How to get private funding for real estate investing?

Unlock the potential and explore private funding to access capital for real estate investments.

Make smart decisions, build wealth, increase income streams, and gain greater independence!

What is Private Funding?

Private funding, or private lending, is when individuals or organisations provide a loan to an individual or business. Private lenders are often more flexible than traditional sources of financing, such as banks and other financial institutions.

Private funding in real estate investments may include cash from family and friends and investments from individuals on crowdfunding sites.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What is a Private Investor For Real Estate?

Private money lenders or private investors usually pool funds. These are the people or institutions with a high-risk tolerance and a desire for better investment returns.

Private money lenders usually have more flexible terms or other perks that property investors may find appealing. Since they aren’t subject to the same rules as traditional lenders, it’s up to the lender to decide the loan terms.

How can I get private funding for real estate investment?

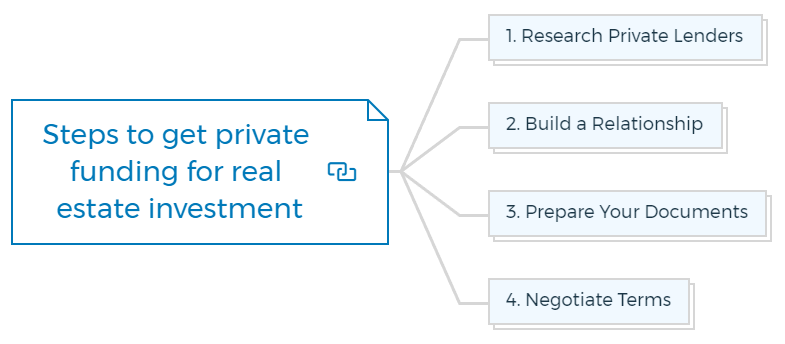

Here are some steps to get private lenders for your next real estate opportunity -

1. Research Private Lenders

The first step to getting private funding is researching private lenders and deciding which type best suits your needs. Consider factors such as loan terms, interest rates, fees, and repayment options.

2. Build a Relationship

Building relationships with private lenders is key to securing the funding you need. Reach out to potential lenders, introduce yourself, and explain your investment goals. Showing you’re a responsible borrower can help increase the likelihood of getting approved for a loan.

3. Prepare Your Documents

Before applying for private funding, ensure you have all the necessary documents, including credit reports, business plans, financial statements, and other relevant documents.

4. Negotiate Terms

Once you’ve identified a potential lender, negotiate the loan terms to ensure it meets your needs.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Why consider Private lending?

- Private lenders can tailor loans to purchasers’ needs and finances.

- You can obtain private mortgages more quickly and efficiently than bank mortgage loans.

- Private money loans typically don’t have a credit or income criteria.

Investors can use the private fund in two ways -

Say you buy a rental property with a typical mortgage but wish to negotiate a lower interest rate or shorter payment period. Private money lenders can refinance and lower deal prices.

Private money is appealing because investors can provide profit shares to lenders (rather than loan repayments).

Private money loans enable investors to buy residential, commercial, and multifamily properties. The key to acquiring these loans is to do the statistics and make the correct pitch.

With private money, investors can buy new deals much faster than with money from banks or other lenders.

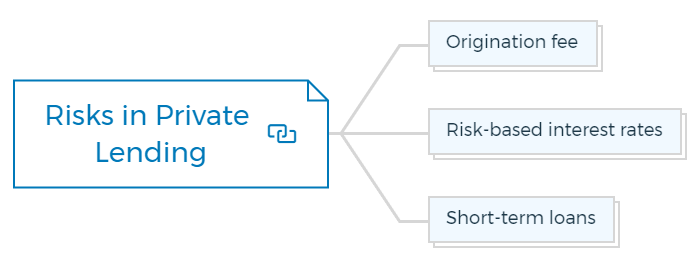

Risks in Private Lending

2-5% of the loan amount, interest rate, and brokerage if a specialist introduces the loan.

Most private lenders want a return of 9–15%pa, and some even want 20%pa.

Unlike banks that allow you to pay back in 30 years, most private lenders require you to pay back in 6-12 months, with some allowing two years.

How do I qualify for private finance?

To be eligible for private funding, you need to have a good credit score and demonstrate that you can make timely payments.

Having a well-written business plan and showing potential lenders the value of your investment are also essential factors in determining if you qualify for private funding.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber