Real estate investing can be a great way to build wealth and generate a steady stream of passive income. However, before making any property investment, knowing the prospective return on investment is crucial.

The cash-on-cash return is a critical metric you can use for assessing the profitability of a real estate investment.

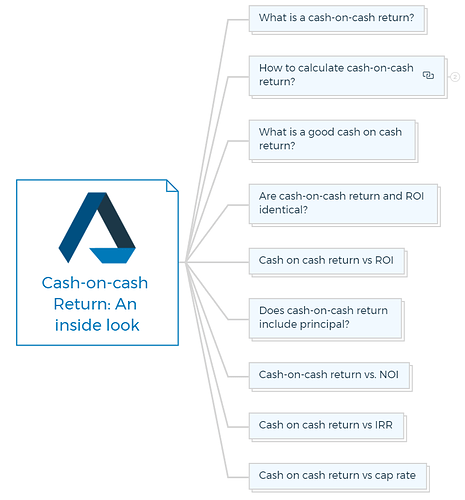

What is a cash-on-cash return?

IMPORTANT

Cash-on-cash return is the ratio of cash earned to cash invested. This financial metric estimates the ROI percentage based on cash invested rather than the overall property value.

Typically, property investors and property developers use the cash-on-cash return to measure commercial real estate performance. It is also called cash yield or equity-dividend yield on property investment.

Divide the annual net cash flow by the total cash invested to derive the cash-on-cash return.

IMPORTANT

Net cash flow refers to the residual amount of cash generated from a real estate investment after deducting all annual operating expenses, including mortgage payments, property taxes, insurance costs, and other related expenses, from the annual rental revenue.

You are missing out if you haven’t yet subscribed to our YouTube channel.

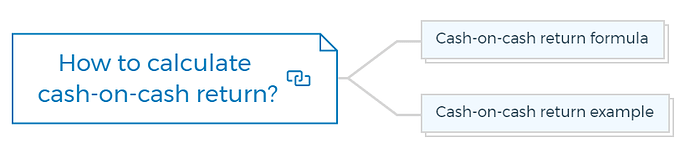

How to calculate cash-on-cash return?

Calculating the cash-on-cash return is simple. Divide the annual net cash flow by the total cash invested.

Cash-on-cash return formula

Cash-on-cash return = Annual net cash flow / Total cash invested

Cash-on-cash return example

Understand cash-on-cash return with this example.

You bought a $500,000 rental property. You mortgaged $400,000 after a down payment of $100,000. Your other expenses, including mortgage, property taxes, and insurance, are $40,000. The annual rental revenue is $60,000

To calculate the cash-on-cash return, you would first need to calculate the total cash invested:

Total cash invested = Down payment + Closing costs

Total cash invested = $100,000 + $10,000 = $110,000

Next, you would calculate the annual net cash flow:

Annual net cash flow = Annual rental revenue - Annual operating expenses

Annual net cash flow = $60,000 - $40,000 = $20,000

Finally, you would calculate the cash-on-cash return:

Cash-on-cash return = Annual net cash flow / Total cash invested

Cash-on-cash return = $20,000 / $110,000 = 0.18 or 18%

What is a good cash on cash return?

Good cash-on-cash returns depend on certain parameters such as investment goals, risk tolerance, and the local real estate market. Real estate investors generally agree that a cash-on-cash return projection of 8 to 12 percent indicates a good investment.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Are cash-on-cash return and ROI identical?

Cash-on-cash return is similar to ROI but not when debt is used in real estate transactions.

Most commercial buildings include debt; thus, the cash return on investment is different from the ROI. ROI evaluates investment returns, including debt. However, cash-on-cash return only evaluates the return on the actual cash spent, offering a more realistic investment performance measurement.

ROI includes capital gains and cash flow generated over a period of time. It considers all cash flows, including original investments, operational expenditures, mortgage payments, and taxes.

Cash-on-cash return measures an investment’s cash income compared to its cash investment.

Both ROI and cash-on-cash return are essential for assessing a real estate investment’s profitability, but ROI is better for long-term investors seeking capital appreciation and cash flow.

