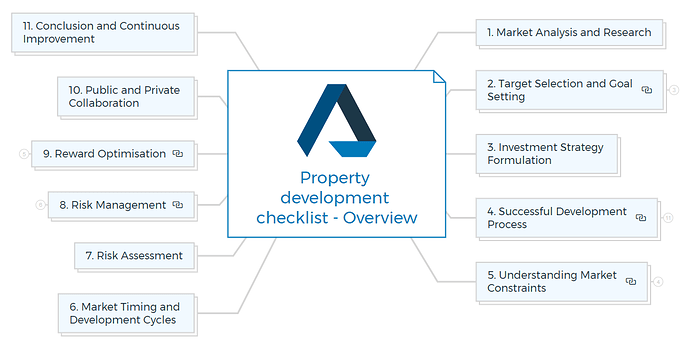

The Ultimate Real Estate Development Checklist for Success

1. Market analysis and research

- Conduct thorough market research to understand current trends, demand, and competition.

- Analyse the competitive landscape, including existing and upcoming developments, to identify your project’s unique selling points.

- Explore future urban development plans and government initiatives that could influence the market’s growth and attractiveness.

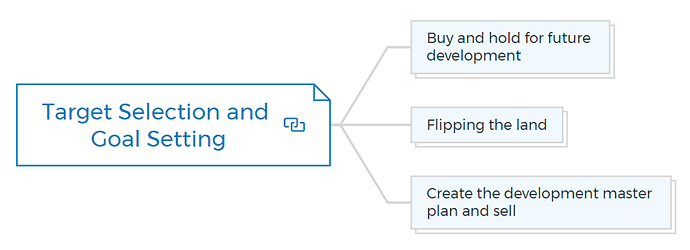

2. Target selection and goal setting

- Define a specific target market for your development project.

- Set clear and achievable goals based on market demand and project feasibility.

Important

As a new developer, you have the chance to strategically align your objectives by exploring three unique land utilisation options:

2.1 Buy and hold for future development

This entails keeping the property for a long time, expecting its value to rise. You may also make rental revenue. Conduct a rigorous study to find sectors with stable growth potential and demand.

2.2 Flipping the land

You might also try land flipping. This entails buying undervalued land, improving it, and selling it soon for a profit. It’s like finding a diamond in the rough and polishing it for a swift return.

2.3 Create the development master plan and sell

This requires envisioning the land’s potential and designing a plan to highlight it. You can then sell the land to stakeholders or other property developers who share your vision and want to make it happen.

This method requires market research and a convincing development proposal.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Investment strategy formulation

- Develop a well-defined investment strategy aligned with your financial goals and risk tolerance.

- Determine the optimal mix of funding sources, including equity, debt, and partnerships.

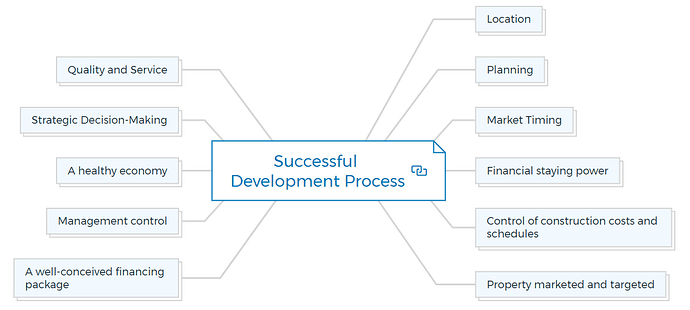

4. Successful development process

- Plan a detailed project timeline, considering all stages from conception to completion.

- Assemble a skilled property development team, including architects, contractors, and legal advisors.

Learn More

The checks in a successful development process involve -

4.1 Location

Selecting a prime location is pivotal, as it determines accessibility, desirability, and potential for growth.

4.2 Planning

Thoughtful and detailed planning ensures a clear roadmap for project execution and minimises unexpected hurdles.

4.3 Market timing

Navigating property market cycles and timing your development launch can significantly impact profitability.

4.4 Financial staying power

Adequate financial reserves safeguard against unexpected challenges during the development journey.

4.5 Control of construction costs and schedules

Keeping a tight grip on costs and schedules ensures efficient use of resources and timely completion.

4.6 Property marketed and targeted

Tailoring marketing efforts to specific demographics enhances property visibility and demand.

4.7 A well-conceived financing package

Crafting a well-structured financing plan contributes to project viability and success.

4.8 Management control

Effective project management ensures coordination and optimisation of all moving parts.

4.9 A healthy economy

A robust economic environment can boost demand and contribute to the project’s success.

4.10 Strategic Decision-Making

Balancing vision with practicality requires strategic decision-making to ensure project success.

4.11 Quality and Service

Delivering quality and exceptional service elevates your development’s reputation and desirability.

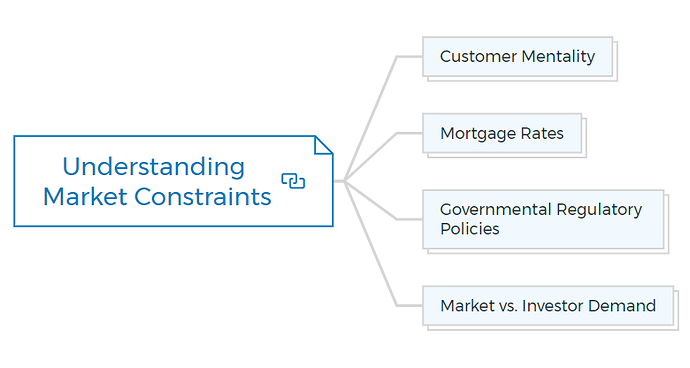

5. Understanding market constraints

- Recognise and assess potential challenges, such as regulatory restrictions, zoning issues, and environmental concerns.

