Continued from…

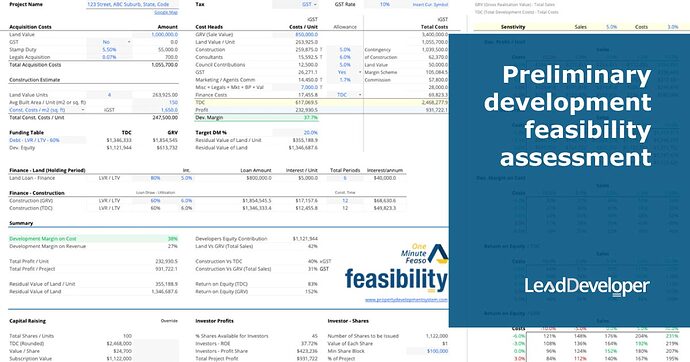

Preliminary Development Feasibility Assessment [Part 1-2]

How To Estimate Your Project Timeline For Your Development Project When Conducting Your Preliminary Property Development Financial Feasibility?

Project Timeline In Lead Developer Suite > One Minute Feaso

Moving on to next thing that you need to know is your Time.

a) That includes the time its going to take you before you start construction. Let’s say you sign a contract, you settle on the block of land and from that point to the point, you start construction.

b) Time its going to take you for Construction Period .

Why the time it’s going to take you before the Construction? . Because if you’re zoning and all those things aren’t ready yet, what happens is that you need to go through a planning process.

You need to get all your reports ready. You need to go consult different professionals, get them to Ok your development. And then go through your local government authority in order to be able to get approval for the development.

Also during that time, you may have settled on the block of land or you may not have settled on the block of land. So you need to figure out what that holding period of that land is actually going to be.

This is because there are two different ways in which Finance works . There is a different set of financing for just buying an investment property and then there is a different set of financing for construction, when it comes to development and starting construction.

Hence there could be two different interest rates. It could be lower just to buy a property and hold it. It could be a little bit more expensive, especially when you are developing it, because it could be a commercial loan depending upon the size of the development.

So that’s why there are two time periods. One of them is the holding period before you start construction. And then another but construction period.

Finance - Land Holding Period

So let’s look at how all these things come together in the One Minute Feaso. In the Example above we’ve got Finance - Land (Holding Period). Under that we’ve got Land Loan -Finance.

When you go and buy a block of land you say, look, I should be able to borrow 80 % of the value of the land. Let’s say from the example above you are buying for $1050000 and you can borrow 80 % of that.

The idea of doing a development is to use as less of your own money as possible, because the less money you use of your own, the greater return you can get on your own money because you only use, let’s say, 20 percent or so of the total cost or 30 percent of the total costs and so on.

So if you’re doing your entire development with your own money, that means you already bought a block of land.

Say, for example, you’ve been sitting on an ancestral property where which was handed down by a grandfather to your father and then it came to you and all debt is paid off.

There is no debt on the property and you’ve got your own money in order to be able to start construction, I’d still say don’t use all of your money, go and borrow the money because otherwise your development margin, which is 33.2% in the above example, is going to be exactly the same as the return on equity.

Now, the way you increase that return on your equity is by leveraging it, by borrowing the money and paying the cost of borrowing.

So going back to the example above you’ve got Land Loan Finance here, you’ve got LVR or the Loan to Value Ratio LTV as it’s known in the US. You’ve got 80 % of that and then you’ve got your interest rate.

So lets say you can borrow the money for 5% . And because you’ve already settled on the block of land, or you have already started your planning process and you know that in 6 months time you should be ready for construction.

So you allow a holding period of 6 months ,you know that, this is gonna be how long your holding period will be. I should allow by 12 month for construction.

So you need to figure out 3 things.

-

What is the money that you can borrow from your lender just to buy and hold a property while you get go through the planning process?

-

What interest is going to cost you and

-

For how long are you going to hold it for?

