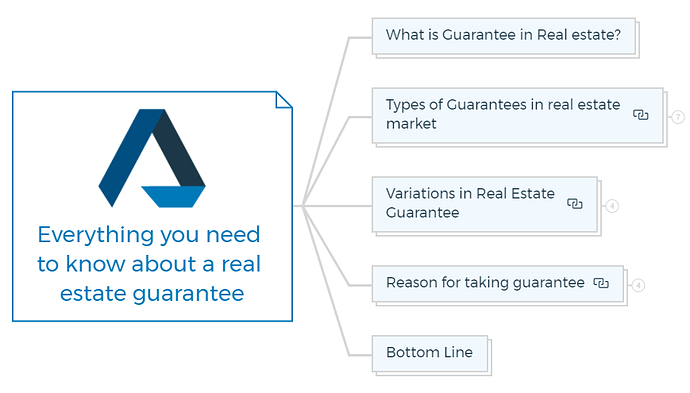

Real estate guarantee

One of the most misunderstood ideas in the loan sector is the guarantee. Most lenders are adamant about getting one, remembering the previous recession. Borrowers are adamant about not giving one and are similarly unimpressed by economic downturns.

Real estate is often seen as a safe investment. This is because, historically, property values have always increased over time. However, in today’s market, there are a number of factors that can affect the value of a property.

That’s why many people are turning to property development guarantees when investing in real estate. This blog post will discuss everything about real estate Guarantees.

What is guarantee in real estate?

Guarantee in real estate generally refers to something that guarantees the title to the property is clear and marketable. This can be either an insurance policy or a bonding company’s guarantee.

If the insurance policy is from a reputable company, it will usually protect against any loss due to fraud, forgery, or undisclosed claims against the property.

The bonding company’s guarantee will protect the buyer if the seller breaches the contract or if there are unsatisfied judgments or taxation liens against the property. In most cases, the buyer will require that these guarantees be in place before they will purchase a property.

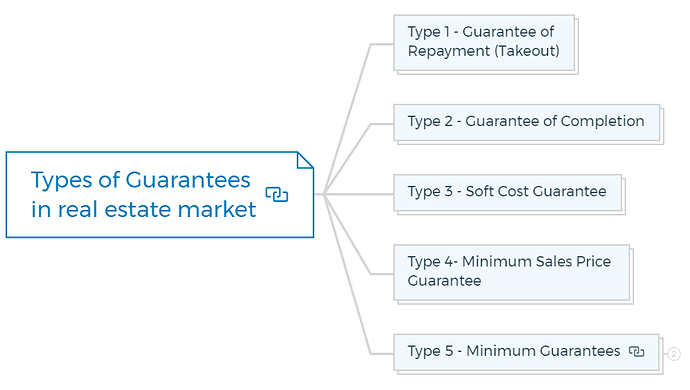

Types of guarantees in real estate market

You must be familiar with the fundamental sorts of guarantees before asking yourself what type of guarantee you want and what kinds you may obtain.

Type 1 - Guarantee of repayment (Takeout)

The repayment guarantee probably least protects the borrower because it is the strongest for the lender.

With this kind of guarantee, the borrower declares that he will pay the lender’s principle and interest out of his pocket if, for any reason, including events beyond his control, the money raised from the project, either as intended or from other sources, is insufficient to cover those costs.

A repayment guarantee may be challenging to acquire because of the vast scope of the circumstances that can cause the guarantee to be activated.

Type 2 - Guarantee of completion

According to a completion guarantee, the borrower will give the lending institution the money required to finish the project if it is not finished according to the plans and specifications within a reasonable amount of time. The borrower is minimizing his exposure to the job’s completion with this guarantee.

He is not required to pay off the lender’s debt, cover the accrued interest, or reimburse the lender.

However, the costs to the property guarantor will be higher than they would be if he had the ability to complete the job himself because there will be work halts before the lending institution steps in and because the lending institution is almost certainly not going to be as practical or cost-conscious as the borrower.

