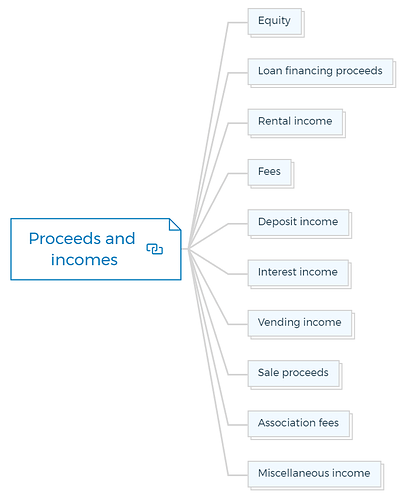

Checklist for preparing development proforma

1. Proceeds and incomes

1.1. Equity

Equity refers to the capital invested in the project by the developer or other stakeholders. This can include personal funds, investments from partners, or contributions from shareholders.

1.2. Loan financing proceeds

Loan financing proceeds are the funds acquired from financial institutions or lenders to finance the development project. This could include construction loans, mortgages, or other forms of debt financing.

1.3. Rental income

Rental income involves revenue generated from leasing out properties within the development, such as residential or commercial spaces.

This income includes -

- Base rent

- Percentage rent

- Common area maintenance (CAM) charges

- Parking

- Operating expense pass-through

1.4. Fees

Any charges collected for services provided, such as management fees, leasing fees, or other service-related charges.

1.5. Deposit income

Deposit income encompasses funds received as security deposits from tenants or buyers. These deposits are held to cover potential damages or defaults.

1.6. Interest income

Interest income is earned from interest payments on loans, deposits, or other interest-bearing accounts associated with the development.

1.7. Vending income

Vending income includes earnings from vending machines or kiosks located within the development premises.

1.8. Sale proceeds

Sale proceeds are revenues from selling units or properties within the development project.

1.9. Association fees

Association fees are regular payments made by property owners to a homeowners’ association for the maintenance and management of common areas and shared amenities.

1.10. Miscellaneous income

Miscellaneous income covers any other sources of revenue that may arise during the development project, such as event rentals, advertising income, or licensing fees.

2. Application of the proceeds

This section outlines how the funds acquired from the various sources will be allocated to different aspects of the development project, including land acquisition, construction, fees, and other expenses.

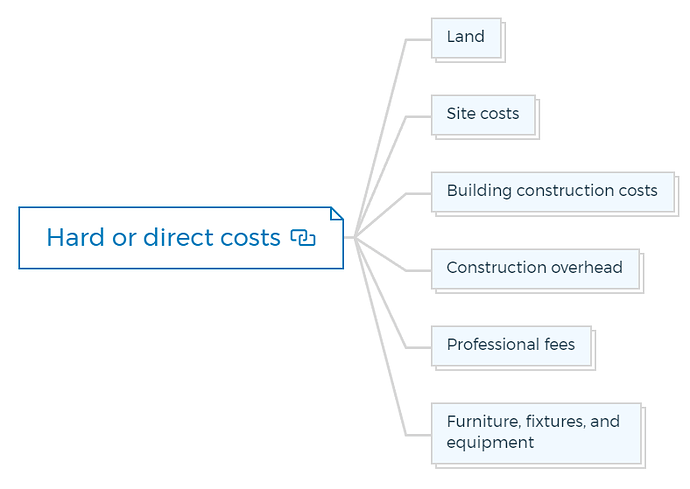

3. Hard or direct costs

3.1. Land

Land costs encompass the expenses associated with acquiring the land on which the development will be built.

3.2. Site costs

Site costs include site preparation, infrastructure development, landscaping, and utilities.

3.3. Building construction costs

Building construction costs involve expenses associated with the actual construction of the buildings within the development, including materials, labor, and construction management.

Learn More

3.4. Construction overhead

Construction overhead includes indirect costs such as permits, inspections, insurance, and project management during the construction phase.

3.5. Professional fees

Professional fees refer to payments made to architects, engineers, consultants, and other professionals involved in the design and development process.

3.6. Furniture, fixtures, and equipment

These costs cover the purchase or installation of furniture, fixtures, and equipment required for the functioning and aesthetics of the developed spaces.

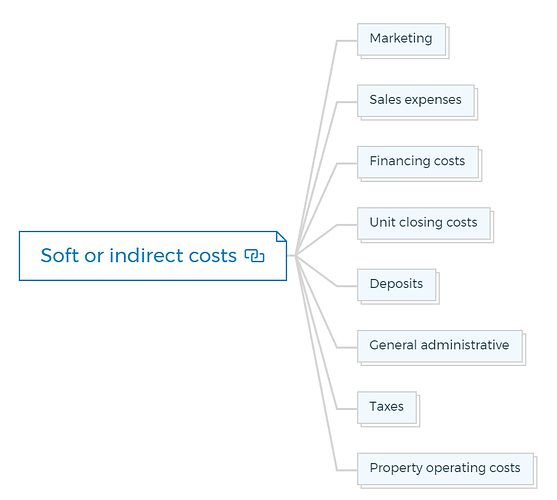

4. Soft or indirect costs

4.1. Marketing

Marketing expenses include promoting and advertising the development to potential buyers or tenants.

4.2. Sales expenses

Sales expenses encompass costs related to the sales process, such as sales commissions, marketing materials, and sales office expenses.

4.3. Financing costs

Financing costs involve interest payments on loans, loan origination fees, and other financial charges related to securing and managing financing for the development.

4.4. Unit closing costs

Unit closing costs cover expenses incurred during the transfer of ownership from the developer to buyers, including legal fees, title insurance, and transfer taxes.

4.5. Deposits

Deposits refer to funds set aside as security for contractual obligations, such as returning tenant deposits or ensuring the completion of construction milestones.

4.6. General administrative

General administrative costs include overhead expenses such as office rent, utilities, office supplies, and other administrative expenses.

4.7. Taxes

Tax costs include property taxes and other applicable taxes associated with the development.

4.8. Property operating costs

Property operating costs involve ongoing expenses required to operate and maintain the developed properties, such as maintenance, utilities, and management fees.

5. Contingency category

The contingency category includes a reserve fund set aside to cover unexpected or unforeseen expenses that may arise during the development project.

This amount is usually based on a percentage of the total development costs.