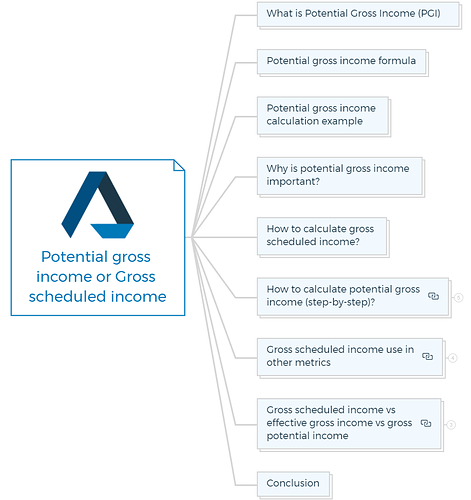

Potential gross income or gross scheduled income in real estate

Potential Gross Income (PGI), also known as Gross scheduled income, is a crucial metric in real estate investments, rental property management, and other related industries.

What is Potential Gross Income (PGI)?

PGI, potential gross income or gross scheduled income, is the maximum income a property can generate in a given period if all of its units or spaces are fully rented out at market rents without considering any deductions for expenses.

In short, it is the maximum potential income without regard to any possible vacancy or credit losses.

For example, suppose a property has ten apartments, each renting for $1,000 monthly. In that case, its PGI would be $10,000 per month or $120,000 per year ($1,000 x 12 months x 10 units).

Potential gross income formula

PGI = Number of Units x Market Rent

Potential gross income calculation example

For instance, a commercial property with 50,000 rentable square feet and $30 per square foot market rent.

Its annual potential gross income would be $1.5 million ($30 x 50,000 sq. ft.). A property with ten $1,000-per-month rental units has a $120,000 PGI for a year.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Why is potential gross income important?

Property managers, investors, and lenders need PGI. It estimates a property’s maximal revenue and profitability. Potential growth income is also used to compute net operating income (NOI).

You can calculate NOI by deducting operating expenses from PGI. NOI determines property value, cash flow, and ROI.

How to calculate gross scheduled income?

Gross scheduled income is a property’s total potential rental income based on existing rental contracts and predicted rental prices for vacant units or spaces. The formula for Gross scheduled income is:

GSI = Rent from occupied space + Potential rent from vacant space

Where:

Rent from occupied space

This is the total rental income payable for that year under existing contracts for occupied space. All current renters are included.

Potential rent from vacant space

The property’s annual rental income is based on market rental rates for vacant units or spaces. This includes rental money from unoccupied units or spaces.

This calculation assumes that all rental units are occupied or may be rented out at market rates without deductions for vacancy or credit losses. Market conditions, tenant turnover, vacancies, and other running expenses may affect the property’s rental income.

Learn More

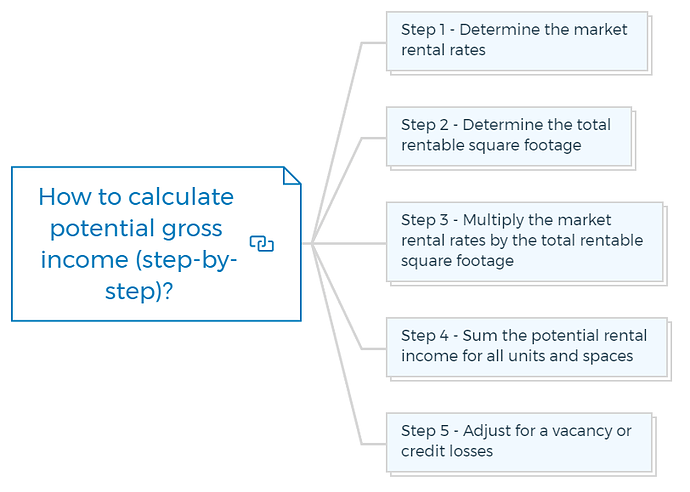

How to calculate potential gross income (step-by-step)?

Here is a step-by-step guide to calculating potential gross income -

Step 1 - Determine the market rental rates

First, determine each unit’s market rental rate. Similar properties in the same location charge market rentals for comparable units or spaces.

You can use online rental listings, local real estate agents and property managers, and rental survey data to research market rental rates.

Step 2 - Determine the total rentable square footage

Then calculate the property’s rentable square footage. This is the total area of the property that is available for rent. The floor plan or interior space measurement will reveal this information.

Step 3 - Multiply the market rental rates by the total rentable square footage

Calculate each unit’s prospective rental income by multiplying the market rental rates by the total rentable square footage.

Step 4 - Sum the potential rental income for all units and spaces

Add up the potential rental income for all units or spaces in the property to determine the total Potential Gross Income (PGI) for the property.

