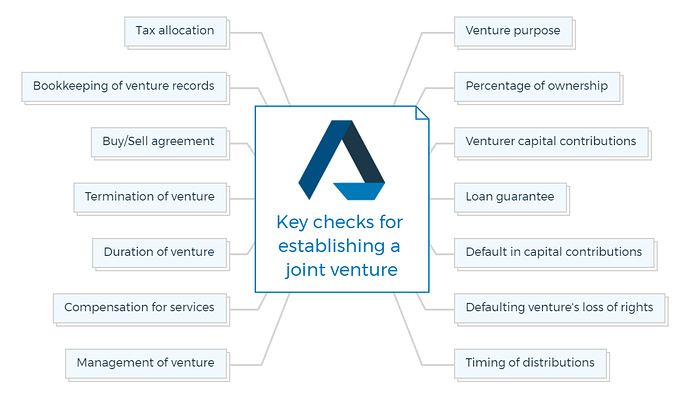

Establishing a joint venture between property developers and investors can be a lucrative partnership, but it requires careful planning and consideration of various factors.

1. Venture purpose

- Define the clear purpose and objectives of the joint venture.

- Ensure alignment of goals and expectations between property developers and investors.

2. Percentage of ownership

- Determine the ownership distribution between developers and investors.

- Specify the voting rights and decision-making power of each party.

You are missing out if you haven’t yet subscribed to our YouTube channel.

3. Venturer capital contributions

- Clearly outline the financial contributions required from each party.

- Specify the timing and method of contributions (cash, property, services).

4. Loan guarantee

- Decide whether any party will provide a guarantee for loans taken by the joint venture.

- Clearly define the terms and conditions of such guarantees.

5. Default in capital contributions

- Establish consequences if any party fails to meet their capital contribution obligations.

- Define the steps to address defaults and possible remedies.

6. Defaulting venture’s loss of rights

- Determine the consequences if one party consistently fails to fulfill its obligations.

- Specify the conditions under which the defaulting party could lose certain rights or benefits.

7. Timing of distributions

- Clearly define how profits and losses will be distributed among developers and investors.

- Determine the frequency and timing of distributions.

8. Management of venture

- Decide on the structure of management (board, executives, committees).

- Outline the responsibilities, decision-making process, and reporting mechanisms.

9. Compensation for services

- Determine whether developers will receive compensation for their management and operational services.

- Clarify how such compensation will be calculated and disbursed.

10. Duration of venture

- Define the expected duration of the joint venture.

- Specify conditions that could lead to an extension or early termination.

11. Termination of venture

- Outline the procedures for terminating the joint venture.

- Include provisions for voluntary and involuntary terminations.

12. Buy/Sell agreement

- Establish a mechanism for developers or investors to buy out the other party’s stake.

- Define the valuation method and process for executing buy/sell transactions.

13. Bookkeeping of venture records

- Agree on a standardized system for maintaining financial and operational records.

- Specify the frequency and format of financial reporting to all parties.

14. Tax allocation

- Determine how tax obligations will be allocated between developers and investors.

- Consider consulting with tax professionals to optimize tax implications.

Learn More