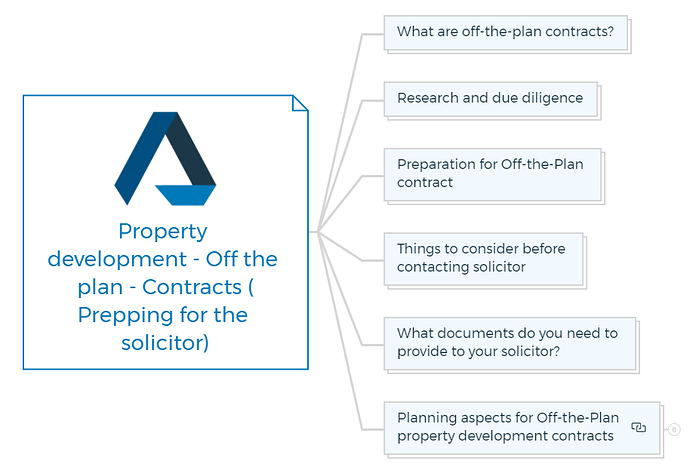

Off the Plan - Contracts (Prepping for the Solicitor)

Property development is a lucrative industry with several legal processes. One common method of property acquisition is purchasing off the plan, which refers to buying a property before it is constructed or completed.

This blog post covers property development, off-plan contracts, and solicitor preparation.

What are off-the-plan contracts?

Off-the-plan contracts involve purchasing a property based on the proposed plans and specifications rather than the existing property. This method provides an opportunity to invest in properties that are yet to be built, often at a lower price compared to the completed market value. However, navigating off-the-plan contracts can be intricate due to the unique considerations involved.

You are missing out if you haven’t yet subscribed to our YouTube channel.

Research and due diligence

Before engaging a solicitor, it is crucial to conduct thorough research and due diligence. This involves evaluating the reputation and track record of the property developer, assessing the location’s market trends, and understanding the potential risks and rewards associated with off-the-plan purchases.

Gathering as much information as possible about the property, the developer, and the local real estate market will help you make informed decisions and communicate effectively with your solicitor.

Learn More

Preparation for Off-the-Plan contract

The first and foremost step is to ensure you have all the information necessary for a clear, efficient, and seamless process. Gather all the essential documents and ensure to be on the same page, as this information will impact the preparation of the contract.

However, an off-the-plan contract is a comprehensive document with many informational pieces. Some of such points are:

- Ensuring you have rights to lodge any section 96 application;

- Ensuring you can amend building plans and designs;

- Ensuring you can change the unit layout, as well as any car and storage space locations;

- Maintaining your right to reduce the area of a unit;

- Maintaining the flexibility to adjust unit entitlements;

- Ensuring you are permitted to change the vendor if you choose to sell the site; and

- Protecting your right to change the finished schedule, should they no longer be practical.

Things to consider before contacting solicitor

Now we will discuss a list of things you need to get in advance before you contact your solicitor.

- You need to contact your land surveyor and obtain the preliminary plan of subdivision or the Building Format Plan (depending on the type of construction).

- The next step calls for obtaining the owner’s corporation proposal that will include a budget, a fee that they will charge and the list of services that will be provided.

- Moreover, you will need to provide architectural drawings, including floor plans and elevations.

- You will need to provide a list of inclusions, fittings/fixtures containing Material Specifications.

Note: Please provide any inclusions you are providing to a purchaser in the apartments you are constructing if you are proposing any options for the purchaser to select colors, fixtures, or fittings.

What documents do you need to provide to your solicitor?

There are a few more documents and essential details that you must provide to the solicitor. Such as:

- Planning Permit(s), including demolition permit

- Building Permits/Approvals (If Available)

- Proposed sunset clause for development

- Development advertising brochures

- Names and current addresses of Directors /Secretary of Vendor Company

- ABN

- Registered Office Name of development or name of building E.g. Isaac Place.

- Details regarding Solicitor - Where and who is appointed to receive information to and from the solicitor?

- Deposit percentage

- Clear statement - If you are selling inclusive of GST or exclusive of GST, note that new dwellings attract GST and whether you will elect to calculate on the margin scheme.

In case of more than one director, it is recommended that a Corporate Power of Attorney should be prepared to enable one Director/Secretary to execute documentation.