Step 5 - Adjust for a vacancy or credit losses

Finally, adjust PGI for predicted vacancy and credit losses. This adjustment accounts for unoccupied or non-paying units. Local market conditions, location, and management, determine the adjustment factor.

A common adjustment factor is 5-10% of the PGI. The formula for calculating PGI can be summarised as follows:

PGI = (Market rental rate x Total rentable square footage) x Number of units

Where:

- Market rental rate

Each unit’s market-based rent.

- Total rentable square footage

The total area of the property that is available for rent.

- Number of units

The total number of units or spaces in the property.

- Vacancy and credit losses

Expected losses from vacancies or non-paying renters.

These steps help you calculate a property’s Potential Gross Income (PGI), an important metric used in real estate valuation and investment analysis.

Property Development Feasibility Study Bundle

Includes 5 x detailed eBooks (193 pages)

✓ Property Development Feasibility Study [THE KEY] - (45 pages)

✓ Real Estate Development ProForma - Ultimate Guide - (39 pages)

✓ Residual Value Of Land Vs Profit Margin - The Winner - (24 pages)

✓ Preliminary Development Feasibility Assessment - (35 pages)

✓ How To Choose a Property Development Feasibility Template? - (50 pages)

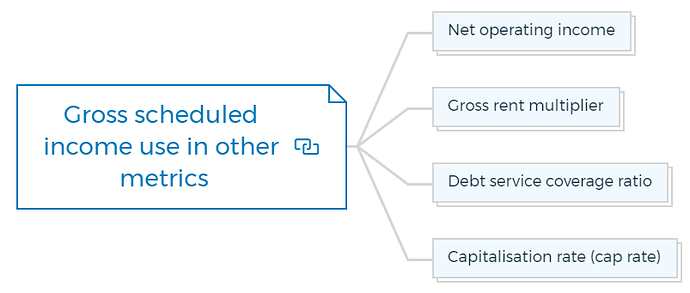

Gross scheduled income use in other metrics

Investment and real estate appraisal use Gross Scheduled Income (GSI). GSI is used in numerous measurements, including property income potential:

Net operating income

NOI is a property’s income after operating expenses but before debt servicing and taxes. The property’s total rental income before operating expenses, i.e. GSI is utilised to compute NOI.

Gross rent multiplier

GRM measures property value compared to rental income. Divide the property’s sale price by its yearly GSI. Lower GRMs indicate a higher property value relative to rental revenue.

Debt service coverage ratio

DSCR measures a property’s ability to generate enough income to pay its debts. Divide the property’s NOI by its annual debt service payments. NOI and DSCR are calculated from GSI.

Capitalisation rate (cap rate)

A property investment’s predicted return is based on its net operating income. Divide the property’s NOI by its market value. NOI and Cap Rate are calculated from GSI.

GSI is crucial to assessing a property’s potential income and value, as well as many other real estate measures.

Gross scheduled income vs effective gross income vs gross potential income

Real estate valuation and investment analysis use GSI, EGI, and GPRI. All metrics measure a property’s earning potential but handle expenses and deductions differently.

Gross scheduled income

If all units were occupied and tenants paid their rent according to their leases, a property may generate GSI.

This statistic comprises all occupied and unoccupied unit rent at market prices. GSI can estimate a property’s total potential income without considering expenses or deductions.

Effective gross income

After vacancies, credit losses, and other deductions, a property’s effective gross income (EGI) is its real income. EGI includes income from all inhabited apartments and other sources like parking and laundry.

Vacancy losses, credit losses, upkeep, repairs, property management costs, and property taxes are also deducted. EGI, unlike GSI, represents a property’s actual income potential.

Gross potential rental income

Gross Potential Rental Income (GPRI) is the maximum rental income a property could receive if all units were rented at market rates, independent of occupancy.

GPRI ignores leasing agreements, vacancies, and credit losses. It only shows potential rental income if all apartments were rented at market rates.

In essence, Gross Scheduled Income (GSI) is the predicted rental income based on current lease agreements, whereas Effective Gross Income (EGI) is the actual income after expenses and deductions.

Gross Potential Rental Income (GPRI) is the maximum rental income a property could make if all units were rented at current market prices, regardless of lease agreements, vacancies, or credit losses.

Learn More

Conclusion

In conclusion, property managers, investors, and lenders in real estate investments and rental property management need Potential Gross Income (PGI). It represents the maximum revenue a property can make if all units or spaces are fully rented at market rents without expense deductions.

Existing rental contracts and predicted rental rates for vacant units or spaces determine a property’s Gross Scheduled Income (GSI). Effective Gross Income (EGI) is a property’s rental income after vacancies and credit losses. PGI, GSI, and EGI determine the property’s net operating income (NOI), debt service coverage ratio (DSCR), capitalization rate (cap rate), and gross rent multiplier (GRM).

Real estate investors must understand these revenue parameters to make informed decisions and maximise profits.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber