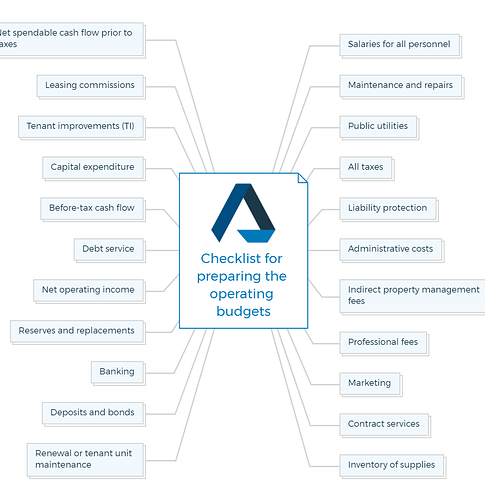

1. Salaries for all personnel

- List all employees, their roles, and salaries.

- Include payroll taxes, benefits, and any bonuses or incentives.

2. Maintenance and repairs

- Document ongoing maintenance costs.

- Budget for periodic repairs and renovations.

3. Public utilities

- Include costs for water, electricity, gas, and trash removal.

- Track utility usage and look for opportunities to reduce consumption.

You are missing out if you haven’t yet subscribed to our YouTube channel.

4. All taxes

- Detail property taxes, income taxes, and any other applicable taxes.

- Keep records of tax assessments and payments.

5. Liability protection

- Include insurance premiums for property, liability, and casualty insurance.

- Maintain records of insurance policies and coverage.

6. Administrative costs

- Cover expenses related to office supplies, software, and administrative staff.

- Include costs for record-keeping and administrative tools.

7. Indirect property management fees

- Account for fees paid to property management companies.

- Detail contract terms and services provided.

8. Professional fees

- Include legal, accounting, and consulting fees.

- Maintain records of contracts and invoices.

9. Marketing

- Budget for advertising and marketing campaigns.

- Track expenses related to promoting the property.

Learn More

10. Contract services

- List expenses for contracted services like landscaping or security.

- Maintain service agreements and invoices.

11. Inventory of supplies

- Document costs of cleaning supplies, maintenance tools, and other supplies.

- Monitor inventory levels and reorder when necessary.

12. Renewal or tenant unit maintenance

- Account for costs associated with tenant turnover and unit maintenance.

- Keep records of repair and cleaning expenses.

13. Deposits and bonds

- Include security deposits and any other financial guarantees.

- Document deposit amounts and conditions.

14. Banking

- List bank fees, charges, and interest expenses.

- Track bank account balances and transactions.

15. Reserves and replacements

- Set aside funds for future capital expenditures and replacements.

- Plan for major repairs or replacements of building components.

16. Net operating income

- Calculate the property’s net income before considering debt service and taxes.

- Analyze this figure for profitability.

17. Debt service

- Include mortgage payments and interest expenses.

- Keep records of loan agreements and payment schedules.

18. Before-tax cash flow

- Calculate the cash flow before accounting for taxes.

- Assess the property’s financial performance.

19. Capital expenditure

- Budget for large-scale property improvements and upgrades.

- Plan for long-term enhancements.

20. Tenant improvements (TI)

- Detail costs related to customizing space for new tenants.

- Track TI expenses for each lease agreement.

21. Leasing commissions

- Include expenses associated with broker commissions.

- Record commission agreements and payments.

22. Net spendable cash flow prior to taxes

- Calculate the cash flow available for distribution or reinvestment.

- Assess the property’s financial health after accounting for all expenses.