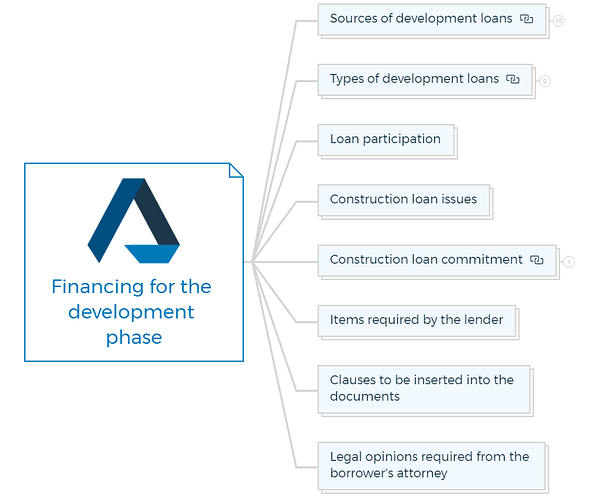

In the initial stage of the development process, acquiring financing becomes pivotal for land acquisition, site improvements, and building construction. The developer’s task is identifying a lender willing to extend such specialized loans.

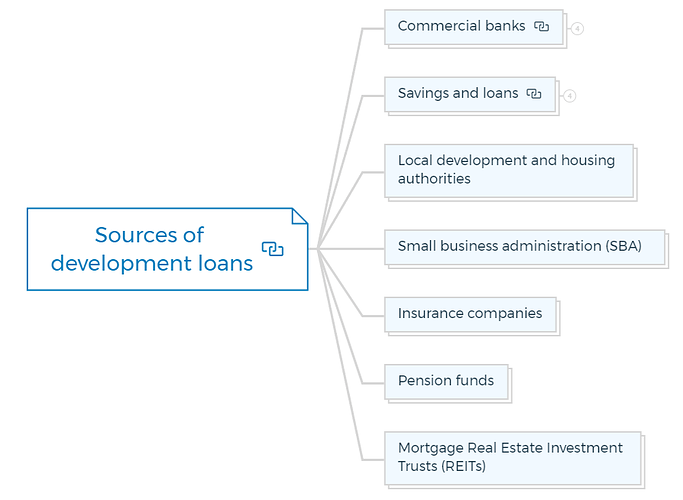

1. Sources of development loans

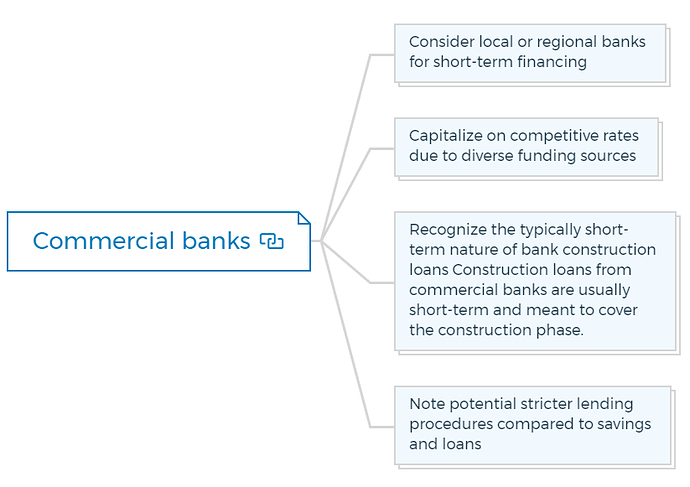

1.1. Commercial banks

1.1.1. Consider local or regional banks for short-term financing

Look for banks that operate in the area where the development is taking place. They are more familiar with local market conditions.

1.1.2. Capitalize on competitive rates due to diverse funding sources

Commercial banks often have multiple funding sources, allowing them to offer competitive interest rates.

1.1.3. Recognize the typically short-term nature of bank construction loans Construction loans from commercial banks are usually short-term and meant to cover the construction phase.

1.1.4. Note potential stricter lending procedures compared to savings and loans

Banks might have more stringent loan approval processes compared to savings and loans institutions.