The guarantor has no further obligations after the development project is finished, regardless of the state of the market or the project’s sustainability.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Type 3 - Soft cost guarantee

Many soft costs are frequently not covered by the construction loan and are instead the sole responsibility of the borrower, depending on the loan’s form.

Since soft costs continue long after construction is finished, if a lender can obtain a soft cost guarantee, it will have successfully secured strong loan protection. These expenses include the most extensive line item of all, your loan interest, and significant line items like taxes and insurance.

Most property developers will insist on a limit (cap) being established if they are forced to provide a guarantee on soft costs. Otherwise, they may continue paying all time without directly influencing these expenditures.

Learn More

Type 4- Minimum sales price guarantee

There is often a minimum sales price in a condominium development. The smallest sum must be paid to the lender before it will release a condo unit from collateral. It is not possible to sell for less than this price unless the borrower adds to the sale price with his own money.

A soft cost guarantee that lasts for a certain amount of time may be included with the release of units. The fees paid to the condominium association, insurance, and real estate taxes are frequently considered guaranteed soft costs. They effectively represent the property’s carrying costs, excluding debt servicing.

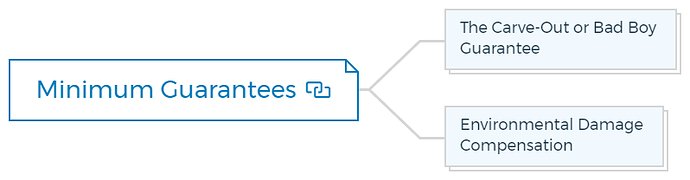

Type 5 - Minimum guarantees

It’s just untrue to be told that the conditions of a construction loan have no recourse by a borrower or lender. There is nearly always an environmental indemnification, and there is always a “bad boy” provision. These serve as the foundation for any loan for property development.

The carve-out or bad boy guarantee

The bad boy or carve-out provision only stipulates that the borrower shall repay the lender for any losses incurred on its loan due to substantial misstatements of fact, fraud, or embezzlement (stealing).

It is exceedingly challenging for a borrower to contest this type of guarantee because it logically follows that he may steal or lie without it.

Environmental damage compensation

Because environmental issues have grown to be a significant part of the public, legal, and lending scene over the past 20 years or so, environmental indemnifications (guarantees) are nearly always non-negotiable. The lender will not approve the loan if the borrower does not provide an environmental assurance.

Because most development loans stipulate that the first construction advance will not occur until all environmental concerns have been resolved and the proof has been submitted to the lender, obtaining an environmental guarantee is no longer a problem.

The borrower must offer an environmental guarantee on the few loans when the lender or borrower advances all or part of the environmental costs during development. He has, or should have, correctly addressed the environmental concerns and expenses of the project; thus, his potential culpability should be limited.

The lender’s environmental consultant supports his estimates as additional proof. Contaminants should be of a size and scope that are cost-manageable about the project’s financial position if they are detected later, for instance, during excavation or, in a rehabilitation project, after the demolition of partitions.

The borrower must cover any cost overruns as he would for any other line item in the budget.

However, you should not overlook that a significant adverse discovery could have disastrous effects on the project’s economic viability. As a result, environmental issues shouldn’t be ignored.

How To Finance Your Property Development Project?

And Other Books On Real Estate Development Finance

Includes 5 x detailed eBooks

✓ Property Development Finance: Easily Finance Your Project? (26 Pages)

✓ 10 Big (Financial) Property Investing Mistakes Made By Investors (58 Pages)

✓ 10 Finance Options For Your Next Property Development Project (29 Pages)

✓ What Is Equity Finance And How Does It Work? (42 Pages)

✓ Property Investment Finance - Ultimate Guide

Variations in real estate guarantee

Limited or incomplete guarantees

Negotiations between the lender and the borrower result in a partial or limited guarantee, which may cover soft costs, hard costs, or certain expenses like interest payments.

It might be based on a percentage, an absolute cost, a time frame, or a mix of all three, just like other indefinite contingent monetary liabilities.

For example, the borrower may agree to pay up to $1 million in losses incurred by the lending institution, pledge to pay 50% of the outstanding loan principal and be responsible for loan interest from the time the loan is in default until the property is foreclosed.

