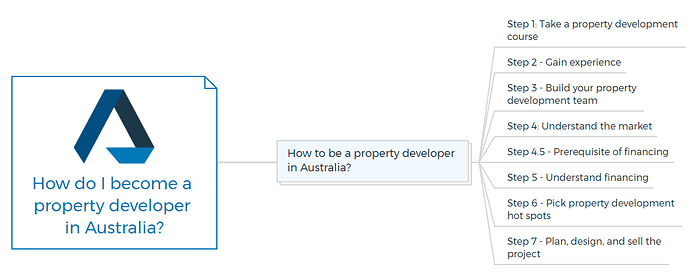

Looking for ways to become a property developer in Australia? Stick to these 7 steps and start making money through real estate development.

How to be a property developer in Australia?

Step 1: Take a property development course

No degrees required.

You can be a property developer in Australia without a degree. Here is how?

Learn the basics of property development online. There are multiple options you can opt for -

- Get yourself our property development books bundle.

- Take our FREE Quick start property development course.

- Enroll in a property development mentoring program. (get step-by-step guidance)

These courses equip you with the knowledge and confidence to undertake your first property development project with competence.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Step 2 - Gain experience

You don’t have to, but many property developers have a real estate, construction, or finance background. Getting experience in one of these fields can be beneficial in understanding the industry and the various aspects of property development.

Having more experience is usually helpful, but there is no rulebook to follow. My first project was a $4.2 million dollar development in another city away from where I live. I managed everything over th ephone and email and visiting the site 3 times in 2 years.

If you know the right strategy, you don’t need any prior experience to get started in the real estate development industry.

Learn More

Step 3 - Build your property development team

Building relationships with architects, builders, real estate agents, and other professionals in the industry can help not only in finding potential development opportunities but alos in execution.

Step 4: Understand the market

Familiarise yourself with the local property market and trends. Understanding the demand for different properties and their potential growth helps you find the scale of the project you can undertake.

By thoroughly analysing the market and the zoning restriction, you can get an idea of the development potential of a site.

Step 4.5 - Prerequisite of financing

A prerequisite of financing is understanding the projects financial feasibility. Have a robust understanding of your property development feasibility is essential to understand what you need to inject as developers’ equity and what you will need to seek financing for. If you don’t know where to begin, start with our feasibility software suite an din particular with our One Minute Feaso to conduct a solid Preliminary Development Feasibility Assessment.

Property Development “How To’s” & Frequently Asked Questions

Includes 5 x detailed eBooks [142 pages]

✓ How To Become A Property Developer? In 10 Easy Steps (51 Pages)

✓ How To Overcome Fear In Property Development? (15 Pages)

✓ How To Become A Real Estate Developer? Without Experience (37 Pages)

✓ Property Developer FAQs – Who, What, When, How? (20 Pages)

✓ How To Become A Real Estate Millionaire In 10 Steps? (19 Pages)

Step 5 - Understand financing

Property development can be a capital-intensive endeavour, so it’s essential to understand the different financing options available, including bank loans, joint ventures, and mezzanine financing.

You should know how much you can borrow and how to manage the associated expenses from a property development project.

Remember that banks and other financial institutions won’t be ready to grant you money just because your proposal sounds good. Lenders will investigate your background and credit score.

You should work on building a solid credit history while learning real estate development.

Step 6 - Pick property development hot spots

Identify suitable sites for development and work on your acquisition strategy along with the SPV (special purpose vehicle) aka financial structure. Check with your accountant for more details.

Quick Tip

A pro tip:

Get a list of areas with strong rental growth, and then overlay that list with a list of suburbs with high Capital Growth Potential to locate the perfect place or your property investment hot spots.

Step 7 - Plan, design, and sell the project.

Work with architects and engineers to create detailed plans and drawings for the project.

Navigate the legal and regulatory requirements to obtain the necessary approvals and permits for the project.

Once the development is complete, market and sell the properties to generate a return on investment.

Here you are. After completing the above steps and the best online courses, you can become a property developer in Australia in no time.

Get the best deals, execute projects, and make thousands of dollars.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber