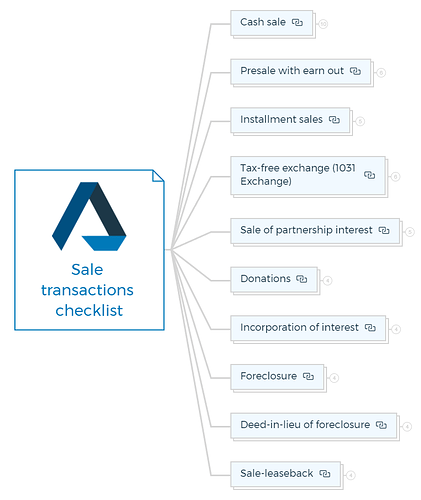

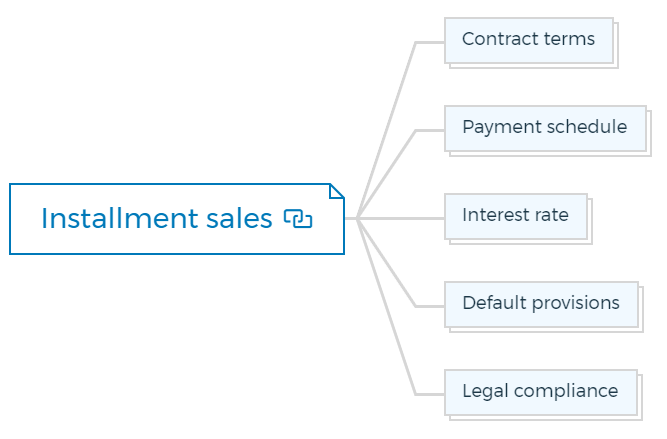

1. Cash sale

1.1. Property valuation

Determine the fair market value of the property.

1.2. Title search

Perform a thorough title search to ensure clear ownership.

1.3. Negotiation

Negotiate the sale price and terms with the buyer.

1.4. Contract preparation

Draft a purchase and sale agreement outlining the terms.

Learn More

1.5. Due diligence

Complete property inspections and investigations.

1.6. Financing verification

Ensure the buyer has the necessary funds for a cash transaction.

1.7. Closing process

Coordinate the closing process with all parties involved.

1.8. Escrow account

Establish an escrow account for funds handling.

1.9. Closing costs

Calculate and allocate closing costs.

1.10. Transfer of title

Execute the deed transfer and record it with the appropriate authorities.

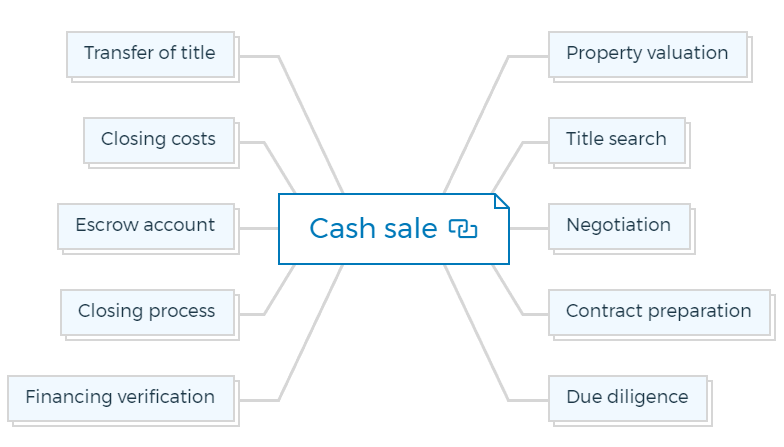

2. Presale with earn out

2.1. Earn out agreement

Draft a detailed earn-out agreement specifying conditions.

2.2. Valuation metrics

Define the metrics that trigger earn-out payments.

2.3. Legal review

Consult with legal counsel to ensure compliance.

2.4. Due diligence

Conduct thorough due diligence on the buyer.

2.5. Escrow agreement

Create an escrow agreement for earn-out funds.

2.6. Reporting mechanism

Establish a reporting mechanism for earnings tracking.