Learn More

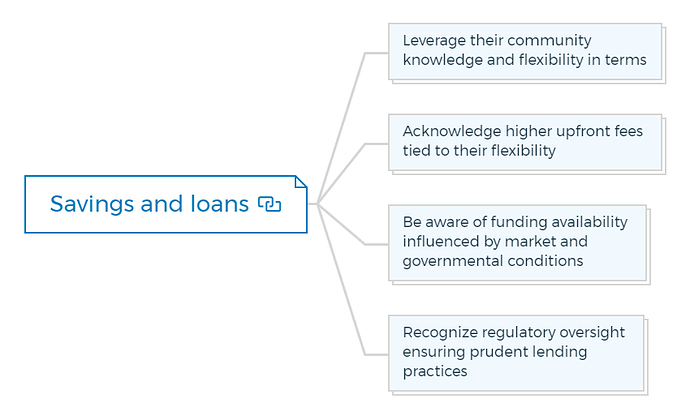

1.2. Savings and loans

1.2.1. Leverage their community knowledge and flexibility in terms

Savings and loan institutions understand local conditions well and might offer more flexible terms.

1.2.2. Acknowledge higher upfront fees tied to their flexibility

While they offer flexibility, savings and loans institutions might charge higher upfront fees for their services.

1.2.3. Be aware of funding availability influenced by market and governmental conditions

Funding availability for savings and loans institutions can be influenced by economic conditions and government regulations.

1.2.4. Recognize regulatory oversight ensuring prudent lending practices

Savings and loan institutions are regulated to ensure responsible lending practices.

1.3. Local development and housing authorities

- These authorities offer financing options that could be taxable or tax-exempt based on specific criteria.

- Be prepared for stringent lending criteria.

- Understand the process involving an inducement letter and credit enhancement.

- Benefit from potential reduced interest rates due to tax-exempt status.

1.4. Small business administration (SBA)

- SBA loans can be used for purchasing property used for business purposes.

- Understand the process’s complexity and time requirements.

- Note the lower interest rate due to the government loan guarantee.

- Recognize restrictions inherent in SBA loans.

1.5. Insurance companies

- Comprehend strict loan criteria associated with insurance companies.

- Consider potential partnership possibilities with developers.

- Appreciate advantages like lower rates, upfront fees, and fewer personal guarantees.

1.6. Pension funds

- Recognize pension funds’ quest for profitable returns.

- Note pension funds’ involvement in the loan market through loans origination.

- Consider potential collaboration between institutions and pension funds.

1.7. Mortgage Real Estate Investment Trusts (REITs)

- Acknowledge the scarcity of REIT lenders: There are limited REIT lenders available due to historical reasons.

- REIT lenders might require participation in various aspects of the project in exchange for providing high loan amounts.

Learn More

You are missing out if you haven’t yet subscribed to our YouTube channel.

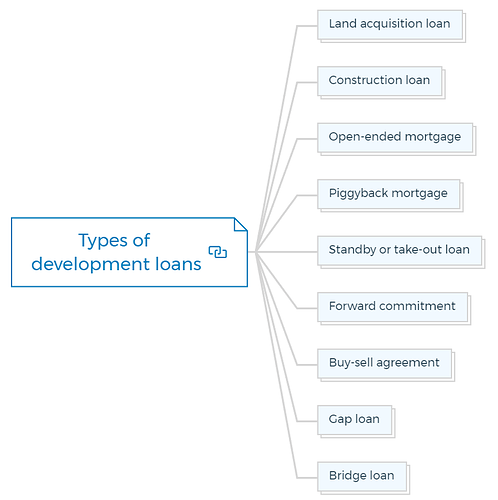

2. Types of development loans

2.1. Land acquisition loan

A loan specifically for purchasing the land on which the development will take place.

2.2. Construction loan

A loan to cover the costs of building the development.

2.3. Open-ended mortgage

A mortgage with flexible repayment terms.

2.4. Piggyback mortgage

Two mortgages used in tandem, often to avoid private mortgage insurance (PMI).

2.5. Standby or take-out loan

A loan that replaces or “takes out” a construction loan when the project is complete.

2.6. Forward commitment

A commitment to provide a loan at a future date.

2.7. Buy-sell agreement

An agreement outlining terms for buying or selling property.