These are some ballpark numbers where you’re trying to figure out this whole feasibility in under a minute. And once you’ve got your land sorted, your next port of call is to actually figure out what you can borrow for construction.

Finance - Construction , Funding Table & Finance Costs

Now for Construction. We’ve got this Funding Table right here. What that funding table is telling you is that we’ve got Debt -LVR/LTV say 70% .What this means is that what is a maximum amount of money that you’ll be able to borrow when it is time for construction(see example below).

This is based on what you have selected under Finance Cost ( also go through finance costs under Cost Heads above).Whether you have selected TDC or GRV.

In the second example above we can see that for the Finance Costs $28,153 we have selected TDC which is based on the Total Costs and not GRV. That means that you go to a lender that is going to borrow your money based on your total costs.

So you figure out what that number is and you put that number for Debt -LVR/LTV. Let’s look at another example let’s say it’s 65%. So you put that 65% over there. That means $ 1,618,459 is the money that you’ll be able to borrow under TDC. If this was GRV, the calculations are then based on the figure $ 2.009,091(see example below).

Based on that you are also able to figure out the amount of money that you will need to put in from your own pocket because this is super duper important.

A lot of developers get caught because they have not been able to figure out what the model money that they will need to come up with in order to do the development.

They get into a project thinking that they’ve carried on for a while and then be able to get rid of it when they can’t get rid of it. They will either incur a loss or they’ll be into all sorts of trouble.

What you need to figure out is what that money is going to be based on the money that you can actually borrow. When it comes to construction loan, this would include the cost of the land in it.

Moving ahead, you’ve got your 65% and then you’ve got your Loan Draw -Utilisation. Now, what is that? What that means is that when you are borrowing money for construction, you’re not going to borrow the entire loan amount from day one.

It is all done progressively as the project unfolds, as the project is built. Your builder or your your construction contractor is going to give you a progress claim. If it’s a smaller project, you have the ability to approve it yourself.

But if it’s anything bigger than three, four townhouses or three, four apartments, your lender is actually going to force a quantity surveyor or a third party involved to come and inspect what your builder has already done and then release the money accordingly.

So in order to account for that in under one minute we use Loan Draw Utilisation in the One Minute Feaso. So if you put 60%, that means that’s the speed at which your money is going to come out.

So when you extrapolate everything and you’ll see in Lead Developer and all those things, we extrapolate everything out on an S-curve.

So because we are doing everything under a minute and we don’t have the luxury of having all the details in place. So we do it in a ballpark figure.

Now we’ve got 60% and the percentage of interest that you will be charged for construction .Then you’ve got your construction time. The construction time here again must be included its very important.

Its the time it actually is going to take you to return the money back to the lender .How can you return the money back to the lender?

The only way you can return the money back to the lender is when the pre-sales that you made or the project, the all the units that you sold to somebody else, they have paid you for those units.

And that’s called a settlement. Once that settlement occurs, that’s when you’re going to get your money back.

In the above example lets say the construction time is 12 months, but I know that building four townhouses is not going to take me 12 months. It could be done in 10 months and I have allowed 2 months extra in there.

But if you think the construction is going to take 12 months, you’d allow 14 months for construction in here so that you’ve got that buffer of 2 months in there and you calculate the interest for it.

So you rather have that buffer built into this, as a habit. You’ll see that as you start doing bigger developments or you start getting detailed with all those developments. You’ll be able to do your feasibility is more accurately than just throwing out numbers without thinking.

So let’s change construction time to 14 months at this stage (see the example below). And based on that, you will get your finance calculations done.

And these finance calculations then go into a loop and they go into a loop about 10 times in order to come up with a probable value based on what you put in.

Once you got all those things, One Minute Feaso calculates and tells you that you’re making 24 % Development Margin on cost .

The developers equity contribution is going to be $1.124,811 So for something that is going to be a total development cost of $2.7 million your ballpark figure for developers equity contribution is going to be $1,124.811 on TDC.

