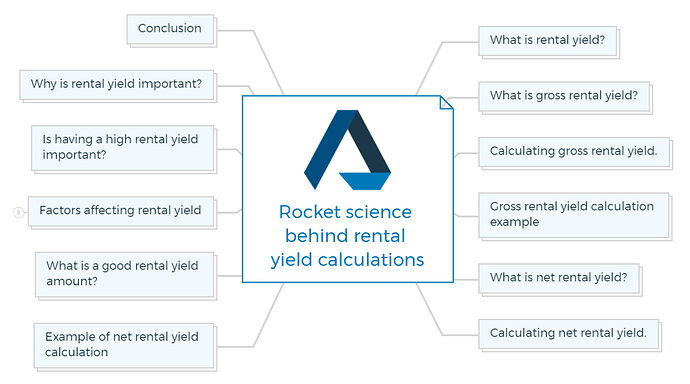

Rocket science behind rental yield calculations

Mastering rental yield: The key to profitable property investment

The next stat in our property development course is Rental Yield. It is an essential metric in measuring the potential profitability of property investment.

Property development requires rental yield knowledge. As a property developer, you must understand the factors that affect the rental return.

Learn everything about rental yield, how it is calculated, different types and the factors that can affect them.

What is rental yield?

It measures the cash an investment property produces per annum as a percentage of its value. Rental yield is an important metric because it indicates how much return on investment (ROI) a property investor can expect to receive from their rental property.

It is typically expressed as a percentage and can be calculated in two ways: gross yield and net yield.

You are missing out if you haven’t yet subscribed to our YouTube channel.

What is gross rental yield?

Gross rental yield is a measure of the income generated by an investment property as a percentage of its overall value without accounting for any associated expenses or outgoings.

Calculating gross rental yield.

To calculate the gross rental yield you are earning on your property, you multiply the weekly rent by 52 times, divide the product by the property’s value, and then multiply it by 100 to get the percentile value.

Gross yield = (Total income rent per annum X 52)/(property value) x 100

Gross yield solely considers rental income and not property expenses or outgoings. Gross yield does not reflect investment profitability.

The net yield gives a more accurate picture of the property’s profitability. Calculating net yield is more complicated, but it gives a more realistic view of the property’s profitability and helps real estate investors evaluate investment prospects.

Gross rental yield calculation example

The gross rental yield of a $500,000 property with $25,000 in annual rental income is:

Gross Rental Yield = ($25,000 / $500,000) x 100 = 5%

In this example, the gross rental yield is 5%, meaning the property provides a 5% return on investment exclusively from rental income.

What is net rental yield?

Net rental yield is an investment property’s income after expenses and outgoings. This formula shows the property’s profitability more accurately than the gross rental yield, which considers rental income.

Calculating net rental yield.

To calculate net rental yield, deduct property management fees, maintenance costs, insurance premiums, property taxes, and other ongoing expenses from the property’s rental income.

Divide this figure by the property’s value and multiply by 100 to get a percentage.

Net yield = [(Total income rent per annum) - All property expenses including outgoings, property management fees, council rates, insurances, etc.)/property value] X 100.

Net rental yield calculation excludes mortgage interest and tax.

Example of net rental yield calculation

For instance, a property with $30,000 in rental income and $10,000 in expenses would profit $20,000. If the property is valued at $500,000, the net rental yield would be calculated as follows:

Net rental yield = ($20,000 / $500,000) x 100 = 4%

After expenses and outgoings, the property’s net rental yield is 4%.

You must watch the above video, which rental yield calculations with real examples for different areas in Australia, giving you valuable insights to make informed decisions.

What is a good rental yield amount?

A good rental yield depends on several factors like location, property type, market demand, and more. Generally, a rental yield of 5% or higher is considered good, but it ultimately depends on the investor’s goals and risk tolerance.

Before buying a property, research to ensure the rental return matches your financial goals and investment strategy.