2.8. Gap loan

A short-term loan to cover a financing gap.

2.9. Bridge loan

A temporary loan until permanent financing is secured.

3. Loan participation

- Evaluate the potential benefits of involving multiple lenders in the financing process: Consider the advantages of diversification and access to different resources.

- Understand the roles and responsibilities of each participating lender: Clarify the duties of each lender to avoid confusion.

4. Construction loan issues

- Address potential challenges and uncertainties tied to construction loans: Identify and plan for issues that might arise during the construction phase.

- Develop contingency plans for unexpected scenarios: Have backup plans to mitigate risks.

5. Construction loan commitment

- Thoroughly review and understand the terms of the construction loan commitment: Ensure complete comprehension of the loan’s terms and conditions.

5.1. Requirements of documentation and other conditions

- The list of documentation and conditions includes but is not limited to:

- Note and Deed to Secure Debt: Legal documents securing the loan against the property.

- Guarantee: A promise to pay the loan if the borrower defaults.

- Security Interest: The lender’s interest in the property as collateral.

- Title Evidence: Proof of clear ownership title to the property.

- Easements: Legal rights allowing others to use the property.

- Hazard Insurance: Insurance covering damage to the property.

- General Liability Insurance: Coverage for accidents on the property.

- Workman’s Compensation Insurance: Coverage for worker injuries.

- Loss of Rents Insurance: Protection against lost rental income.

- Other Insurance: Additional required insurance.

- Certificate of Insurance: Proof of insurance provided to the lender.

- Construction Loan Agreement: The legal agreement detailing the loan terms.

- Appraisal: A professional assessment of the property’s value.

- Authority to Borrow: Authorization to borrow on behalf of the developer.

- Due-on-Sale Clause: A provision triggering full loan repayment upon sale.

- Current Survey: An updated property survey.

- Soils Testing: Testing for soil stability.

- Parking: Verification of available parking.

- Building Permit: Permission to construct.

- Independent Consultant: Oversight by an independent professional.

- Construction Contracts: Agreements with contractors.

- Architectural Contracts: Agreements with architects.

- Costs and Contracts: Ensuring alignment between costs and contracts.

- General Contractor’s Completion Bond: Assurance of project completion.

- General Contractor’s Reserve: Reserved funds for unexpected costs.

- Certificate of Completion: Proof of project completion.

- Certificate of Occupancy: Permission to occupy the property.

- Assurance of Utility Availability: Verification of utility access.

- Plans and Specification Assignment: Management of plans and specifications.

- Compliance with Governmental Regulations: Adherence to regulations.

- Preleasing Requirement: Fulfillment of preleasing conditions.

- Assignment of Leases: Transfer of lease agreements.

- Additional Collateral: Additional assets offered as security.

- Tenant Estoppel Certificate: Tenant confirmation of lease terms.

- Subordination of Leases: Lease agreements made secondary to the loan.

- Signage and Publicity: Management of signage terms.

- Secondary Financing: Additional financing arrangements.

- Further Encumbrances: Restrictions on additional borrowing.

- Related Agreements: Fulfillment of related agreements.

- Other Documents: Submission of required documentation.

- Financial Statements: Provision of financial information.

- Legal Opinions: Legal perspectives on various aspects.

- No Adverse Change: Confirmation of no negative changes.

- Bank’s Right to Waive: Lender’s right to waive certain conditions.

- Loan Disbursement Procedure: Process for loan disbursement.

- Representative of Borrower: Designated borrower representative.

- Assignment or Modification: Changes to loan terms.

- Acceptance of Commitment: Acknowledgment of loan commitment.

- Expiration of Commitment: Loan commitment expiration terms.

- Termination of Commitment: Conditions for commitment termination.

6. Items required by the lender

- Confirm the specific documentation and information demanded by the lender: Address the lender’s specific requirements promptly.

7. Clauses to be inserted into the documents

- Collaborate with legal experts to incorporate relevant clauses into loan documents.

8. Legal opinions required from the borrower’s attorney

- Seek necessary legal opinions from legal advisors in alignment with the lender’s requirements: Obtain legal opinions to fulfil lender expectations.