Project Report - Part 2

The video “Project Report - Part 2” provides a comprehensive guide on constructing an effective project report for property development, crucial for attracting investment or securing joint venture agreements with landowners. Here’s what it covers:

Project Charter

Highlighted as a crucial executive component of the project report, essential for securing funding and development rights.

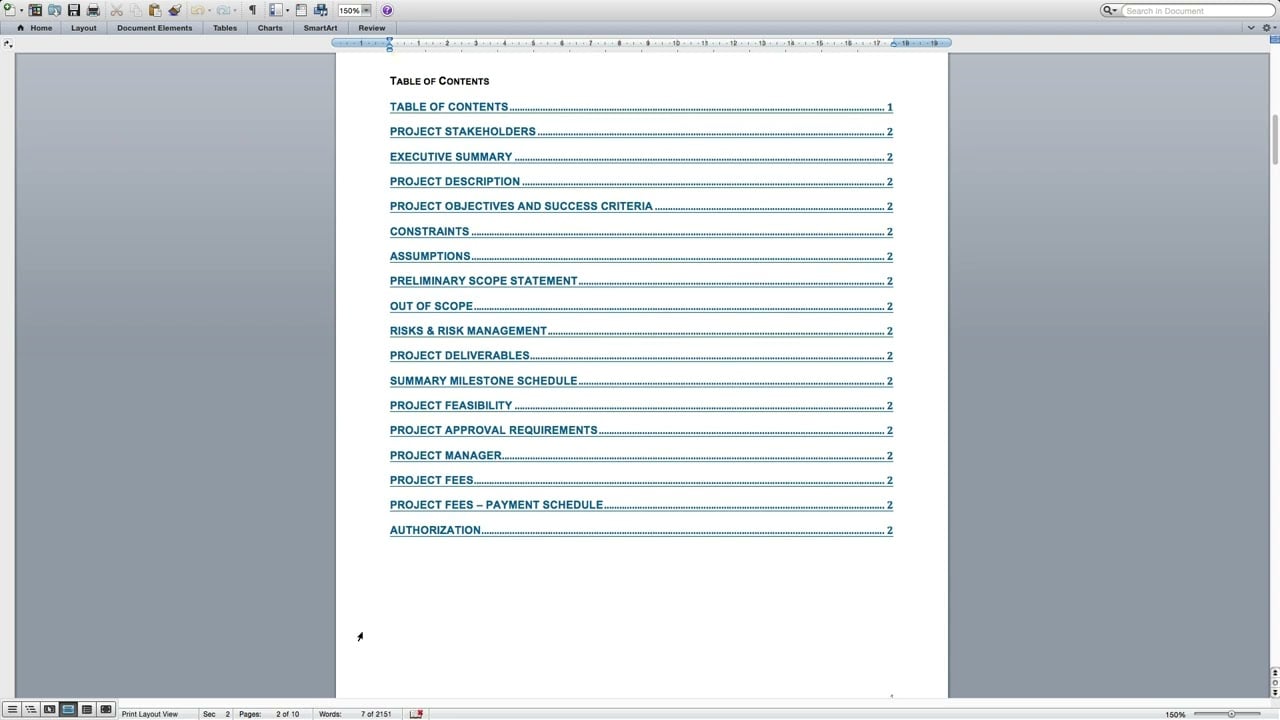

Report Contents

Details the inclusion of stakeholder identification, executive summary, project description, objectives, constraints, assumptions, risk management, and deliverables.

Template Customization

Discusses the flexibility of the template to incorporate personal branding elements like logos and contact information.

Critical Sections

Emphasises the importance of including constraints, assumptions, risk management strategies, and project deliverables clearly.

Financial Feasibility

Stresses on the inclusion of a financial feasibility study detailing costs, contingencies, and expected development margins to assess project viability.

Professional Presentation

Advises on the necessity of presenting well-researched, relevant, and concise information to avoid the perception of “fluff.”

Insights based on numbers

Milestone Scheduling

The video stresses the importance of setting realistic milestones for project development phases, like permits, sales, and construction, to manage timelines effectively.

Financial Figures

It elaborates on the inclusion of detailed financial projections and fee structures to ensure transparency and trust with stakeholders.

Risk Management

Detailed risk management strategies, including categorisation and probability assessment, are essential for preparing for potential challenges.

Frequently Asked Questions

How does the project report contribute to securing investment or partnerships for property development?

The project report plays a pivotal role in securing investment or partnerships for property development by providing a comprehensive and professional overview of the entire project. This report serves multiple critical functions:

Attracting Investors

It details the project’s scope, objectives, and expected outcomes, alongside financial feasibility studies, to demonstrate the project’s viability and potential for return on investment. By presenting well-researched and accurate financial figures, the report reassures investors of the project’s profitability and risk management strategies.