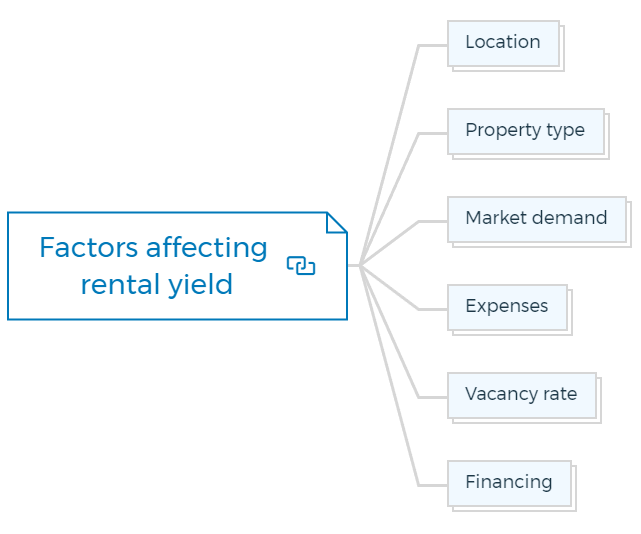

Factors affecting rental yield

The trend of rental yield varies from place to place and the attributes of the specific location. The primary classification would be urban and suburban towns for our calculations, but plenty of factors can contribute to the rental yield of a specified location.

For instance, if you are opting to buy or develop a property in a suburban area, the rental yield is likely to be high since the properties are comparatively less expensive in places far away from CBD.

Quick Tip

The farther you are from the city, the higher the rental yield. Properties that are farther from CBD give you a better rental yield.

Several factors affect investment property rental yield. These are:

Location

Location considerably affects rental yield. High-demand, low-supply areas have greater rental yields than low-demand, high-supply areas.

Property type

Apartments, residences, and commercial properties have various rental yields. Property age and condition also affect rental yield.

Market demand

Rental yield is affected by local rental property demand.

Expenses

Consider all the expenses, including property management, upkeep, taxes, insurance, and more. These costs might dramatically lower the net rental yield.

Vacancy rate

The vacancy rate, or the percentage of time that the property is unoccupied, can impact the rental yield. A higher vacancy rate will lower the rental income and decrease the rental yield.

Financing

The financing of the property, such as the interest rate on the mortgage, can also impact the rental yield. Higher financing costs will decrease the net rental yield.

Is having a high rental yield important?

A higher rental yield is important for property investors as it indicates a better return on investment. When assessing a property investment, rental return is only one factor.

Location, capital growth possibilities, market conditions, and property upkeep costs also affect investment property profitability. While a high rental yield can be good, it’s necessary to consider all variables before investing.

Remember - If a suburb becomes desirable, renters are first to flock there.

Why is rental yield important?

Property developers must use rental yield to assess a property’s financial performance. Rental yield helps developers determine a property’s profitability and potential returns by comparing its income to its valuation.

Rental yield can also indicate capital growth. A suburb’s rental yield above 5% indicates a considerable demand for rental units. This could enhance property values, making it a desirable location for development.

Rental yield also helps developers prepare for unexpected events like renters leaving or low demand. Real estate developers can find alternate tactics and backup plans to retain profitability and reduce financial risk by utilising comparison data and rental yield projections.

Rental yield provides financial information and predicts growth opportunities for property development. It’s crucial when measuring property investment profitability and sustainability.

Conclusion

Rental yield is a crucial aspect to consider when investing in a property. Understanding how to calculate gross and net rental yield and how it varies based on location and property type can help you make informed decisions when buying or developing real estate.

Moreover, if you are interested in mastering the financial feasibility of property development, be sure to check out the feasibility suite. It will equip you with the knowledge and skills you need to become a successful property developer.

Test your understanding

- Multiple Choice:

- What does the rental yield measure?

a) The property’s square footage.

b) The annual cash an investment property produces as a percentage of its value.

c) The mortgage interest of a property.

d) The vacancy rate of a property.

- True/False:

- Gross rental yield considers both rental income and property expenses.

- Fill in the Blanks:

- To calculate the gross rental yield, you multiply the weekly rent by ______, divide the product by the property’s ______, and then multiply it by ______ to get the percentile value.

