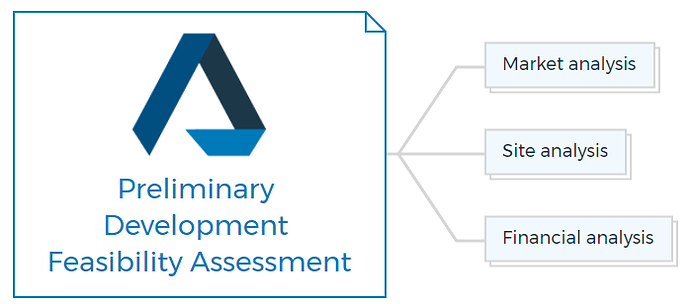

Preliminary development feasibility assessment

A preliminary development feasibility assessment is a process of evaluating the potential for a proposed real estate development project. This assessment typically involves analyzing a variety of factors, including the market conditions, zoning and land use regulations, the costs of construction and development, and the potential return on investment.

The goal of a preliminary development feasibility assessment is to determine if a proposed project is economically viable, and whether it is worth pursuing further.

The assessment typically includes:

- Market analysis - evaluating the demand for the type of property proposed and assessing the competition

- Site analysis - reviewing the physical attributes of the site, such as zoning, topography, and soil conditions

- Financial analysis - projecting the costs of the project, including land acquisition, construction, and carrying costs, and evaluating the potential return on investment.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Once the preliminary assessment is completed, the property developer can use the findings to make a decision about whether to proceed with the project or to make adjustments to improve the project’s feasibility.

This assessment is a crucial step in the real estate development process as it helps the developer to evaluate the potential risks and rewards of a proposed project before incurring significant costs.

Property Development Books - “Starter-Pack”

18 Property Development Books To Get You Started Now

Includes 18 x detailed eBooks

✓ Property Development Checklist - 6 Pages

✓ How To Finance Your Property Development Project? - 13 Pages

✓ Property Development Team - 19 Pages

✓ Site Acquisition Process - 14 Pages

✓ The Ultimate Guide To Getting Started In Property Development - 42 Pages

✓ My Secret Property Development Process - 28 Pages

✓ How To Nail Your Next No Money Down Deal? - 29 Pages

✓ Industry Insiders Guide To Managing Risks In Property Development - 26 Pages

✓ How To Become A Property Developer? - 41 Pages

✓ Do You Have What It Takes To Be A Property Developer? - 12 Pages

✓ 7 Common Mistakes Made By Property Developers & How To Avoid Them? - 12 Pages

✓ 5 Reasons, Buy & Hold Property Investors Fail At Property Development - 16 Pages

✓ 10 Financial Mistakes Made By Property Investors & Developers - 54 Pages

✓ My 26 Question Due Diligence Checklist - 21 Pages

✓ Property Development 101: The Feasibility Study - 34 Pages

✓ Property Development 101: Construction Guide - 55 Pages

✓ Property Development Blueprint - 66 Pages

✓ Your Definitive Guide To Property Options - 36 Pages

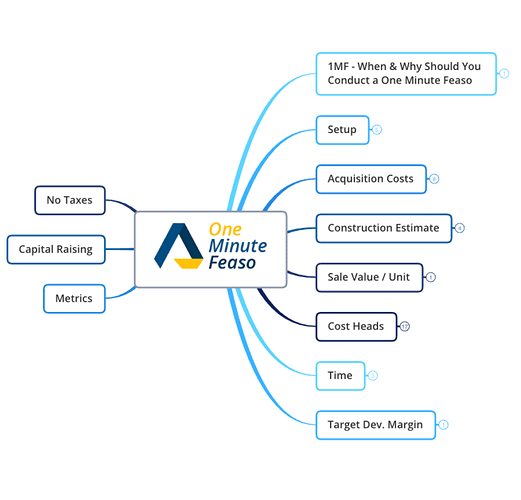

One Minute Financial Feasibility – the above image shows a screenshot of my one-minute feaso or quick feaso. This feaso tells me what I can expect to make for each unit.

It is so easy to use that even people starting out in property development can use it easily; there are only 10 input fields that you may have to fill out to get answers. So as you can see, it is ridiculously simple to run numbers using my financial feasibility applications.

Lead Developer Feasibility Suite – involves a lot more details and helps break down costs further in a lot more detail. It also takes into account the time value of money, for example, the cost of interest is calculated based on the time it is injected into the project rather than a flat per annum rate.