The title is transferred to the lender or a third party or pays a maximum dollar amount (cap) of a percentage of both soft and hard costs.

Who guarantees

Your letter of interest in response to a business loan proposal should always specify the guarantees needed (or requested) and who should provide them. The types and identities of the guarantors should be varied because your letter frequently serves as the starting point for discussions.

Later, when you and the borrower engage in back-and-forth conversations (perhaps with input from your senior management), it will be clearer what assurances are secured and who is providing them.

Because the lender (and his investors) will be dependent on the developer (the “key man”) to turn the initial investment into a return, he will be the one who, at the very least, offers the guarantees.

He should be held accountable because he has the leading power and responsibility for seeing that the project is finished, rented out, and sold. Regarding its members, each sort of legal body has its protections and exposures.

For instance, in a general partnership, the general partners bear direct responsibility for losses sustained in the ordinary course of business. They frequently work closely with the development team as well.

However, no member of a limited liability corporation is individually accountable. Their capital contributions represent the extent of their prospective loss.

Due to the diverse ownership forms and agreements among investors, the legal entity and the agreement between members may forbid specific individuals from guaranteeing without affecting their ownership rights and best interests.

While obtaining a guarantee from the participant with the highest net worth isn’t always necessary, doing so is always recommended.

Several and joint guarantees

You should aim to get joint and several guarantees if the borrowing team includes more than one person. This allows you to challenge all or a single guarantor for the total debt.

For instance, under a joint and several guarantee, if three guarantors each contributed $2 million for a one-third interest in a project and the lender supplied $24 million in the financing, each would be contingently liable for the total $24 million.

It amounts to a 12 times return on each person’s investment. The joint and several components can give you more negotiation power if there are problems with the home loan.

Worth of a guarantee

Due to the borrower’s extensive legal defenses, the lender never prevails in court for development loans because of the borrower’s guarantee.

Some of these defenses seem incredibly unjust, yet a skilled borrower’s lawyer can always make them effective. The lender may be accused of interfering in the borrower’s affairs and thus be blamed for the loan default.

The borrower is no longer liable for loan repayment if the lender had another route out of the situation—for example, through a takeout lender or through an insurance bond—that did not materialise due to the lender’s error.

It is possible to inflate a non-material administrative error by the lender into a significant error. Even if the lender over-advanced funds—a situation that most borrowers would not object to—the lender might still be held accountable for acting recklessly if they failed to leave enough money on hand to advance during the final stages of the project.

When choosing between taking legal action against the borrower and taking legal action against the property, the lender should take legal action against the property first because the lender will likely have difficulty in court. The developer is likely to be financially weak, and the legal process can take years when the asset deteriorates.

Learn More

Reason for taking guarantee

A guarantee is typically required as a condition of a development loan to exchange the guarantee for borrower performance. With a guarantee, there is always an implied risk that the lender would attempt to enforce its claim against the borrower’s private property by going to court.

Due to this contingent exposure, the borrower will typically cooperate with the lender longer and harder to attempt and resolve any issues that may arise.

Suppose the situation deteriorates to the point that the lender must pursue a foreclosure sale and possibly seize the asset. In that case, the lender can bargain for the borrower’s release from his guarantee in exchange for the property deed.

As a result, the property can be transferred to the lender in less time and for less money because it will be delivered in better shape. Additionally, it enables the lender to avoid a drawn-out and expensive foreclosure process.

Trading on his guarantee provides various benefits for the borrower. He is no longer at risk of investing much time and money in legal representation and court fees. He can prevent the possibility, however remote, of suffering a severe irreparable loss and declaring bankruptcy if the potential liability about his net worth is significant.

He could be able to exchange his property and the complete release of his guarantee for a cash buyout, depending on the situation, the market, and the lender’s negotiating process. In other words, if he gives up the deed instead of foreclosing, the lender will pay him some money.

He may be able to strike an agreement that keeps this a secret as well. Nobody will know more about the issues he or the project is facing. Then he can continue operating his business and seek a new loan with a different lender.