- Multiple Choice:

- Which of the following is NOT deducted when calculating the net rental yield? a) Mortgage interest b) Property management fees c) Insurance premiums d) Maintenance costs

- Descriptive:

- Briefly explain the difference between gross rental yield and net rental yield.

- Calculation:

- Given a property with a value of $600,000 and annual rental income of $30,000, calculate the gross rental yield.

- True/False:

- A net rental yield gives a more realistic view of the property’s profitability than a gross rental yield.

- Multiple Choice:

- Generally, what rental yield percentage is considered good? a) 2% b) 5% c) 10% d) 15%

- Descriptive:

- Discuss the impact of location on rental yield.

- Multiple Choice:

- Which of the following factors does NOT impact rental yield? a) Property age and condition b) Color of the property’s walls c) Market demand d) Vacancy rate

- Descriptive:

- Why is it important for property developers to consider rental yield when assessing a property’s financial performance?

- True/False:

- If a suburb has a rental yield above 5%, it indicates a decreasing demand for rental units in that suburb.

- Short Answer:

- What does a high rental yield signify for property investors?

- Descriptive:

- List and briefly explain at least three factors that can affect the rental yield of a property.

- True/False:

- Properties farther from the Central Business District (CBD) tend to have a lower rental yield.

- Descriptive:

- Why might rental yield be used as an indicator for capital growth in a suburb?

- Short Answer:

- Why is considering both rental yield and other variables like location and market conditions essential before investing in a property?

- Multiple Choice:

- Which of the following best describes why rental yield is important to real estate developers? a) It predicts color trends in property interiors. b) It helps developers prepare for unexpected events like renters leaving. c) It helps developers determine the height of the property. d) It determines the property’s square footage.

- Short Answer:

- Based on the article, how can rental yield projections help real estate developers?

- True/False:

- Mastering the financial feasibility of property development solely depends on understanding rental yield.

Note: It is advised that these questions be followed by an in-depth review of the provided article to ensure that examinees have adequately understood and internalized the content.

Test Your Knowledge

Assignment: Mastering Rental Yield Analysis in Property Investment

Objective

This assignment is designed to deepen your understanding of rental yield and its significance in property investment. You will apply concepts related to gross and net rental yield calculations, assess the impact of various factors on rental yield, and develop strategies for property investment based on rental yield analysis.

Instructions

Complete the following tasks, ensuring to show your work and reasoning. Use the concepts learned from the article on rental yield in property investment.

Tasks

Understanding and Calculating Rental Yields

To Do: Calculate the gross and net rental yields for three properties of your choice (e.g., a residential apartment, a commercial space, and a suburban house). Assume realistic values for rental income, property value, and expenses.

- Provide a brief description of each property, including its location, type, and condition.

- List all assumptions made for rental income, property value, and expenses.

- Show your calculations clearly.

Comparative Analysis

To Do: Compare the rental yields of the properties you have analyzed. Discuss which property presents the best investment opportunity based on rental yield alone and explain why.

Impact of Factors on Rental Yield

Research Question: How do factors such as location, property type, market demand, and expenses influence rental yield? Provide examples to support your explanations.

- Identify specific factors that could affect the rental yield of each property you have analyzed.

- Discuss how a change in one of these factors might impact the rental yield.

Strategic Investment Planning

To Do: Based on your understanding of rental yields and the factors affecting them, propose a strategy for an investor with a $1 million budget. Your strategy should aim to maximize rental yield while considering risk and market conditions.

- Outline your investment strategy, including the types of properties considered, targeted locations, and any other relevant factors.

- Justify your strategy with reference to rental yield analysis and market research.

Reflection on Rental Yield Importance

Research Question: Why is understanding rental yield crucial for property developers and investors? Discuss how rental yield can influence investment decisions and property development planning.

- Reflect on the role of rental yield in assessing property investment profitability.

- Consider how a developer or investor might use rental yield projections to mitigate financial risk.

Submission Guidelines

- Compile your calculations, analyses, and answers in a structured report format.

- Include a title page, introduction, main body (with sections corresponding to the tasks above), conclusion, and references.

- Use graphs or tables where appropriate to support your analysis.

- Cite any external sources used for market research or property data.

- Submit your report as a PDF file via mail or comments