We will continue our discussion on How to Use Target Development Margin When Using the One Minute Feaso next.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

How To Use Target Development Margin?

Target Development Margin In Lead Developer Suite > One Minute Feaso

The next thing that we need to figure out is your Target Development Margin. This is the number 1 reason we were doing this One Minute Feaso in order to determine the Residual Value of Land.

That is the maximum price you should be paying for this site based on it’s on its Development Potential. So whatever the highest best possible use is that is 4 townhouses in this example, I should be paying X amount for the land if I want to make 20 percent the total cost of this development.

So let’s look at this.

We’ve got a Target Development Margin. On a smaller site, up to four to six units. I’m happy with making 15% because the smaller the site the more competition that you are going to face in order to acquire the site.

From Our Example above where our land value we put in as 1050000, if I put 15% as my Target DM% this is telling me that my residual value of land is about $1414051.7.That means I can still afford to pay 1.4 million for this site.

Now if we go and change the land value to $1400,000. You’ll see that my development margin is about 15.3%. What this is telling me is that on the total cost that I that I’ve got, if I make 15%, I can afford to pay 1.4million for the block of land.

In case say I’m paying only 1,200,000, for example, you know, I’m making 24 % development margin on this site.

On the basis of the above 2 scenarios in the feasibility, based on all the cost and other details that you allowed for in this feasibility you can go back to the agent or to to the seller and tell them, that you know you can easily put 4 townhouses on it.

And that’s the maximum that I want to pay for this, because I’ve got all these costs that I have to incur and I simply to make my minimum return on this project in order to go ahead with it.

This is why we do this feasibility in the first place in order to figure out what is the maximum price that we can pay for land -Which is your Residual Value of Land $1,411,842 and $372,373 is basically just breaking that into for each unit.

We will summarize our Preliminary Development Feasibility Assessment with One Minute Feaso next.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Property Development Feasibility Summary Section In One Minute Feaso

Summary In Lead Developer Suite > One Minute Feaso

Now we are getting into the summary section of the One Minute Feaso and what each one of these means and how you should read this to your advantage.

Development Margin on Costs will tell you the ballpark Development Margin that you’re making on this site. It is based on cost. And so you’re making about 24% in costs in the above example.

Development Margin on Revenue and 19% on revenue.

Total Profit per unit based on the number of units that you’re developing. As per our previous example the number of units was 4. Based now on this example, you’ve got $162,615 profit on each unit.

As for Total Profit. You’re making $650,462 as a total profit.

You get your Residual Value of Land $1,397,331

You’ve got your Developers Equity Contribution, which is $1,124,811 which is based on the amount of money that you can borrow.

Then you’ve got Land Vs GRV(total sales), which is the value of the land vs. the gross realization value, which is about 45%

Construction Vs. TDC. That means your construction is about 37%. Here you want to make sure that your Construction Costs vs. your Total Development Costs is always less than 40%.

Once it starts going more than that, you’ll see they’ll start putting pressure on the value of the land as well.

Construction Vs GRV, which is total sales of construction value based on the total sale value or the gross realization value that you’ve got there.

Return on Equity (TDC) if you borrow money based on the Total Development Costs or total costs and Return on Equity (GRV) based on if you if you are able to borrow money based on your total sales value.

So you’ll see that your return falls down if you are able to borrow less money. So if you borrow more money, that means there’s more funding available for you for the development. You’ll make a better Return on your Equity.

How To Calculate Return For Your Investors Using One Minute Feaso?

Return For Investors In Lead Developer Suite > One Minute Feaso

Capital Raising

Here you need to figure out what is the amount of money that you are going to raise? Now, that is a tricky concept. It requires a fair bit of knowledge, but it actually kicks in based on the amount of money that you are required to come up with.

Now, if you are able to raise that money from your investor, that means you’re basically doing a No Money Down deal.