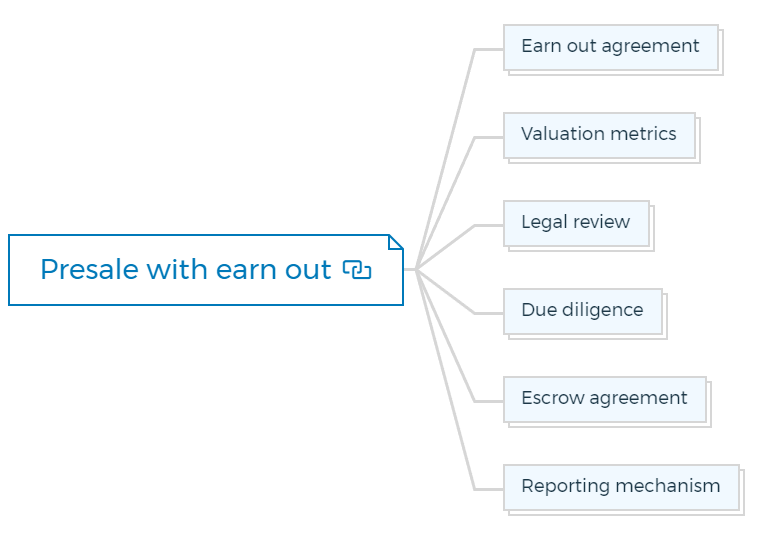

3. Installment sales

3.1. Contract terms

Clearly outline the installment terms in the sales agreement.

3.2. Payment schedule

Create a payment schedule with due dates.

3.3. Interest rate

Determine the interest rate (if any) on the installments.

3.4. Default provisions

Specify default provisions and remedies.

3.5. Legal compliance

Ensure compliance with installment sale regulations.

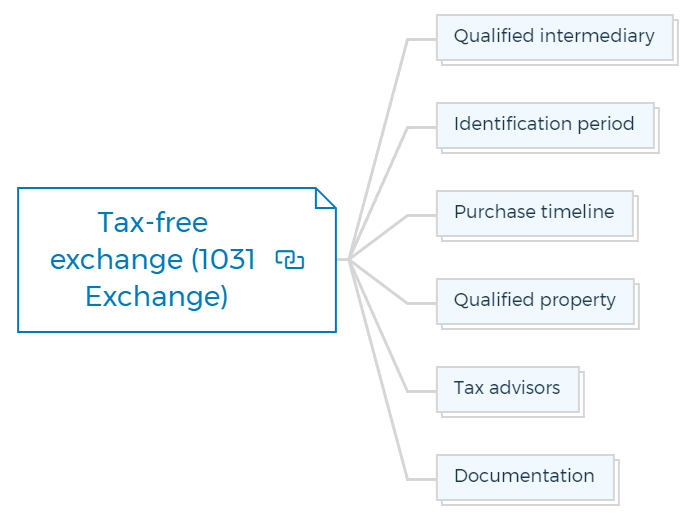

4. Tax-free exchange (1031 Exchange)

4.1. Qualified intermediary

Select a qualified intermediary to facilitate the exchange.

4.2. Identification period

Adhere to the 45-day identification period.

4.3. Purchase timeline

Complete the acquisition of the replacement property within 180 days.

4.4. Qualified property

Ensure the replacement property meets IRS requirements.

4.5. Tax advisors

Consult with tax professionals for guidance.

4.6. Documentation

Properly document the exchange process.

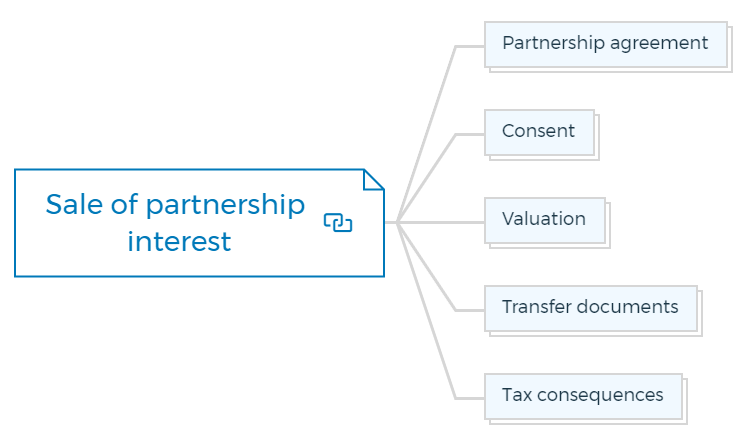

5. Sale of partnership interest

5.1. Partnership agreement

Review the partnership agreement for sale provisions.

5.2. Consent

Obtain consent from other partners if required.

5.3. Valuation

Determine the fair market value of the partnership interest.

5.4. Transfer documents

Prepare the necessary transfer documents.

5.5. Tax consequences

Assess the tax implications for both the seller and buyer.

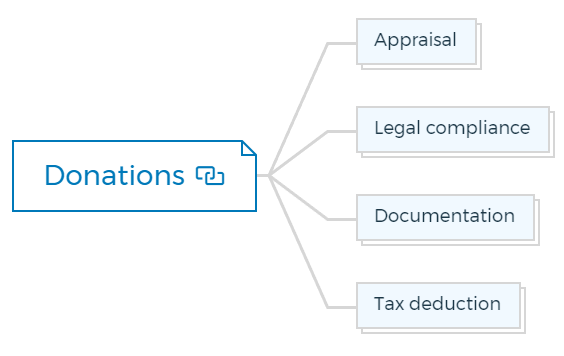

6. Donations

6.1. Appraisal

Obtain a qualified appraisal for the property’s value.

