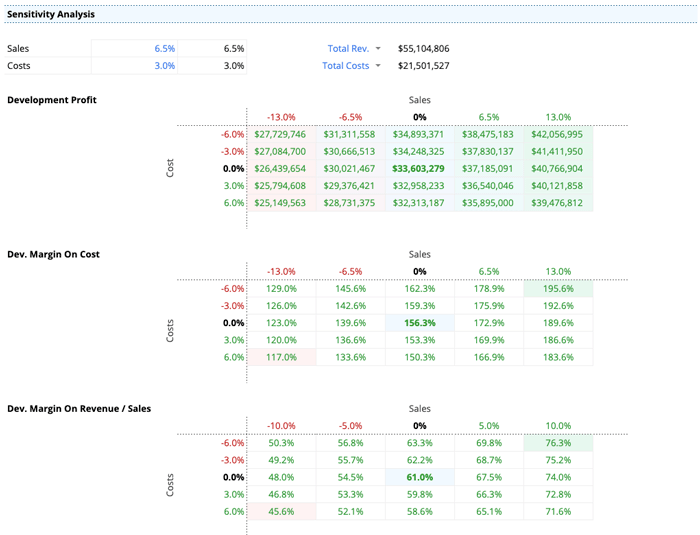

Following are some examples of property development feasibility study examples from our Lead Developer Feasibility Suite - property development software. For feasibility study the first thing you need to do is plan planning.

In this phase you job as a property developer is to project all your development costs across your project’s timeline. Here is an example of a project plan schedule.

Example 1: Calculating Net Operating Income

Example 2: Calculating Project Development Costs

Example 3: Financing Options

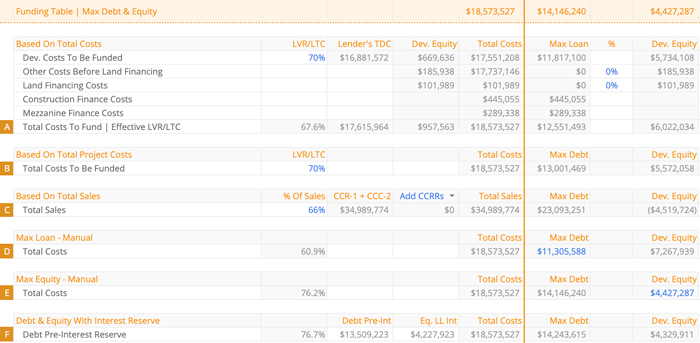

Example 4: Financing Funding Table

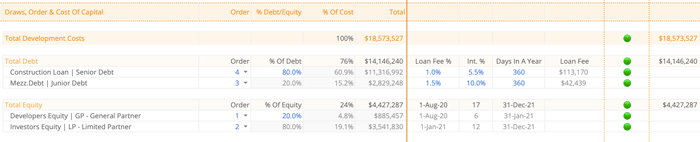

Example 5: Construction Draw Order & Schedule

Example 6: Project Metrics & Gantt Chart

Example 7: Sensitivity Table

FAQs

Why is it important to do a property feasibility study?

A thorough feasibility study can tell you whether your proposed development will be a massive success or a failure in the planning.

It will highlight several challenges such as site suitability and what can be built on it, planning permission, working with the local council, neighbor disputes, budget overruns, return, etc. It will help you make a better decision.

Who should conduct a feasibility study?

Property developers and property investors may conduct a property feasibility study. If they consider the land worthy, they will spend time and money on it.

Property developers consider feasibility studies a smart option because they are more inexpensive than actual projects. Feasibility studies allow property investors to get insights before investing.