So the way I have structured The One Minute Feaso is that everything is already being thought through and done for you.

What we are trying to do here is raise the total amount of money that we need to come up with in order to do the development because the rest can be borrowed from a lender. We are raising The Developers Equity Contribution.

Let’s look at the total rounded costs. So you’ve got your total cost, which is in the example is $2,750,000. we round them up over here under Capital Raising section.

You want to be able to justify to your investors that the total money and that’s why the One Minute Feaso has a TDC(rounded) option.

If you’re not happy with the automatic roundup, you can come up with your own roundup. So you can say, look, I’m going to go with 2.7 million at this stage or simply type whatever that number is that you want.

That tells me that my value per share in the example that figure $27,500 based on total shares per units being 100. You might be able to issue a 1000 units or 5000 units or whatever.

In that scenario, the moment total shares/unit goes over 100, I think of this 100 as a %. What this is telling me is that based on the 100% the money that I need to raise the value of each year for that unit, for the total cost that I’ve got is going to be $2,750,000.

Now, I could override this and say, look, I’m going to go with the $30000 value. You can override it and put $30000 in there.

No one’s stopping you from doing that, but you shouldn’t, because you will have to present to the investors and build the case with your investors in order to do that. So I’m just going to go $27500 at this stage.

And that gives you a subscription value. What is the subscription value? Is the same amount of money that you need to come up with just rounded off or Developers Equity Contribution rounded off .

So I’m saying that I need to come up with $1,125,000 rounded off .

But you could say, look, you know, I’m going to put in $1,25,000of my own money or you might have already put that money into the project to get to a certain level.

So if you say, look, I’m just gonna raise a $1000000 from the investors and what does it look like? So that’s what it will look like.

Investors Profits

% of Shares Available for Investors based on the amount of money that you need to raise by is 36 %.

Investors Return on Equity -ROE. What that means is If you wouldn’t raise a $1,000,000 from investors and they own 36 % of the project, they’re going to be making about 23.65% return on equity.

This is different from the projects return on equity because that is for the entire project based on the money that needs to come up.

whereas what you’re trying to do is raise this money from the investors and the rest of it comes from the lender so that you can do it and no money down deal. So you’ve got Investors -Return on Equity, 23.65%.

You’ve got Investors -Profit Share, which is $236,532 . That is telling you, based on the amount of money that you have raised in the amount money and about the percentage of the project that the investors will end up owning. That’s what that is.

Then the One Minute Feaso will also give you the total number investors that you require based on the minimum share block. So you might say that, look, I just want each investor to come up with $50000.

You can put $50000 there’s no problem whatsoever. Again, agencies like the Securities Commission comes in ,ASIC comes in, your requirement for Australian financial security license kicks in and it might be a different body in the country that you work in and you’re trying to raise money.

In Australia, if you are a sophisticated investors, you are a you are allowed to put in money into this program so long as you can prove that you are a sophisticated investors.

I usually keep Min Share Block $100,000. anything below that means you are doubling the number of investors that you would need. Which in turn would mean that you’re doubling the amount of people that you will need to deal with.

The less that number is, the better it is for the development especially for small and medium sized development, where you’ve got 4 townhouses, you don’t want 50 people in the project, so to speak.

When we put in $100,000 as Min Share Block, Total Investors Required is calculated as 10 you know, you only need 10 people.

If this was $50,000 as you will see, this will change total investors Required to 20 now you know, you need to go over twice as much money (see example 2 and 3 ).

If you can find $250,000 and you know that you got 4 investors come together and they can do $250,000 Min Share Block , you know, that’s what they will need to come up with(see example 1 above).

Our Total Project Profit, is $650,462 .Value of Each Share is going to be $1.

Under Investor -Shares you are issuing a 1,000,000 for $1 each . Whereas Under Capital Raising its telling you Value/Share based on the percentage of the project.