Learn More

Cash on cash return vs ROI

Understand the difference between cash-on-cash return and ROI with the help of an example.

Investor A is considering a $500,000 rental property. The investor expects $20,000 in net operating income (NOI) from $50,000 in rental revenue and $30,000 in operating expenditures.

The investor has two options for financing the property: Option A involves a 20% down payment of $100,000 and a 4% fixed-rate mortgage with monthly payments of $1,996.05. Option B involves a 50% down payment of $250,000 and no mortgage.

Using the cash-on-cash return formula, we can calculate the cash-on-cash return for each option:

Option A:

Annual cash flow = NOI - mortgage payments

Annual cash flow = $20,000 - ($1,996.05 x 12)

Annual cash flow = $20,000 - $23,952.6

Annual cash flow = -$3,952.6

Cash-on-cash return = Annual cash flow / Cash invested

Cash-on-cash return = (-$3,952.6) / $100,000

Cash-on-cash return = -0.0395 or -3.95%

Option B:

Annual cash flow = NOI

Annual cash flow = $20,000

Cash-on-cash return = Annual cash flow / Cash invested

Cash-on-cash return = $20,000 / $250,000

Cash-on-cash return = 0.08 or 8%

Option B provides a larger cash-on-cash return, making it a better investment.

The ROI for each option is different. To calculate ROI, we must account for all financial inflows and outflows throughout time, including original investments, operational expenditures, mortgage payments, and taxes.

Option A:

Total pre-tax cash inflows = ($50,000 - $30,000) x 10 years = $200,000

Total pre-tax cash outflows = $100,000 (down payment) + $23,952.6 (mortgage payments x 10 years) = $369,526

ROI = (Total pre-tax cash inflows - Total pre-tax cash outflows) / Total pre-tax cash outflows

ROI = ($200,000 - $369,526) / $369,526

ROI = -0.458 or -45.8%

Option B:

Total pre-tax cash inflows = ($50,000 - $30,000) x 10 years = $200,000

Total pre-tax cash outflows = $250,000 (down payment) = $250,000

ROI = (Total pre-tax cash inflows - Total pre-tax cash outflows) / Total pre-tax cash outflows

ROI = ($200,000 - $250,000) / $250,000 ROI = -0.2 or -20%

Option A provides a greater ROI despite a lower cash-on-cash return. Option A offers a lower initial investment and mortgage interest tax deduction.

This example shows how cash-on-cash return and ROI differ and how they can affect investment selections based on the investor’s goals and finances.

Learn More

Does cash-on-cash return include principal?

Cash-on-cash return excludes mortgage principal payments. It solely considers the property’s down payment and closing fees.

Principal payments diminish property equity, which might boost ROI. The cash-on-cash return does not include it.

Cash-on-cash return vs. NOI

NOI is a property’s cash flow before mortgage payments, interest, taxes, and depreciation. It quantifies investment income like the cash-on-cash return.

NOI includes rental revenue, operational expenditures, and other income streams, while cash-on-cash returns solely include rental revenue and operational expenditures.

Cash on cash return vs IRR

IRR, or internal rate of return, measures an investment’s prospective return over time. It accounts for the time value of money, including the initial investment and future cash flows.

IRR takes into account the investment’s total cash flow and its time, unlike cash-on-cash return. Cash-on-cash return solely analyses investment income relative to cash invested.

Cash on cash return vs cap rate

Cap rate (capitalization rate) is a property’s potential return on investment depending on its revenue. It is calculated by dividing the net operating income by the property’s value.

The cap rate helps assess assets’ prospective profitability but doesn’t account for capital spent. In contrast, cash-on-cash return considers only the cash invested in the property relative to the cash income generated by the investment.

In conclusion, cash-on-cash return is a simple yet valuable metric for real estate investment profitability. It shows investors the property’s projected cash income compared to their investment.

To make informed investment decisions, examine additional elements such as the local real estate market, operational expenditures, rental revenue, and investment objectives.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber