Continued from…

Ultimate guide to commercial real estate leases [Part 1- 2]

How to calculate profit for lease options?

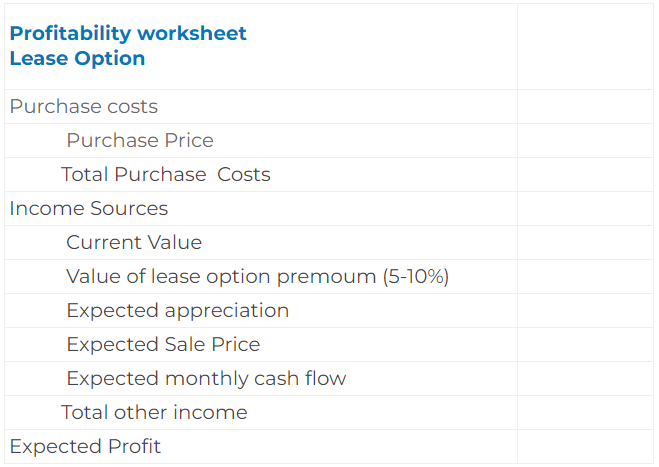

Start by constructing a worksheet to calculate the lease option’s profitability.

You will need to approximate appreciation because it cannot be predicted with precision.

Newspapers are a fantastic resource for local appreciation rates. Base your projections on the forecasts made by the real estate boards or local journalists.

Use 5% when figuring up your option premium in neighborhoods or condo complexes where all the houses are identical in size or model. The comparables should be available for the appraiser when you attempt to sell the home, and you may use up to 10% if the community is quite diverse.

Determine the cash flow or rental values as well. Similar to sales comparables, you may also use rental comparables. Here are three methods for finding comparable rentals:

- Read the local paper. Verify all of the nearby rentals. These are your comparables, or “comps.”

- Consult members of the local landlords’ group. The MLS does not list a lot of rentals.

- Are the statistics from the first two sources insufficient? Make a trial newspaper ad. Too many phone calls. You might be charging too little. Too few. You might be charging too much. Like fishing, you can try changing the bait to see what occurs.

Worksheet for calculating profits for lease options

You are missing out if you haven’t yet subscribed to our YouTube channel.

Profit calculation examples for real estate investor

Let’s understand the calculation with two different examples.

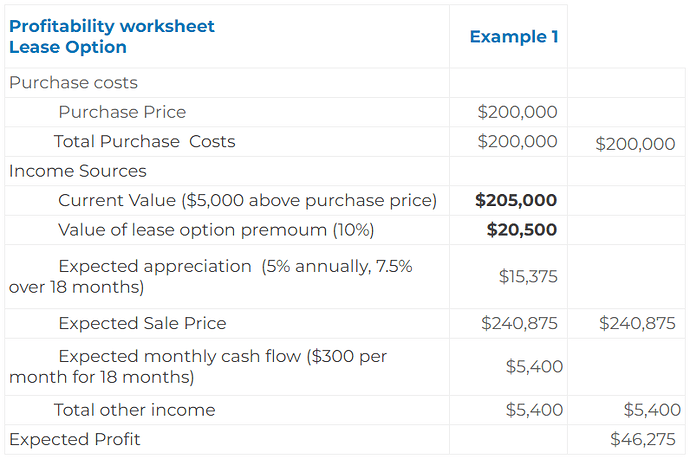

Example 1

For $200,000, the seller will sell you the house. At this time, it is valued $205,000.

The rate of appreciation is 5% annually. The price will increase by 7.5 per cent (5 per cent x 1.5 = 7.5 per cent) because it will be sold with an 18-month option. This results in an appreciation value of $15,375 ($205,000 x 7.5%) over the 18 months.

Rent will cost you $1,500 to the property owner. You may rent it out for $1,800, generating a $300 monthly income.

This area has a wide variety of distinctive residences. From $180,000 to $300,000 is the price range.

As a result, we can include a more significant option premium of 10%, or $20,500. The home’s retail value has increased by $35,875, thanks to the $20,500 option premium and the $15,375 appreciation.

What is the projected profit for the next 18 months? Let’s look at how to calculate the dealer’s profit:

The resulting profit from this transaction, fewer transfer fees, title insurance, and potential option credits from the investor (you) to the buyer would be about $46,275 if all payments were completed throughout this option period and lasted the whole 18 months.

Does this generate the profit you need? Move forward with these terms if that is the case. If not, you can either reject the offer or continue the negotiations.

Ultimate Getting-Started Guides To Property Development

Everything you need to get started in property development.