So when you are raising money, that means each share on the this side is going to be $27500 if they are only 100 shares as this is the percentage side. where as the Investor -Share side is number of shares .

The Investors will end up owning about 9.1 % of the project and the total Return/share is going to be $6505 and Return/Investment Block is going to be $59,133.

That means that if somebody puts in $250,000, they will go home with about 60 grand in profit and their Return on Equity is going to be 23.65%.

Because see, when people advertise that you don’t come and invest in this project. And I’ll give you 20 percent return on this money. They are talking about Investors ROE.

So, yeah, this isn’t a sophisticated way of doing it.

The sophisticated way of ding it is doing as a cash flow waterfall where you you have a minimum return that you achieve and that is not part of this course that will be covered under a different feasibility suite that I’m working on currently.

And that is also not part of the lead developer suite. That is part of the lead developer plus system that is going to be released maybe later on down the track sometime.

But at this stage, on a ballpark figure, you want to figure out the money that you want to raise, what that money is going to be.

And if all that money is going to be raised from investors so that you can do a no money down deal. And this is how you can work it out.

And I wish you all the very best. Don’t forget to check out the other feasibility apps that are included in here. You got One Minute Feaso or you’ve got Smart Feasibility Calculator that you can work with, that you’ve got a Smart Real Estate Investment Analysis.

And you’ve also got a Lead Developer, which is a detailed feasibility application and does everything that you need to do from cash flow to financing options and so on.

How To Do Sensitivity Analysis Using One Minute Feasibility For Your Preliminary Development Feasibility Assessment?

Sensitivity Analysis In Lead Developer Suite > One Minute Feaso

One last thing this One Minute Feasibility includes is a Sensitivity Analysis and it is super easy to do using the One Minute Feaso. It gives you a glance into what might happen if things were to go wrong or things were to improve.

For example,

1)The Sales Value that you’re planning by time your project is finished, it might go up .

2)The Cost that you had accounted for could have blown out for whatever reason or

3)The worst could happen where the costs would go up and the sale value would come down.

Have you ever wondered what would that do to your project?

So any time you’re doing a project, you always, always must 100 percent do a sensitivity analysis.

And what that does is, in a glance it tells you what will happen if things were to go wrong or improve.

Under the Sensitivity Analysis we can see how the following get affected in case Sales or Cost Value change.

1)Development Profit/Unit

2)Development Margin on Cost

3)Return On Equity/TDC

4)Return On Equity/GRV

Now, this is super easy to do. All you have to do is change the increments or the decrements for the scale for Sales and Cost.

So say, for example, you want to see what the scenario would look like if the sale value would move in a 5% fashion. And we do the same thing for the cost, but we do it at 3%( see example 2 below).

Sensitivity Analysis -Development Profit

Now, if you look at the above example where Costs is 0% and Sales is 0% nothing is going up or nothing is going down. Everything is exactly the same. Only if the sales went down by 5 %.

But the costs are zero, your profit per unit from $162,616 would fall by 20 %. And the same thing will happen as you keep moving left.

If you keep if you keep going right, it is telling you that costs are exactly the same, but you will manage to get extra 5 % for the same value by the time you finish. That improved your profit and pushed it to $205,116.

The same thing happens here (see example 3 above) with your Development Profit. Now above is profit per unit. This is telling you what’s happening for the entire development.

So let’s say your sales were to go down by 5 % and that your costs also went up by 3 percent see column 3 (-5.0%) row 5 (3.0%) .from $650,462 profit, you’re now doing $397,976 profit.

Sensitivity Analysis -Development Margin On Cost

And if you look into your Development Margin, it’ll tell you that, okay, it shows 24 percent right now (see example 4 below).

But if things were to go bad, it would it can fall down to 14 percent or in a worst worst case scenario is 10 percent and 6 percent.