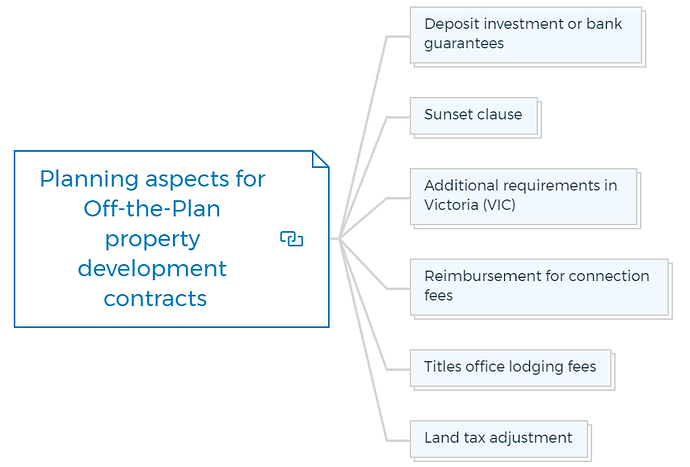

Planning aspects for Off-the-Plan property development contracts

Deposit investment or bank guarantees

The special conditions in the contract should specify whether you, as the property developer, will invest the purchaser’s deposit or accept bank guarantees.

This ensures that the deposit is secured before the subdivision plan is registered.

Sunset clause

The contract should include a sunset clause that outlines the timeframe within which you anticipate the plan of subdivision to register.

If the subdivision is not registered within that timeframe, the purchaser can withdraw from the sale.

Additional requirements in Victoria (VIC)

In Victoria, you must provide various documents throughout the transaction, including Council Form Y, which provides street allocation and identification for each lot.

Other documents may include building permits, builder’s warranty insurance certificate, occupancy permits, and any other permits, approvals, or Section 173 agreements required by the council.

Reimbursement for connection fees

If you expect the purchaser to reimburse you for connection fees for utilities such as electricity, gas, or telephone, this should be clearly stated in the contract of sale.

You will need to provide tax invoices for these services, and the purchaser will reimburse the amount at settlement.

Titles office lodging fees

When the plan is certified by the council and ready to be lodged at the Titles Office, you will be responsible for paying Titles Office lodging fees and any mortgagee’s consent and production fees associated with the registration process.

Land tax adjustment

Suppose a land tax is payable on the property, and you want the purchaser to bear the responsibility for adjusting this amount. In that case, you will need to provide the necessary land tax information for calculation and inclusion in the contract.

It is important to note that the specific requirements and regulations may vary depending on the jurisdiction and local laws. Therefore, it is advisable to consult with a qualified solicitor or legal professional familiar with your area’s specific laws and regulations.

Test Your Knowledge

Assignment: Understanding Off-the-Plan Property Development and Contracts

Objectives

- To comprehend the concept and details of off-the-plan contracts.

- To understand the importance of research and due diligence in property development.

- To identify the essential documents and preparations needed before drafting an off-the-plan contract.

- To analyze the role of solicitors in the property development process.

Instructions

Part A: Understanding Off-the-Plan Contracts

To Do

Define “off-the-plan” contracts in your own words, including the potential benefits and risks involved in such agreements.

Research Question

Investigate the legal implications of off-the-plan contracts in your jurisdiction. Identify any consumer protection laws that apply to these contracts.

Part B: Research and Due Diligence

To Do

Create a due diligence checklist for evaluating a property developer before purchasing an off-the-plan property. Include at least five critical factors to investigate.

Research Question

Choose a real estate market and analyze its current trends. Report on how these trends might affect the risks and rewards of purchasing off-the-plan properties in this market.

Part C: Preparation for Off-the-Plan Contract

To Do

Given the points mentioned in the article (e.g., rights to lodge any section 96 application, ensuring flexibility in unit layouts, etc.), draft a list of clauses you would want included in an off-the-plan contract to protect the developer’s interests. Justify each clause.

Research Question

Explore the legal requirements for off-the-plan contracts in another country. How do these requirements compare to those in your initial research for Part A?

Part D: Engaging with Solicitors

To Do:

Based on the documents listed in the article, prepare a comprehensive package you would provide to a solicitor to start the contract preparation process. Explain the significance of each document.

Research Question

Interview a real estate solicitor or conduct online research to find out common challenges solicitors face when preparing off-the-plan contracts. Summarize your findings and suggest potential solutions.

Additional Tasks

Presentation

Prepare a presentation summarizing your key findings and insights from each part of the assignment. Highlight the differences in legal requirements between jurisdictions (if applicable).

Discussion

Organise a discussion group to debate the risks and benefits of investing in off-the-plan properties. Consider factors such as market trends, legal protections, and the economic climate.

Submission Guidelines

- Complete all tasks and research questions in a clear and organized manner.

- For research-based tasks, cite at least three reputable sources per question.

- Submit your assignment as a single document, with each part clearly labeled.