Securing Partnerships

For joint ventures, especially with landowners, the project report outlines the development’s benefits, roles, and responsibilities, and shared goals. It ensures all parties have a clear understanding of the project’s framework, expectations, and how it aligns with their interests.

Establishing Credibility

The professionalism and depth of the report, including stakeholder identification, risk assessment, and detailed financials, establish the developer’s credibility and seriousness about the project. This credibility is crucial for attracting funding and partners in a competitive market.

Overall, the project report functions as a foundational document that communicates the project’s strategic plan, financial viability, and operational guidelines to potential investors and partners, making it indispensable for securing the necessary support for property development.

What role do financial feasibility studies play in the overall project report, and how are they evaluated?

Financial feasibility studies within a project report are crucial as they offer a detailed analysis of the project’s economic viability, including cost estimates, revenue projections, and profitability analysis. Here’s how they are evaluated and their role in the overall project report.

Assessment of Viability

Financial feasibility studies provide a snapshot of the potential financial outcomes of a project, helping stakeholders understand if the projected returns meet or exceed the investment requirements. This includes analysis of construction costs, land value, legal fees, and expected sales revenue.

Risk Management

By identifying financial risks and their potential impact on the project, these studies enable developers to implement strategies to mitigate them. This might involve contingency planning for cost overruns or delays.

Investor Confidence

Detailed and realistic financial projections are key to building confidence among investors and partners. It shows that the developer has thoroughly researched and planned for various financial scenarios, ensuring that the project is not only viable but also profitable.

Decision Making

The insights gained from financial feasibility studies guide decision-making processes for both developers and investors. It helps in determining whether to proceed with the project, adjust the project scope, or reassess the financial strategies to ensure success.

Compliance and Approval

For projects requiring external funding or approval from regulatory bodies, presenting a comprehensive financial feasibility study is often a prerequisite. It demonstrates due diligence and financial responsibility, which are critical for gaining the necessary approvals.

In the context of the project report, the financial feasibility study substantiates the project’s economic justification, showcasing a well-thought-out plan for achieving financial success. It plays a vital role in securing the confidence of investors, partners, and regulatory bodies by providing transparent, detailed, and realistic financial projections.

What is the purpose of a project report in property development?

A project report in property development serves as a comprehensive guide for constructing effective presentations to attract investment or secure joint venture agreements with landowners. It is crucial for securing funding and development rights.

What is a Project Charter, and why is it important?

A Project Charter is a critical executive component of the project report, outlining the project’s scope, objectives, and stakeholders. It is essential for securing funding and development rights, acting as a foundational document that guides the entire project.

What should be included in the contents of a project report?

The contents of a project report should include stakeholder identification, an executive summary, project description, objectives, constraints, assumptions, risk management strategies, and deliverables. These elements provide a detailed overview of the project, ensuring that all aspects are clearly communicated.

Can the project report template be customised?

Yes, the project report template is flexible and can be customised to incorporate personal branding elements such as logos and contact information. This customisation helps in aligning the report with the branding strategy of the organisation or individual.

Which sections of the project report are critical?

Critical sections of the project report include constraints, assumptions, risk management strategies, and project deliverables. These sections are vital for outlining the project’s limitations, expected challenges, and the strategies to mitigate these risks, as well as what the project aims to achieve.

Why is including a financial feasibility study important?

Including a financial feasibility study is important because it details costs, contingencies, and expected development margins. This assessment helps in determining the project’s viability and assures investors or partners of the project’s financial soundness.

How should the project report be presented?

The project report should be presented in a well-researched, relevant, and concise manner. Avoiding the inclusion of unnecessary “fluff” ensures that the report is professional and focused, enhancing its credibility.

What are milestones, and why are they important for a project report?

Milestones are significant checkpoints or goals within the project development phases, such as permits, sales, and construction. Setting realistic milestones is important for effectively managing timelines and ensuring project progression is on track.

How detailed should financial figures in the project report be?

Financial figures in the project report should be detailed, including comprehensive financial projections and fee structures. This level of detail ensures transparency and builds trust with stakeholders by clearly outlining the financial aspects of the project.

What constitutes effective risk management in a project report?

Effective risk management in a project report involves detailed strategies that include categorisation and probability assessment of potential challenges. This proactive approach is essential for preparing and mitigating risks throughout the project lifecycle.

Test Your Knowledge

Multiple-Choice Questions on Project Report Construction for Property Development

1. What is the primary purpose of the Project Charter in a project report for property development?

A. To outline the marketing strategies for property sales.

B. To provide a comprehensive budget breakdown.

C. To act as a foundational document outlining scope, objectives, and stakeholders essential for securing funding and development rights.