Conveying the property to the lender instead of foreclosure may be a desirable choice given all the possible incentives.

What kind of guarantee may the lender obtain?

You at least know your institution’s minimal needs if your lending criteria specify the types of guarantees needed to make a development loan.

You can choose whether to demand more than the minimum based on the transaction’s risks, the borrower’s sophistication and financial standing, demand and what the competition is asking for.

You will have almost everything you need if you obtain a payback, finish, and soft cost guarantee.

Small and medium-sized loans

Currently, practically all lending banks need a completion guarantee and may also require a repayment guarantee for small to medium development loans (up to $25 million).

A guarantee is more critical for loans of this level because many borrowers are financially capable of funding them in full if necessary. The borrower has few options because lenders in the cutthroat market for midsize loans need these assurances.

Big loans

Guarantees can be absent or only partially present for lending institutions with the capital necessary to make significant loans ($40 million or more).

One explanation for this is that higher sums of money are involved, which makes even huge developers more unwilling or unable to have such a sizable contingent obligation on their balance sheet. If the developer is a publicly traded corporation, this is especially true.

The lending institution’s decision to waive a guarantee on a significant project is that without a proven track record, good credentials, and a solid financial situation, the developer would not be able to secure the funding necessary to complete a project of this scale. This has some foundation.

However, if full or significant guarantees were required, it would be difficult or impossible for a lender to do large-quality development finance due to lender competition.

Because the borrower believes that completion is in his control, it is currently not difficult to secure a completion guarantee regardless of the size of the loan. Getting a repayment guarantee is not so simple.

Although the borrower typically has control over completion, he has a legitimate argument that no one can prevent a decline in the real estate market as a whole when the project is finished. He should therefore share the risks with the lender.

Make sure that your intentions are properly recorded

The terms and conditions of the mortgage loan shall be translated into legal documents by your closing attorney. You must specify the sort of assurance that is being offered in unambiguous terms. You should consult an attorney for clarification if you have any questions regarding the guarantee’s terms and the manner of ownership.

Bottom line

Although it is unlikely, relying on a guarantee can have a significant influence. The lender could utilize it to influence the borrower in a lousy circumstance.

It can operate as a motivator for the borrower to remain committed and productive. If necessary, it can play a significant role in regaining possession of a property instead of foreclosing on it.

Of course, the borrower should initially aim to give as little as possible. The borrower can afford to give more because they know there is a slim chance that a guarantee will be used, but only if they receive something in return.

He could negotiate better loan terms, including a lower interest rate, by using the guarantee as a negotiating tool.

FAQs

What is a guarantee agreement?

A guarantee agreement is a formal document between two parties that outlines the terms of a guarantee. The guarantor agrees to provide a certain amount of financial coverage in the event that the other party defaults on their obligations.

Guarantee agreements are commonly used in business transactions, where one party may require some financial assurance from another.

For example, a lender may ask for a personal guarantee from a borrower in order to secure a loan. If the borrower then fails to make repayments, the guarantor would be responsible for Covering the cost.

What are the benefits of a guarantee?

There are a few benefits to having a guarantee in real estate. One is that it can give potential buyers peace of mind, knowing that they’ll be able to get their money back if something goes wrong with the property.

Additionally, it can make it easier to sell a property, as buyers will feel more confident about what they’re buying. Finally, it can help reduce the chances of fraud or other illegal activities taking place with regard to the property.

What is a guarantee in contract?

A guarantee in a contract is a type of assurance from one of the contracting parties that another party will fulfill their obligations under the contract.

This can take the form of a personal guarantee, wherein an individual guarantees that they will personally pay for any damages or losses incurred by the other party, or it could be a financial guarantee, wherein a bank or financial institution guarantees payment if the first party defaults on their obligations.

Guarantees are often used in situations where one party is seen as being more likely to default on their obligations than the other, and can provide some security to the innocent party.

Property Finance Made Easy

We specialise in Development funding | Commercial finance | Construction loans | Portfolio refinancing & Property investment loans in Australia.

Click Here to strategise with Amber