Continued from…

Ultimate Guide To Getting Started In Property Development [Part 1-2]

Property Development Finance

Once you’ve conducted your financial feasibility study and determined that your project will be worthwhile in terms of profitability, you’ll need to work out how you’re going to finance it.

Development finance is significantly more complicated than obtaining a normal retail loan for a straightforward buy and hold property investment, so it’s essential to have a thorough understanding of how it works.

This is a crucial part of the development process; without finance, there is no project, unless you’re able to fund the entire project yourself, which not only is unlikely but also does not make business sense.

While you’ll be borrowing significant funds, you will also need some equity to put into the project, and you’ll know exactly where your personal capital is required from your financial feasibility study.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

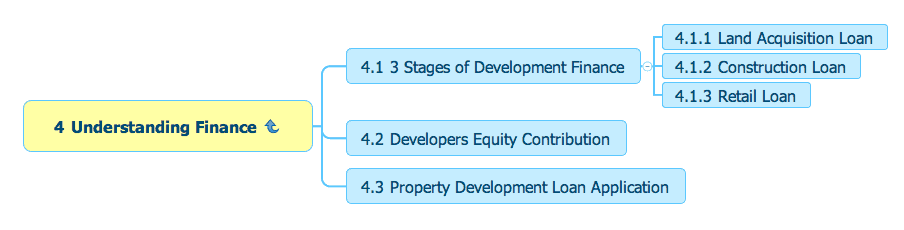

The 3 Stages Of Property Development Finance

Land Acquisition Loan

When you purchase a development site you usually get a long-term retail loan from a lender, and you start making loan repayments as soon as it settles. If there’s an existing house on the land you can rent this before the development begins to help with repayments.

It’s important to note that lenders don’t like providing loans for investors that are simply land banking unless the land is in an established suburb and they know they can sell quickly if necessary.

If it’s a block of land in the outskirts of a city they will want the purchase to be part of a full development loan; otherwise, you must fund the land purchase yourself, and developers do this mostly through joint ventures, particularly for subdivisions.

It’s common for developers to partner with someone who already owns a block of land, and to use their skills to undertake the development.

Construction Loan

This is for the building phase of the development and will usually consist of an interest-only loan, but it differs from a normal loan in that the interest will likely be capitalized.

That is, rather than making regular interest repayments during the construction phase, the interest charged each month will instead be added to the total amount you owe, and you then start making repayments when the project is completed.

Some lenders will also finance the GST, by extending an overdraft facility, but some won’t. If it’s the latter you can claim the GST regularly through your BAS statement – doing this helps with cash flow, and interest is calculated on the drawn-down amount.

Retail Loan

If, upon completion of your development, you decided to hold some or all the properties you’ve built you’ll need to get another retail loan. It’s advisable to get an offset account or a line of credit attached to it.

Learn More

Developers Equity Contribution

Generally, you’ll be required to cover 20% to 30% of the total costs of your development, with lenders usually only allowing developers to borrow the remainder, being 70% to 80%.

The loan-to-value ratio (LVR) the lender allows you to have will depend upon your project; if you are building less than three-four dwellings it’s considered a residential development, but if it’s more it’s classed as commercial, which usually requires more equity from the developer.

Either way, the LVR will be much lower than that for a “buy and hold” investment. Part of the funding you’ll be required to input yourself will be at the conceptual stage of the development.

Since it’s not funded by traditional lenders, this initial capital usually comes from private funding or seed capital – that is, it either comes from the developer’s personal assets or their friends and family, as either an equity stake or as borrowings.

It pays for costs such as consultants’ fees and required reports, to progress the development and get it up to the development approval or planning permit stage.

Since development loans are provided in staged payments developers often need extra funding to get by in between. If you need short-term access to funding outside the three main stages the options include bridging loans, caveat loans and non-recourse loans, as well as mezzanine finance.

These are usually offered by specialized lenders willing to take the extra risks. Beware that they usually come with higher interest rates, so using this funding can erode your profits.

Property Development Loan Application

Property Development is a riskier proposition than a simple buy and holds property investment to not only an investor but also to a lender.

As a result, the process for applying for development finance is more complicated, with the lender’s research being more thorough and restrictions being tighter.

This is a constantly evolving field, with conditions and loan types changing, especially between lenders, so you’ll need to keep abreast of changes.

A good place to start when applying for a loan is by handing over your property development financial feasibility to your lender – this will enable you to demonstrate you’ve done your homework and that the numbers stack up, proving the project will be profitable.

While there is a wide range of factors lenders will consider for your application, the end-product of the development is what they’re particularly interested in, as this will be the security for the money they’re loaning you.