D. To detail the architectural plans for property development.

2. Which of the following is NOT typically included in the contents of a project report?

A. Detailed architectural designs.

B. Executive summary.

C. Risk management strategies.

D. Financial feasibility study.

3. How can a project report template be customised?

A. By including as much technical jargon as possible.

B. By incorporating personal branding elements like logos and contact information.

C. By using a one-size-fits-all approach.

D. By limiting the details of financial projections.

4. What makes the constraints and assumptions sections critical in a project report?

A. They detail the project’s budget allocations.

B. They outline the project’s limitations and expected challenges, providing clarity on project boundaries.

C. They include promotional materials for marketing purposes.

D. They list all potential investors and their contributions.

5. Why is a financial feasibility study important in a project report?

A. It provides a platform for advertising the project.

B. It details costs, contingencies, and expected development margins to assess project viability.

C. It outlines the legal framework for property development.

D. It specifies the technology to be used in construction.

6. The advice to present well-researched, relevant, and concise information in the project report aims to:

A. Increase the document’s length.

B. Enhance the credibility of the report by avoiding unnecessary “fluff.”

C. Focus solely on the technical aspects of the project.

D. Make the report appealing to the general public.

7. Setting realistic milestones in a project report is important for:

A. Only the construction phase.

B. Managing timelines effectively across project development phases like permits, sales, and construction.

C. Estimating the total number of pages in the report.

D. Detailing the interior design choices.

8. Detailed financial projections in the project report are included to ensure:

A. There is enough material for a sequel report.

B. Transparency and trust with stakeholders.

C. The report aligns with architectural norms.

D. Stakeholders have a comprehensive list of all employees involved.

9. Effective risk management strategies in a project report should include

A. Only high-probability risks.

B. A categorisation and probability assessment of potential challenges.

C. Risks related to external political situations only.

D. A list of all possible natural disasters.

Answers:

- C

- A

- B

- B

- B

- B

- B

- B

- B

Assignment

Practical Exercise: Constructing an Effective Project Report for Property Development

Objective:

To apply the concepts learned from “Project Report - Part 2” by creating a mock project report for a hypothetical property development project, focusing on attracting investment or securing a joint venture agreement.

Instructions:

Project Charter Creation:

Draft a Project Charter for a hypothetical property development project. Include the project’s scope, objectives, and key stakeholders. Ensure it outlines the necessity for securing funding and development rights.

Report Contents Development:

Stakeholder Identification

List potential stakeholders involved in your project (e.g., investors, local government, community groups).

Executive Summary

Write an executive summary that encapsulates the essence of your project, its objectives, and its significance.

Project Description

Provide a detailed description of your project, including the location, type of development (residential, commercial, mixed-use), and scale.

Objectives

Outline clear, measurable objectives for your project.

Constraints

Identify potential constraints your project may face (e.g., zoning laws, environmental regulations).

Assumptions

Note any assumptions made during the planning phase of your project.

Risk Management

Propose strategies for managing identified risks.

Deliverables

Specify the tangible outcomes your project aims to achieve.

Template Customization:

Design a template for your project report that includes personal or hypothetical branding elements (e.g., a logo contact information). Ensure the template is professional and aligned with your project’s branding strategy.

Critical Sections Emphasis:

Revisit the sections on constraints, assumptions, risk management strategies, and deliverables. Ensure they are clear, detailed, and well-articulated.

Financial Feasibility Study:

Conduct a mock financial feasibility study detailing the projected costs, contingencies, and expected development margins. Evaluate the project’s financial viability.

Professional Presentation:

Review your report to ensure it is well-researched, relevant, and concise. Remove any “fluff” to enhance its professionalism.

Milestone Scheduling:

Develop a timeline that includes realistic milestones for your project’s development phases (e.g., obtaining permits, beginning sales, starting and completing construction).

Financial Figures Detailing:

Include detailed financial projections and fee structures in your report to ensure transparency and foster trust with potential stakeholders.

Risk Management Strategies:

Elaborate on your risk management strategies, including how you categorize risks and assess their probability. Detail how you plan to mitigate these risks.

To Do’s:

Compile all the sections into a single, cohesive project report document.

Ensure the document is formatted professionally and is easy to navigate.

Prepare to present your project report in a simulated stakeholder meeting setting.

Research Questions:

- Investigate current trends in property development that could influence your project’s success.

- Research effective risk management strategies used in real-world property development projects.

- Explore different financial models for property development and how they impact investment attraction and joint venture agreements.

Submission Requirements:

- Submit the completed project report document.

- Include a separate document addressing the research questions.