Sensitivity Analysis -Return On Equity / TDC

The fourth table here shows you if you were to borrow money based on the total cost. So your LVR or your Loan to Value Ratio was based on the money that you were able to borrow on TDC.

Your Return on Equity would have this sort of effect. So if all these things were to happen, sales were to move in this scenario you can easily see what the Worst-Case scenario could be.

These are the scenarios that I look at most of the time when I’m doing a feasibility, I try and check out this area and I see, okay, if the costs were to go up by another 6 % and my sales were to go down by another 7 %. What would it do to my bottom line?

Sensitivity Analysis -Return On Equity /GRV

And the last table here is the same thing. But in this scenario, it assumes that more equity was available to you because you borrowed money based on an LVR against your total sales value.

It is telling you the effect of the return on equity on your project in the last two tables.

So what you want to do is have a realistic scenario. First of all, you’ve got to have realistic figures in here. Now, I know when you’re starting out, it’s very difficult.

But you start off with averages and then you see, “OK, I might be 10 % off. Might be 7 % off”. “What does that do to my projects If my costs were to go up by 7 %?”.

I was more confident with my sales and I said, look, sales can move around 5 percent or so. So I’ll put those scenarios in there and see what it is doing to my bottom line.

Look at this scenario I have $850000 allowed ,can my sales go down to about $765000. Can they ?Are they can they not?. If you think that sort of massive drop off the top can not happen.

I’ve been in this area. I look at these houses, I look at these apartments. They are going right here for there for those sales. Is it $850000 ,might be a $810000 or so .

So you come in and tweak your percentage here and put in 3 %, for example. And that way you will know how this whole thing is moving. Now your Worst-Case scenario is 6 percent now. So you’re still breaking even.

So that’s your Worst-Case scenario. You still get your money back in this scenario. So this sensitivity section, I have not seen this anywhere.

And now I actually incorporate this into all my visibilities because I want to keep an eye on the Worst-Case scenario. Anytime I’m doing a development.

One Minute Feasibility Checklist

All The Information You Need To Complete A Property Development Feasibility In Under One Minute

A) SetUp

- Property Address

- GST

- GST Rate

- Currency Symbol

B) Acquisition Costs

- Land Value

- GST %

- Stamp Duty %

- Legals Acquisition Costs

This will calculate your Total Acquisition Costs.

C) Construction Estimate

- Land Value

- GST %

- Stamp Duty %

- Legals Acquisition Costs

This will calculate your Total Acquisition Costs.

D) Allocate Costs

- GRV (Sale Value/unit)

- Construction Allowance %

- Consultants Allowance %

- Council Contributions %

- GST Yes/No

- Marketing / Agents Commission Allowance %

- Miscellaneous + Legals +Marketing + Building Permit + Valuation per unit

- Finance Cost -TDC/GRV

This is how you can allocate your different development costs your Total Development Costs will get calculated.

E) Project Timeline

Finance - Land

- Land Loan - Finance %

- Interest %

- Total Periods(months)

- Finance - Construction

- Loan Draw - Utilization %

- Interest%

- Construction Time

Funding Tables

- Debt - LVR / LTV -%

This is when your Development Margin Cost will get calculated.

F) Target Development Margin

- Target Development Margin%

G) Return For Investors

- TDC(Rounded) Override

- Value/Share Override

- Subscription Value Override

- Min Share Block

Helps Work out ball park

H) Sensitivity Analysis

- Sales%

- Cost%

It gives you a glance into what might happen if things were to go wrong or things were to improve.

FAQs

What is preliminary feasibility?

A preliminary feasibility study is often used in due diligence to assess whether or not to proceed with a thorough feasibility study and as a “reality check” to identify project areas that need greater attention.

How long may the feasibility take?

A feasibility study should take 60 to 90 days to complete. Unless the market is scorching, don’t put up a lot of money, if any, inland sales agreements at this time.

Make sure any contracts you sign contain a refund of your money if you decide not to proceed with the project.