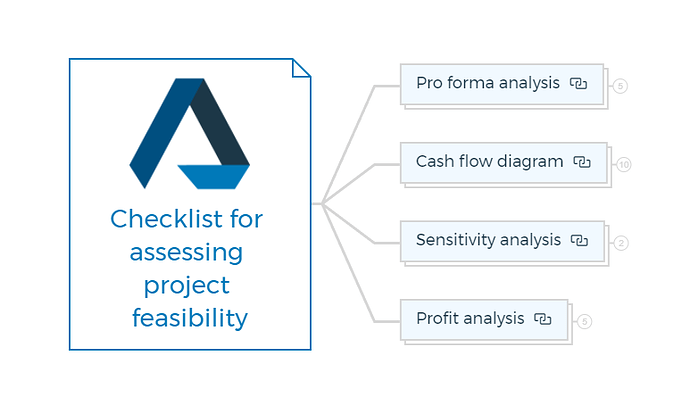

1. Pro forma analysis

1.1. Market research and demand assessment

- Evaluate current and future demand for the type of property in the target location.

- Analyze local market conditions, including competition and pricing trends.

1.2. Site analysis

- Assess the suitability of the property in terms of location, size, zoning, and environmental factors.

1.3. Financial projections

- Create a detailed pro forma income statement, balance sheet, and cash flow statement for the project.

- Estimate development costs, including land acquisition, construction, permits, and professional fees.

1.4. Funding sources

- Identify potential sources of funding, such as loans, equity investors, or grants.

1.5. Regulatory and legal considerations

- Determine all necessary permits and approvals required for the development.

- Assess the legal and regulatory risks associated with the project.

You are missing out if you haven’t yet subscribed to our YouTube channel.

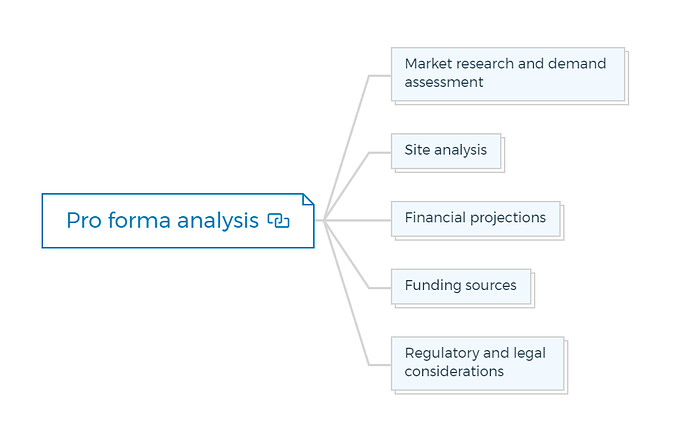

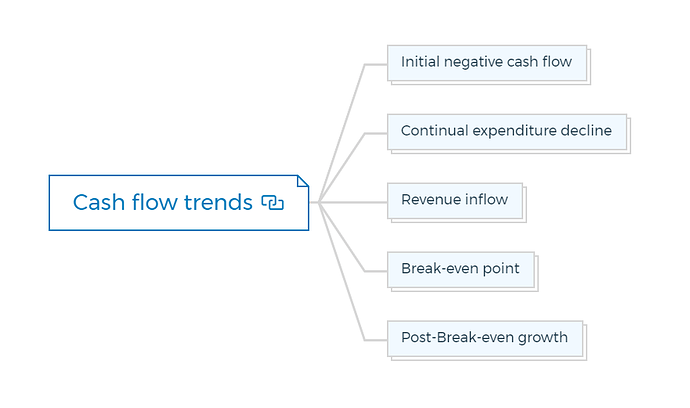

2. Cash flow diagram

2.1. Cash flow representation

2.1.1. Cash flow projection

Ensure the creation of a cash flow projection that visually represents the project’s revenues and expenditures over its entire lifespan.

2.1.2. Line plot

Utilize a line plot to connect the data points of revenues and expenditures, resulting in a graphical representation of the project’s cash flow dynamics.

Learn More

2.2. Financing structure

- Determine the financing structure, including loan terms, interest rates, and repayment schedules.

- Analyze the impact of different financing options on cash flow.

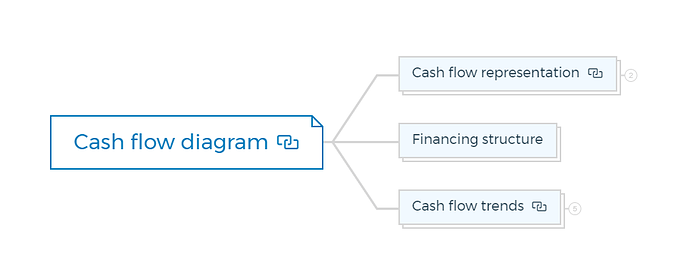

2.3. Cash flow trends

2.3.1. Initial negative cash flow

Recognize that the initial point on the cash flow line will be negative, representing the expenditure phase where project funds are utilized.

2.3.2. Continual expenditure decline

Observe the declining trend of the cash flow line as expenditures continue to be incurred.

2.3.3. Revenue inflow

Identify the point on the cash flow line where revenue generation commences, signifying the transition from expenditure to revenue phases.

2.3.4. Break-even point

Identify the crucial milestone on the cash flow line where revenues and expenditures intersect, indicating the break-even point.

2.3.5. Post-Break-even growth

Understand that beyond the break-even point, the cash flow line should ascend as revenue surpasses expenditures, indicating profit generation.

3. Sensitivity analysis

3.1. Risk assessment

- Identify key assumptions in your financial projections, such as rent growth rates and construction costs.

- Perform sensitivity analysis by varying these assumptions to understand their impact on project feasibility.

3.2. Risk mitigation

- Develop strategies to mitigate identified risks, such as contingency plans for cost overruns or delays.

4. Profit analysis

4.1. Profitability metrics

- Calculate key profitability metrics, including Net Present Value (NPV), Internal Rate of Return (IRR), and Return on Investment (ROI).

4.2. Exit strategy

- Determine the exit strategy for the project, such as selling the property or holding it as a long-term investment.

- Evaluate the potential returns and risks associated with the chosen exit strategy.

4.3. Market appreciation

- Consider potential property appreciation over time and its impact on long-term profitability.

4.4. Tax implications

- Analyze the tax implications of the project, including capital gains tax and property tax.

4.5. Risk-adjusted return

- Calculate the risk-adjusted return by factoring in the project’s inherent risks and uncertainties.