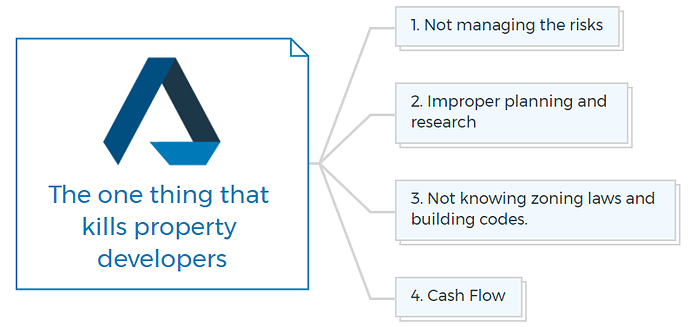

The one thing that kills property developers?

I can tell you four things that can kill a property developer and their project. Don’t miss the last one.

1. Not managing the risks

A lack of proper risk management can be particularly challenging for property developers and potentially kill a project.

This can include not anticipating potential risks, needing adequate funding to cover unexpected costs, and being unable to adapt to changing market conditions.

For example, if there is a change in market conditions, such as a sudden drop in demand for a specific type of property, a developer without a proper risk management plan may struggle to sell their properties and potentially face financial losses.

You are missing out if you haven’t yet subscribed to our YouTube channel.

2. Improper planning and research

Another thing that can kill a property developer is a lack of proper planning and research; this can include not understanding the local market and trends, not having a solid business plan, and not having a clear understanding of the costs involved in a project.

This can lead to underestimating the costs of a project and needing more funding to complete it or developing properties that are not in demand and struggling to find buyers.

3. Not knowing zoning laws and building codes.

Not understanding zoning laws, building codes, and regulations can lead to delays, costly fines and penalties, and even halt the project entirely, which can also kill a property developer.

Industry Insiders’ Secrets To Managing Risks & Avoiding Mistakes & Pitfalls In Property Development

Get the Risks & Mistakes Bundle Now

Includes 5 x detailed eBooks [120 pages]

✓ Risks In Property Development - Industry Insiders Guide (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 7 Property Development Mistakes And How To Avoid Them (8 Pages)

✓ 5 Reasons Buy-and-hold Investors Fail At Property Development (12 Pages)

✓ Property Mastermind: 8 Skills Needed For Property Development Success (16 Pages)

4. Cash Flow

Cash Flow is the major killer of small to medium-sized property developers.

Property development projects incur costs until the construction is complete, titles are available, and properties are sold and settled. This process often takes 12–18 months, a long time to invest without seeing a return.

Developers without an auxiliary business must work smarter to survive the development lifecycle because property development is a capital-intensive industry.

Consider using some best property development cash flow strategies -

- Replace some of your equity while the project is in progress.

- Plan projects effectively.

- Keep your costs down.

- Include a Development Management Fee.

- Negotiate your settlement terms.

- Make sure you have a plan B.

Learn More