Mostly, they’ll want to ensure that if a mortgagee in possession situation occurs they’ll be able to sell the end-product and get their money back.

As well as scrutinizing your development and financial feasibility, lenders will also analyze the developer to ensure they can service the loan, have experience and can provide the necessary equity. A proven track record or some sort of an experience in the field is what the lenders will be looking for.

They are not only after the serviceability and equity but lenders these days also consider your ability to execute the development.

Most newbies can circumvent their lack of experience by having an experienced mentor who looks into everything they do and guides them through their first development.

To maximize your chances of the loan/s being approved, you should approach the lender in the most professional manner, preparing and submitting a detailed application. It should include the following details:

- Site particulars – including the site description and zoning

- Development particulars – including the type and the design concept

- Costings – Including the feasibility study with gross realization value and profit margin

- Scalability Analysis – including the strengths of the end product and why it will appeal to buyers, such as location, quality and suitability to the target demographic

- Project timelines

- Personal details of the developer – including your financial situation, such as the equity you can input and your experience.

- Development team’s details – including their experience, with examples of other projects they have delivered.

If you need help with finding the right lender and getting your loan submitted correctly and approved, it’s wise to seek the help of a professional, such as a specialized development finance broker.

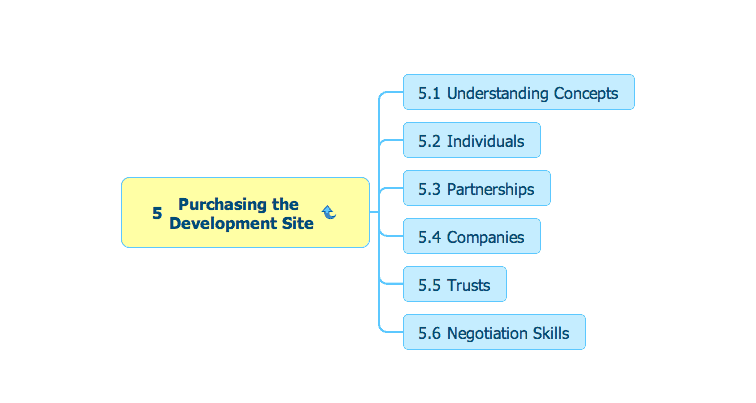

Purchasing The Development Site

Once you’ve secured funding for your development project, you can move ahead with the purchase of the site. But before you act you’ll need to determine which entity you’re going to buy the property in.

It might seem logical to buy it in your own name but this may not be the best course of action, as it may not provide you with the best asset protection or help you minimise the tax implications.

You must seek specialist advice from your accountant from the outset to determine which name you’ll buy the property under. It’s wise to set up the right structure from the beginning to avoid any costly changes down the track.

Your accountant will consider your individual circumstances and the specific project you’re undertaking and determine what the best financial structure should be to suit your requirements. There isn’t a one-size-fits-all approach.

The way it’s structured will largely hinge on whether you’re undertaking the development on your own or with a partner, and what your long-term plan upon completion of the development is.

Your personal financial situation will also help determine the right financial structure for you.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Understanding The Concepts

While your accountant will advise on the best course of action as part of your wider investing strategy, as a developer you should have a good understanding of the different ways you can structure things and why.

Spend time researching the various investment structures so you can make a more educated decision.

Property developers undertaking small-to-medium residential projects often use a new entity and/or structure for each project, largely to minimize risk.

The investment structure refers to the way your investments are legally owned, and following are some of the main entities through which to buy:

- Individual – The simplest ownership vehicle is to hold investments in your own name. Benefits include the ease and the administration of it, the low cost and it’s tax effectiveness, especially if you are a high-income earner. The big disadvantage is the lack of asset protection.

- Partnership – Also relatively simple and is a separate entity for tax purposes. It must distribute income to the partners but does not pay tax. It offers no risk protection.

- Companies – This is usually used for a business rather than property investments, but a development is similar to a business hence it could be a good way to go, depending upon your situation. The benefit is that the tax rate on profits is 30% and it offers some asset protection, but drawbacks include that investment sales aren’t eligible for a capital gains tax discount. It has high set up costs, but some asset protection and can work well for investors.

- Trusts – There are three main types – discretionary, unit and hybrid – with ranging benefits and disadvantages. Trusts are a popular investment structure and often provide for asset protection.

The tax issues associated with a development can be complex, especially if you want to sell some of the end-product but keep some in your portfolio long-term.

Often companies are used as development vehicles and trusts are used to hold properties long term, due to their potential for the 50% CGT discount when it’s eventually sold.