6.2. Legal compliance

Ensure compliance with IRS regulations for charitable donations.

6.3. Documentation

Maintain records of the donation for tax purposes.

6.4. Tax deduction

Verify eligibility for tax deductions.

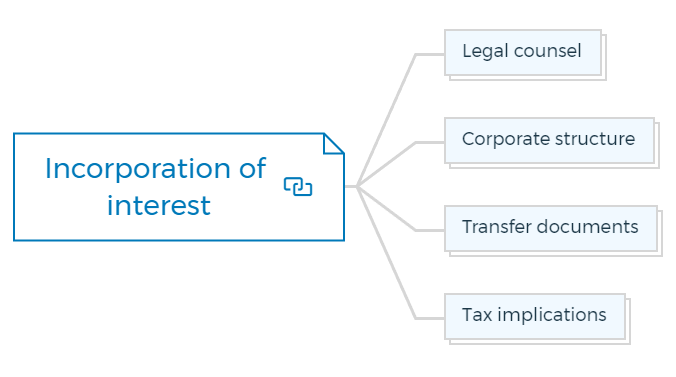

7. Incorporation of interest

7.1. Legal counsel

Consult with legal counsel regarding incorporation.

7.2. Corporate structure

Choose an appropriate corporate structure.

7.3. Transfer documents

Prepare the necessary transfer documents.

7.4. Tax implications

Consider the tax implications of incorporation.

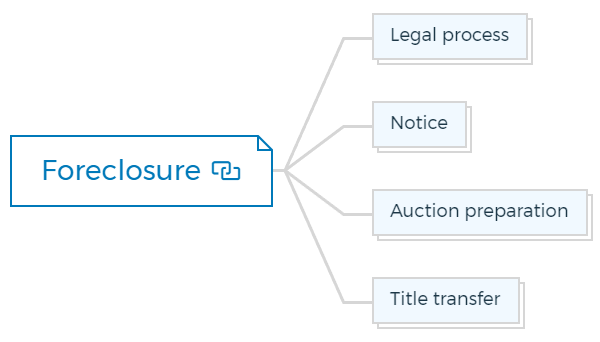

8. Foreclosure

8.1. Legal process

Understand the foreclosure process in your jurisdiction.

8.2. Notice

Provide required notices to the defaulting party.

8.3. Auction preparation

If necessary, prepare for a foreclosure auction.

8.4. Title transfer

Ensure clear title transfer upon successful foreclosure.

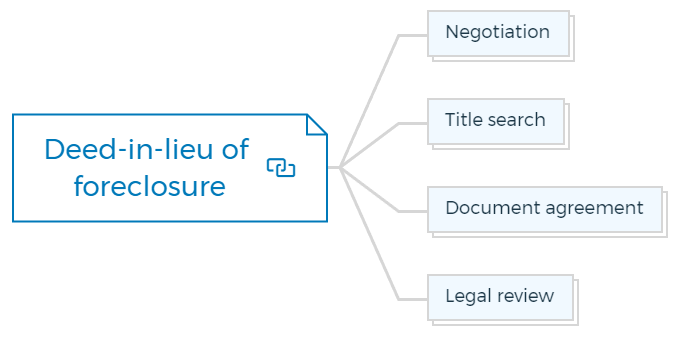

9. Deed-in-lieu of foreclosure

9.1. Negotiation

Negotiate with the defaulting party for a voluntary transfer.

Learn More

9.2. Title search

Perform a title search to verify ownership.

9.3. Document agreement

Prepare a deed-in-lieu agreement.

9.4. Legal review

Consult legal counsel to ensure compliance.

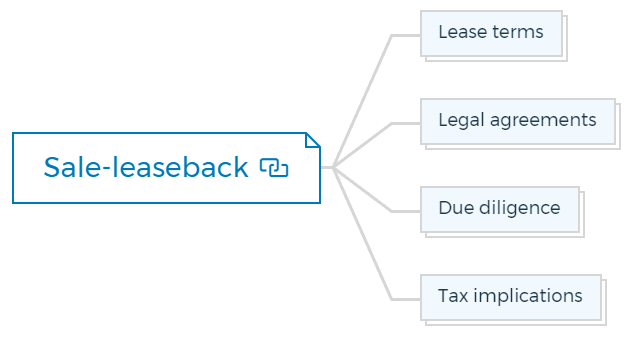

10. Sale-leaseback

10.1. Lease terms

Establish lease terms and rental rates.

10.2. Legal agreements

Draft a sale-leaseback agreement.

10.3. Due diligence

Conduct due diligence on the buyer/tenant.

10.4. Tax implications

Assess the tax consequences of the sale-leaseback arrangement.