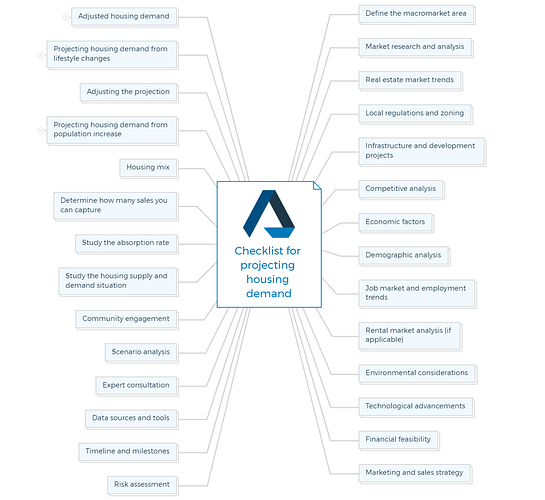

1. Define the macromarket area

Macromarket area refers to the larger geographic region or market zone where a property developer or investor is focusing their real estate activities. This area can encompass cities, suburbs, metropolitan regions, or other sizable geographic boundaries within which real estate trends and demand are analyzed and projected.

- Clearly define the broader market area you are targeting.

- Consider factors such as city boundaries, economic regions, or metropolitan areas.

2. Market research and analysis

- Identify the target location (city, neighborhood, or specific area).

- Collect historical data on property prices, sales, and rental rates.

- Analyze economic indicators (GDP growth, employment rates, income levels).

- Study population trends and demographic shifts.

Learn More

3. Real estate market trends

- Assess the current state of the real estate market (buyer’s or seller’s market).

- Identify recent market trends (e.g., rising demand for green or smart homes).

- Analyze the impact of COVID-19 or other relevant events on the market.

4. Local regulations and zoning

- Understand local zoning laws and regulations.

- Research any upcoming changes in zoning that might affect housing supply and demand.

You are missing out if you haven’t yet subscribed to our YouTube channel.

5. Infrastructure and development projects

- Identify upcoming infrastructure projects (e.g., highways, public transportation).

- Determine the potential impact of these projects on property values and demand.

6. Competitive analysis

- Study the competition, including other real estate developments in the area.

- Analyze their pricing strategies, amenities, and marketing efforts.

7. Economic factors

- Monitor interest rates and their impact on mortgage affordability.

- Keep an eye on inflation and its potential effect on housing costs.

8. Demographic analysis

- Understand the age, income, and lifestyle preferences of the target demographic.

- Consider the needs of various segments (e.g., millennials, retirees, families).

9. Job market and employment trends

- Research major employers in the area and their hiring trends.

- Consider the impact of remote work on housing demand.

10. Rental market analysis (if applicable)

Assess the demand for rental properties in the area. Analyze rent growth rates and vacancy rates.

Learn More

11. Environmental considerations

Evaluate environmental factors (e.g., climate change, natural disasters) that might affect demand.

12. Technological advancements

Consider the impact of technology (e.g., smart home features) on demand.

13. Financial feasibility

Calculate the cost of development and potential return on investment (ROI). Assess financing options and interest rates for the project.

14. Marketing and sales strategy

Develop a marketing plan to target the identified demographic. Create a sales strategy that aligns with market conditions.

Learn More

15. Risk assessment

Identify potential risks and create a risk mitigation plan. Consider market downturns, regulatory changes, and unexpected events.

16. Timeline and milestones

Set clear project milestones and deadlines. Regularly review and update the checklist to stay aligned with changing market conditions.

17. Data sources and tools

Identify reliable data sources, market research firms, and analytics tools.

18. Expert consultation

Consider consulting with real estate experts, economists, and local professionals.

19. Scenario analysis

Develop multiple scenarios (optimistic, realistic, pessimistic) to account for uncertainties.

20. Community engagement

Engage with the local community and potential buyers to gather feedback and insights.

21. Study the housing supply and demand situation

- Analyze the current inventory of available housing units in the target area.

- Assess whether there is an oversupply or undersupply of housing.

22. Study the absorption rate

- Calculate the rate at which available housing units are being sold or rented.

- This helps gauge how quickly the market can absorb new units.

23. Determine how many sales you can capture

- Estimate the percentage of the market share you can capture.

- Consider factors like pricing, location, and marketing efforts.

24. Housing mix

- Determine the types of housing units (e.g., single-family homes, apartments, condos).

- Assess the demand for each type and their respective sizes and features.

25. Projecting housing demand from population increase

- Analyze population growth trends in the target area.

- Use this data to estimate the increase in demand for housing units.