When selecting a financial entity for your property development project, you should consider tax implications, asset protection, long-term goals and your personal financial situation along with the level of flexibility required.

Property Development & Negotiation Skills

Remember that the price you pay for your development site will determine your profit margin, so it’s critical you negotiate at the time of site acquisition.

If you have done your financial feasibility correctly, you will know the maximum price you can pay for your financial feasibility to stack up.

So, one method when negotiating is to simply impart this to the seller & the real estate agent, rather than haggling over price. Must Read: How to control property with little or no money?

This involves simply sharing your knowledge with them, telling them what you can do with the land and what the costs are, leaving you with a figure of $x that you can afford to pay.

Show them the financial feasibility if you need to, to back up your claims with facts and figures.

The golden rule of negotiating is to refrain from getting emotional & always having your BATNA (Best Alternative To Negotiable Agreement).

As a developer, a deal is all about the numbers; it’s not about your love of the site, but the profit you can make at the end of the day. If it doesn’t stack up, walk away; it’s not worth the risk & the hassle.

For this reason and this reason alone, I never buy a development site in an auction and neither do I negotiate to pay more for a site.

It’s important to understand that negotiating isn’t just about the price of the block. To make your offer more attractive to the vendor you can also negotiate on the terms of the purchase, such as settlement times, inclusions and access, or even losing the “subject to finance” clause if you are confident of what you are doing.

Sometimes offering the most favourable conditions will get your offer over the line, even if there’s one on the table for a higher amount. While you certainly want to secure the development site at the best possible price it’s often unwise to lowball the seller.

This will immediately put them off and no matter what special conditions you offer they probably won’t accept, dismissing you as a tyre kicker.

In fact, offering your best offer first might even get you over the line immediately. Again, all this will depend upon where the market is at, at the time of purchase.

It’s also advisable to act quickly when you find the right property and be prepared when it comes to the way in which you will negotiate.

You can even try role play to develop possible responses in advance to lots of different scenarios, so that if the vendors say “X” you can respond with “Y”.

Be forthright and put your money where your mouth is, submitting a written contract with a holding deposit to show you’re serious.

Negotiating is a skill, and if you do it right it can result in thousands of dollars in savings. If you get it wrong, however, you can either end up paying too much or a perfectly good deal could slip by.

It’s especially crucial to negotiate well in a hot market because if you don’t step up, there are plenty of other buyers who will come along and pull the rug out from under you, and agents will only be more than happy to oblige the vendor.

If you don’t have good negotiating skills then either get educated and become a master, or seek the help of a professional to do it on your behalf (hopefully you’ll be able to claw back this cost by paying less for the purchase price).

From your due diligence you would have established the right product fit for your development site, and after settling on the purchase you’ll need to refine and finalise your project concept.

The next step is to then get permission for undertaking your development and to progress your project with the help of various consultants.

Obtaining Permits

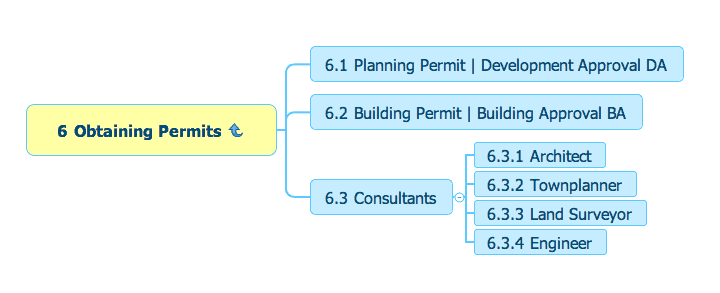

The two broad permits you’ll need to apply for are 1) Planning Permit also known as Development Approval (DA), and a Building Permit also known as Building Approval (BA).

A planning permit or DA gives permission for a development on a particular piece of land.

To obtain the DA, you make an application to the local council, which will then either grant the permit or a notice of the decision, depending on whether there are any objections to the application.

If you are given the latter you may need to revise your application in some way to address objections.

You will then usually get your DA or permit after a cooling-off period, but be aware that a strong objector can lodge a claim with the Civil and Administrative Tribunal (or equivalent in your state or territory), which can delay your development by months.

One way of tackling this and avoiding a trip to the tribunal is to approach the objector directly and try to appease them by handling their objection – perhaps by showing them shadow diagrams to prove there are no shadows affecting their property if that’s the issue and it occurs more often than not.

If the council refuses to grant you a permit or you aren’t happy with the conditions of their approval you have the option of lodging an application for review in the Civil and Administrative Tribunal as long as your development was designed within the residential codes.