Includes 6 x detailed eBooks [159 pages]

✓ My Secret Property Development Process (42 Pages)

✓ Preparing For Your First Property Development Project (29 Pages)

✓ How To Choose Property Development Courses For Fast Results (24 Pages)

✓ What Does The Property Clock Say? (14 Pages)

✓ Property Market Cycle – Get In Or Get Out? (31 Pages)

✓ Bonus: Property Investment Strategies: Definitive Guide (19 Pages)

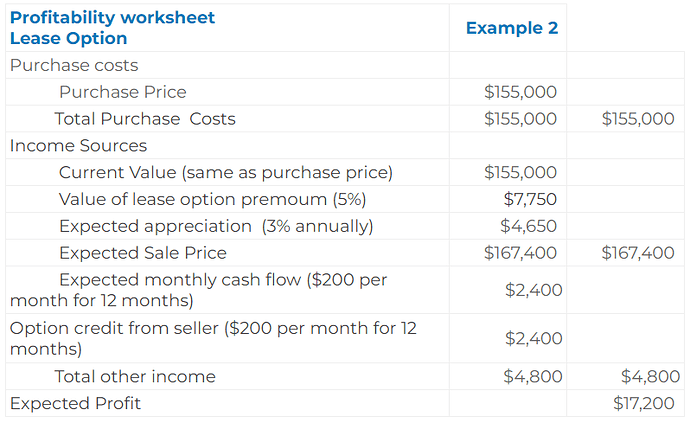

Example 2

On a 12-month option, the seller will sell you their house for $155,000. It is valued at $155,000. If the appreciation is 3 percent annually, there will be an extra $4,650 ($155,000 x 3 per cent) after one year.

This house is located in a neighborhood where all the houses are identical and cost between $150,000 and $158,000. This yields a more reasonable option premium of only 5%, or $7,750 ($155,000 x 5%).

($4,650 + $7,750) The appreciation plus the option premium is $12,400. The property owner will receive $1,200 in rent from you, and you’ll charge $1,400 for the rental.

You can also get a $200 monthly credit from the seller toward the purchase of this house.

Let’s examine the anticipated annual profit:

For an investor, this transaction would not be nearly as profitable. Before closing fees, it would only make $17,200, leaving little room for unforeseen issues. This opportunity might fall short of your minimum profit standard.

There are, however, methods for renegotiating the agreement with the seller. It must be more of a buyer’s market with a low appreciation rate.

You ought to be able to haggle over the cost and the terms. Request a lower price and more monthly financing for the property purchase.

You can also request a buy-down of the mortgage’s equity during the option period. You would receive the $10,000 credit that was paid on the mortgage balance during the option period since you had been making that mortgage payment during that time.

For instance, if the seller owes $100,000 on the house at the beginning of this option and only owes $90,000 at the end, you would receive that $10,000 credit.

Allow the transaction to stall if the seller refuses the new conditions until they become sufficiently motivated to accept them and the deal meets your profit criteria. It must achieve your bottom line and produce a win for both the buyer and the seller.

Final words

Leases are important commercial contracts and should be reviewed by a lawyer specialising in this area.

If you’re a tenant, it’s important to know your rights and what to expect from your landlord. If you’re a landlord, it’s important to understand the commercial tenant’s perspective and be reasonable when setting rent increases.

So, what is a commercial lease? How do you go about leasing a property for your business? What should be included in the lease agreement? And finally, what are some of the things that can happen during a lease agreement – like rent increases or early termination? Hope this article has answered all of those questions and more.

If you’re still unclear on any aspect of commercial leases, don’t hesitate to get in touch. Register for Free Quick Start Property Development Course, and take the steps for successful property development.

FAQs

What is the difference between a gross lease and a net lease?

There are a few key differences between gross and net leases. A gross lease typically means that the base rent is all-inclusive and does not factor in additional charges like property taxes or insurance.

On the other hand, a net lease typically means that these additional charges are factored into the rent amount. In addition, gross leases often have shorter terms than net leases.

Another key difference between the two types of leases is who is responsible for maintenance and repairs. In a gross lease situation, the landlord is generally responsible for taking care of any necessary upkeep on the property. However, with a net lease, the tenant may be responsible for maintaining and repairing the property – or at least some portion of it.

What is the most common lease for the retail property?

The most common lease for the retail property is a triple net lease. A triple net lease is a commercial real estate lease in which the tenant or lessee agrees to pay all or a part of the property’s taxes, insurance, and maintenance costs. Triple net leases are also known as NNN leases.

How do real estate leases work?

A lease is an agreement between a tenant and a landlord in which the tenant agrees to pay rent to the landlord in exchange for the right to use and enjoy the landlord’s property.

The most common type of lease is a fixed-term lease, which specifies the beginning and end dates of the lease. At the end of the lease term, the tenant must either vacate the property or renew the lease for another term.

Leases can also be month-to-month, which means that the lease automatically renews every month unless one party gives written notice that they will be terminating it. This type of lease is popular among renters because it allows them to move on if they easily find a better deal elsewhere.