- Develop contingency plans to address unexpected obstacles.

5.1 Customer mentality

Understand potential buyers’ or tenants’ preferences and priorities, including their lifestyle choices and design expectations.

5.2 Mortgage rates

Monitor fluctuations in mortgage rates, as they can influence the affordability and demand for properties.

5.3 Governmental regulatory policies

Stay informed about changes in governmental policies related to real estate development, which can impact project feasibility and profitability.

5.4 Market vs. investor demand

Differentiate between market demand (end users) and investor demand, as these can affect property pricing and rental potential.

6. Market timing and development cycles

- Study and analyse the four real estate development cycles (recovery, expansion, hyper-supply, recession) and their impacts.

- Strategically time your project’s initiation and completion to maximise returns.

Learn More

7. Risk assessment

- Identify and evaluate potential risks related to financing, construction, market volatility, and regulatory changes.

- Quantify and prioritise risks based on their potential impact.

Different types of risks that you should consider -

- Financial Risk

- Capital exposure, profitability fluctuations.

- Opportunity Risk

- Inflationary Risk

- Physical Destruction Risk

- Liquidity Risk

- Health, Family, and Ego Risk

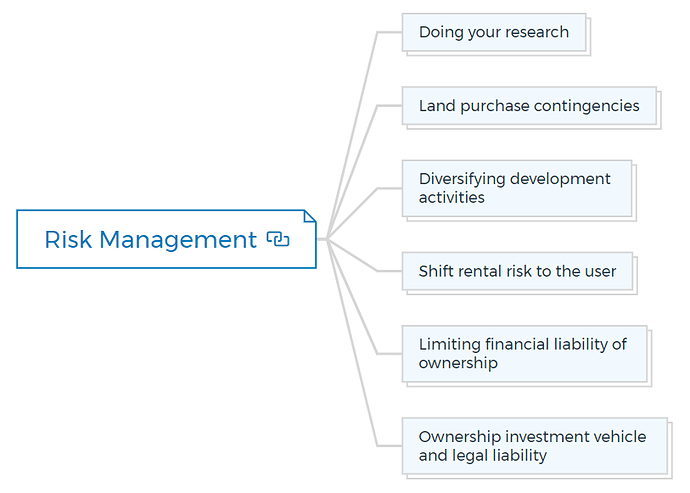

8. Risk management

- Implement risk mitigation strategies, such as diversifying your investment portfolio, securing insurance, and maintaining strong contingency reserves.

- Regularly review and adjust risk management strategies based on changing market conditions.

You can follow the below tips to manage your development risks effectively -

8.1 Doing your research

Thorough research informs informed decisions and minimises risks.

8.2 Land purchase contingencies

Include protective clauses for unforeseen events during land acquisition.

8.3 Diversifying development activities

Engaging in a mix of projects spreads risk exposure.

8.4 Shift rental risk to the user

Lease agreements transfer some risk to tenants.

8.5 Limiting financial liability of ownership

Structuring ownership to reduce personal financial exposure.

8.6 Ownership investment vehicle and legal liability

Select ownership structure aligning with liability tolerance.

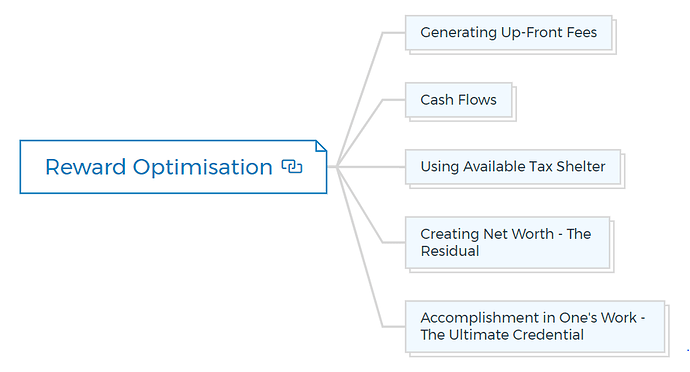

9. Reward optimisation

As you navigate the dynamic world of real estate, consider these vital aspects that lead to reaping the rewards:

9.1 Generating up-front fees

A key to unlocking success is the ability to secure up-front fees, swiftly turning investments into tangible returns from the outset.

9.2 Cash flows

The journey to real estate triumph is paved with consistent cash flows fueled by well-planned rental income and strategic property sales.

9.3 Using available tax shelter

Skillfully using tax incentives and deductions adds another layer of success, maximising profits through smart financial planning.

9.4 Creating net worth - The residual

As developments mature, so does your net worth. Each project adds to your financial foundation, solidifying your position as a real estate expert.

9.5 Accomplishment in one’s work - The ultimate credential

Beyond profits, every successful development serves as your ultimate credential, showcasing your prowess in the industry and opening doors to new opportunities.

10. Public and private collaboration

- Foster positive relationships with local government agencies, community stakeholders, and private partners.

- Engage in transparent communication to build trust and facilitate smooth project progression.

11. Conclusion and continuous improvement

- Monitor project performance against set goals and make necessary adjustments.

- Learn from each development experience to refine your strategies for future projects.

Remember that successful real estate development requires a blend of research, careful planning, risk management, and adaptability to market dynamics. This checklist serves as a guideline to help you navigate the complexities and maximise the potential of your real estate investments.