One of the keys to getting fast development approval is to buy correctly – if you buy a site that already has the right zoning and no overlays or an overlay that is conducive to development, it will be easier to get a DA and subsequently a BA, which is a permit for the method of construction for your development.

If your site doesn’t have the right zoning, there are overlays, or you’re trying to increase the density higher than what the res-codes allow in the area, the approval process could be dragged out significantly.

There are many risks associated with property development. To find out more, read a post I wrote a post on How To Manage Risks in Property Development?

Watch A Video On How To Handle Objections In Property Development?

Consultants & Professionals

You’ll need to engage various consultants and put together your property development team to help you obtain approvals, prepare relevant reports and progress the project.

It’s crucial to know exactly who you need when applying for a DA, and from there a BA – to determine which consultants you require at each stage and what you need from them.

Here’s a basic outline of what they do, but is by no means exhaustive:

- Architect – An architect is involved right throughout the process, and their tasks are many and varied. They design your development to provide the highest and best use for the site, but they’re also involved in town planning and may also administer the building contract and oversee construction.

- Town planner – A town planner plays a vital role, working with the architect to ensure the development fits within the planning regulations in the relevant council area. They should also be able to help avoid objections to your development by identifying possible issues and working with the architect to create a design that overcomes these.

- Land Surveyor – The task of a land surveyor includes determining the boundaries of the site and conducting a set-out survey, which sets out the exact position of the building within the legal boundaries of the site.

- Engineers – Engineers ensure the build is structurally sound and depending on your project, you may need more than one type.

Marketing Your Development

You can start marketing your project as soon as you’ve got approvals.

Marketing is one of the most crucial aspects of your development, as without marketing you will not be able to sell your development.

Concept And Design

In coming up with a concept and design for your development you need to be conscious of creating a product that will sell, and if you’ve done your due diligence properly you’ll have this covered.

Regardless, you’ll still need great marketing to sell the lifestyle associated with buying into the development and get sales across the line fast.

Pre-Sales (Off the Plan)

Traditionally marketing would have started when the product was completed, and real estate agents could simply show potential buyers through. But these days the landscape has changed, with marketing kicking in much earlier in the project.

Why? Because lending restrictions have tightened, and banks are becoming more strict with pre-sales requirements in order to de-risk the project and safeguard their interest.

Often they require at least 50-60 per cent of the final product to be sold off the plan before construction commences, and they’ll want updates on sales as the project progresses.

Since off-the-plan sales are so important there’s now much more involved in marketing than just getting a real estate agent on board – although this will be part of it.

Buyers Perception

Buyers need to be able to fully envisage the completed product even though there’s nothing physical for them to see, so it’s important to get quality renders and material boards done as part of your marketing mix.

While traditional marketing such as flyers and print advertising is still around, digital marketing is catching up fast. Any way in which you can show the property digitally – perhaps even through virtual reality or 3D visuals is a plus.

Marketing Renders

Avoid the temptation to get cheap renders – your sales will hinge upon potential buyers being able to really get a feel for your completed product, and they won’t be compelled to buy if your renders are sub-par, especially if your product is $500K+, which is a very significant investment for anyone.

Marketing Material

The marketing material you should also include a finishes schedule to show buyers the colour scheme and the materials that will be used.

You can even get a materials board done so people can physically touch the materials, such as the tiles, floorboards, and materials for the kitchen benchtops and sample finishes.

Think Outside The Box

Think outside the box when it comes to marketing – online is where it’s all happening these days, so look at various options. It could be through having a website, direct advertising or even utilizing social media to reach your target market.

Whatever you do to market your development, just make sure you understand your target market and determine how to reach and engage with potential buyers. And lastly, make sure your product is priced right.

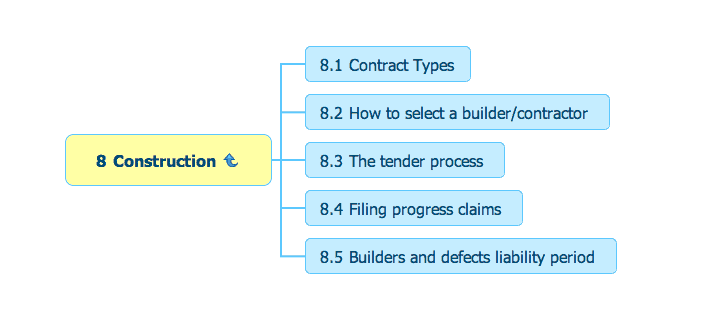

Construction

As soon as you’ve got your permits and you’ve put a marketing plan into action to get some pre-sales, you’ll need to get the development springing into life by getting started on the construction.

You don’t need to be a builder to get this right, but like everything, you should have a thorough understanding of the processes involved.

