Once the lender has granted approval for the loan, the developer’s attorney, along with the lender’s attorney, must collaboratively create a comprehensive closing checklist encompassing all essential components necessary to finalize the transaction.

Subsequently, the property developer should arrange and assign tasks within their team to expedite the completion of the transaction. The below list represents the various categories of requirements essential before the closing process.

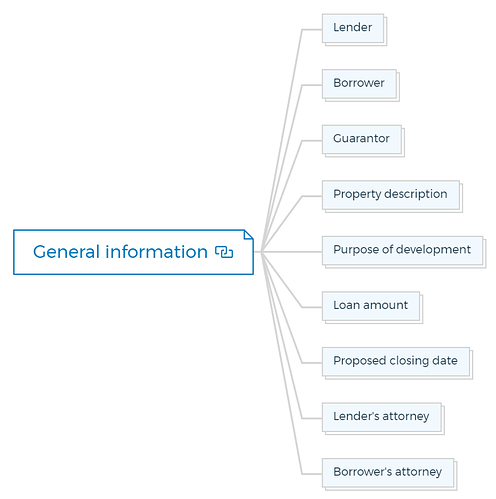

1. General information

1.1. Lender

The financial institution providing the loan.

1.2. Borrower

The entity or individual borrowing the funds.

1.3. Guarantor

If applicable, someone providing a guarantee for the loan.

1.4. Property description

Detailed information about the property, including its location, size, and any relevant features.

1.5. Purpose of development

The reason for which the loan is being taken, such as construction, renovation, or investment.

1.6. Loan amount

The specific amount of money being lent.

1.7. Proposed closing date

The anticipated date on which the closing will occur.

1.8. Lender’s attorney

The legal representative for the lender.

1.9. Borrower’s attorney

The legal representative for the borrower.

You are missing out if you haven’t yet subscribed to our YouTube channel.

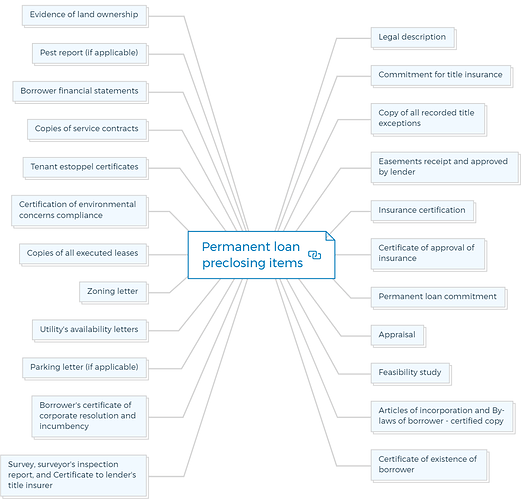

2. Permanent loan preclosing items

2.1. Legal description

A legally accurate description of the property to be financed.

2.2. Commitment for title insurance

A promise to provide title insurance, ensuring clear ownership of the property.

2.3. Copy of all recorded title exceptions

Any existing issues or claims against the property’s title.

2.4. Easements receipt and approved by lender

Easements granted over the property to third parties, approved by the lender.

2.5. Insurance certification

Proof of property and liability insurance coverage.

2.6. Certificate of approval of insurance

Lender’s confirmation of insurance coverage.

2.7. Permanent loan commitment

A formal agreement from the lender to provide the loan.

2.8. Appraisal

An expert’s assessment of the property’s value.

2.9. Feasibility study

A study assessing the project’s viability, often for commercial properties.

2.10. Articles of incorporation and By-laws of borrower - certified copy

Legal documents of the borrower’s organization.

2.11. Certificate of existence of borrower

Proof that the borrower is a valid legal entity.

2.12. Survey, surveyor’s inspection report, and Certificate to lender’s title insurer

Property survey documentation.

2.13. Borrower’s certificate of corporate resolution and incumbency

Document verifying authority to borrow.

2.14. Parking letter (if applicable)

Confirmation of parking space availability.

2.15. Utility’s availability letters

Confirmation of utility availability for the property.

2.16. Zoning letter

Confirmation of property’s zoning compliance.

2.17. Copies of all executed leases

Copies of tenant lease agreements.

2.18. Certification of environmental concerns compliance

Verification of compliance with environmental regulations.

2.19. Tenant estoppel certificates

Tenants’ confirmation of lease terms.

2.20. Copies of service contracts

Agreements for services related to the property.

2.21. Borrower financial statements

Financial documentation of the borrower’s financial health.

2.22. Pest report (if applicable)

Assessment of pest-related issues on the property.

2.23. Evidence of land ownership

Documentation proving ownership of the land.

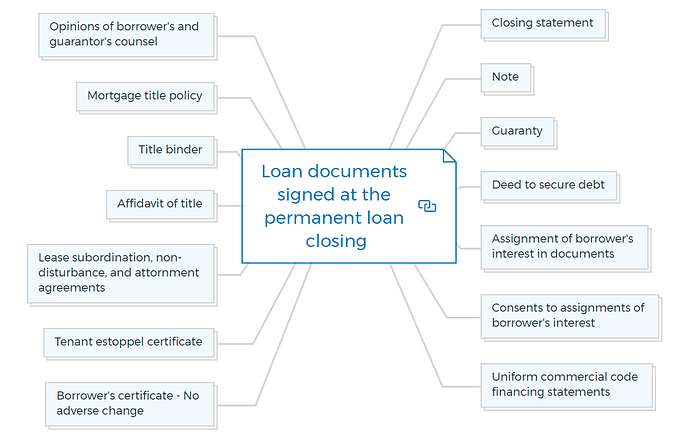

3. Loan documents signed at the permanent loan closing

3.1. Closing statement

Detailed financial breakdown of the transaction.

3.2. Note

A legal document outlining the terms of the loan, including repayment terms.

3.3. Guaranty

A guarantee document, if someone else is guaranteeing the loan.

3.4. Deed to secure debt

Legal document granting the lender a security interest in the property.

3.5. Assignment of borrower’s interest in documents

Transfer of borrower’s interest in documents to the lender.

3.6. Consents to assignments of borrower’s interest

Agreements from relevant parties allowing the assignment of interests.

3.7. Uniform commercial code financing statements

For personal property used as collateral.

3.8. Borrower’s certificate - No adverse change

Confirmation of no significant changes since approval.

3.9. Tenant estoppel certificate

Confirmation of lease terms from tenants.

3.10. Lease subordination, non-disturbance, and attornment agreements

Agreements between lender, borrower, and tenants.

3.11. Affidavit of title

Sworn statement regarding property title.

3.12. Title binder

Preliminary report on title insurance.

3.13. Mortgage title policy

Title insurance policy for the lender.

3.14. Opinions of borrower’s and guarantor’s counsel

Legal opinions on the transaction from borrower’s and guarantor’s attorneys.

Learn More

Each item in the checklist represents a crucial aspect of the closing process, ensuring that all legal, financial, and procedural requirements are met for the permanent loan agreement.