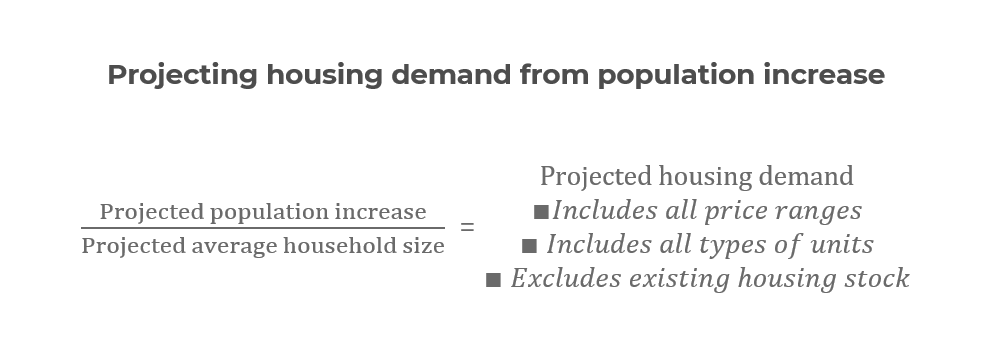

25.1. Formula for projecting demand from population increase

When you see more people moving into the area, check if the size of households is changing because of social shifts in the past five years or more. Look at how much it has been decreasing each year. Then, estimate the average household size for the year when you plan to start selling properties. You can find this information in public sources like census data, state and local agencies, and published marketing reports.

Once you’ve figured out the average household size for that year, divide the expected increase in the population by this estimated average household size. This calculation will tell you how many housing units are needed to accommodate the growing population in the larger market area.

26. Adjusting the projection

- Adjust the housing demand projection based on factors such as migration patterns, divorce, and birth rates.

- Consider the impact of these adjustments on the overall projection.

27. Projecting housing demand from lifestyle changes

- Analyze lifestyle trends that may affect housing preferences (e.g., remote work, sustainable living).

- Estimate how these changes will influence demand.

27.1. Formula for projecting housing demand from lifestyle changes

To figure out how many housing units are needed because of lifestyle changes, follow these steps:

- Find the projected average household size for the future year when you plan to start selling properties. You can find this information in sources like census data or marketing reports.

- Subtract the projected average household size from the current average household size. This difference represents the change in household size due to lifestyle shifts.

- Multiply this difference by the total number of existing housing units in the area.

- Finally, divide the new total by the projected average household size for that future year. This calculation will give you an estimate of the housing demand caused by lifestyle changes.

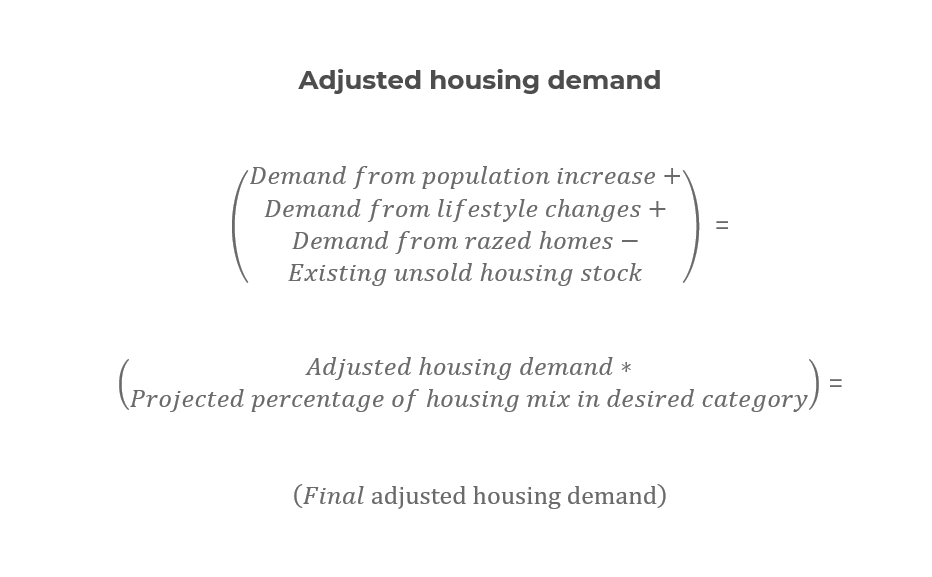

28. Adjusted housing demand

- Combine the population-based projection and lifestyle-based projection.

- This adjusted demand should provide a more accurate picture of the expected demand.

28.1. Formula for calculating adjusted housing demand

To fine-tune your estimate of how many housing units you’ll need, you can make some additional adjustments. Here’s how:

- Consider any homes that are expected to be demolished or razed in the chosen year. To estimate this number, look at the average number of homes that have been demolished over the past five years. However, if there has been a major event like a hurricane or earthquake, these averages might not apply.

- Subtract the number of unsold housing units that currently exist. This gives you the adjusted housing demand, which now includes all types of housing.

- If you’re only interested in a specific type of housing for your project (like apartments or single-family homes), multiply the total adjusted housing demand by the percentage of that housing type in the overall housing mix projection. This final number represents the adjusted demand specifically for your chosen housing type.