Your knowledge of the construction phase should include – but is not limited to – the following:

Type Of Construction Contracts

A fixed price contract is often the best option since you’ll know upfront what your costs will be.

Unexpected costs will often have to be covered by the builder, however, there are some unknowns, such as difficulties encountered with the landscape, such as hitting rock, that may have to be covered by the developer.

How To Select A Builder/Contractor

Just like any industry, there are good builders and there are bad builders, so careful selection is important.

It can be cheaper to subcontract building work, but for inexperienced developers, the easier option is to select a good licensed builder who has the relevant experience, insurances and comes highly recommended.

The Tender Process

Potential builders you’re considering will submit a tender for the work. Get a professional to compare their contracts if necessary.

Filing Progress Claims

Under most building contracts the contractor is paid progressively throughout the project. They submit progress claims which are then assessed by the QS appointed by the bank before the progress claim is released.

Builders And Defects Liability Period

When the project is completed, builders must issue a warranty and they’ll be responsible for any defects in the building during the period it covers.

Construction Costs

While you’ll have had an idea of the construction costs for your project from early on – especially if your quantity surveyor has prepared a cost plan – the final cost will be unknown until the end.

As you go through each process the cost of construction will change. It can’t be finalized until the development approval has been granted, for instance, as the council may request changes that will impact upon the cost of building and it will also depend on what happens when work on the site starts.

The costs of construction will be largely determined by two main factors – the availability of materials and labor.

Materials generally rise in price over time in line with inflation but if something is in short supply it will be more expensive, and if it’s imported the price will be affected by exchange rate fluctuations.

Labor costs are also impacted by demand and supply – if workers are in short supply the costs will rise, and vice versa. If you’re building in an area where there’s lots of development going on this is something to consider, as the shortage of skilled labor means your costs may be higher.

You should know the costs of these factors up front, but if your project drags on over a long period of time (more than, say, the usual six to 12 months) and something changes in terms of the supply, the costs can rise.

Keep in mind that construction costs are generally higher in areas where the cost of living is higher. It’s also often more expensive to build in regional areas due to the availability of materials and labor.

Each development site is different, so construction costs will differ from project to project – there isn’t a one-size-fits-all, even if you’re using the same plans.

There can also be problems with time delays, which can sometimes be avoided by getting a contract that specifies when a build must be completed, and if it goes over the builder can be held responsible for the extra costs.

Construction costs will also be dependent on the finish you go for. Don’t go for the cheapest option, but also make sure the product you’re constructing is suitable for the demographic you’re targeting and the sale price.

Your Property Development Strategy

You should know what your strategy is for the development – in terms of whether you intend to hold some or all of the finished product or sell it – right from the outset.

This is largely because it will impact many aspects of the development, such as being able to claim GST.

To determine whether you should keep some or all of the properties you’ve built it’s a good idea to look at the potential cash flow – if they’re going to be neutral or positively geared then it’s probably a good idea to hold them, as long as they also have capital growth prospects and you can afford it.

Often properties you’ve developed will offer good cash flow as you’ll have paid wholesale prices for it.

Whatever your strategy, it’s highly likely that you’ll be selling at least some of the properties you’ve developed to pay down the debt, and hopefully many of these will be your pre-sales, so you will have signed contracts ready and waiting for settlement upon completion of the project.

Settlements

To ensure these settle straight away you’ll need to make sure the titles are ready in advance; start this process around three months out from completion.

Having the titles ready on time means you can reduce your costs by reducing your interest.

At the end of the construction you’ve drawn down 100% of your construction loan, and you’ll be paying a huge amount of interest – it could be $400 to $1000 per day, depending on the size of your development, which will be eating into your profits.

If you’re keeping some of the finished properties, you may also need to refinance and get them tenanted ASAP to help you service the loans.

Selling the properties in the development means you’ll be able to realise your profit straight away, but you’ll also miss out on future capital growth that would come from holding the properties for the long term, and you’ll have to pay taxes on your profit and selling costs, eroding your profit margin.

The happy medium, therefore, is often is to sell some and keep some. If you keep some you can also realise your profit by accessing the equity to buy again, rather than using the profits.

Find Out More About Property Developer Courses.

FAQs

Is it worth getting into property development?

If you’re in a very secure financial situation, it is not worth thinking about how to go into property development. Bringing on a property to develop is a big step, and if you make a mistake, you might find yourself in a lot of debt with a property you can’t sell and even lose your house.

What makes a good property developer?

The most brilliant property developers have outstanding interpersonal and communication skills. They can connect with individuals from various walks of life and establish genuine connections rapidly.